INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Despite COVID-19 forcing cuts in information technology spending, many venture-funded technology companies are relatively optimistic about their future, at least once the pandemic eases. But for the small businesses that employ half of U.S. workers, the picture is decidedly more grim.

That’s the upshot of this week’s CUBE Insights, which are powered by Enterprise Technology Research. For some context, first let’s recap the current information technology spending outlook.

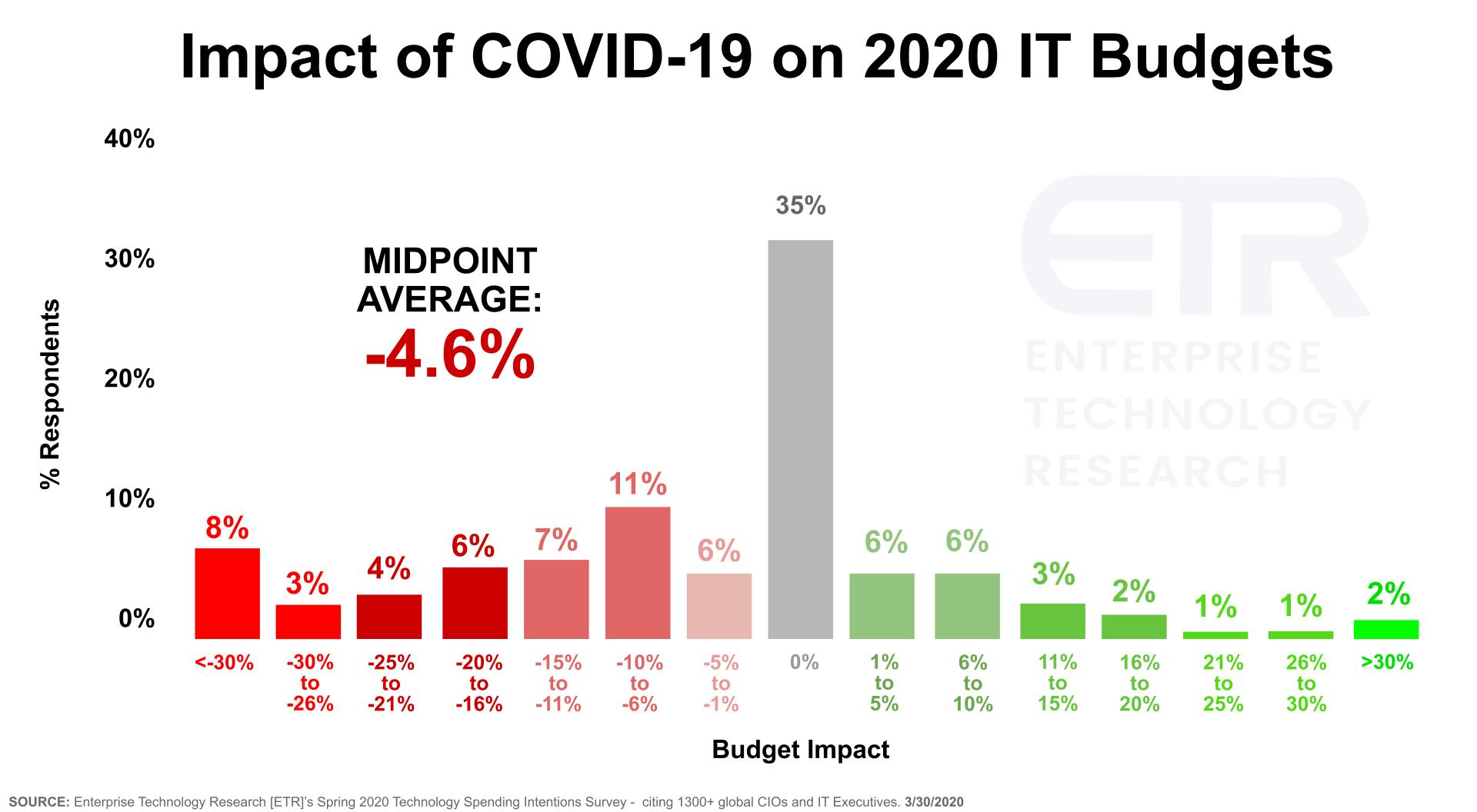

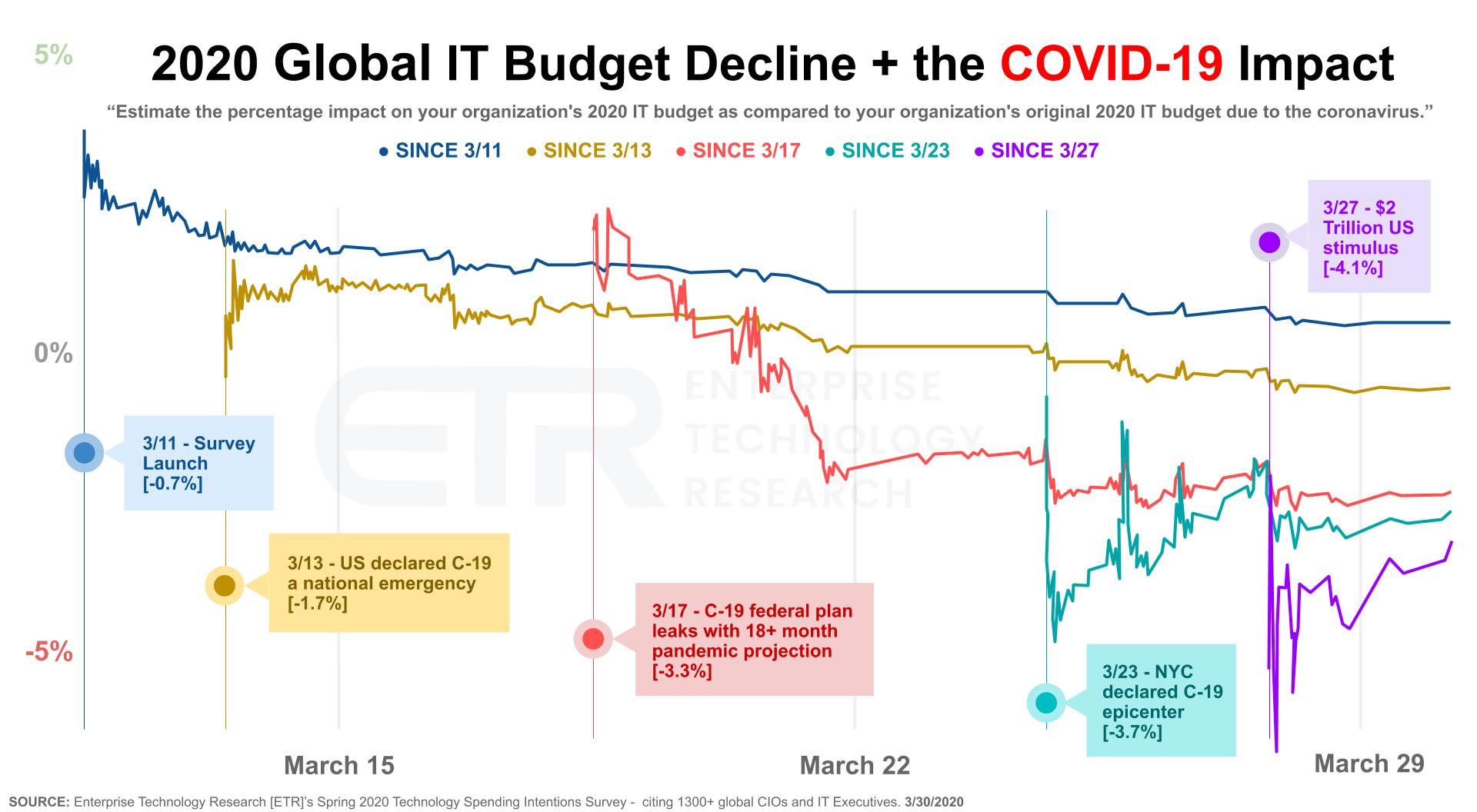

ETR was the first to quantify with real survey data, the impact of COVID on IT spend as reported in our first Breaking Analysis on this topic. To review, we entered the year with a consensus forecast for IT spending of 4%. After analyzing more than 1,200 chief information officer responses over a survey period of approximately 30 days, we’re now calling for a -4% growth rate in 2020.

