INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

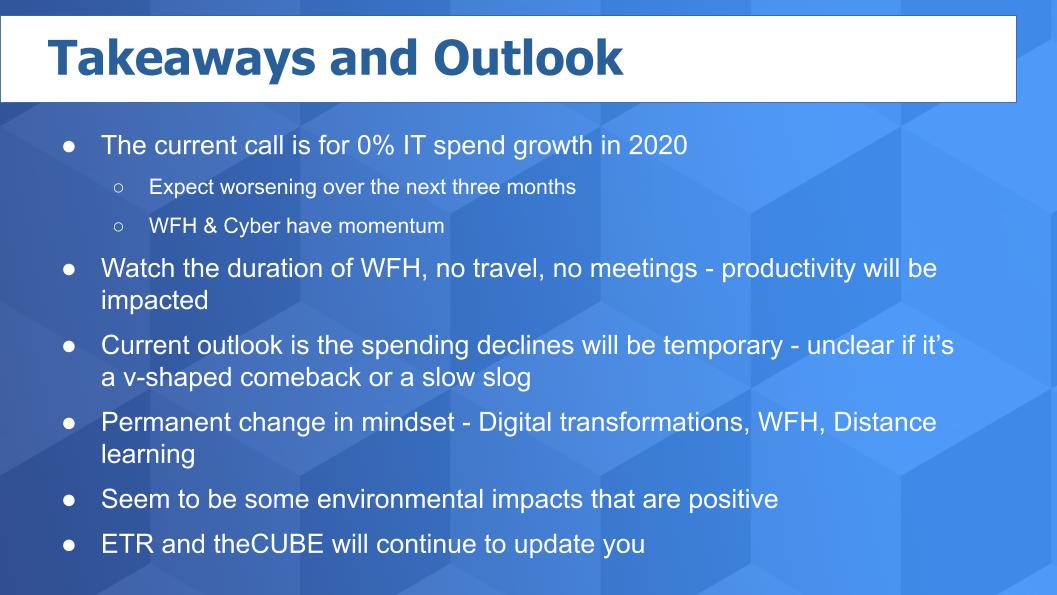

Information technology budgets will be flat this year and potentially worse as the coronavirus pandemic takes full hold — and changes in how technology is deployed and how we work are bound to become permanent fixtures of the IT landscape.

That’s the upshot of fresh data from the latest Enterprise Technology Research spending survey. In particular, ETR added a drill-down question to assess the impact of the COVID-19 pandemic on IT budgets. This week we had the pleasure of hosting ETR Director of Research Sagar Kadakia, who took us through the details of that survey.

In this week’s Breaking Analysis, we want to accomplish three things:

And then we’ll summarize take a look ahead.

Where are we at this point in time? We’ve gone from fear of missing out in the stock market to all-out fear.

As you well know, the economic impact is ugly. This is the first time we’ve ever seen a government imposed recession – rightly so to save lives. We’ve also never seen such an across the board double downward shift in supply and demand. This creates uncertainty and ambiguity in pricing which makes forecasting anything very difficult.

The liquidity shock and credit risks are of primary concern. The price of oil is a big issue because energy companies account for a sizable portion of the high yield credit market – more than 10% – so as prices fall, it’s harder for oil companies to repay loans, which creates default risk. So this has the market functioning very poorly.

It’s the question everyone is asking.

A poorly functioning market signals that we are not yet at the bottom. We’re not stock pickers or market technicians, but we’ve seen a lot of downturns. When I was at International Data Corp., we had an exclusive deal with Goldman Sachs and two of its analysts were embedded in our Framingham offices. In 1987 on Black Monday and the following weeks, with no internet, we stared at the Goldman real-time terminal and watched the market plunge, then bounce back and then plunge again.

Bottoms are impossible to predict. Because they’re not technical, they’re psychological. In 1987 and after the dot-com bust and in the 2008 financial crisis, each time you saw the S&P 500 rally – sometimes as high as 10% — it would suck investors back into the market and then it would invariably pull back. And that will likely happen here: The market will not be just fine any day now in our view.

