INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Graphics chipmaker Nvidia Corp. had a lot to live up to today when it reported its first-quarter earnings, after its stock hit another in a string of recent all-time highs. Bottom line: It didn’t.

But the results still easily beat expectations, if not as much as some of those investors may have hoped.

Thanks to the continuing boom in artificial intelligence applications and cryptocurrency “mining” that both use large numbers of its graphics processing units, Nvidia reported a first-quarter profit of $1.98 a share, up 145 percent from a year ago. Earnings before certain costs such as stock compensation was $2.05. Revenue jumped 66 percent, to $3.21 billion.

Wall Street had forecast that Nvidia would earn an adjusted profit of $1.46 a share on revenue of $2.89 billion, so it easily beat predictions as it has done each quarter for more than two years now. The Santa Clara, California-based company itself had provided guidance of $2.90 billion in revenue, plus or minus 2 percent.

“Nvidia registered another monster quarter with overall revenue up 66 percent,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy. “Every business unit was up.”

Nvidia also issued a new forecast, saying second-quarter revenue would be $3.1 billion, plus or minus 2 percent, again above Wall Street’s $2.95 billion consensus.

Still, investors may be in a mood to take some profits. Shares were falling about 3 percent in after-hours trading. They had closed up 1.7 percent, to $260.13, in regular trading before the report. Nvidia’s stock has been setting records for much of the past trading week.

Revenue from Nvidia’s data center business leaped 71 percent, to $701 million. That beat one Street average prediction of $656 million but fell short of the $703 million Thomson Reuters had reckoned from its own analyst poll. That may have contributed to investors’ negative reaction.

They also might be a bit worried that the company’s overall revenue outperformance came at least partly from demand from makers of computers for mining cryptocurrencies. The impact of cryptocurrency mining, which uses computers with GPUs in them, has been a source of continuing concern to investors, since many believe the phenomenon could be short-lived or at least volatile in the short term. In the last couple of quarters, Nvidia has downplayed the impact, saying last quarter that miners were mostly using gaming computers rather than specialized ones, making the impact hard to extract from Nvidia’s core gaming business.

Chief Financial Officer Colette Kress did reveal for the first time on the earnings conference call that first-quarter cryptocurrency revenue was $289 million. But she said that in the second quarter, it would fall to a third of the level of the first quarter.

Gaming revenue, which remains more than half the total, rose 68 percent, to $1.72B, above analysts’ forecast of $1.61 billion. Another operation, professional visualization from its Quadro workstation GPUs, rose 22 percent, to $251M, squeaking past the $248 million consensus.

The only potential disappointment was automotive revenue, which inched up only 4 percent, to $145 million, just over the Street’s $140 million estimate. “The small 4 percent auto sales increase doesn’t alarm me as it was Nvidia’s largest auto quarter ever and with Tesla softness, doesn’t come as a surprise,” Moorhead said.

