APPS

APPS

APPS

APPS

APPS

APPS

iPhone maker Apple Inc. today delivered a strong first quarter, posting earnings that beat Wall Street targets thanks in part to stronger-than-expected demand for its iPhone 11 and 11 Pro handsets.

The company reported a profit before certain costs such as stock compensation of $4.99 per share on revenue of $91.8 billion, up 9% from a year ago. Wall Street had forecast earnings of $4.55 per share on revenue of $88.5 billion.

In a conference call with analysts, Apple Chief Executive Officer Tim Cook (pictured) said the company’s sales benefited from strong demand for its latest iPhone models, as well as wearable devices such as the Apple Watch and AirPod earphones. He added that Apple’s active installed base of devices now tops 1.5 billion.

All in all, Apple’s iPhone revenue came to $55.96 billion in the quarter, up from $51.98 billion a year ago. Wearables, home and accessories revenue meanwhile chipped in another $10.01 billion in revenue, up from $7.31 billion last year. And Services revenue came to $12.71 billion, up from $10.87 billion.

“iPhone 11 was our top-selling model every week during the December quarter, and the three new models were our three most popular iPhones,” Cook said. “We had double-digit growth in many developed markets, including the U.S., the U.K., France and Singapore and grew double digits in emerging markets, led by strong performances in Brazil, Mainland China, India, Thailand and Turkey.”

Apple Chief Financial Officer Luca Maestri added that the company now has more than 480 million paid subscriptions on its platform, and this number should exceed 500 million in the next quarter. He added that the company is aiming for more than 600 million paid subscriptions by the end of the year.

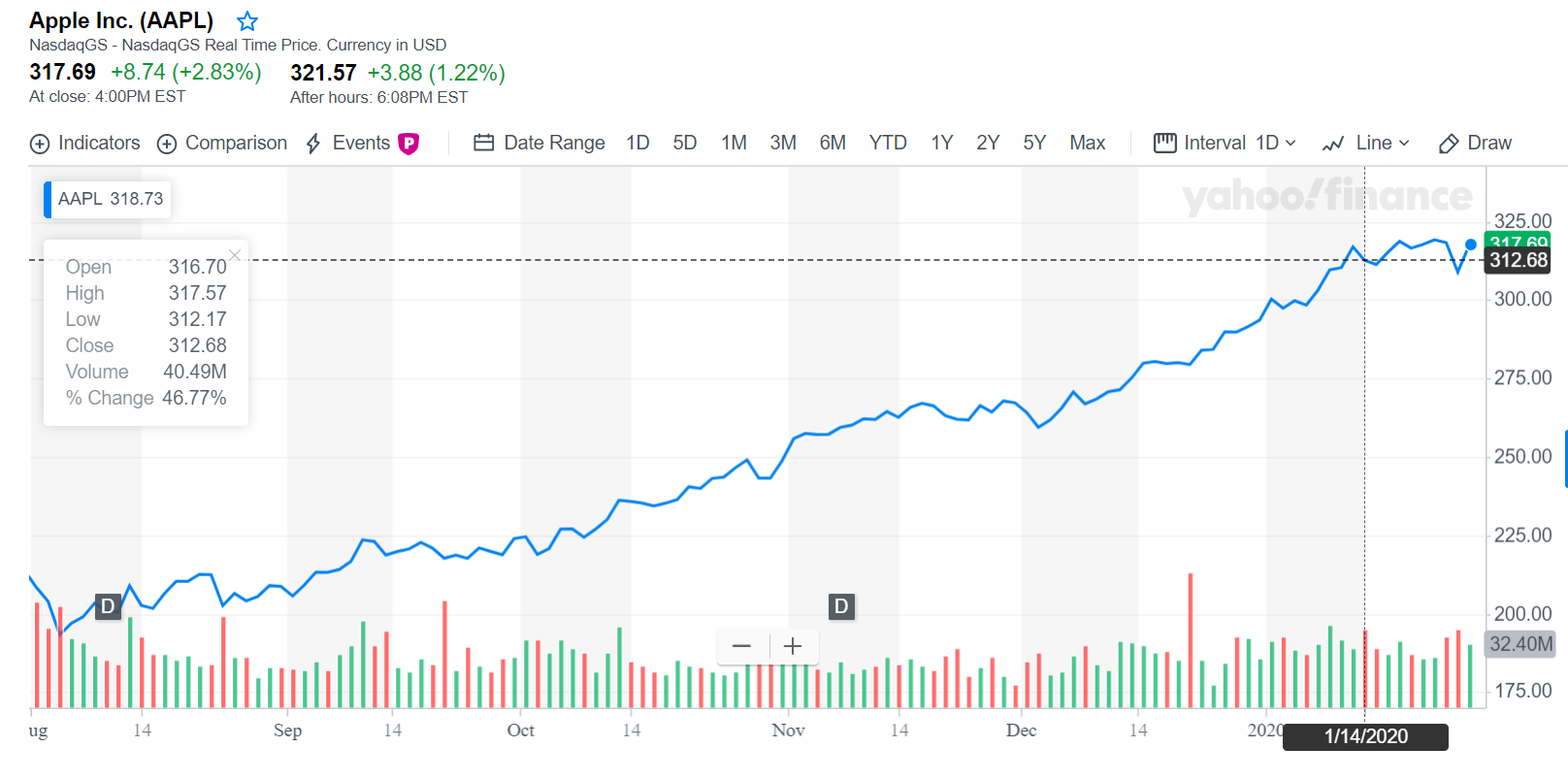

The stronger-than-expected sales were enough to stir some excitement among Apple’s investors. The company’s stock rose by more than 3% at one point, before settling back down up around 1.5% in after-hours trading.

“Apple is and remains the iPhone company,” said Holger Mueller of Constellation Research Inc. “If the iPhone swims, Apple does well, if the iPhone sinks, Apple struggles.”

That said, he also thinks it’s “way too early to tell if services can wean Apple from its dependency on iPhone sales. The watch certainly can’t, even if every iPhone user had one it would give Apple a break of about four to six months in hardware revenue.”

Apple’s shares have been on a tear of late, with optimism fueled by the strong iPhone 11 cycle, impressive Apple Watch sales and the success of its services business, which drives recurring revenue. Investors are also optimistic about the prospect of newer iPhones later this year that will come with 5G features.

One concern that did arise from Apple’s conference call was its guidance for the next quarter, as officials gave a wider range than usual thanks to fears about the potential impact of the Wuhan coronavirus on its sales. Executives said they’re expecting second-quarter revenue of between $63 billion and $67 billion, the midpoint of which is still above Wall Street’s forecast of $62.45 billion in revenue.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.