INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

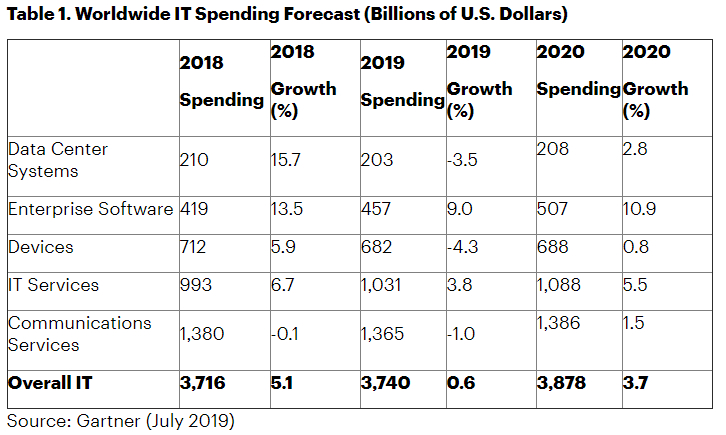

Gartner Inc. predicts that worldwide information technology spending will rise just 0.6% this year, to $3.74 trillion, which would represent the slowest growth the sector has seen in three years.

The research firm published its projection today along with breakdowns for individual market segments — with enterprise software leading the way on growth.

Gartner’s report encompasses five areas: data center systems, enterprise software, devices, IT services and communications services. Though the 0.6% projected growth would at first glance suggest that the market is flat, looking at the surveyed segments individually reveals an industry in flux.

Gartner expects spending on enterprise software to jump 9% this year, to $457 billion. A big contributing factor is companies’ ongoing effort to replace traditional on-premises applications with cloud services. Gartner observed that this trend is being felt in more and more parts of the software market, with its forecast making a special mention of the productivity tools category.

Companies’ growing investment in cloud services is eating into their budgets for on-premises technology. Gartner estimates that the data center systems market will shrink by 3.5% in 2019, to $203 billion.

Yet despite the significant decline in this area, there’s one segment that is projected to take an even bigger hit this year. Gartner sees sales of personal computers and mobile devices dipping 4.3%, to, $682 billion, a drop that doesn’t come as too much of a surprise given major hardware makers’ recent earnings. Apple Inc. reported a 5.1% revenue decrease for the second quarter, while Samsung Electronics Co. Ltd. saw its profits plunge more than 50% in the same period.

Gartner blames consumers’ reduced appetite for new devices largely on market saturation. “There are hardly any ‘new’ buyers in the devices market, meaning that the market is now being driven by replacements and upgrades,” said Gartner research vice president John-David Lovelock. “Add in their extended lifetimes along with the introduction of smart home technologies and IoT, and consumer technology spending only continues to drop.”

The research firm sees the market faring somewhat better in 2020. Gartner’s current projection for next year, which will be updated multiple times over the coming quarters, forecasts a modest 0.8% increase in device spending. At the same time, Gartner anticipates that the enterprise software market will pick up yet more steam and see a 10.9% revenue increase in 2020.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.