If you’re looking for a silver lining, the canals in Venice are running clear, which is amazing to see, and nitrous oxide levels over China are way down.

Let’s shift gears and take a look at what the COVID-19 IT budget impact for 2020. How will coronavirus affect IT spending and specifically, what industries that are being most affected right now?

As we show below, there are some obvious sectors like energy and transportation, retail and the like that are feeling the deepest pain. Sagar Kadakia from ETR provided additional color in this clip on the industry impact. He also commented on some key findings regarding the supply chain disruption. (This ETR Tutorial we created explains the spending methodology in more detail.)

As Sagar points out, the ETR survey underscores that we will not likely see a quick snapback – we don’t expect a one- to two-month fix.

In our research in the field and in particular speaking to people in theCUBE network we can make some additional comments highlighted above.

We’re seeing sales teams bring down their forecasts, but they’re not cutting them in half. Not yet anyway.

In assessing the COVID-19 IT budget impact, ETR found a counterintuitive result. Specifically, a meaningful percentage of customers actually plan to spend more on IT in 2020. Why? Because they’re trying to preserve productivity with work-from-home solutions and they need to add infrastructure. So they’re pivoting their budget to WFH. And they need to secure that infrastructure, so cybersecurity spend is seeing some momentum.

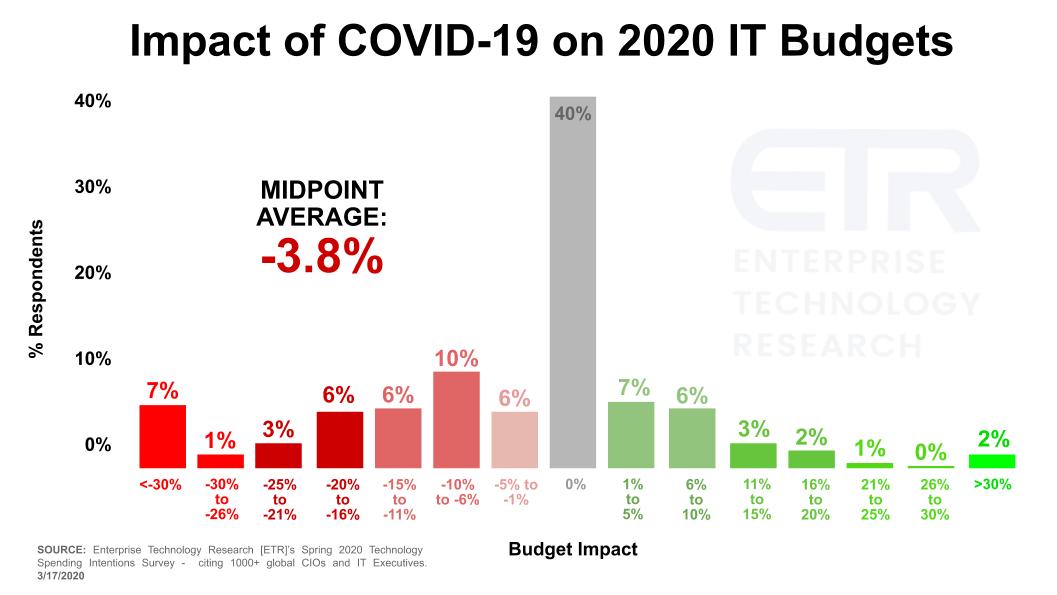

The above chart from ETR shows some interesting data. The chart shows survey results from the current sample of respondents (1,000+ CIOs and IT buyers) taken this month. Notably:

ETR’s Kadakia further explains the chart in this clip.

Kadakia went on to explain that consensus expectations were that global IT spend would be roughly 4% before coronavirus and the pullback takes us to flat. But what has not been reported is the offset to the declines particularly from WFH infrastructure.

