INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

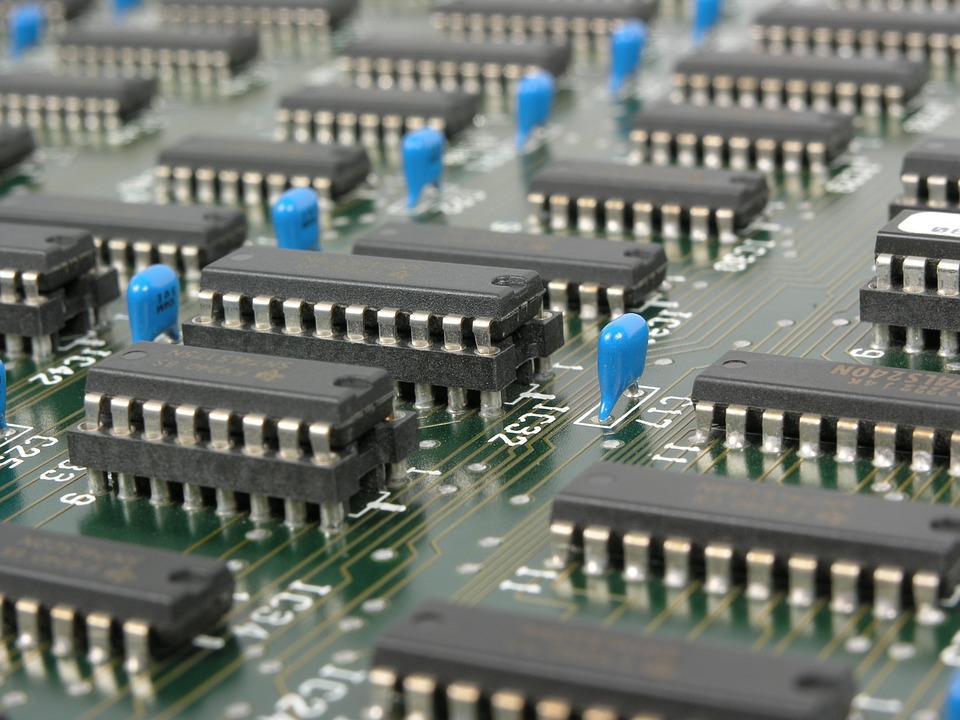

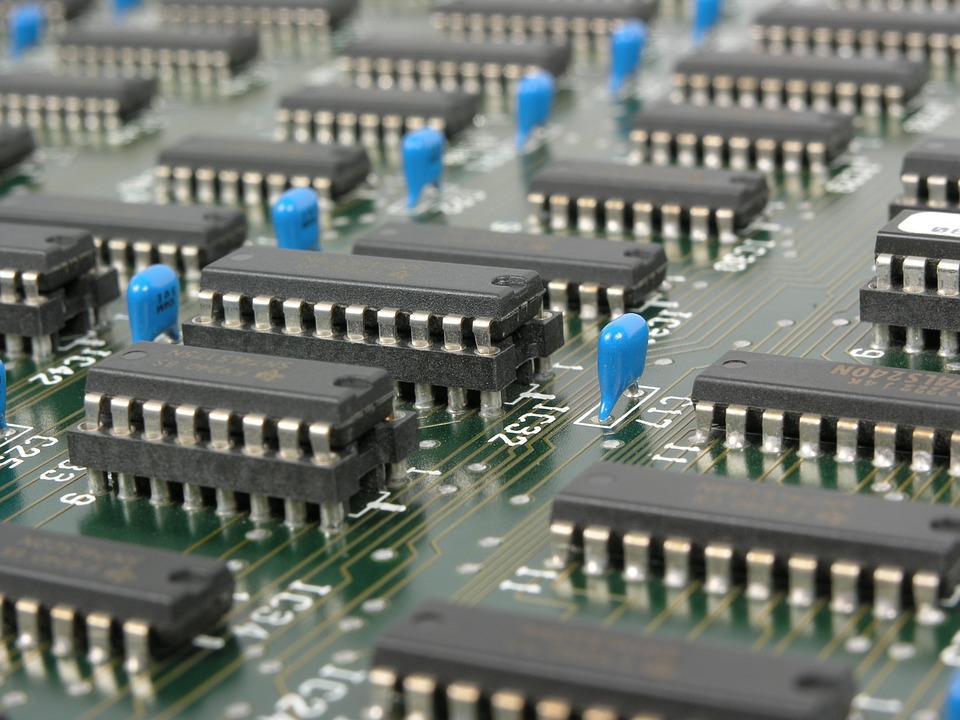

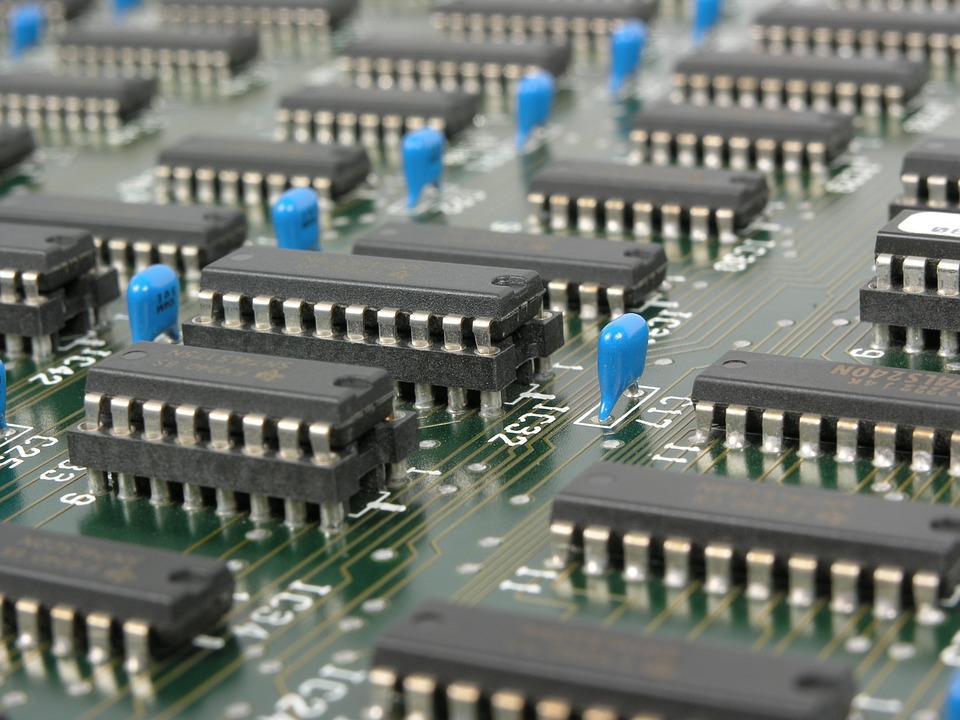

Technology firms’ spending on semiconductors rose by 17 percent in 2017 thanks to rising demand for memory chips for data centers and “internet of things” devices, but to the likely relief of buyers, the hot market is likely to cool this year.

The chip market is likely to see a further increase in spending in 2018, fueled by a new round of IoT deployments and the growth of technologies such as artificial intelligence. However, the price hikes that drove additional growth last year are likely to ease, meaning prices could stabilize, industry analyst IHS Markit, owned by IHS Inc., said in a new report released Tuesday.

IHS said that global chip spending topped $292 billion in the last year as suppliers struggled to meet renewed demand for DRAM and NAND flash memory. The analyst firm said the blame for last year’s memory chip shortage could be laid at the feet of data center operators, which raced to roll out all-flash storage options so customers could gain quicker access to big data.

The industry is likely to slow down this year, however. IHS said it expects memory chip prices to stabilize, while spending will return to single-digit growth. “If market equilibrium between supply and demand is reestablished for those memory components this year, prices will likely normalize,” IHS predicted.

That prediction tallies with a recent report from another analyst firm, Gartner Inc., which said it expects memory prices to stabilize this year as Chinese chipmakers ramp up memory production this year.

IHS said that the usual suspects were the largest consumers of flash memory chips over the past year. Smartphone makers Apple Inc. and Samsung Electronics Co. Ltd. were the biggest spenders, with enterprise hardware makers Lenovo Group Ltd., Huawei Technologies Co. Ltd. and Dell Technologies Inc. rounding out the top five.

About a third of the global memory chip spending went on chips for wireless technologies used in smartphones, while servers and other computer platforms accounted for a further 17 percent. The industrial IoT and automotive sectors also spent a significant amount on memory chips over the last year.

With spending on traditional memory chips likely to stabilize, more money is expected to be poured into the so-called “next-generation memory market” over the next five years.

In a separate report published in December, the Ireland-based analyst firm Markets and Research said it expects this emerging sector to be driven by greater demand for big data storage among enterprises, in addition to the need for greater bandwidth and more scalable memory options for AI and IoT deployments.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.