INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Data center company Nutanix Inc. saw its stock take a hammering today despite beating Wall Street’s targets with its second-quarter financial results.

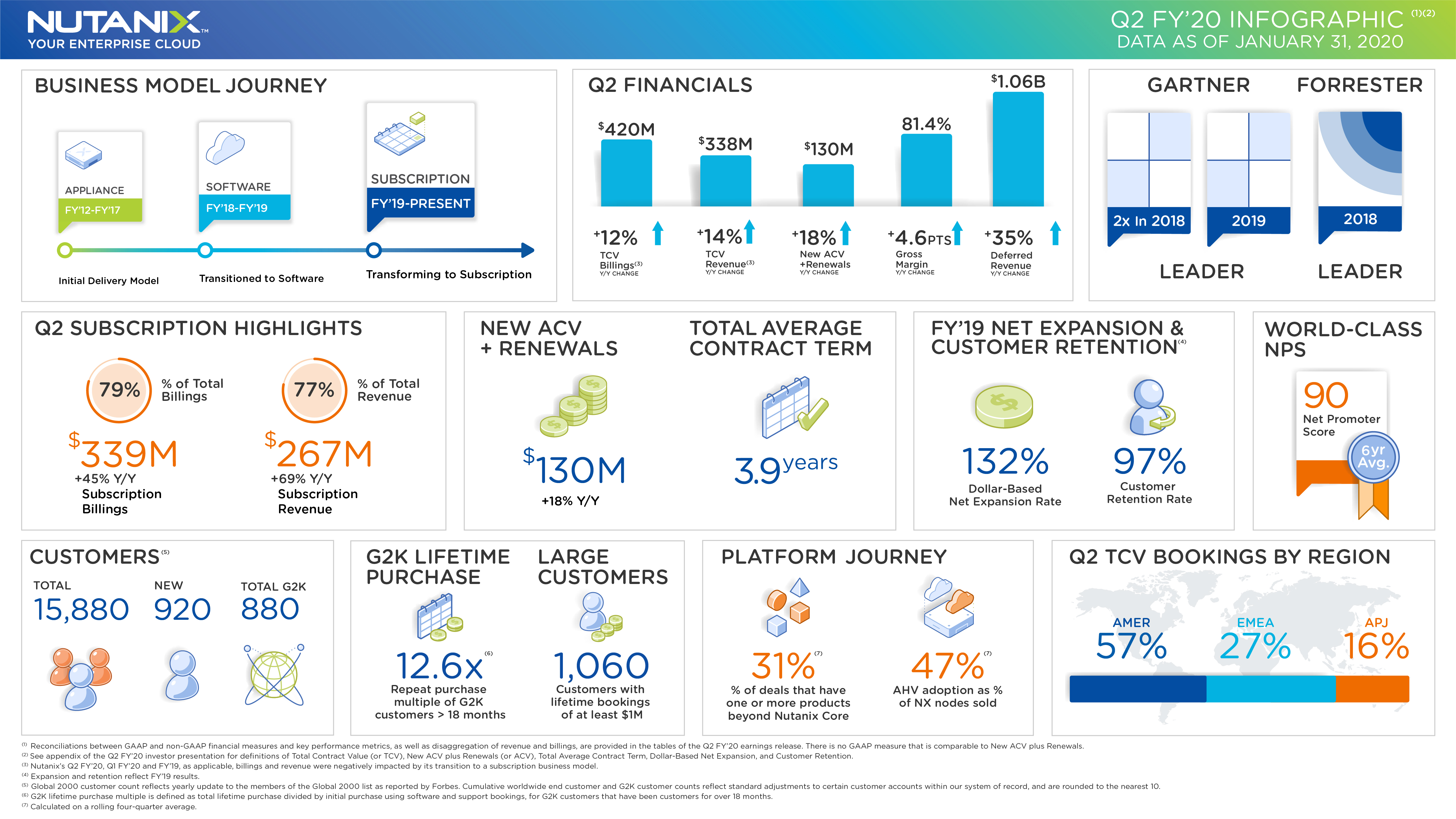

The company, which sells hyperconverged information technology infrastructure that integrates compute, storage and networking components, reported a loss before certain costs such as stock compensation of 60 cents per share on revenue of $346.8 million, up from $335.4 million in the same period a year ago.