As we’ve previously reported, this is ETR’s latest survey data from its second-quarter survey and depicts how respondents see the impact of COVID-19 on IT spending in 2020. While 28% of respondents expect a decline of more than 10%, a full 35% expect no change.

Importantly, 21% expect actually to increase spending as a direct result of work-from-home infrastructure deployments, such as spending on collaboration tools and related networking, security, VPN and VDI infrastructure. Without this offset, the picture would be substantially worse and forecasters should expect significant headwinds in traditional IT sectors, particularly capital spending for on-premises data center projects that don’t support near-term worker productivity.

Remember, ETR launched this survey on March 11 and ran it through early April – so it caught the the change in sentiment literally in real time on a daily basis.

That progression is shown in the above graphic, which overlays the key events that occurred during that time. What ETR did was to model and rerun the data excluding the responses prior to each event. Of course, the forecast progressively worsened over time. However, as you can see on the purple line, there was an uptick in sentiment from the stimulus package and it appears that Congress is preparing another cash injection into the economy soon.

ETR is now entering a quiet period for two weeks to analyze the data set further, after which we’ll begin to report on specific sectors. But we have some thoughts on what we’ve seen and what we expect in the coming weeks for sectors that will see wider swings.

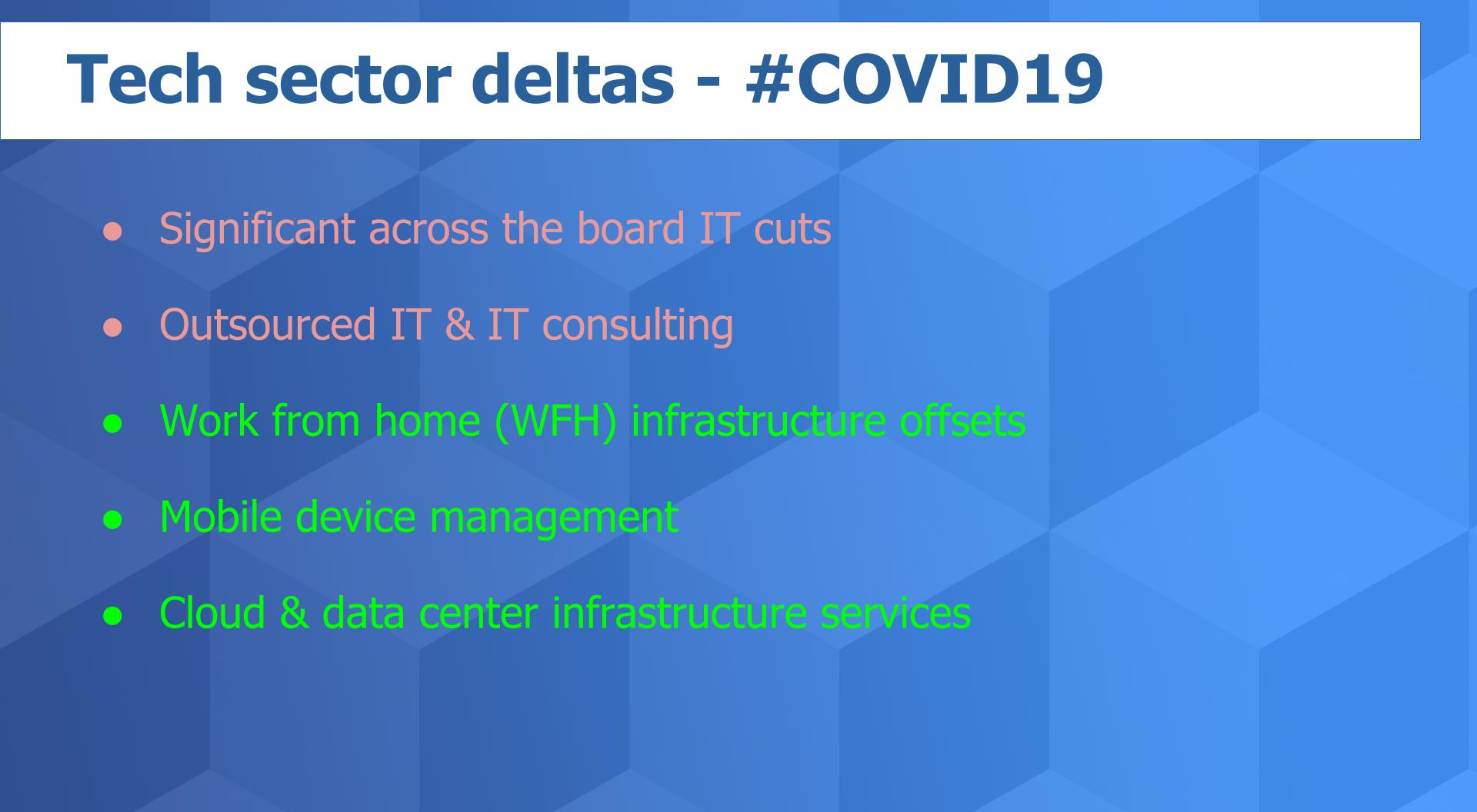

In the slide above are some of the sectors we’re watching closely for big changes. As we’ve reported, we’re seeing substantial cuts in IT spend and capital spending across the board. We would expect sectors such as IT consulting and outsourcing to be way down as organizations put many projects on the back burner.

But there are bright spots as shown in the green. One that we really haven’t highlighted to date is the cloud- and data center-related services. Cloud is definitely going to remain strong in our view. And related services to connect to clouds via colocation services to reduce latency across clouds will also be strong in our current thinking.

Let’s talk about some of the learnings and takeaways from our conversations with CxOs over the past couple of weeks. One of the great things about theCUBE is that we get to build relationships with many people. Over the past 10 years we’ve interviewed more than 5,000 people. So we’ve reached out to a number of execs over the past few weeks to try and understand how they’re managing through this crisis.