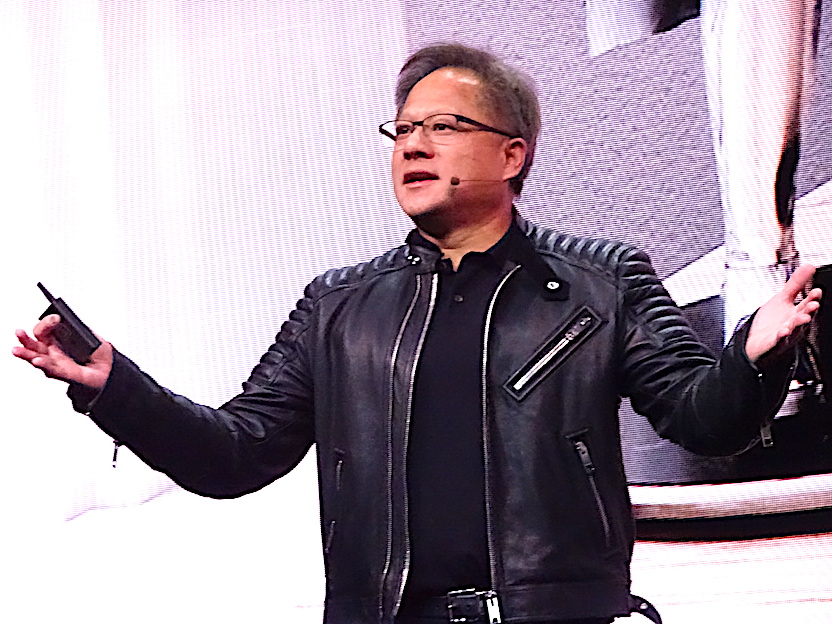

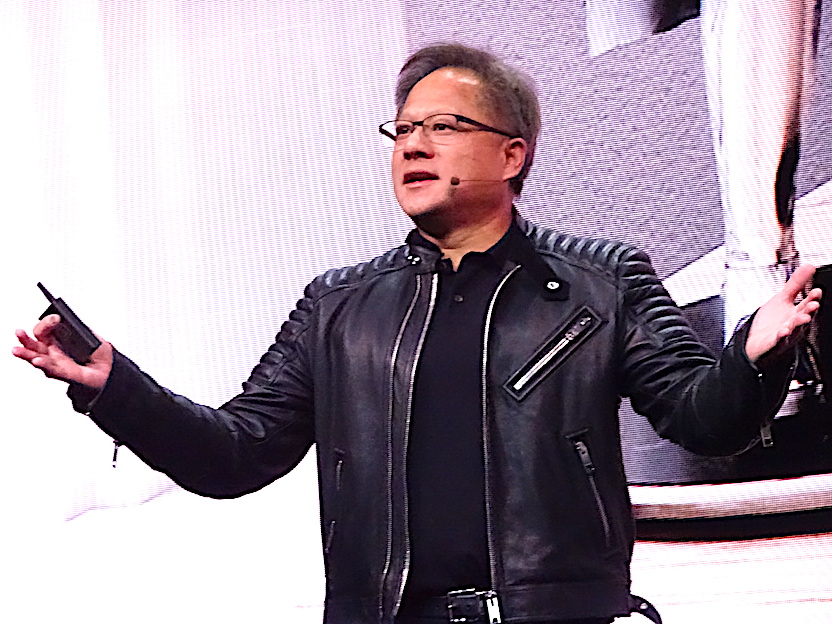

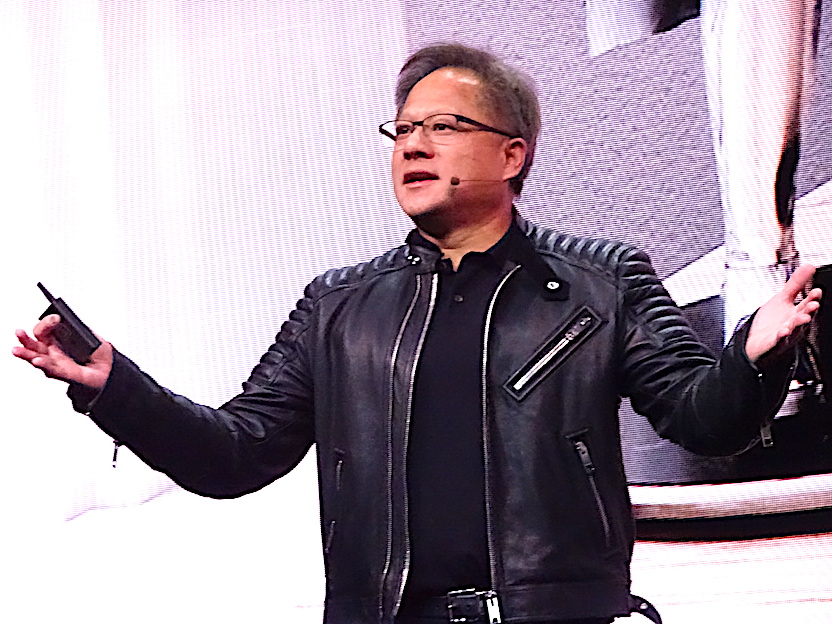

“We had another great quarter. … with growth across every platform,” Jensen Huang (pictured), Nvidia’s founder and chief executive, said on the call. “At the heart of our opportunity is the incredible growth of computing demand for AI.”

The big internet companies such as Google Inc., Facebook Inc. and Amazon.com Inc. use the chips, which are especially adept at deep learning, the kind of processing needed for machine learning algorithms, to power services such as image and speech recognition. They’re also critical for emerging technologies such as self-driving cars.

The results indicate Nvidia’s long run of positive results is continuing, particularly in the fast-growing data center business driven largely by AI enthusiasm. The growth marked a continuation of the segment’s recent recovery from a slow patch last summer when the company was in the process of rolling out a new flagship chip.

Still, Nvidia faces more competition than it has for years as more companies look to specialized silicon for deep learning. Intel Corp. has been pitching both its own mainstream central processing units for at least some machine learning workloads, and it has picked up a number of chip companies in recent years to do more specialized AI work such as computer vision. Google this week introduced a new Tensor Processing Unit for AI work, though it doesn’t sell them, using them in its own cloud data centers.

Eventually, those rivals could siphon off business from Nvidia’s GPUs — maybe. For now, though, Nvidia rules the roost. Late last month, for instance, Google added the latest Nvidia chips to its data centers, making them available on its public cloud.

“I expect most of the Nvidia competition to come in 2019 when Intel is ramping Nervana and their discrete GPU efforts and when AMD has their new Navi architecture,” Moorhead said. “It’s a growing market so everyone can gain business.”

For his part, Huang said Nvidia, in particular with its new TensorCore GPU, remains faster and more programmable than others such as Google’s Tensor Processing Unit. “We’re far ahead of the competition,” he said.

The impact of cryptocurrency mining, which uses computers with GPUs in them, has been a source of continuing concern to investors, since many believe the phenomenon could be short-lived or at least volatile in the short term. In the last couple of quarters, Nvidia has downplayed the impact, saying last quarter that miners were mostly using gaming computers rather than specialized ones, making the impact hard to extract from Nvidia’s core gaming business.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.