BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Dutch cryptocurrency exchange Blockport N.V. has declared bankruptcy and will cease trading at the end of the month after failing to raise €5 million ($5.62 million) in a security token offering, a similar fundraising method to an initial coin offering but with security tied in.

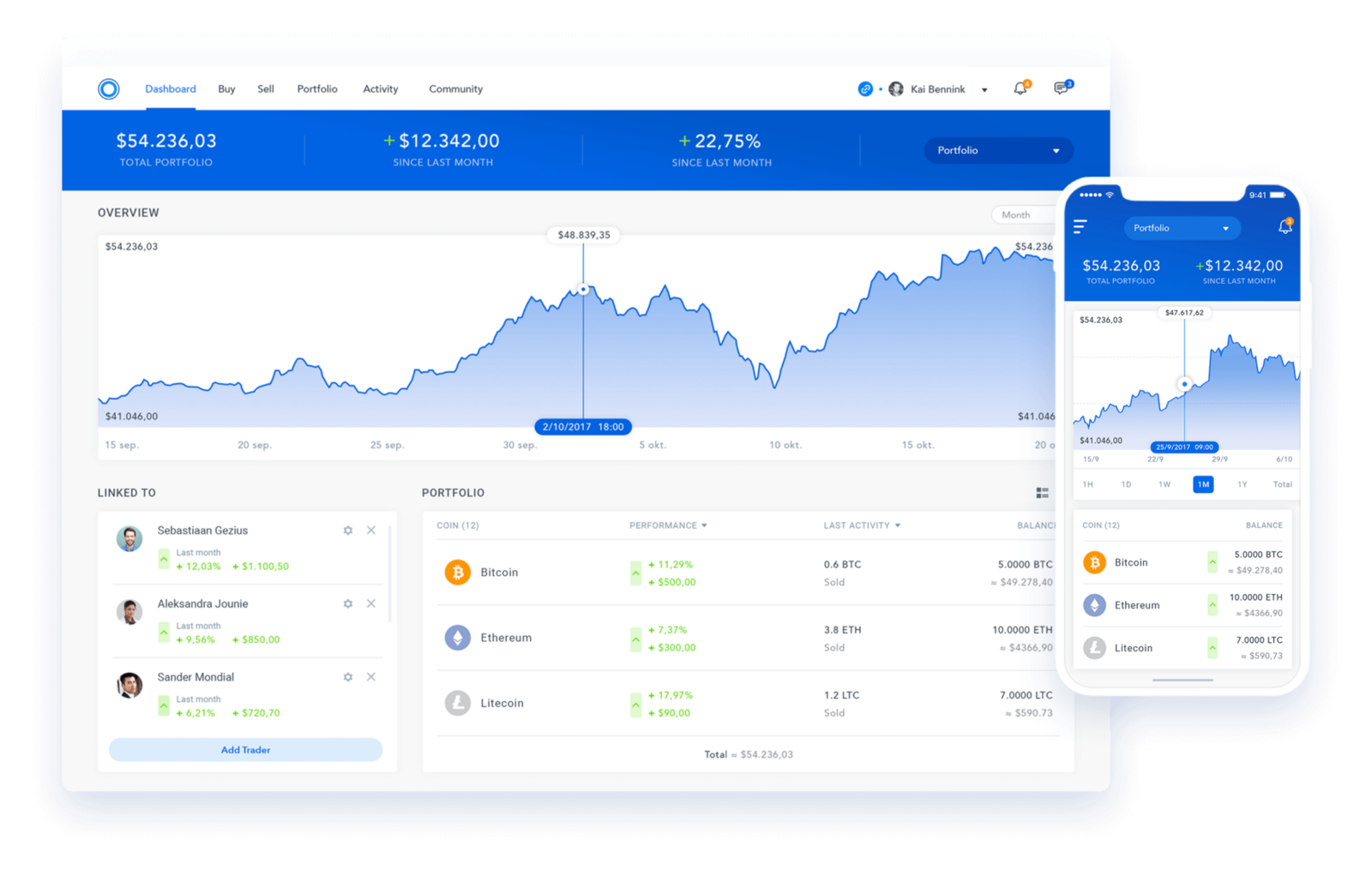

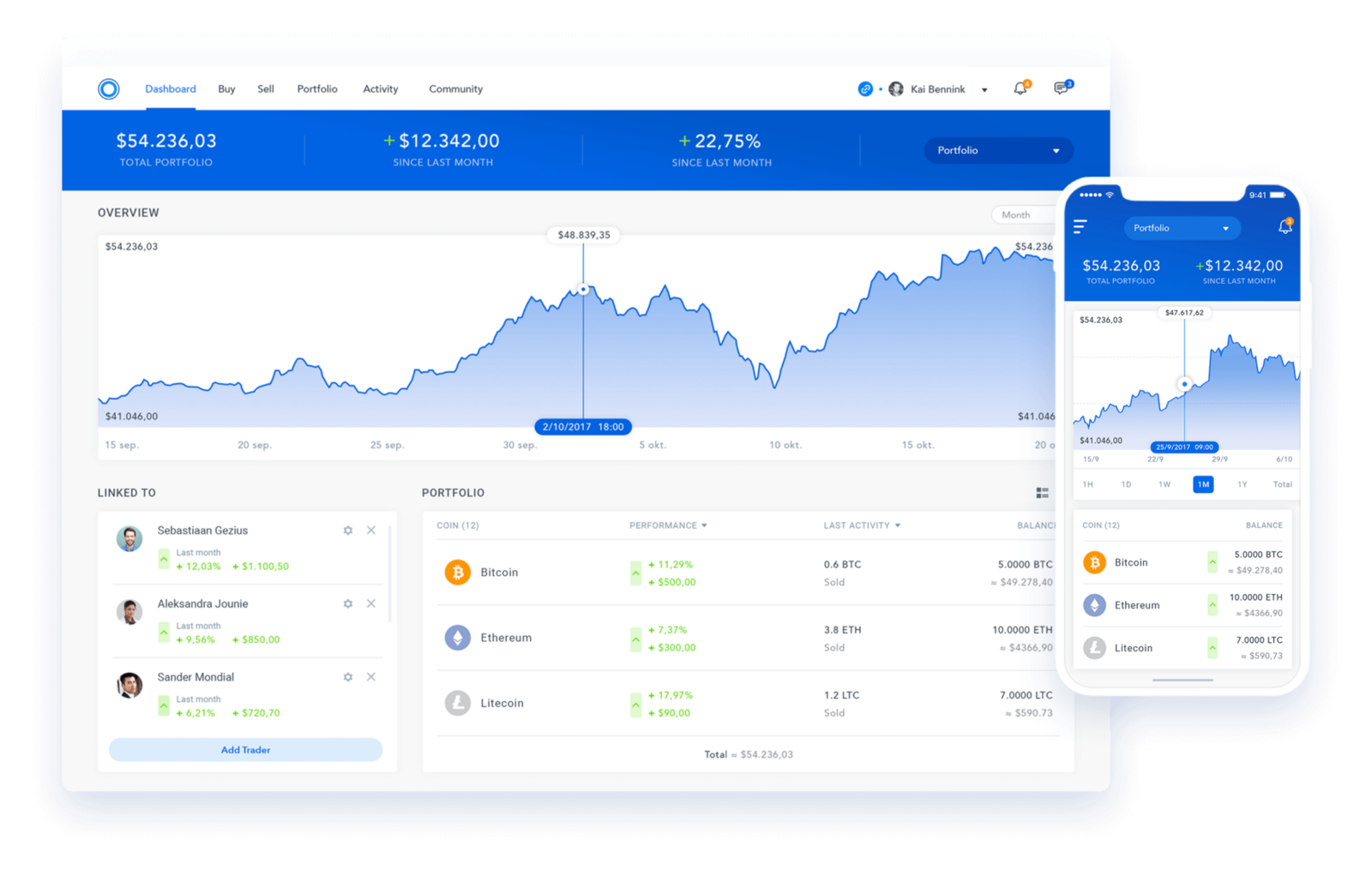

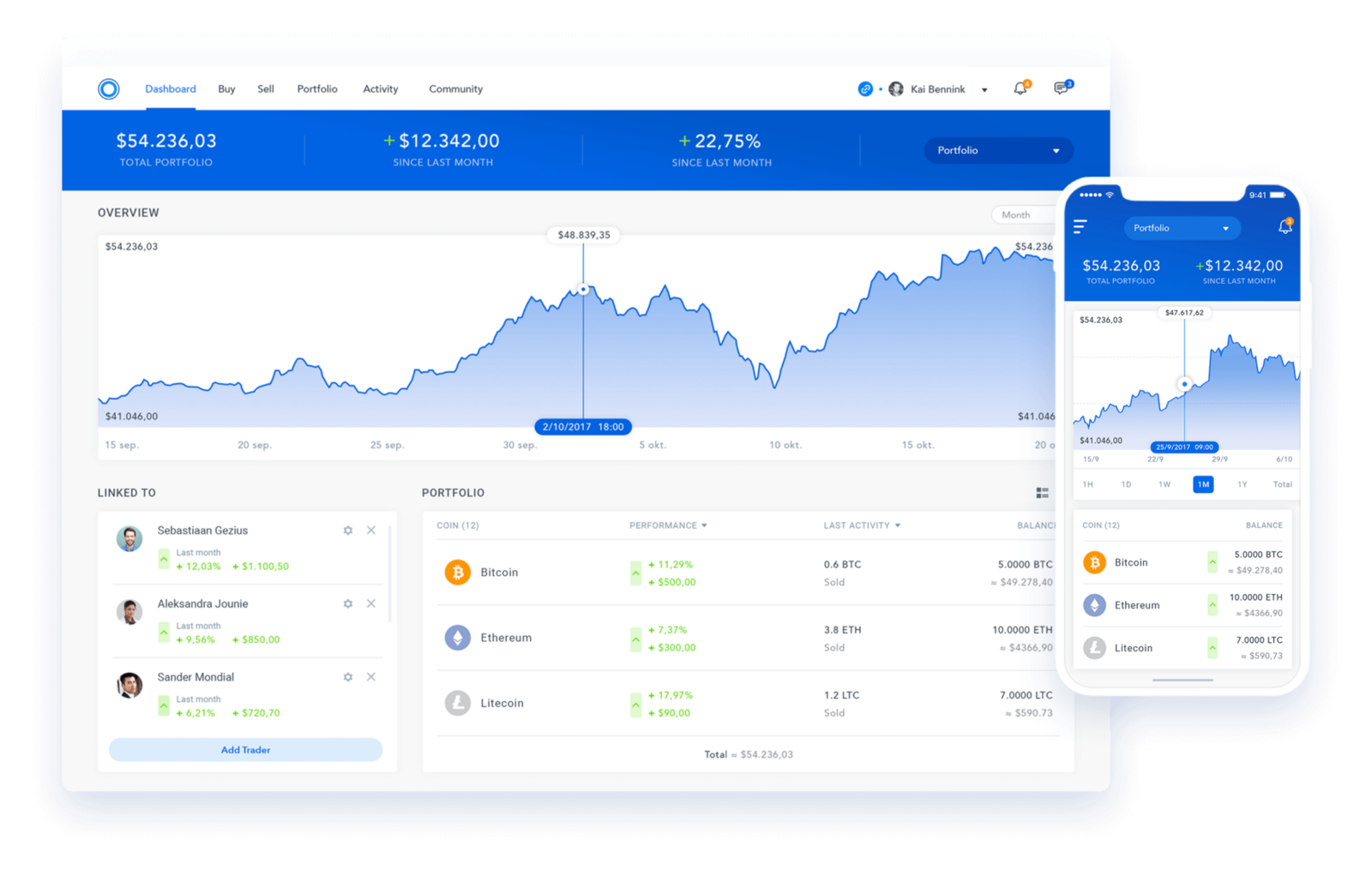

Founded in 2017, Blockport pitched itself as a “social crypto exchange” based on a hybrid decentralized architecture. The company offered an end-to-end trading platform that was claimed to address issues such as high barriers to entry through a “completely new and effortless trading experience.”

The buzzword-laden pitch aside, Blockport offered a fairly typical cryptocurrency exchange setup with the ability to buy, sell and store any cryptocurrency. The social aspect isn’t quite as clear, with the company simply describing that angle as a “knowledge sharing community.”

