INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Palo Alto Networks Inc. on Tuesday acquired behavioral attack detection firm LightCyber Ltd. for $105 million in an all-cash deal. But just a few hours later, the maker of security firewalls reported second-quarter revenues that missed Wall Street forecasts.

The company also provided fiscal third-quarter guidance substantially short of forecasts, with Chief Executive Mark McLaughlin reporting “execution challenges.” Palo Alto Networks’ shares fell 13 percent in after-hours trading Tuesday. The results contrast with earnings upsides reported by other security companies such as Check Point Software Technologies Inc. and Fortinet Inc.

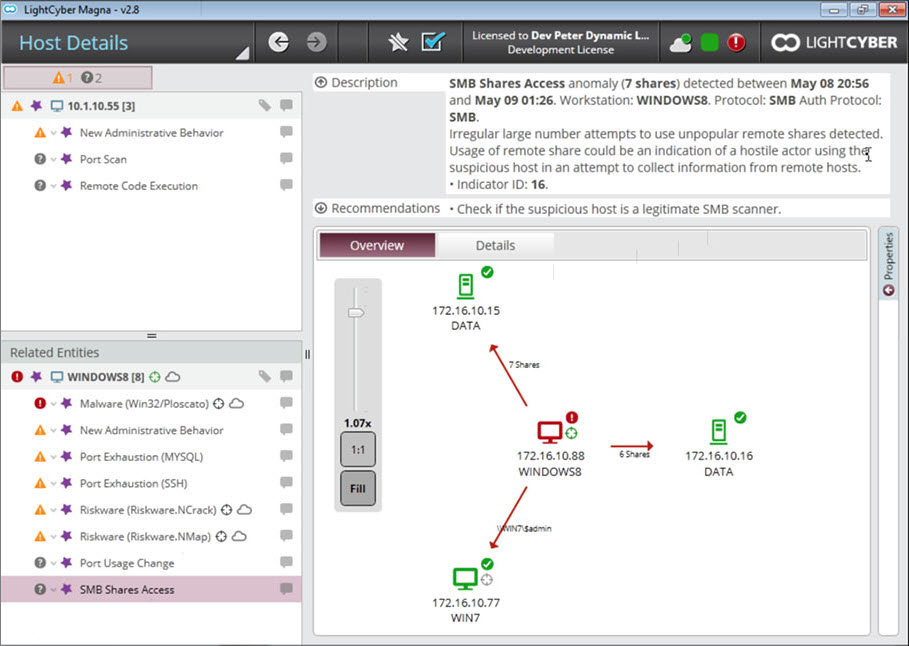

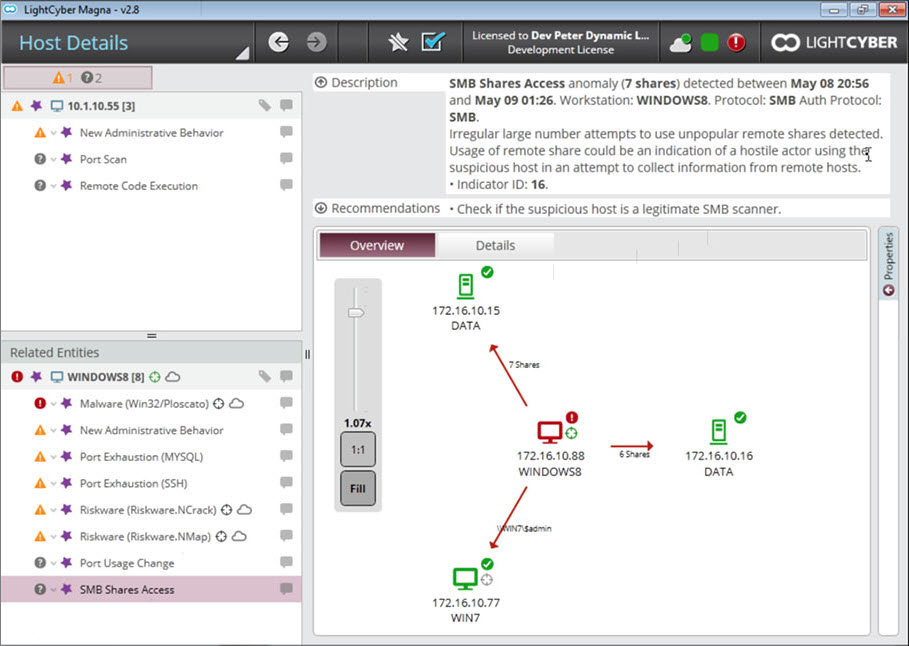

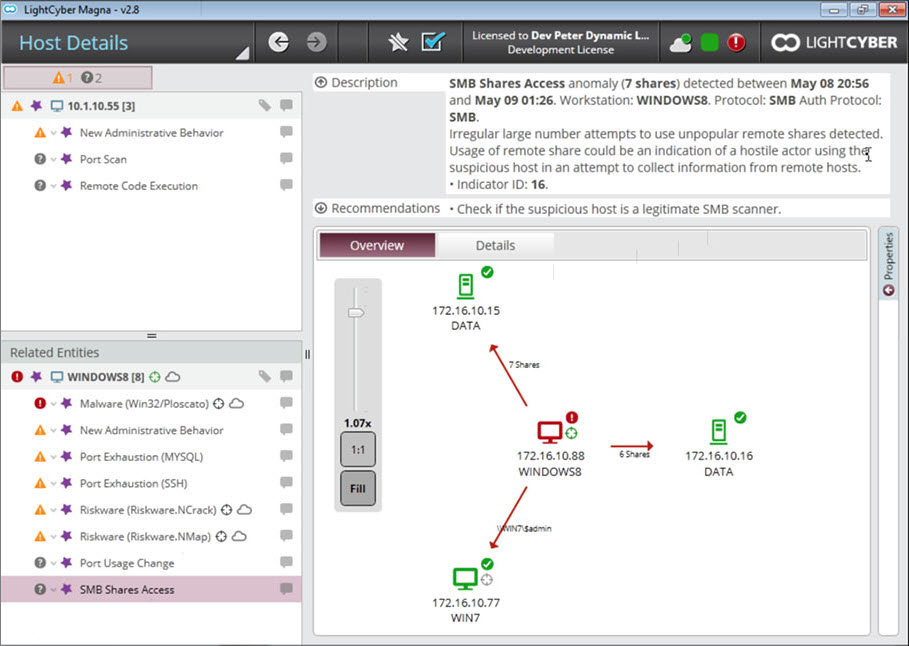

Founded in 2011, LightCyber offers a behavioral attack detection platform that was developed with the recognition that targeted attackers can circumvent traditional threat prevention systems and then operate with unfettered access to network resources.

The company’s Magna platform uses machine learning to identify behavioral anomalies inside a network to deliver security visibility into a wide range of attack activity, aiming to detect and stop attacks before damage is done. LightCyber claims that its automated investigative data with rich user, endpoint and network context delivers high accuracy because of the breadth of data context included in the behavioral profiling process.

Palo Alto Networks said that they would continue to offer LightCyber products and support existing customer implementations while it integrates LightCyber as a subscription to its security platform, a process expected to be completed by the end of the year. Chief Executive Officer Mark McLaughlin added that the acquisition would complement the company’s current automated threat prevention capabilities.

Experts agreed with the merits of the acquisition. Mark Miller, a partner at Dallas-based M&S Technologies, told CRN that it makes a lot of sense for Palo Alto Networks to buy, rather than build, a company in this market, because there are multiple companies in the space already, and the acquisition would add a broader sales base for LightCyber. “Selling it as an add-on feature or subscription would be the way to go,” Miller said. “If they can go back to their current Palo Alto Networks customer base, it should garner sales for them.”

LightCyber had raised $32 million over three rounds from investors that included Access Industries, Amplify Partners, Battery Ventures, Glilot Capital Partners and Vertex Ventures.

With reporting from Robert Hof

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.