CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Wikibon, the market research company of SiliconANGLE Media Inc., recently updated its forecast for the True Private Cloud, a fast-growing segment of the cloud computing market that involves bringing cloud technologies to where data resides, whether on-premises in data centers or at the network edge or in the public cloud. This is a summary of the full report, which includes more detailed revenue projections, vendor analyses and more. It’s available here for free.

The True Private Cloud segment of the cloud market is a natural consequence of the global migration to cloud operating models. Data that can’t, or shouldn’t, be moved to public clouds will be computed on TPC platforms, which leverage and integrate with cloud technologies on-premises or near-premises. This year, the TPC market will continue to accelerate, attracting all major cloud players, resulting in a highly dynamic market through the next decade.

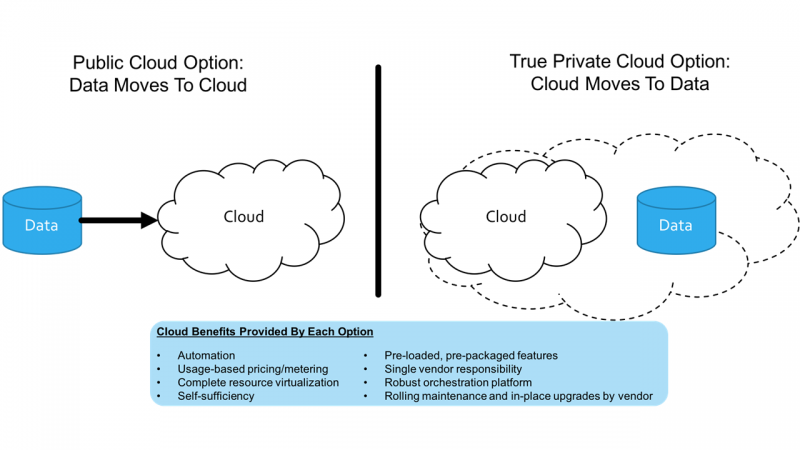

Wikibon has been predicting the emergence of a distinct True Private Cloud segment of the cloud market since 2015. Our reasoning was simple: As businesses adopted data-first business strategies – the basis for digital business transformation – they would begin organizing cloud-based business systems around natural patterns of data placement. Latency, bandwidth, IP protection, regulation, ingest/egest costs – all constrain cloud options. As we’ve stated, the long-term industry trend will not be to move all data to the public cloud, but to move the cloud experience to the data (pictured).

A “true private cloud” is distinguished from a “private cloud” by the completeness of the integration of all aspects of the offering, including performance characteristics such as price, agility and service breadth. Equally important is the nature of the relationship with the cloud supplier – namely a single point of purchase, support, maintenance and upgrades, often referred to as a “single hand to shake, and a single throat to choke.” The key benefit of true private cloud is that it provides solutions close to the cost and agility characteristics of public cloud in an on-premises deployment when business, security and latency requirements dictate.

For the last few years, Wikibon’s prediction of the emergence of True Private Cloud generated disagreement among some cloud industry competitors. The reason? On the one hand, cloud service suppliers or CSPs argued that all data could move to public clouds. On the other hand, suppliers of on-premises systems continued to negate the cloud operating model, suggesting that customers really wanted to buy cloud-friendly technologies on traditional system types. The exception was Microsoft Corp., which positioned Azure Stack as an on-premises extension of the Azure Cloud.

That has all changed in 2018. Most major CSPs and systems companies have introduced products and services that give customers real choices regarding where to process data within a hybrid cloud operating model. Although some of these approaches are nascent, all point to serious longer-term commitments to support TPC architectures. This is excellent for users, who shouldn’t have to make choices between adopting cloud operating models and exploiting data-first application architectures such as edge computing, artificial intelligence and others.

In May 2017, The Economist famously declared that data was the world’s most valuable resource; that “data is the new oil.” It’s a perspective that has been emerging for some time, but it fails to capture a central tenet of data-first, digital business transformations. Oil – and virtually any other nondata resources – is constrained by the economics of scarcity. Generally, oil can be applied to one use, in one place, at one time. The same oil cannot concurrently power your car and heat your home.

