BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

As the number of companies that use chatbots continues to grow, so is investor interest in the technology rising. Boston’s Glasswing Ventures and five other funds jumped on the bandwagon today by leading a $8.3 million funding round into Talla Inc., one of the startups at the forefront of the trend.

The two-year-old firm offers a chatbot designed to answer the frequently recurring questions that often account for the bulk of the requests sent to a company’s help desk. Talla can be fed information from a Google Doc or a knowledge base, and the algorithms under the hood take care of the rest.

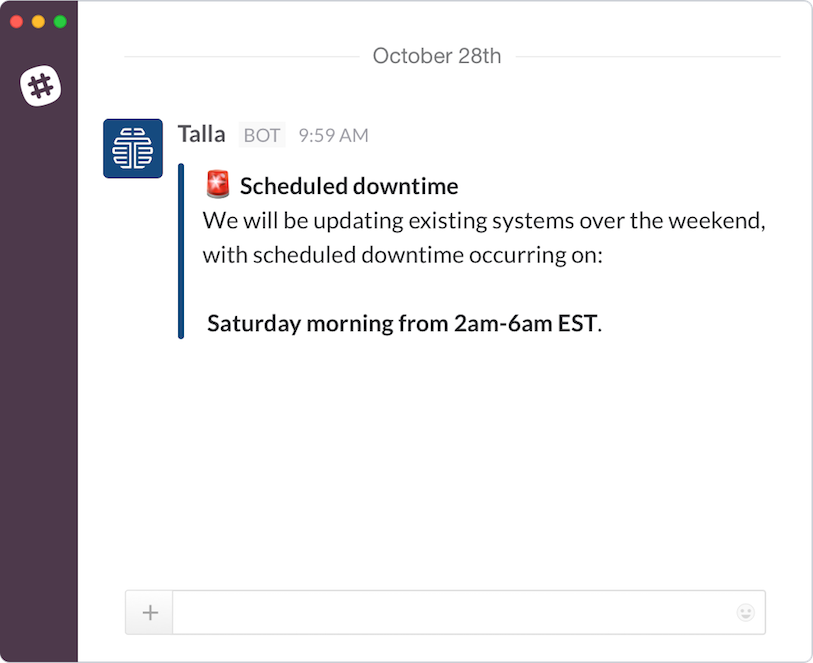

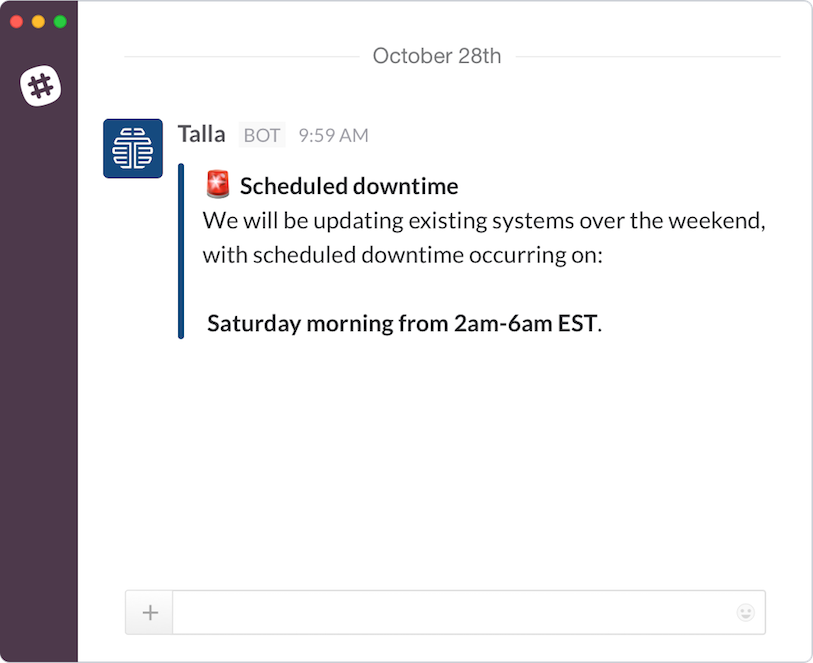

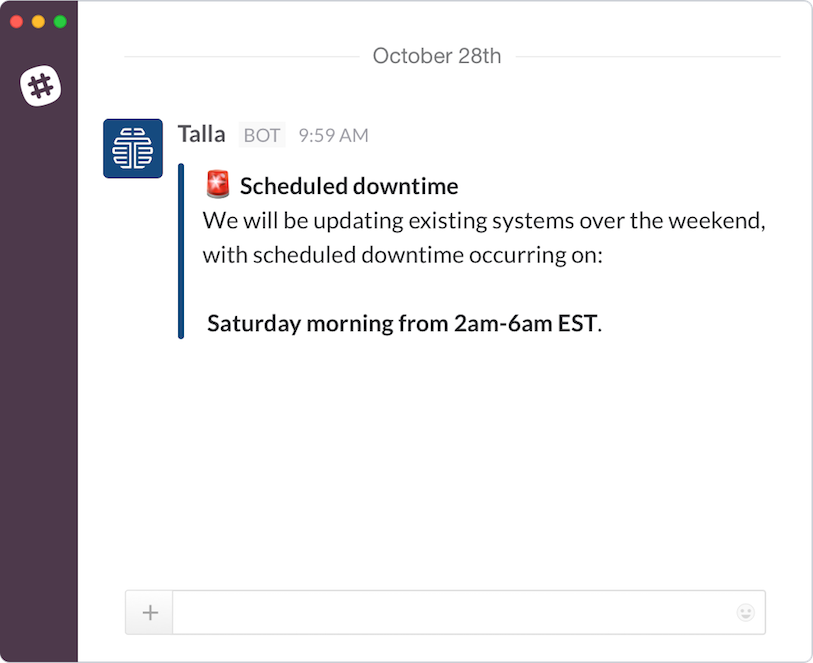

Talla answers inquiries in a concise natural-language format designed to help users quickly find what they’re looking for. If a new employee seeks information about how to set up their computer, for instance, the chatbot can present the relevant documentation in a neat list. Moreover, the bot could be configured to include a menu in the message that lets the users input whether they’re on a Mac or Windows machine and bring up the specific help page they need.

Talla analyzes each such interaction to help companies identify areas for improvement. From there, the insights are made available in a backend management console that doubles as a hub for handling requests too complex to be answered automatically. Moreover, managers can use the platform to distribute pre-written messages as part of on-boarding and training programs.

According to Talla, its platform can cut the number of tickets that reach the help desk team’s inbox by half while helping users find answers to their questions faster. It’s currently designed mainly to handle technology and human resource-related inquiries. Rob May, the startup’s founding chief executive, shared in a blog post that the new funding will be used to widen the bot’s capabilities.

One way Talla plans to accomplish that is by enhancing the natural-language processing technology at the heart of the platform. Additionally, May wrote that his team is working to develop more third-party integrations and make the offering compliant with the financial sector’s SOC 2 security standard as part of an effort to court large enterprises.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.