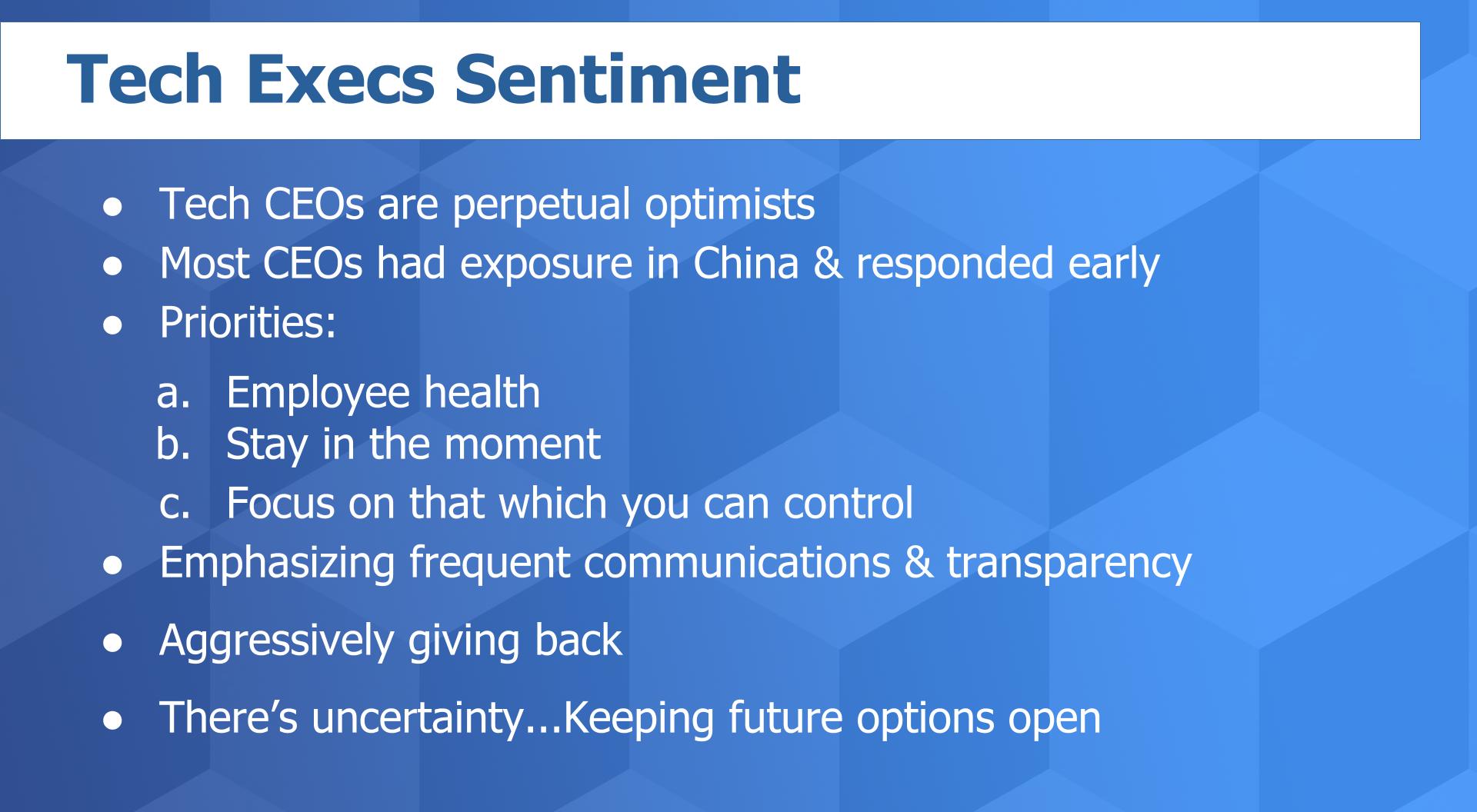

The chart above summarizes some of the things we heard. First, of course tech execs are glass-half-full thinkers. It was interesting to hear how many of the people we spoke with had early visibility on this crisis because of their operations in China and other parts of Asia – so they saw this coming to the U.S. and many were ready.

As you’ll hear from the execs directly, they all have an air of confidence about their long-term viability and put their employees ahead of profits. At the same time, once they see that their employees are OK, they want them focused and productive. They’ve all increased the cadence and frequency of communications. And most or all are giving back with free, no-strings-attached software and similar programs.

But the bottom line is they don’t know what’s coming. They don’t know when this thing will end, what a recovery might look like, when people will feel safe traveling again and what the overall economic impact will be. They hope for the best and plan for the worst.

Here’s a highlight clip of five execs that we interviewed: Melissa Di Donato, chief executive of SUSE; Frank Slootman, CEO of Snowflake Inc. and former chairman and CEO of ServiceNow Inc.; Jeremy Burton, CEO of Observe Inc., who was chief marketing officer of Dell Technologies Inc.; Sanjay Poonen, chief operating officer of VMware Inc.; and Sri Srinivasan, senior vice president and head of collaboration for Cisco Systems Inc.

So you can hear it from the execs who all either currently or at one point have led large companies and teams. The other thing Slootman told us, by the way, is he approves investments in engineering with no qualms because that’s the future of the company. But he’s much more circumspect with go-to-market investments because he wants to see a high probability of yield before investing.

We want to share some perspectives of smaller early-stage companies as well. We’ve all seen the Sequoia Capital “Black Swan” memo and you may remember the onerous R.I.P. Good Times alert from 2008, basically advising companies to stop spending on all nonessential items. Slootman also somewhat scoffed at this advice and told us you should always stop spending money on all nonessential items.

Regardless, we’ve talked to a number of early-stage investors and portfolio companies and want to share some of their plays that they’re using during the crisis. It may add some value to the “cut, cut, cut” narrative.

Here’s a summary of five key moves that we see:

What we’ve seen is that startup companies with strong annual recurring revenue streams are in good shape, believe it or not. In almost all cases we’ve seen targets lowered, but there are examples of startups increasing their outlook: Think Zoom. But generally we’ve seen target resets of between 55 and 15% down, which often is in line with board level goals. We have seen more drastic reductions of up to 50%.

We’ve actually heard pretty good stories from larger tech companies and venture-funded startups. Now we want to talk about small businesses broadly, and what we’re hearing from small businesses owners and the banks that serve them.

