NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

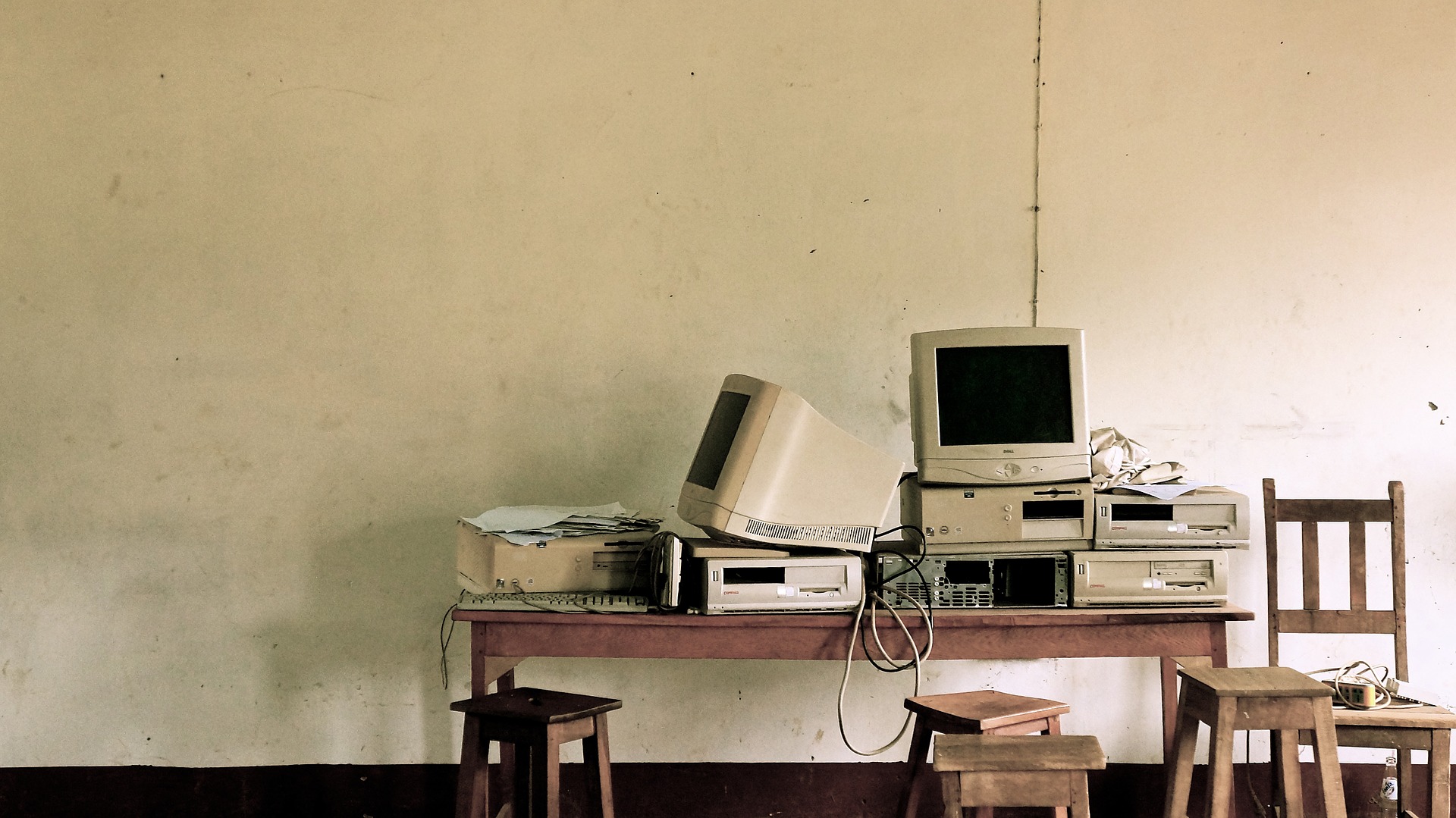

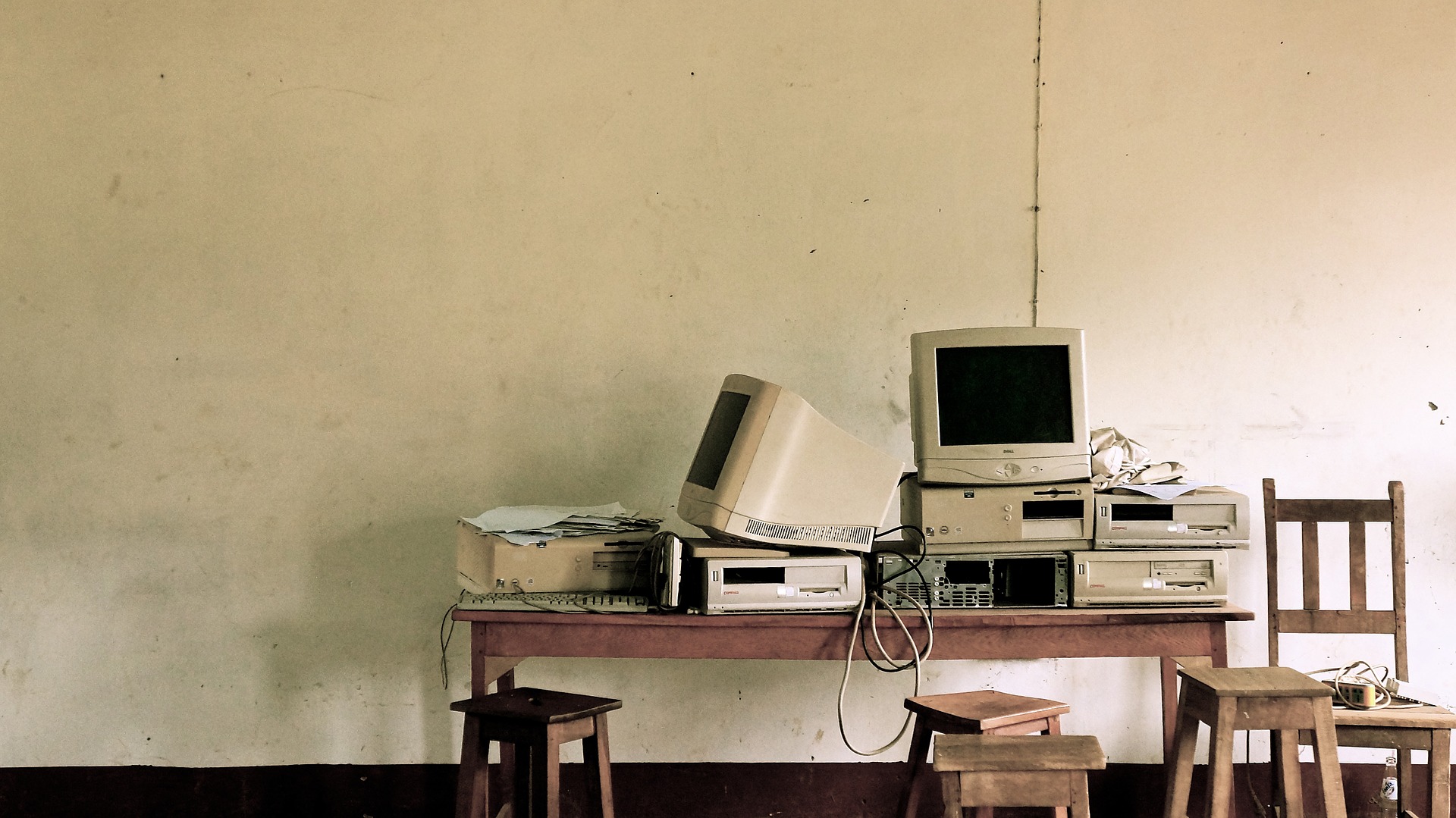

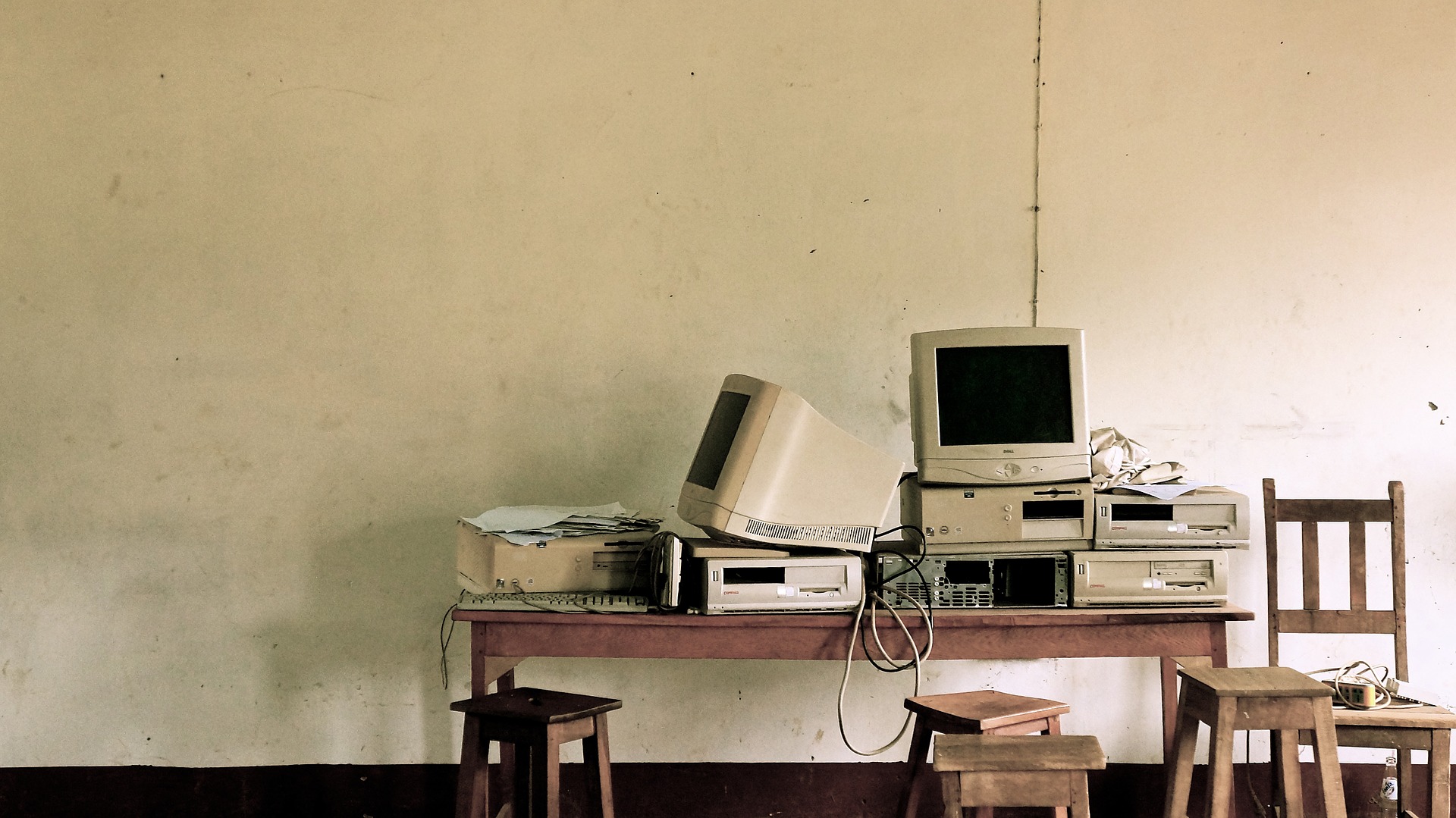

Everybody has known for ages that the PC market, while perhaps not quite doomed, is certainly going through a long period of decline which it’s unlikely to bounce back from. Tech industry analysts including Gartner Inc., and International Data Corp. (IDC) have both said so, on more than one occasion, but now the former is saying there’s still an opportunity for vendors to claw back some revenues by selling high-end machines to gamers.

In Gartner’s latest report, “Market Trends: Three Key Strategies to Increasing Profits in the PC Market”, it reminds us once again of the struggles vendors are experiencing. It points out how PC shipments have fallen through the roof in recent years, from 343 million units in 2012 to just 232 million (estimated) units in 2016

“In terms of revenue, the global PC market has contracted from $219m in 2012 to an expected $137m in 2016,” said Meike Escherich, principal research analyst at Gartner, in a statement. “PCs are no longer the first or only devices users are choosing for internet access.”

