CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Updated:

There’s still a cloud hanging over Amazon.com Inc., but that’s a good thing.

Thanks once again to strong growth in its cloud computing operation, the tech and retail giant today reported better-than-expected profits in its first quarter. But light guidance for second-quarter companywide operating income kept a lid on shares, which rose only about 1% or so in initial after-hours trading before falling a fraction of a point.

Overall, Amazon revenue rose 17%, to $59.7 billion, and it earned a net profit of $3.56 billion or $7.09 a share, well over double the $1.6 billion reported a year ago. Operating income also more than doubled, to $4.4 billion from $1.9 billion a year ago.

The profits beat Wall Street’s forecast by a wide margin. Analysts on average had forecast a net profit of $2.3 billion on $59.65 billion in revenue.

“Amazon absolutely crushed its Q1 earnings,” Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, told SiliconANGLE.

Amazon also provided updated guidance for the current quarter with a typically wide range of $59.5 billion to $63.5 billion in revenue, covering the $62.4 billion Street consensus. But its forecast of $2.6 billion to $3.6 billion in operating income fell below a $4.19 billion consensus, bracketing last year’s $3 billion.

That could be an indication that Amazon plans to keep spending big on data centers, warehouses and international expansion. But in comments on an earnings conference call, Chief Financial Officer Brian Olsavsky cited the fact that the company’s stock compensation expenses typically rise in the second quarter as a prime reason for the muted guidance.

Flagging another big cost going forward, Olsavsky also essentially announced a new service that’s coming: one-day free Prime Shipping. He said Amazon is spending $800 million to build out the system for halving the free shipping time.

The one-day shipping got a lot of attention from analysts, both in terms of its costs and its potential. “We think that will open up a lot of potential purchases,” Olsavsky said. At least one analyst agreed. “If the company can afford it, free one-day Prime Shipping would deliver significant tactical and strategic value,” Charles King of Pund-IT Inc. told SiliconANGLE.

The pace of revenue growth was the slowest since 2015, thanks to Amazon’s addition of Whole Foods Market, a slowdown in international markets and the company’s sheer size. But investors are hoping higher-margin businesses such as cloud computing, advertising and selling services to other merchants will mean more profits at the perennially profit-stingy company. That appears to have happened at least for this quarter.

“If margin improvements become a common theme for the quarters ahead, Amazon will be increasingly difficult to beat,” King said.

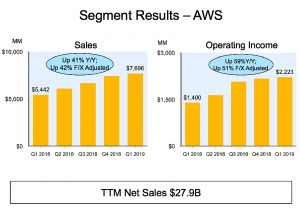

Amazon Web Services Inc., the company’s closely watched cloud unit, saw revenue rise 41% from a year ago, or 42% before currency exchange shifts, to $7.7 billion — a hair over what analysts had reckoned — bringing the annual run rate to more than $30 billion. Operating income jumped 59%, to $2.22 billion.

Amazon Web Services Inc., the company’s closely watched cloud unit, saw revenue rise 41% from a year ago, or 42% before currency exchange shifts, to $7.7 billion — a hair over what analysts had reckoned — bringing the annual run rate to more than $30 billion. Operating income jumped 59%, to $2.22 billion.

The revenue growth was a slowdown from the fourth quarter’s 45% pace. Olsavsky said that was partly because of a big AWS quarter a year ago, making comparisons tougher, but he also said the business “will always be lumpy” because of uncertainties in how quickly companies adopt AWS and the cloud and migrate operations out of their own data centers. But he added that customer usage of AWS services continues to outpace revenue growth.

A report today in The Information that AWS’ second-biggest corporate customer, Apple Inc., last year cut its AWS spending by more than half last year, to about $370 million as the iPhone maker develops more of its own data centers. The move is seen as a reflection of a rising trend by large cloud computing customers to use multiple clouds as well as their own data centers in “hybrid” arrangements to handle their information technology needs.

Still, although the cloud unit remains a relatively small portion of Amazon’s overall revenue at about 13%, its profitable tail continues to wag the retail dog. Its operating income made up fully half of Amazon’s overall profit from operations, almost as much as the entire North American retail operation’s.

All this didn’t do much for investors either way, as shares waverered between about a 1% gain and a half-point loss in after-hours trading before settling in later about a 1.5% gain as more details emerged during the earnings call. Update: On Friday, shares rose about 2.5%.

In regular trading Thursday, Amazon’s stock hit its highest point since last October, closing up a tiny fraction of a point to $1902.25 a share. Like Microsoft Corp. briefly did yesterday when it reported better-than-expected quarterly results also thanks partly to its cloud operations, Amazon hit the trillion-dollar market valuation market for a single day last Sept. 24.

Microsoft reported a 73% jump in its Azure cloud business, continuing to outpace AWS’ growth. Google LLC, the distant third-place cloud player, will report its earnings results Monday. AWS and Microsoft are contending for a $10 billion Pentagon contract known as JEDI, though AWS is considered the frontrunner to get the deal.

AWS has continued to release a constant flurry of new services, such as new cloud infrastructure regions and a new archive storage class, in a bid to stay ahead of hard-charging rivals such as Microsoft and Google. It also announced a continuing stream of new and expanded customers such as Lyft Inc., Volkswagen and Ford Motor Co. in the quarter. “The rolling thunder coming out of AWS is unmatched,” Amir Sharif, co-founder of cloud security startup Aporeto Inc., told SiliconANGLE at an AWS Summit last month.

As a result, Moorhead added, “the AWS train doesn’t look to be stopping any time soon, a testament to a growing market, but also AWS sustained competitiveness with cost-saving downshifting features, a multitude of compute, storage, networking and database options, and winning in core areas of machine learning.”

Advertising also continued rapid growth, with Amazon’s “other” segment, comprised mostly of ad sales, rising 34 percent, to $2.72 billion. According to eMarketer, it’s now the third-larger digital ad seller behind Google and Facebook Inc.

Like other tech companies, Amazon has been facing more regulatory and activist scrutiny. In prepared remarks seemingly aimed at generating good public relations, Chief Executive Jeff Bezos chose to highlight a new Amazon Future Engineer program in which it provides scholarships and internships to underrepresented groups.

THANK YOU