The picture is not good. Many small businesses are in deep trouble. The aid package to small businesses is not working its way through the banking system nearly fast enough. Despite the Treasury Secretary’s efforts, the bottom line is our data suggests that banks don’t want to make these loans to most small businesses. Banks make no money on these loans and are being overwhelmed with volume. The service fees on the loans are a pittance and the banks complain that the government guidelines are opaque.

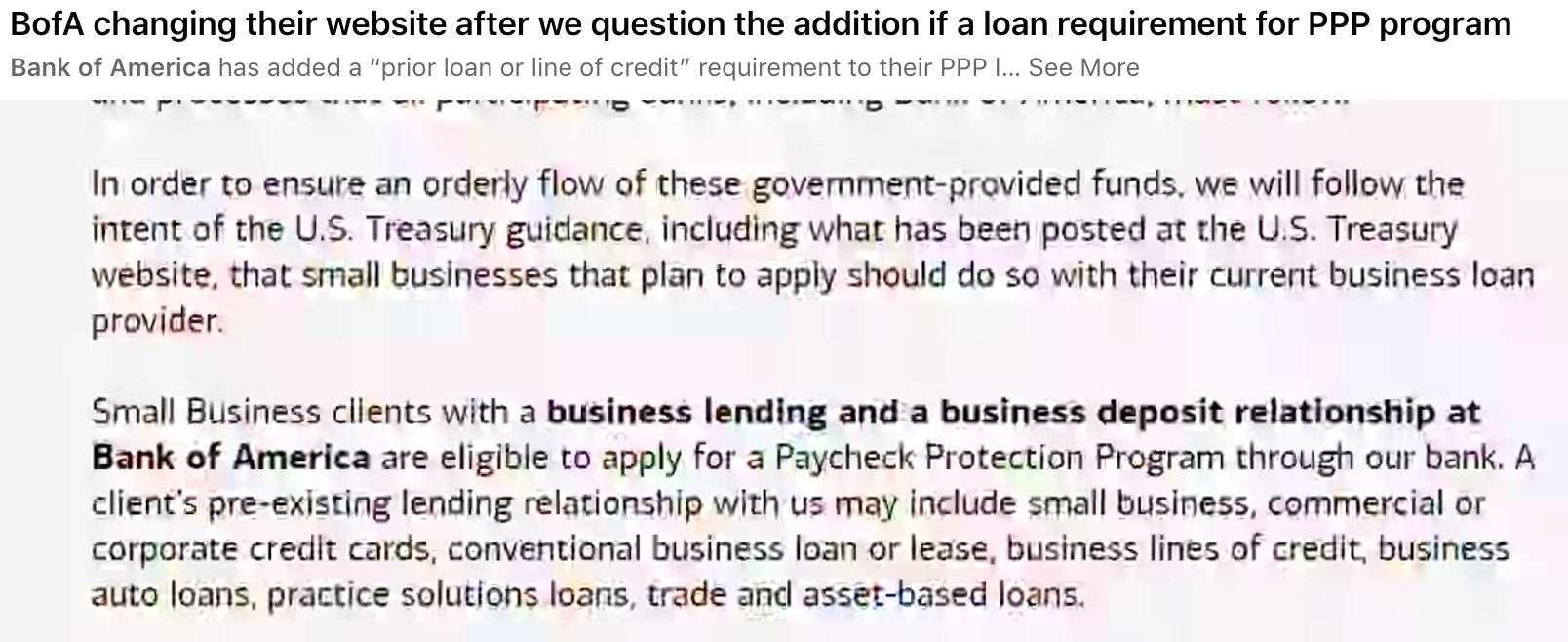

As an example, when the Paycheck Protection Program for small businesses hit, Bank of America signaled that it would only help companies with both a banking and a lending relationship with the bank (see Steve Noviello’s post below). After government pressure, BofA changed its policy, but it’s unclear if the bank’s new posture is just optics.

UBS is another example. It said it was only directly helping companies with more than 500 employees and for small businesses it was outsourcing the banking relationship. That at least gave small businesses an option. And our understanding is the UBS partner didn’t impose the same restrictions as BofA and has been pretty responsive to small businesses. But the outsourced bank requires applicants to go through a “Know Your Customer” process that likely slowed applications down somewhat.