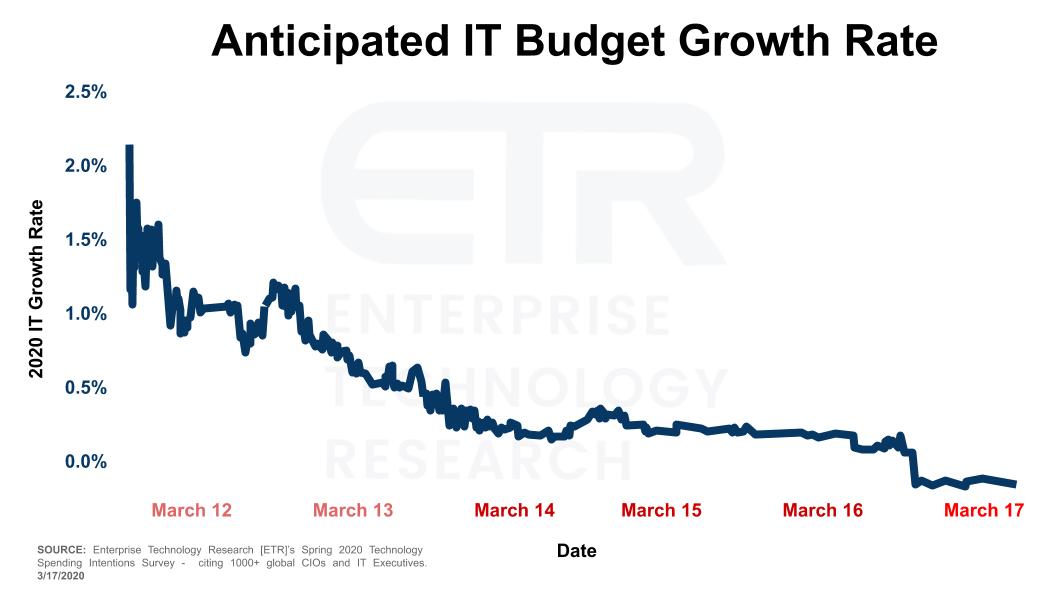

Obviously this could all change. And the chart below underscores the uncertainty and dynamic nature of the risk right now.

This chart shows the daily impact of the expected retraction. Earlier in the survey ETR saw about a 2% retraction and you can see by March 17 its down to flat. So as we heard from Kadakia, the ETR thesis is calling for 0% IT spend growth in 2020 because of some of the WFH offset. If news continues to worsen, the outlook will follow and will be adjusted accordingly.

The current call is for flat IT spend in 2020. It would be worse if not for the uptick in WFH infrastructure – not just collaboration and video tools but virtualization solutions, VPNs, network upgrades, mobile devices, laptops and the software to secure them.

Despite the work-from-home offset, we expect this picture to worsen over the next three months. Watch the duration of remote work-at-home mandates and travel bans, as well as the no-meeting policy. There’s little doubt that productivity will be hurt. You can’t just flick a switch and scale up remote worker productivity.

Having said that, the expectation from CIOs is that this will be temporary. What’s unclear is the shape of the recovery. Will it be V-shaped or a slow slog? We can see the distant rim on the other side of the canyon, but we just don’t know how far away it is or how deep is the canyon.

In our view, however, there will be permanent changes. As we said on our last Breaking Analysis, over the next several months, organizations will learn new things that will shape their thinking in the future. We expect accelerated digital transformations, sustained viability of WFH options, new capabilities from distant learning with the college shutdowns, new risk mitigation paradigms.… The list goes on.

This is the new normal. We know it’s a cliche, but this time it’s true.

It’s true for our organization as well. TheCUBE skeleton crews are in the studio and we’re keeping the content flowing. ETR survey data keeps rolling in – you can get updates on its Web site – and the team there is as vigilant on this issue as are we from our remote studios. Likewise, SiliconANGLE’s reporters, most of whom have already been working from home all over the world, continue to report the latest news.

Many on our in-studio team are working from home but are still on the grid. Currently, our Palo Alto studio is fully operational for four days each week capturing remote guests on camera and tying into our Boston studio operation. So get in touch if you need anything – we are here to help.

Remember these episodes are all available as podcasts wherever you listen. Ways to get in touch: Email me at david.vellante@siliconangle.com or direct-message me at @dvellante on Twitter, and comment on our LinkedIn posts.

Here’s the full video analysis:

THANK YOU