INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Despite the inexorable advance of cloud computing giants into data centes and enterprise technologies, venture capitalists are still betting that startups in storage, networking, databases and other enterprise products have plenty of opportunity to thrive.

OK, so maybe it’s no surprise VCs, who are paid to find startups to invest in, insist that, yes, of course there are plenty of promising enterprise startups to invest in.

But as Amazon.com Inc., Google Inc., Microsoft Corp., Salesforce.com Inc. and others keep expanding their cloud services, they’re in essence invading a large swath of enterprise markets such as storage, computing and networking. That pressure looks to intensify as the public cloud players start to embrace hybrid computing, worming their way into data centers with an eye to siphoning off workloads to their clouds more easily.

None of that seems to be discouraging VCs — at least those who spoke at the enterprise-focused Structure conference in San Francisco Tuesday — though they’re getting a little choosier on what kinds of startups they back.

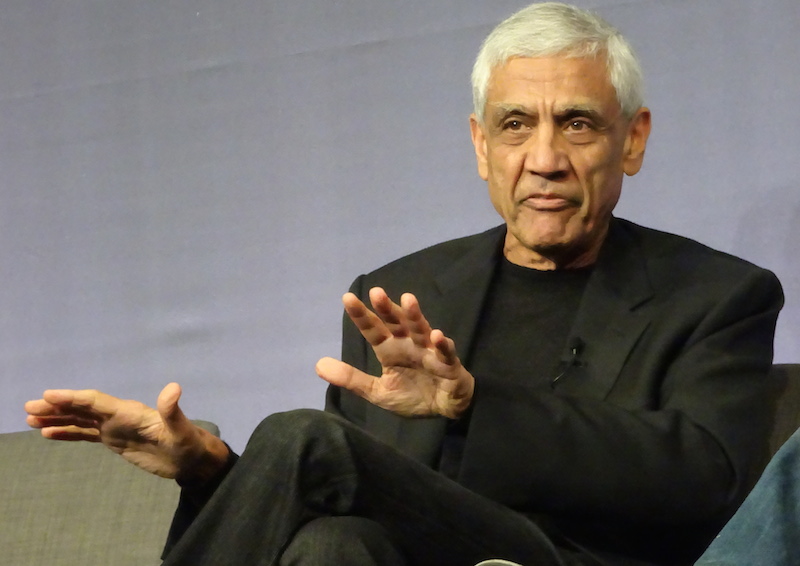

“Everything has started to shift in the last two or three years” in the enterprise, said onetime Sun Microsystems Inc. cofounder Vinod Khosla (above), founder of Khosla Ventures. “Every area I look at is being reinvented at a different scale.”

As a result, he said, there are big opportunities for agile startups, especially those that start small but have big ambitions. Khosla cited Nutanix Inc., which recently went public, as well as Khosla Ventures-backed Rubrik Inc., which started out with a hardware data archiving product recently introduced a cloud data management service. “No matter where I look–DevOps, AI, analytics–it’s a whole different world,” he said.

Khosla also views security as a ripe area for investment, mostly because he doesn’t see “anybody attempting the right approach, which is fundamentally reinvent security from the ground up. Security is a huge problem, so there are huge opportunities.”

Not least, he thinks artificial intelligence and machine learning will have a much bigger impact on data center infrastructure. He thinks it could eliminate 80 percent of what information technology people do. “That’ll be exciting,” he said, before noticing the audience of IT people was noticeably quiet. Waving at them, he added breezily, “They’re all in the other 20 percent.”

AI, however, is an example of how VCs are getting choosier on the kinds of companies they choose to fund even in hot areas because the giants are investing so much themselves that they’re leaving fewer opportunities to upstarts. AI startups can still compete, said Creighton Hicks, a partner at Kleiner Perkins Caufield & Byers, by making a better AI that they can sell.

But Sunil Dhaliwal, founder and general partner at Amplify Partners, said AI startups will struggle without the massive datasets the big companies can amass. “If you’re a startup trying to compete on an algorithm and you don’t have the dataset to make that useful, you’re probably dead,” he said.

THANK YOU