AI

AI

AI

AI

AI

AI

A mere two years after exiting stealth mode, artificial intelligence chip startup Habana Labs Ltd. has been acquired by Intel Corp. in a landmark $2 billion acquisition.

Revealed today, the transaction is notable not only for its size but also the potential effects on Intel’s strategic roadmap. Habana’s cutting-edge silicon could potentially enable the company to narrow the gap with rival Nvidia Corp. in the increasingly important AI processor market, which is expected to pass $25 billion by 2024.

Founded in 2016, Israel-based Habana has raised about $120 million from investors. In June, the startup debuted Gaudi, an eight-core processor designed for the sole purpose of training AI models. Habana showed in an internal benchmark test that Gaudi managed to train a popular machine learning model 3.8 times faster than Nvidia’s flagship V100 graphics card for data centers.

The startup has a second chip called Goya that’s touted as having record-beating performance as well. It’s based on the same eight-core architecture as Gaudi but features a different design optimized for inference, or running AI models once they’re already trained and have started working with live data.

“Habana turbo-charges our AI offerings for the data center with a high-performance training processor family and a standards-based programming environment to address evolving AI workloads,” said Navin Shenoy, executive vice president and general manager of Intel’s Data Platforms Group.

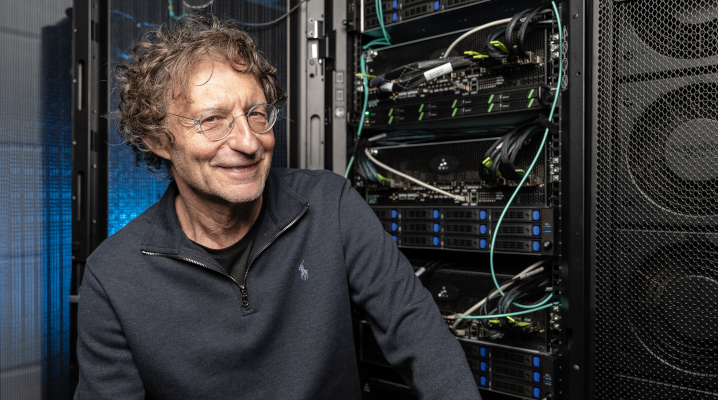

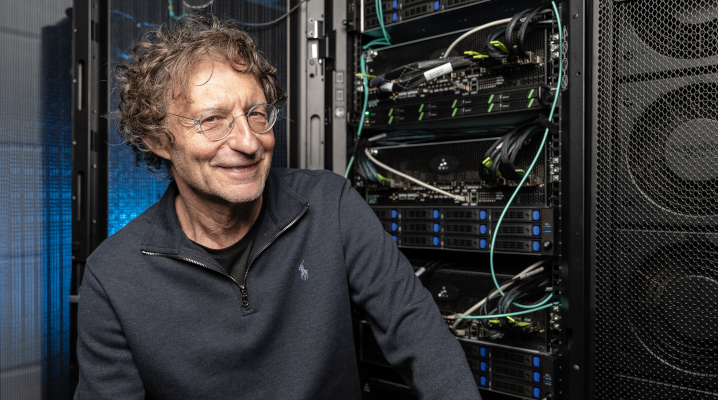

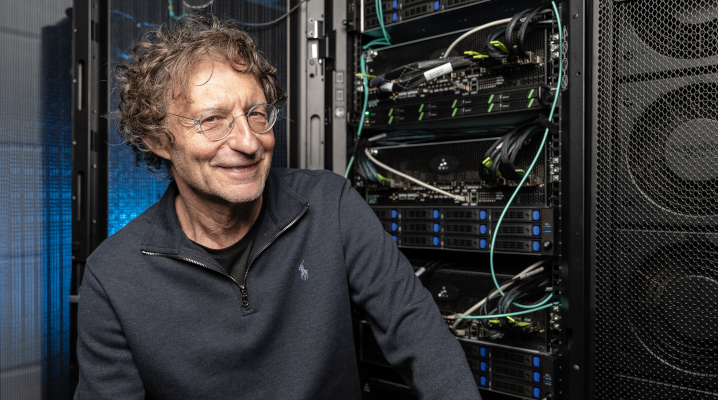

Intel said that Habana will operate as an independent business unit under the current leadership team once the acquisition wraps up. Avigdor Willenz (pictured), the startup’s chairman, will join the chipmaker in the role of senior adviser.

Habana is not the first startup Intel has acquired in a bid to catch up with Nvidia on AI. Back in 2016, the company shelled out a reported $400 million to buy Nervana Systems Inc., whose technology forms the basis of its current AI processor lineup.

Analyst Karl Freund of Moor Insights & Strategy commented that it’s “hard to imagine” a scenario where Nervana processors would continue to play a significant role in Intel’s portfolio now that it has acquired Habana. However, he believes that Intel will likely adapt the the Nervana software stack to run on Habana silicon.

The startup’s chips already have some initial market traction. Habana said earlier this year that several hyperscale cloud providers and firms in the autonomous vehicle market are using Goya.

Intel is increasingly looking to specialized processors such as Habana’s for revenue growth. This month, Chief Executive Officer Bob Swan remarked that he’s working to shift the focus inside the company from maintaining its historical 90% share of the server processor segment to trying to achieve a 30% market share across “all silicon.”

Rival Nvidia, in turn, also moved to expand its market focus this year by acquiring networking equipment maker Mellanox Technologies Ltd. for $6.9 billion. Indeed, that deal may have also had something to do with Intel’s decision to pick up Habana.

Habana sells its chips as part of data center cards that feature built-in 100-gigabit Ethernet connectivity. Karl Freund said it’s likely much cheaper than Mellanox’s standalone 100Gb Ethernet hardware.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.