INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Artificial intelligence is driving a lot of new services from internet giants such as Amazon Web Services Inc., Google LLC, Facebook Inc. and Microsoft Corp. — and they all need Nvidia Corp.’s graphics chips to power AI in their massive data centers.

Once again, that was a key driver of Nvidia’s growth in its fiscal fourth quarter. The Santa Clara, California-based chipmaker today said its net profit shot up 71 percent from a year ago, to $1.1 billion, or $1.78 a share, up 80 percent. Revenues jumped 34 percent, to $2.91 billion.

The results smashed Wall Street forecasts. Analysts had modeled a profit of $1.17 a share on revenue of $2.68 billion. Nvidia itself had forecast $2.6 billion to $2.7 billion in revenue.

“Nvidia had a stellar quarter with 34 percent revenue growth overall and growth in every business unit,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy.

The company also issued a new forecast for the first quarter of $2.9 billion in revenue give or take 2 percent, well above the consensus of $2.46 billion, and a gross margin of 62.7 percent plus or minus a half-percentage point.

The results gave a huge lift to Nvidia’s shares. In after-hours trading, its shares rose as much as 12 percent. In regular trading, they had fallen more than 4 percent, to $219.07 a share, on a day when the overall markets again plunged, also by about 4 percent or more than 1,000 points. Nvidia shares were up about 14 percent since the start of the year.

On another choppy but ultimately up day for the overall market Friday, shares rose 7 percent.

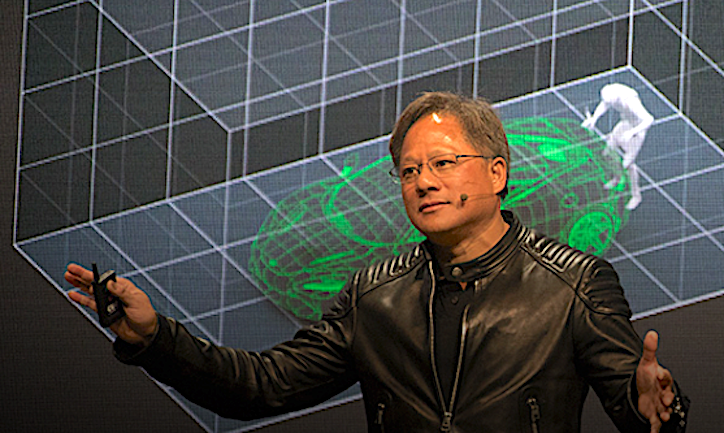

“Industries around the world are racing to incorporate AI,” Nvidia Chief Executive Jensen Huang (pictured) said in prepared remarks. “Virtually every internet and cloud service provider has embraced our Volta GPUs,” the company’s latest generation of graphics processing units.

Nvidia’s mainstay chips and systems for video gaming rose the most of any segment, up 29 percent from a year ago and 11 percent from the previous quarter, to $1.739 billion.

But data center sales saw the biggest quarter-to-quarter rise, up 21 percent, to $606 million. That was up more than 105 percent from a year ago and beat analysts’ average estimate of $552 million.

The big internet companies companies need the chips, which are especially adept at the kind of processing needed for machine learning algorithms, to power services such as image and speech recognition. They’re also critical for emerging technologies such as self-driving cars.

The growth signaled that the crucial data center segment is showing steadier momentum. In the second quarter, data center growth from the previous quarter had flagged to nearly flat, which Nvidia at the time blamed on a transition to a new generation of data center chips. Sequential growth in the segment rebounded to 20 percent in the third quarter, so an even higher growth rate in the fourth quarter is a positive sign.

Cryptocurrency mining, which requires high-powered chips such as its GPUs, has become a significant market for Nvidia over the past year or so, but the company has downplayed the potential and made no mention of it ahead of a 2 p.m. PST earnings conference call.

The reticence isn’t just because it’s still relatively small but also because of the uncertainty and volatility surrounding the business. The recent downdraft in prices of cryptocurrencies such as bitcoin, as well as recent crypto mining crackdowns by some countries such as China, raises more questions among investors on the sustainability of the business.

Indeed in the third quarter, cryptocurrency mining fell by more than half from the second quarter, to $70 million. Huang blamed the decline on miners migrating to more standard gaming computers for the task and said that “for some time, we will see that crypto will be a small but not zero part of our business.”

Chief Financial Officer Collette Kress reiterated on the earnings call that “cryptocurrency trends likely will remain volatile.” Some of the cryptocurrency demand was fulfilled with dedicated chips and some from gaming chips, the latter demand contributing to lower-than-usual inventory of gaming chips. But she didn’t provide an estimate for cryptocurrency-related revenues.

“I expect datacenter to grow, but am cautious on gaming, as it includes bitcoin mining,” said Moorhead. “It’s harder to estimate how quickly it goes to ASICs,” or application-specific integrated circuits customized to mining.

Moorhead also noted that the automotive segment only had slow growth, down 8 percent from the prior quarter and up only 3 percent from a year ago. He attributed that to slower adoption of self-driving car electronics.

Despite its seemingly dominant position with its graphics chips, Nvidia may face more concerted competition going forward. Intel Corp. in November announced a surprise partnership with longtime rival Advanced Micro Devices Inc. to make chips for high-end laptop personal computers that combines Intel’s central processing unit with AMD’s GPU. Intel also hired Raja Koduri, AMD’s recently departed chief GPU architect, to do the same job at Intel.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.