APPS

APPS

APPS

APPS

APPS

APPS

Updated with announcement:

Business and financial software company Intuit Inc. today confirmed it’s acquiring personal finance company Credit Karma Inc. for $7.1 billion in cash and stock.

“Our mission is to power prosperity around the world with a bold goal of doubling the household savings rate for customers on our platform,” Intuit Chief Executive Officer Sasan Goodarzi said in a statement. “By joining forces with Credit Karma, we can create a personalized financial assistant that will help consumers find the right financial products, put more money in their pockets and provide insights and advice, enabling them to buy the home they’ve always dreamed about, pay for education and take the vacation they’ve always wanted.”

Under the deal, Credit Karma reportedly will continue to function as a standalone business, with Chief Executive Officer Kenneth Lin remaining remaining in charge. Intuit said Credit Karma has nearly $1 billion in unaudited revenue in calendar year 2019, up 20% from 2018.

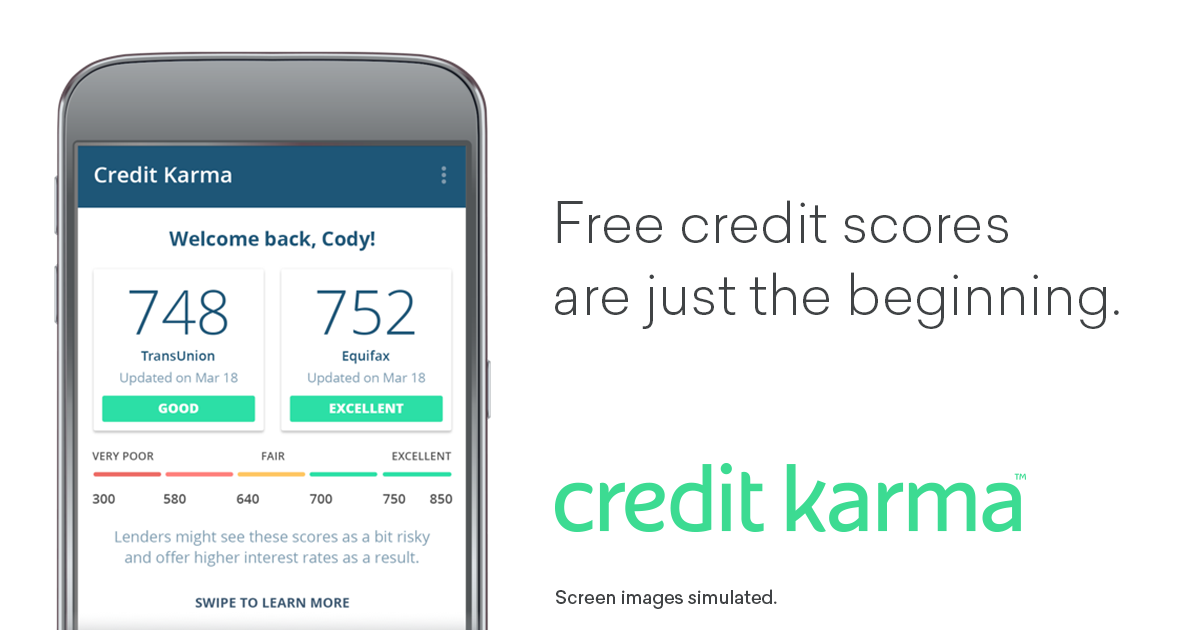

Founded in 2007, Credit Karma offers a range of financial services including credit monitoring, free access to credit scores, data-breach alerts and tax-filing services. The company also matches users to credit cards and loan products based on their credit history.

It’s not known how much Credit Karma has raised in its 13-year history, but it’s believed to have been worth $4 billion as of its last private capital raising in 2018. The company reportedly had been considering pursuing an initial public offering this year but balked at the prospect because of mixed IPO results from large tech floats in 2019.

Credit Karma will be Intuit’s largest acquisition in its 37-year history. The deal would also help Intuit expand its customer base of 84 million people, as well as offer complementary services. As The New York Times noted, “Intuit could try to match all the tax data its TurboTax customers provide with the credit-scoring data that Credit Karma holds,” letting “Intuit serve up better customer prospects to credit card issuers — and eventually let Intuit charge lenders more for access to its hoard of data.”

The deal would come in the footsteps of a two multibillion-dollar deals in the financial services sector this year. Visa Inc. signed a deal in January to acquire financial technology startup Plaid Financial Inc. for $53 billion, while Morgan Stanley announced Feb. 20 that it would acquire E*TRADE Financial Corp. for $13 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.