The direct fundraising path wasn’t a new one for Blockport. In January 2018, the company raised $15 million in an ICO. The new STO raise, by comparison, didn’t even manage to reach a minimum threshold of €1 million ($1.13 million).

Why the STO failed is open to speculation. The company said that “there are multiple internal and external factors that have played a role during our fundraise that had their effect on the overall sentiment and performance of the STO” before adding that “it’s fair to say that the market has spoken.”

The reason for the bankruptcy was only slightly more clear. The company said that “running our operations and platform as-is without a substantial investment is currently not an economically viable and responsible option.” In other words, despite having raised $15 million, Blackport has run out of money.

Speaking to TNW’s Hard Fork today, Blockport founder Sebastiaan Lichter demonstrated where the cliche and buzzword-driven communications waffle from the company comes from, saying that “since our first equity fundraising (STO) round was unsuccessful, we can’t uphold our planned growth trajectory and therefore have to significantly scale down our operations and team.”

Lichter went on to claim that the company would continue to develop its products in “stealth mode” despite filing for bankruptcy before adding that it’s in talks with “several parties for a potential relaunch.” Apparently just admitting it has run out of money and is closing down is too hard to admit in an interview.

Not surprisingly, the tokens issued by Blackport in its initial ICO are now nearly worthless. The tokens were trading at $0.007295 as of 10 p.m. EDT on a market cap of $389,580 versus an initial market cap of $15 million on debut.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.