APPS

APPS

APPS

APPS

APPS

APPS

Shares in Israel-based freelancer marketplace Fiverr Inc. defied expectations in its initial public offering today on the New York Stock Exchange, closing their first day up 90%.

Fiverr’s stock debuted at $26, up from its initial offering price of $21 per share and never looked back, closing regular trading at $39.90, up 90%. The good news didn’t stop there, with the company’s share price continuing to rise in after-hours trading, hitting $42.85, up just over 100% on its IPO price.

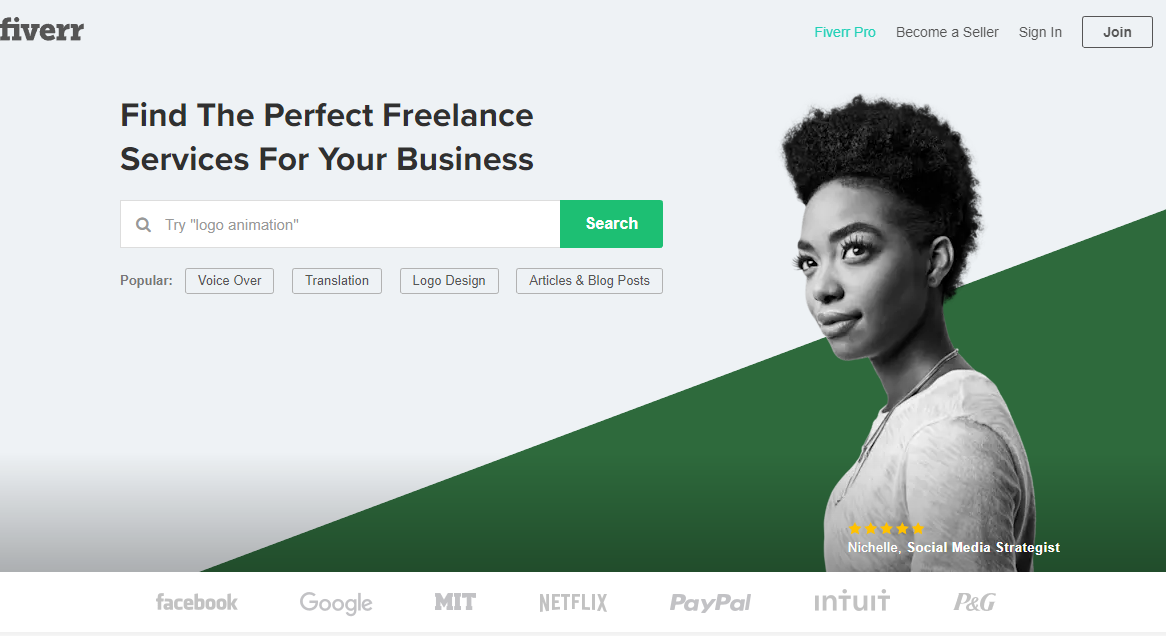

Founded in 2010, Fiverr offers a freelance market place that originally had all services priced at $5, but it has since changed that business model. Described as a member of the gig economy alongside companies such as Airtasker Inc., Fiverr freelancers primarily offer digital services.

Although the company has a reasonable revenue and has found a willing audience, like many tech companies going public, particularly in the gig economy, Fiverr also floated having never made a profit, and it warned that it was unlikely to do anytime soon. Unlike Uber Technologies Inc., Lyft Inc. and others, investors dismissed concerns over long-term profitability and embraced the company instead.

One theory is that investors didn’t so much see Fiverr as a gig economy site but as more of an e-commerce play. That argument came from Chief Executive Micha Kaufman, who told MarketWatch that “it’s really like e-commerce 20 years ago.”

Others were more cautious. “Public markets haven’t (as yet) rolled out the red carpet for cash-burning gig economy start-ups, such as Upwork, Uber and Lyft,” Rohit Kulnarni, an executive director at MKM Partners, wrote in a note to clients. “We are believers in the long-term potential of these marketplaces, but risks such as [an] unclear pathway to profitability and the debate around gig economy workers labeled as 1099-contractors would likely weigh on near-term post-IPO performance.”

Whatever the reasoning, Fiverr capped off an excellent week for IPOs. CrowdStrike Holdings Inc. debuted on the Nasdaq Wednesday and closed the day up 70% on its IPO price. The support continued today, with shares in the company up a further 16.5% in regular trading.

THANK YOU