Gartner’s most recent report on the declining PC market came this April, in which it placed the blame squarely on smartphones and tablets, which are cheaper and good enough for the average consumer. As a result, PC vendors have been left reeling, with firms like Acer Inc., Fujitsu Ltd., Samsung Electronics Co. Ltd., Sony Corp., and Toshiba Corp., all losing ten percent or more of their market share in the last five years. Meanwhile, market leaders Dell Inc., HP Inc., and Lenovo Group Ltd., might have managed to grow their market shares, but their revenues are still declining.

The sole bright spots in the market are the “ultramobile premium” and “gaming PC” segments, and that’s where PC vendors should be focusing their efforts, Gartner reckons. Indeed, ultramobile premiums are actually likely to see some revenue growth to around $24.5 million this year, a 16 percent increase from one year ago. By 2019, Gartner says it’ll be the largest segment of the PC market in terms of revenue, worth around $58 million a year.

“The ultramobile premium market is also more profitable in comparison with the low-end segment, where PCs priced at $500 or less have 5 per cent gross margins,” said Tracy Tsai, research vice president at Gartner. “The gross margin can reach up to 25 per cent for high-end ultramobile premium PCs priced at $1,000 or more.”

The other growth opportunity, gaming PCs, remains but a niche segment. Vendors sell but a “few million” of these machines each year, but they can still make a fairly decent profit on them, with average selling prices (ASPs) ranging from $850 at the low end to $1,500 at the high end.

“The high-end, purpose-built gaming PC segment (for example, $1,000 or more) is where PC vendors should focus for long-term profitability, despite this segment’s competitiveness,” said Tsai.

Last but not least, Gartner reckons PC vendors might also be able to bleed a bit of cash out of the Internet of Things (IoT) market.

“Vendors could detect with sensors if a battery is getting too hot or a hard-disk drive is being overworked, and they could send an alert to customers to get PCs checked before they suddenly go down,” said Ms. Tsai. “This would save vendors’ operating costs and also helps users with better service.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.