That stands in stark contrast to data as a business resource. Data can be copied, combined and shared at almost no cost; the same data can concurrently improve products and customer engagement. The economics of scarcity do not apply to data.

That doesn’t mean that data isn’t subject to rules. Among other things, data requires time to move and energy to sustain; latency and bandwidth dictate absolute constraints on what a business can do with data. Furthermore, privatizing data requires compliance with security, IP policy and regulatory regimes. Taken together, these constraints ensure that all data won’t end up in one public cloud, but rather in a multitude of distributed locations, each architected to compute local data according to the needs of local tasks.

But while data locality ensures a distribution of processing, enterprises increasingly demand a public-cloudlike experience for all locations, both on-premises and at the edge. Essentially, this means that technology vendors must render products in cloud service terms: pay-as-you-consume; self-service console; software-defined resources services acquired via APIs; and advanced use of automation to keep administration complexity and costs at a minimum.

Now, a robust and increasingly competitive TPC segment has emerged, is poised for significant growth, and will be a locus of technology innovation globally. As the technology foundation for TPC matures, the TPC market:

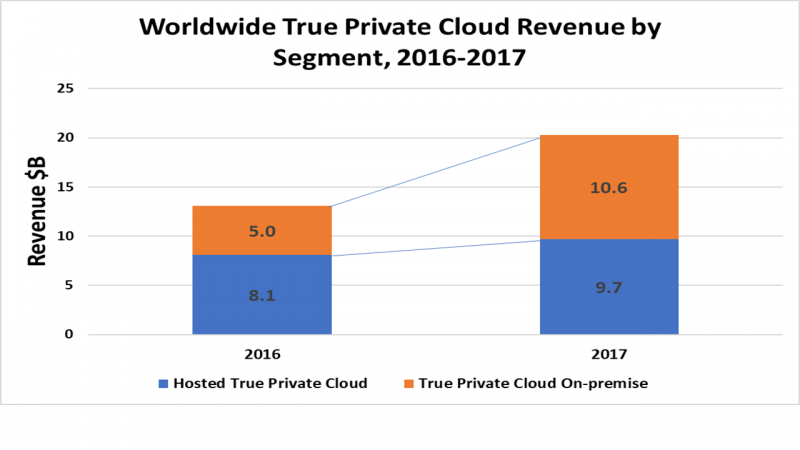

Experienced strong 2017 growth. The TPC segment grew nearly 55 percent in 2017, bolstered by maturing TPC offerings and services. From a 2016 base of $13.1 billion, the 2017 TPC market grew to $20.3 billion. The TPC sector is roughly 40 percent the size of infrastructure-as-a-service sector and growing about 50 percent faster.

For the past few years, much of the TPC spending was on hosted private cloud services. These near-premises options continued to attract spending, growing 20 percent, to $9.7 billion in 2017. On-premises TPC options, however, experienced hyper-growth in 2017, more than doubling to $10.6 billion.

VMware Inc.’s ecosystem, featuring the most robust technology base and strong partnerships with Amazon Web Services Inc., Google LLC and IBM Corp. public clouds, is leading TPC growth today. Dell EMC, Hewlett Packard Enterprise Co. and Cisco Systems Inc. with NetApp Inc. hold the top three share positions in the on-premises TPC market, with Dell EMC enjoying a leadership 29 percent share. The hosted TPC sector is led by IBM, Rackspace and DXC.

Offers real enterprise options. All large vendors of infrastructure products and services – including AWS, Google and Azure – are moving to provide fully functional TPC solutions. Enterprise demand for hybrid cloud capabilities means that only trumpeting public or on-premises cloud services is not a viable long-term vendor option.