Credit unions are another key source for small businesses in local communities. Our conversations with credit unions indicate that: 1) The volume is impossible for them to manage – they normally handle only a few loans a month for small businesses and they’re being asked to process many dozens; and 2) They don’t trust the promise that the government will guarantee these loans. Specifically, our data suggests that historically, smaller banks have been reticent to process loans backed by the Small Business Administration because if they miss dotting an i or crossing a t, the loans may not be secured.

In a way you can’t blame the banks. They’re being asked to execute on these programs without clear guidance on how they are to enforce the guidelines and what happens if they make a mistake. Will the federal government pull their guaranteed backing? What are those guidelines and what’s the bank’s liability and authority to enforce them?

Why do we spend time talking on this topic? Because nearly half of U.S. employees work for small businesses. Nearly 17 million workers in the U.S. have filed for unemployment to date. Small-business employees are a mainspring of consumer confidence and the ultimate outcome for these people will have a ripple effect on the economy.

The bottom line is that the banks got bailed out in the financial crisis of 2008 and need to step up. They should be aggressively investing in automation systems such as robotic process automation to increase the capacity of processing these programs and get it done.

Recent stock market rebounds are being hailed by investors as a necessary backstop. While reticent to predict the bottom at current levels, most investors believe we won’t hit previous recent lows because of the aggressive fiscal and monetary policies enacted by the Federal Reserve and Congress. That’s good news for Wall Street.

Many have used the line “there’s no such thing as a free lunch,” including Milton Friedman, whom we’ll credit here. Why? Because he espoused controlling the money supply and letting the markets fix themselves. Now in fairness to Friedman, he believed the debt in and of itself was not the problem, rather the real culprit was the deficit spending that creates the debt.

