BIG DATA

BIG DATA

The maker of software for managing large amounts of machine-generated data also forecast that second-quarter revenue will come in at between $356 million and $358 million, above analyst estimates of $354 million. “It was a solid start to the year in terms of pure execution and product innovation,” said Chief Executive Doug Merritt.

Despite the third straight quarterly decline in new enterprise customer acquisitions – Splunk signed 460 new customers in the quarter, compared with 570 during the previous three months – executives expressed confidence that the company can reach its stated goal of $20 billion in annual revenue and 20,000 new customers by 2020. However, Merritt conceded that the slowdown is an area of concern.

“We believe we should be adding even more new customers, and we have made number of investments to be sure that we focus on this area,” he told analysts on the company’s earnings call.

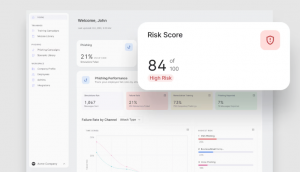

That remains investors’ main concern as well. “We think the company’s progress on this metric needs to be monitored as it generates a vast majority of its revenues from the installed base,” Mizuho Bank analyst Abhey Lamba said in a note to clients. “Management has undertaken some initiatives to accelerate new customer signings but we have yet to see results.”

Customers who are coming on board are steadily paying more. Nearly 400 six-figure deals were recorded in the quarter and 43 customers placed orders of $1 million or more, up from 35 a year ago. Cash flow improved more than 80 percent, to $76.5 million, up from $41.4 million a year ago.

Channel play

Splunk will increasingly rely upon channel partners to sign new deals and drive customer growth. Although that strategy will create some pressure on margins in the short term, it will ultimately give the company more predictability and visibility into long-term performance. Splunk has set a goal of deriving 65 percent of its revenues from subscriptions, up from 50 percent today. “Short-term billings are lower, but customers tend to pay annually,” said Chief Financial Officer Dave Conte.

The company is also diversifying its product portfolio to address more vertical market and functional opportunities, many of which have been identified by customers. For example, Splunk recently introduced Insights for Infrastructure and Industrial Asset Intelligence, which apply its machine log analysis capabilities to server monitoring and industrial machine operations, respectively. It also acquired Phantom Cyber Inc. for $350 million to extend its reach into the security market.

Even the General Data Protection Regulation, which takes effect tomorrow in Europe, has created new opportunities as well. “We’re seeing more customers ask if we can help them with GDPR,” Merritt said. “It’s an indication of all of the use cases for Splunk.”

New products will also address smaller-market customers with laser-focused services at lower price points. Merritt pointed to Splunk Insights for Ransomware, a tool that small and midsized organizations can use to analyze event logs and spot behavior consistent with ransomware, as an example of diversification in both focus and pricing. “Our strategy is to continue to offer different capabilities priced in a way that makes sense based on the value delivered and compared to other categories of tools that are similarly priced,” he said.