CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Enterprise spending on cloud computing technologies continues to grow at a breakneck pace, topping $150 billion in the first half of the year, according to a new report from Synergy Research Group.

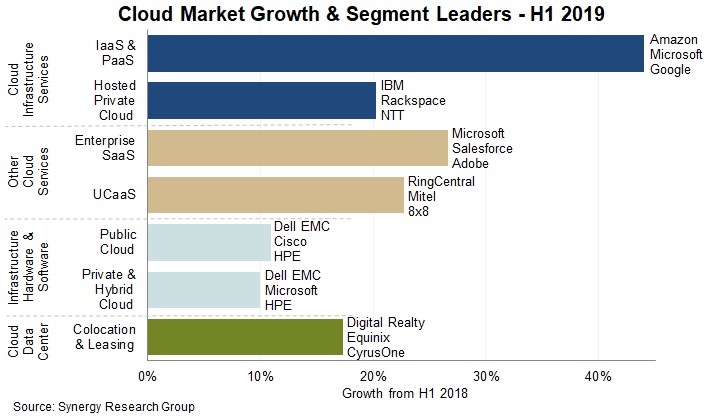

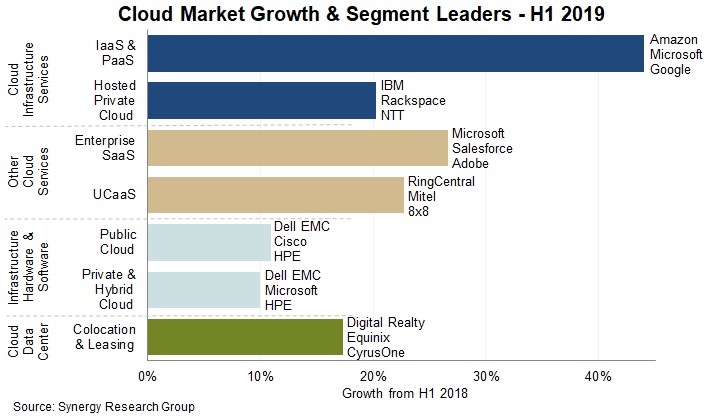

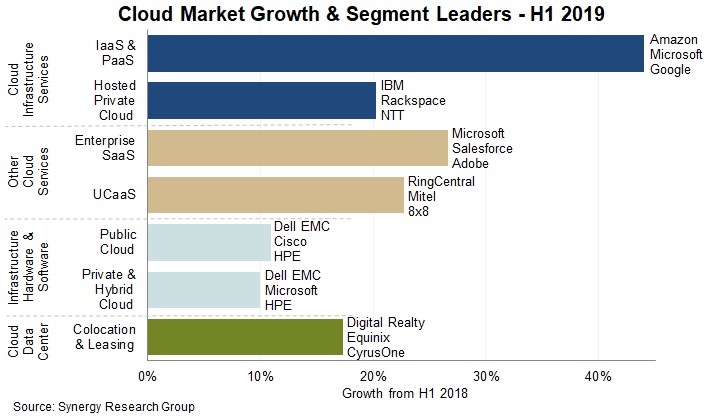

Synergy said spending on seven cloud services and infrastructure segments in those six months grew by 24% from the first half of 2018. The fastest-growing segment was infrastructure and platform services, which saw spending rise 44%, followed by cloud software services, up 27%.

“Cloud-associated markets are growing at rates ranging from 10 percent to well over 40 percent, and annual spending on cloud will double in under four years,” John Dinsdale, chief analyst at Synergy, said in a statement. “Cloud is increasingly dominating the IT landscape.”

Synergy said the increased spending was primarily being driven by enterprises’ embrace of hybrid cloud deployments and their strategy of using multiple public cloud providers to avoid being locked in to any one platform. This means that although Amazon Web Services Inc. remains far ahead of its rivals in the public cloud market, companies such as Microsoft Corp. and Google LLC are also benefiting as they introduce new offerings designed to differentiate their platforms.

During the first half of the year, spending on cloud hardware and software came to almost $55 billion, split evenly between private and public clouds. That compares with $70 billion spent on cloud hardware and software throughout the entirety of 2018, Synergy said.

Those investments have helped cloud providers to generate more than $90 billion in revenue from the infrastructure, platform and hosted private cloud services they offer. The investments also mean greater spending on data center leasing and colocation services, Synergy said.

There has also been growing demand for more specific cloud services such as databases and analytics, and that’s creating more opportunities for specialized firms such as Salesforce.com Inc., Adobe Inc., VMware Inc. and Rackspace Inc. Synergy said they have all become “major players” in the cloud services segment.

Also benefiting from the increased spending are the main suppliers of cloud infrastructure, which include Dell EMC, Cisco Systems Inc. and Hewlett-Packard Enterprise Co.

“The flip side is that some traditional IT players are having a hard time balancing protection of legacy businesses with the need to fully embrace cloud,” Synergy Research said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.