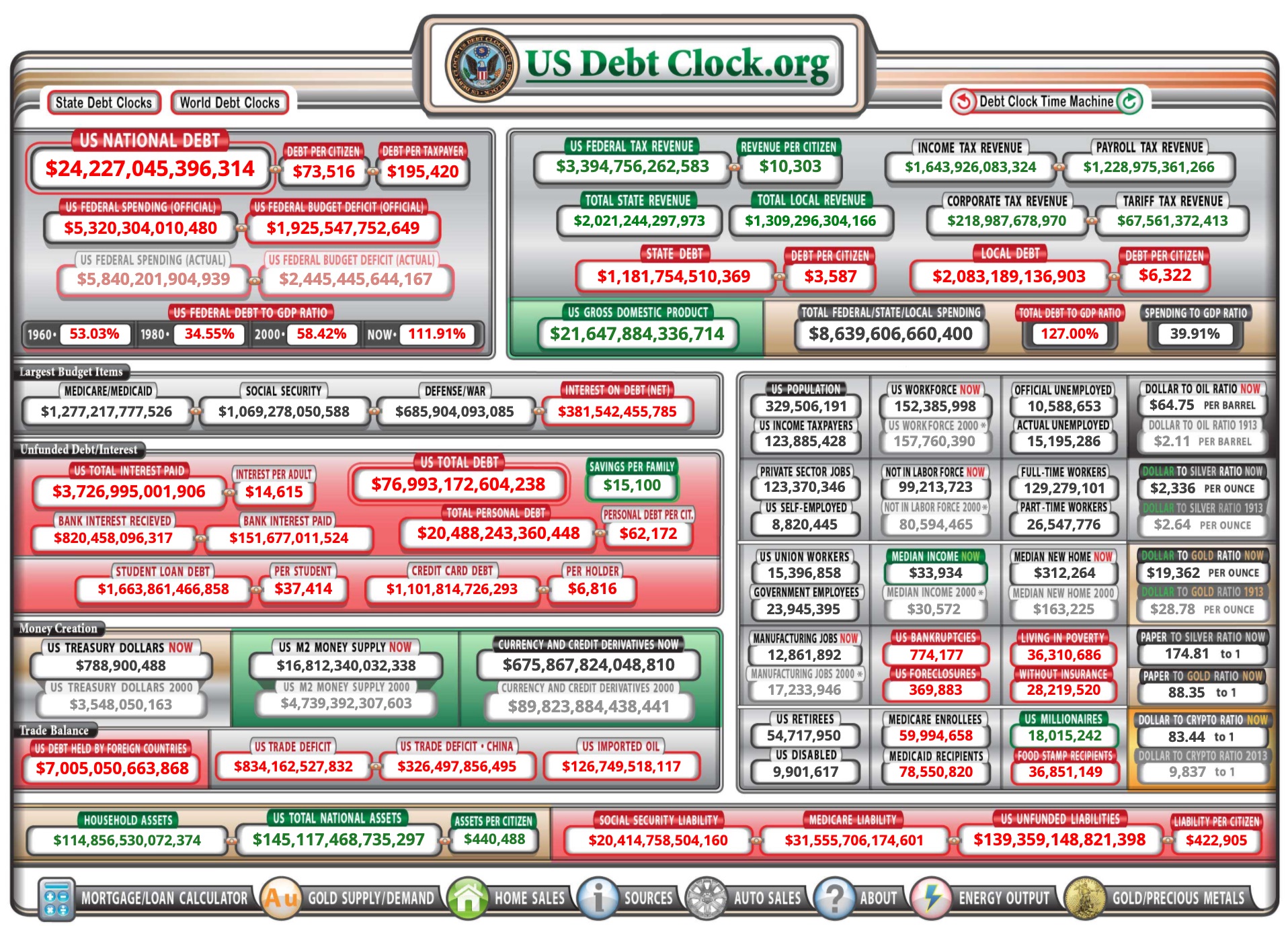

Nonetheless, we can’t help but point out that currently the U.S. national debt clocks in at more than $24 trillion. That’s $195,000 per taxpayer, a figure that grew by around $800 in the past 24 hours. Americans’ personal debt is now $20 trillion. Total unfunded liabilities (meaning Social Security, Medicare Parts A, B & D, federal debt held by the public and federal employee/veterans’ benefits) now stands at $139 trillion. That equates to about $423,000 per citizen. The average liquid savings per U.S. family is $15,000. U.S. debt is now 111 percent of gross domestic product.

To Friedman’s point of concern, the real federal spending deficit is around $2.5 trillion.

For several years, we’ve been applying parts of Keynesian economic theories, and it seems to have been working. Namely, governments should prevent deep recessions and depressions. All one needs to do is compare the government’s response to the financial crisis of 2008-2009 with the inaction to the Great Depression. Moreover, predictions of inflation post-2008/2009 proved wrong.

But the concern is it’s very unlikely that we can grow our way out of this annual deficit burden. And we worry about that. We’ve worried about that for a long time now.

We’ll try to keep the rhetoric to a minimum and stay positive. Perhaps one of the outcomes of this crisis will be a society that has the appetite and resolve to rethink the pattern of ignoring massive deficits. Perhaps.

