APPS

APPS

APPS

APPS

APPS

APPS

Dropbox’s initial public offering began Thursday evening, just a couple of hours after a stock market rout that slashed more than 740 points off the value of the Dow Jones Industrial Average. Uh-oh.

Yet when Dropbox’s shares started selling to the public starting Friday morning, a day when the market would fall an additional 425 points, the file storage and collaboration provider’s shares shot up more than 40 percent.

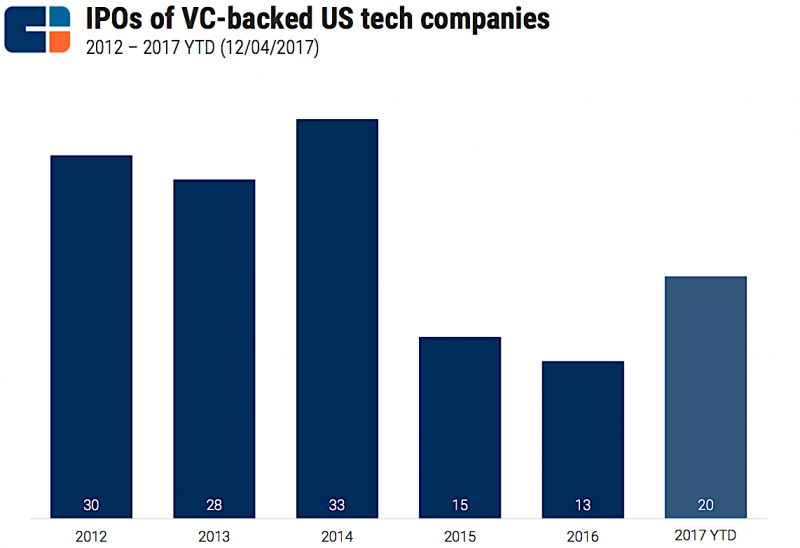

It was a potent sign of investor interest in new offerings, one that bodes well for a raft of technology companies that have either filed or are expected to file for IPOs this year. That would be a turnaround from many years in which tech IPOs have stagnated.

“They’re moving the machinery ahead to go public,” said Matt Murphy, a partner at Menlo Ventures. He reckons there are at least 50 enterprise software companies alone with about $100 million in annual revenue, rapid growth and a path to profitability in four to six quarters, the three key factors investors are looking for in IPOs. “In the next 12 to 18 months, I think you’ll see a material pickup.”

Indeed, on Friday another tech company, Pivotal Software Inc., filed to go public. Even if the impetus appeared to be majority owner Dell Technologies Inc.’s desire to pay off its massive debt from buying EMC Corp. in 2016, it was yet another signal that the IPO window could be opening.

An even more high-profile offering is expected April 3 from music service Spotify AB. This week, DocuSign was reported to be looking at an IPO later this year. On Monday, work management platform Smartsheet Inc. filed for its initial offering. And in January, SurveyMonkey Inc. was said to be preparing for an IPO.

Many unicorns, from Uber Technologies Inc. to Airbnb Inc., have been able to raise as much venture capital as they need to expand, so they choose to stay private and avoid the red tape, hassle and short-term thinking a quarterly focus often brings.

As a result, the number of IPOs has plummeted from about 300 a year 20 years ago to less than half that — and not all of those are in tech.

Why does the dearth of IPOs matter, if companies don’t feel they need to go public because there’s so much private capital sloshing around? As much as anything, IPOs and the rapid expansion of companies they tend to spur, as well as the new company formation that follows from the wealth created by IPOs, also mean lots of jobs. As Scott Kupor, a managing partner at the VC firm Andreessen Horowitz, said last year, ”Simply put, a lack of IPOs means fewer jobs.”

There’s no lack of jobs in technology either right now, but that won’t last forever, so many observers believe it’s important to restart the flywheel — and, not least, provide returns to VC firms’ limited partners.

“We do need liquidity as a barometer of the health of the ecosystem,” Murphy said. “It’s very measurable when there’s an IPO.”

Indeed, consider the case of MuleSoft Inc., which went public a year ago. The application network platform was worth up to $2.9 billion at the initial offering price, and investors then bid it up 44 percent the first day, pushing the valuation past $4 billion.

“For awhile there was a sentiment that the private markets’ [valuations] were ahead of the public markets’,” Murphy noted. “I don’t think a private investor would have invested in MuleSoft at $4 billion to $5 billion.” But the public valuation ended up setting a floor for an even higher valuation for MuleSoft, which was acquired this week by Salesforce.com Inc. for $6.5 billion.

What’s more, despite some IPOs such as Snap Inc.’s not performing very well in subsequent months, some — especially in enterprise software and cloud services — have set a positive example for investors. Since late 2016, companies such as Nutanix Inc., Twilio Inc. and Okta Inc. have not only had successful IPOs, but in the last couple of months, their shares have risen significantly, suggesting their businesses are sustainable.

All this price inflation depends ultimately on a healthy stock market, which is far from a sure thing in a world in which a tweet from President Trump can tank stocks overnight. And the continuing presence of big money from VCs such as SoftBank Group Corp. and its $100 billion Vision tech fund, private equity firms and sovereign wealth organizations may allow some unicorns to continue to stay private.

But for now, IPOs are offering a potentially higher return than existing stocks in what is by most estimates a fully valued stock market.

“People have a lot of capital, where are they going to put it?” said Robert R. Ackerman Jr., founder and managing partner of the venture capital firm AllegisCyber. “IPOs are one of areas where they hope to find that growth.”

That was apparent not only in Dropbox’s reception, but another offering last week. Shares of security firm Zscaler Inc. last week more than doubled on their debut (pictured).

Cybersecurity could be prime territory for IPOs, Ackerman said, with at least a half-dozen firms such as Cylance Inc., CrowdStrike Inc. and AlienVault Inc. close to or above a $100 million annual run rate. “Portfolio managers want cyber in their portfolios, but there isn’t much” in the way of public security companies, he said.

But there are companies in many others areas close to the IPO threshold, said Murphy, from financial tech firms to enterprise software to life sciences. Most attractive among all of these are companies that sell software as a service in the cloud, which has a more predictable revenue stream.

Still, there’s hardly a guarantee. A lot of investors thought 2017 was primed to loosen the floodgates on new offerings. That never happened. It will take a lot more like Dropbox and Zscaler to make 2018 a comeback year for IPOs.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.