A variety of advanced, data-first application patterns will drive demand for TPC. These include the “internet of things,” advanced analytics (especially use cases that use an enterprise’s sensitive information), social media and applications that employ AI technologies to automate or augment operations and engagement. Together, using these applications, about 4 billion users are generating nearly 3 exabytes of data per day. An important portion of that data will move to public clouds, but the vast majority – we estimate more than 90 percent – will stay local or be discarded.

Recognizing this, every single global provider of infrastructure products and services is mobilizing to provide TPC options or support TPC options. In the last year, we’ve seen a number of trends: For one, Microsoft Azure, AWS and Google Cloud are providing core and edge platforms. Also, systems vendors such as Dell EMC, IBM, Oracle Corp. and HPE are introducing TPC technology and services. In addition, serverless computing is moving into the development mainstream. And not least, supporting technologies security, data protection and dynamic data integration are being recast to support TPC.

Will be an epicenter of cloud growth and innovation. The cloud operating model is defined by public cloud service providers, but traditional systems vendors that make strong TPC commitments will help shape hybrid cloud technology stacks. Intercloud integration technologies that simplify operating hybrid cloud applications and supporting workloads such as data protection will be an especially keen area of invention.

As we stated in last year’s TPC report, this growth will be more than enough to sustain large systems companies such as IBM, HPE, Oracle, Cisco and others that have both excellent enterprise customer relationships and the means to transition their installed base to cloud solutions that truly are comparable to leading-edge public cloud services. The public cloud will not create a monopsony of just a few buyers capable of either vertically integrating hardware development and manufacturing or extracting business-threatening concessions from traditional infrastructure heavyweights.

Additionally, our prediction that enterprises would follow patterns for choosing TPC or public cloud options based on workload characteristics is unfolding. Workload will be the main determinant of public cloud and TPC choices. Horizontal SaaS applications that don’t feature significant latency concerns, like most human-user, function-specific applications, will continue to grow in the public cloud, as will a range of big data and greenfield applications, so long as they don’t involve significant data movement costs. Industrial internet of things, high-value legacy and essential data (such as finance) applications will tend to move toward edge TPC options.

TPC also will attract greenfield applications that are likely to suffer onerous data communications costs unless sensible edge data reduction policies are taken. Very importantly, as AI workloads become more prevalent, we believe training jobs will tend to run in public clouds, while inferencing applications will be placed on-premises or at the edge, often using TPC solutions.

Our expectation is that virtually all enterprise IT will be conducted utilizing a hybrid cloud model that will be dominated by SaaS and TPC, with IaaS playing an important role in engagement applications and big data services. This will lead to a new dynamic in the cloud business: how best to traverse cloud boundaries as applications increasingly are composed from networks of cloud services operating in different clouds. Cloud gateways will be a fix, but the pressure to choose cloud alternatives that can support applications end-to-end will be extreme. Microsoft and Oracle are best positioned to offer end-to-end SaaS and TPC today, but Alibaba, AWS, Google, Huawei, Tencent and others will strengthen their TPC offerings to keep pace across all points of enterprise presence.

One area where Wikibon will be especially focused in 2018/2019 is application migration. Migrating database-centric operational applications is extremely difficult. “Good enough” is failure. AWS and Google Cloud are touting services based on advanced ML and related technologies for simplifying migrations to public cloud-based database options. For Oracle and SAP customers, the transitions are made simpler by following paths specifically engineered by Oracle and SAP.

Our advice? If an application, by virtue of its workload characteristics, can easily be replatformed to the public cloud, it should eventually be replatformed. Thus, users should let the large public cloud vendors assess migrations and offer options. At the least, you’ll gain important insight into what has to be done to modernize high-value operational applications.

The bottom line: True Private Cloud solutions are no longer aspirational. All major providers of infrastructure products and cloud services are mobilizing to provide TPC options to support workloads featuring data that doesn’t naturally fit in public clouds. Chief information officers should incorporate TPC into enterprise cloud strategies, selecting vendors that demonstrate strong TPC commitment, support for an advanced cloud operating model and provide services to streamline transitions.

THANK YOU