Wall Street had Nutanix down for a wider loss of 69 cents per share on revenue of just $341.09 million.

It was a decent performance, but whatever optimism it may have garnered was quickly washed away when Nutanix issued its guidance for the next quarter. The company said it’s expecting a loss of 89 cents per share, which is far higher than the 74-cent loss predicted by Wall Street analysts.

The forecast sent a shiver down the spines of Nutanix’s shareholders, as the company’s stock promptly lost 16% of its value in after-hours trading. Update: Shares plummeted nearly 24% in Thursday trading.

In an interview with SiliconANGLE, Nutanix Chief Executive Officer Dheeraj Pandey (pictured) cited the company’s speed of execution in subscriptions — which means less revenue in the short term — as well as the potential impact of the coronavirus on its Asia-Pacific and Japan. He said about two-third of the lower forecast stems from a faster-than-expected transition to subscriptions for its services.

Just two years ago, Nutanix was primarily seen as a hardware company, selling a combined server and storage platform for corporate data centers. These days, however, hardware makes up just a small portion of its sales, as Nutanix is now more of a software company that sells a virtualization platform for hybrid and multicloud deployments.

The transition is progressing well, at least. Nutanix reported subscription billings of $399 million, up 45% from a year ago. Subscriptions represented 79% of the company’s total billings in the quarter, executives said. Moreover, subscription revenue rose 69%, to $267 million, representing 77% of the company’s total revenue.

Pandey told SiliconANGLE that this proved the company’s message around the portability of its licenses is working. He forecast that Nutanix’s entire business would be subscriptions within the next three years.

“Our stack can run anywhere and everywhere, including the public cloud,” Pandey said. “We can enable a lot of lift-and-shift. We offer simplicity and reliability to applications running anywhere.”

Moor Insights & Strategy analyst Steve McDowell, who follows Nutanix closely, said that most of the critical indicators indicate the company’s transition is going well.

“Subscriptions grew 69% last quarter, making up over 75% of the company’s revenue,” he said. “Contract renewals are up nearly 20%, which just highlights Nutanix’s nearly unbelievable customer retention rate of 97%.”

Competing the transition is one thing, but making money is quite another, and today’s exodus indicates that investors still have concerns over Nutanix’s ability eventually to turn a profit.

Addressing those concerns, Pandey insisted that the company’s situation isn’t as bad as it looks, saying that it had lots of deferred revenue still sitting on the balance sheet that will show up later.

“Will get more leverage from going to software, it’s less expensive to scale up,” Pandey said. “We’ve been pretty prudent about using cash.”

As for the coronavirus impact, Pandey said it’s tough to predict, but it’s already seeing some effects in Japan, a key market for the company, as well as elsewhere in Asia. Other tech companies such as Apple Inc. have also been reporting a likely slowdown as the virus exploded in China and spread elsewhere.

“This is the first time we’re actually facing an environment that’s very murky,” Pandey said. “But business has to be done. At some point, manufacturing has to come back, transportation has to come back.”

McDowell told SiliconANGLE that Nutanix’s biggest issue is not the coronavirus, but rather, its struggle with the longer sales cycles that are inherent when selling subscriptions to enterprises.

“It’s very different from selling HCI appliances into server racks,” McDowell said. “This is a model that requires a skillset that differs from Nutanix’s legacy at nearly every level of the organization. It’s this mismatch that is largely behind the disappointing guidance.”

Still, McDowell said there was no reason to doubt Nutanix’s long-term prospects. He said the hyperconverged infrastructure market is still growing, and Nutanix remains the only real choice apart from VMware Inc.’s offerings. He also pointed to Nutanix’s “rabidly faithful” customer base as another reason for optimism.

“The danger is in the mid-term,” McDowell said. “Should Nutanix’s stock continues to fall, it becomes a compelling takeover target. Today its market cap is just above $6 billion, which is pricey for an HCI acquisition. But a few points’ drop and it becomes almost affordable for a company like HPE.”

“Nutanix keeps executing on its journey towards subscription revenue, though the conversion rate seems to be slowing down,” Constellation Research Inc. analyst Holger Mueller said. “It’s good to see Nutanix increasing the attach rate of its products, as it keeps innovating and rolling out new products. It’s now all about execution for the Nutanix executive team, to ensure the success of the Nutanix next generation compute platform in the of Infinite computing.”

With reporting from Robert Hof

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.