BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Updated:

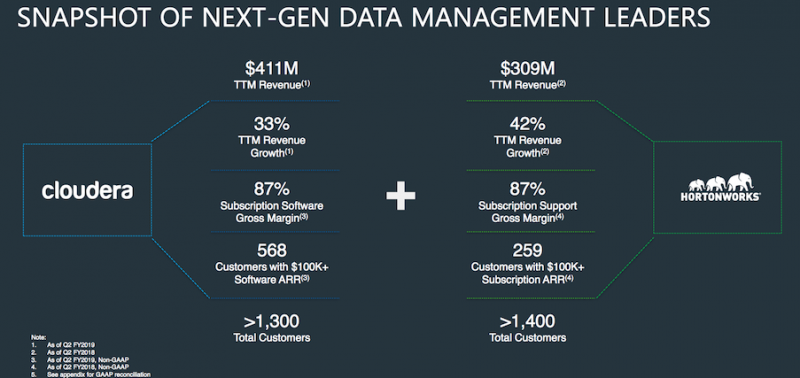

Two big-data pioneers, Cloudera Inc. and Hortonworks Inc., today announced what they called a merger of relative equals, saying they’ll combine their companies into a new entity with about $720 million in annual revenue.

The all-stock deal, really closer financially to an acquisition by the somewhat larger Cloudera, signals an acceleration of a long-simmering consolidation in the market for big data.

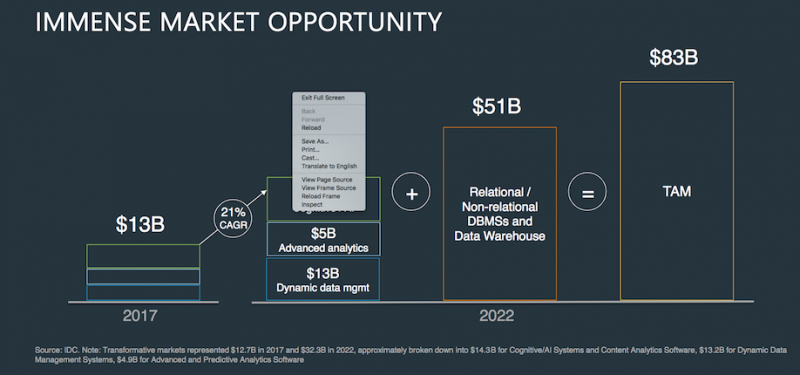

That’s the umbrella term for technologies that enable companies to collect, analyze and use huge amounts of data generated by companies, customers and internet-connected devices. In particular, both companies commercialized the Hadoop open-source big-data software originally developed by Yahoo Inc., along with related software.

“The combined company will have more scale to do innovation faster,” Cloudera Chief Executive Tom Reilly (pictured) said on a conference call today. “This is the perfect time for the companies to come together.”

Stu Miniman, an analyst with SiliconANGLE sister market research company Wikibon, said the deal was rumored for some time but represented a combination of arch-rivals. “The Hatfields and the McCoys join forces,” he said.

The problem with the market, added Wikibon Chief Analyst Dave Vellante, is that most companies are still losing money selling commercial versions of open-source software or services to support them. “Many exited the Hadoop distribution business because it was very expensive and not lucrative,” he said. “It’s very hard to support all these open-source projects and make money, so this makes sense.”

Indeed, said Hadoop veteran Justin Borgman, CEO of big-data query service Starburst, “Cloudera has wanted to do this for years. The Hadoop market has been a knife fight for both vendors, and by creating a monopoly, they finally have the leverage to raise prices and stop the bleeding on their income statement.”

Forrester Research Inc. analyst Noel Yuhanna said in a blog post that “it’s a win-win situation for customers, partners and the vendors” partly because the companies can create an “end-to-end cloud big data management offering” that would be easier for customers to use.

Reilly said the company would focus even more on software containers, a way to run applications on multiple kinds of computing environments without rewriting them. Essentially, the company will aim to provide cloud computing inside customers’ data centers, a trend known as hybrid cloud that’s taking off industrywide in a big way. In addition, Reilly focused on the potential market in the “internet of things,” the notion of corralling and using the data produced by myriad connected devices at the edge of computer networks.

“Our businesses are highly complementary and strategic,” he added in a statement. “By bringing together Hortonworks’ investments in end-to-end data management with Cloudera’s investments in data warehousing and machine learning, we will deliver the industry’s first enterprise data cloud from the Edge to AI. This vision will enable our companies to advance our shared commitment to customer success in their pursuit of digital transformation.”

For his part, Hortonworks CEO Rob Bearden, who will become a board member of the combine company, said there will be “lots of cross-selling opportunities,” meaning the ability for each company’s products to be sold to the other’s customer base. “Nearly overnight all of our customers will be able to experience edge to AI,” he said.

Executives said they will provide a three-year window in which customers can continue using either Cloudera or Hortonworks products, but within a few quarters, a “unity release” will be available for those that want to migrate to it.

Investors, as well as analysts on the conference call, liked the deal, which will give the combined company a $5.2 billion valuation based on the two firms’ stocks on Tuesday. Both Cloudera’s and Hortonworks’ shares shot up about 25 percent in after-hours trading on the news. Update: On Thursday, shares of each company were rising a more moderate 10 percent each.

Both companies, and now the combined one, compete both with huge cloud computing companies such as Amazon Web Services Inc. and with private companies such as MapR Technologies Inc. Hortonworks went public in 2014 and Cloudera did its initial public offering last year. In August, Hortonworks reported a revenue jump of 40 percent, to $86.3 million, in its most recent quarter, while Cloudera’s fiscal second-quarter revenue reported in early September rose 23 percent, to $110.3 million.

In the deal, Cloudera emerges as the bigger piece, since its shareholders will own about 60 percent of the equity of the combined company and Hortonworks shareholders will hold 40 percent. Wikibon Chief Research Officer Peter Burris noted that “Cloudera had greater portfolio of fungible assets, so they win.”

Hortonworks Chief Operating Officer Scott Davidson will be COO of the combined company, but Hortonworks Chief Product Officer Arun C. Murthy will keep his same title and so will Cloudera Chief Financial Officer Jim Frankola.

Frankola said on the conference call that there will be cost savings of $125 million from combining the companies, though some of that will be invested back in the business after the integration is carried out next year. In 202o, he said, he expects more than $1 billion in revenue growing 20 percent a year, as well as more than a 15 percent operating cash flow margin from more than $150 million cash flow.

The combined company will have more than 2,500 customers, 120 of them with more than $1 million in annual recurring revenue, and more than $500 million in cash with no debt.

Burris noted that the company will have several challenges to address: improving integration efficiencies, revamping Hadoop and the Hadoop portfolio for use in modern AI and machine learnings applications, and shortening customer time-to-value to keep them in the fold as more cloud options rapidly improve.

Indeed, such mergers often take considerable time to carry out, potentially giving customers a reason to look elsewhere, a factor competitors likely will try to exploit.

“I can’t find any innovation benefits to customers in this merger,” MapR Chairman and CEO John Schroeder said in emailed comments. “It is entirely about cost cutting and rationalization. This means their customers will suffer.” He claimed that “we continue to see Cloudera and Hortonworks customers move to MapR.”

“Hortonworks’ better differentiation now is in streaming data, which is an area where Cloudera comes up short, so that could be complementary,” added Wikibon analyst James Kobielus. “Cloudera is starting to lead with partners and consulting, which are weak areas for Hortonworks. So I do see some potential here for them to take on MapR in this new era of streaming, edge, AI and embedded apps.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.