One of the things we believe is that there will be permanent changes from COVID-19 – both in personal and business settings. It’s ironic that this hit as we’re entering a new decade. As we’ve reported before, we expect digital transformations to be accelerated and the many companies that have talked digital from the corner office, but haven’t really walked the walk, will now be more aggressive in that regard. As well, we expect more cloud, more subscription, less wasted labor, more automation, more work from home and fewer big physical events – at least for a while.

And we definitely see companies potentially sub-optimizing near-term profits to increase business resiliency. We talked to Inderpal Bhandari, IBM Corp.’s global chief data officer, this week about this very topic. He told us that he has a data-oriented approach so that you can have your cake and eat it too, meaning you can increase business resiliency and profitability. We’ll share more about that in the coming weeks.

We continue with theCUBE skeleton crews in our studios in Palo Alto and Boston. Our digital “Green Room” has been lined up with guests and we’ll keep the content flowing.

As well, theCUBE will keep you up to date and really dig in after ETR’s quiet period. Look for updates on the ETR website and make sure to check out SiliconANGLE for all the news and analysis you’ve always gotten.

Remember these episodes are all available as podcasts wherever you listen. Ways to get in touch: david.vellante@siliconangle.com, @dvellante on Twitter and comment on our LinkedIn posts.

Also, you may want to check out this ETR Tutorial we created, which explains the spending methodology in more detail.

Here’s this week’s full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.