CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

IBM Corp.’s new chief executive has an opportunity to reset the direction of the company.

Outgoing CEO Ginni Rommety inherited a strategy put in place over two decades, which fossilized into a lower-margin services-led model that she helped architect. Rometty spent a large portion of her tenure shrinking the company so it could grow. Unfortunately, she ran out of time before she could see that happen.

For years, IBM has squandered chances to invest aggressively in the key waves that are powering the current tech economy. Instead, it tried to balance investing in future innovation with placating Wall Street.

IBM did invest and has a strong base from which to work if it redirects its use of cash. We believe it has an opportunity to return to the Big Blue status that set the standard for the tech industry. But several things must change, some dramatically, for IBM to succeed in this endeavor.

In this week’s Wikibon CUBE Insights Breaking Analysis, powered by Enterprise Technology Research, we’ll address our view of IBM’s future and try to accomplish three things:

Let’s first look at some comments from Krishna and try to understand them a bit more and what they mean for IBM’s future.

In IBM’s earnings call, in interviews and in internal memos, Krishna has given several clues as to how he’s thinking. The slide above addresses a few of the key points. Krishna has clearly stated he’s committed to growing IBM and increasing its value. This is not surprising as all IBM CEOs have been under pressure to do the same. But saying and doing are two different things. We’ll look into that further later on in this segment.

Krishna stated that he wants the company to lead with a technical approach. As we reported in January when Krishna was appointed CEO, we are encouraged that IBM chose a technical visionary to lead the company. His predecessors did not have the technical depth needed to make the bold decisions that we believe are required to power the company’s future. As a technologists, we believe his decisions will be more focused on bigger technical bets that can pay larger returns, though perhaps with more risk.

As a point of tactical commentary, IBM noted that it was doing well coming into March but software deals especially came to a halt as customers focused on managing the pandemic. This is of near-term concern and we have little doubt IBM is carefully watching and managing this dynamic to the best of its ability.

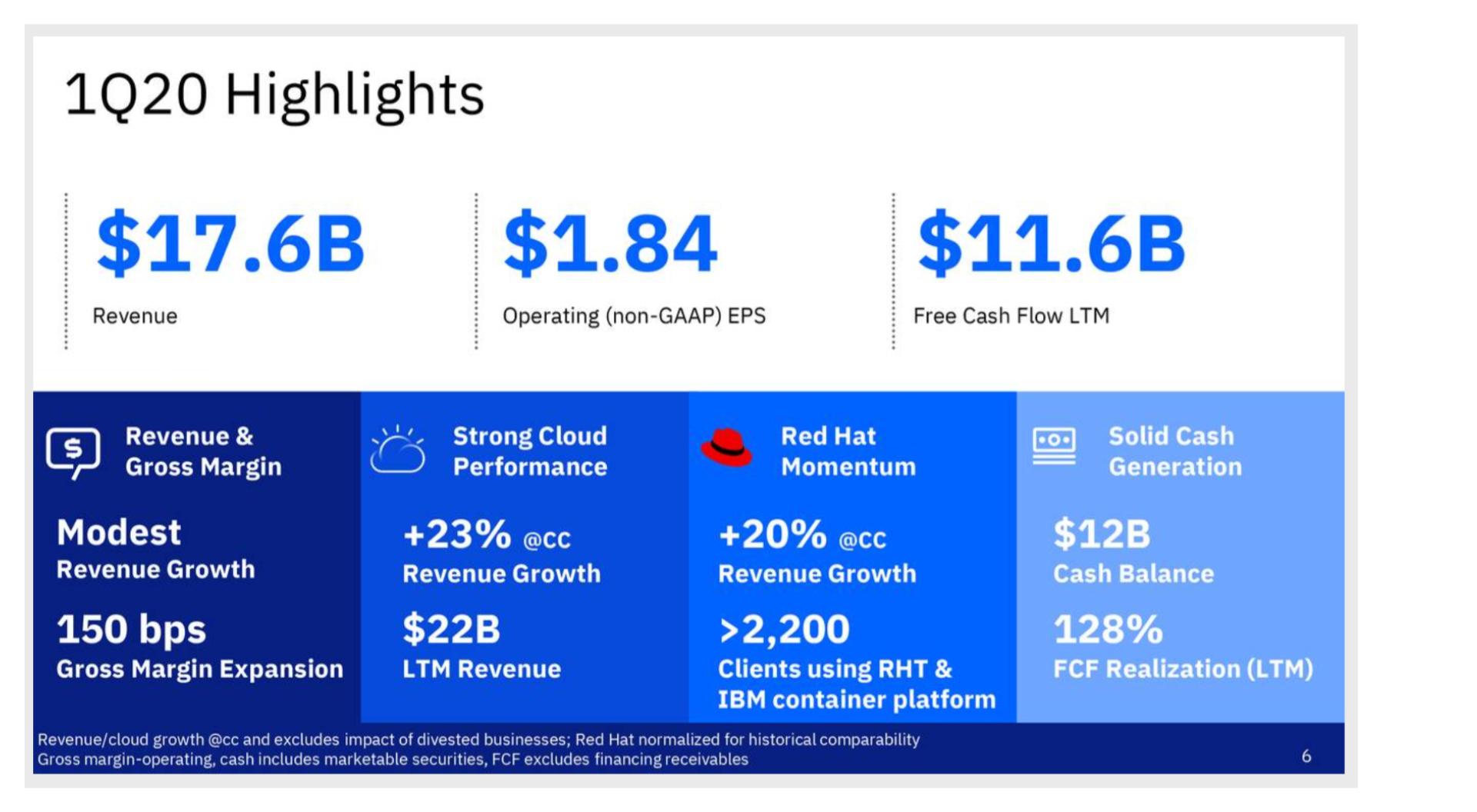

The chart below pulls some of the data from IBM’s quarter:

IBM cites “modest revenue growth” on this slide. But revenue was down 1.5% for the quarter in constant currency relative to last year, so we don’t understand how it’s “growth.” Cloud revenue for the past 12 months was $22 billion and grew 23%. We’ll unpack that in a moment. Red Hat showed good growth and IBM continues to generate solid free cash flow.

Like many companies, IBM prudently suspended forward guidance. Some investors bristled at that but we have no problem with it. There’s too much is uncertain right now and it’s the right thing to do.

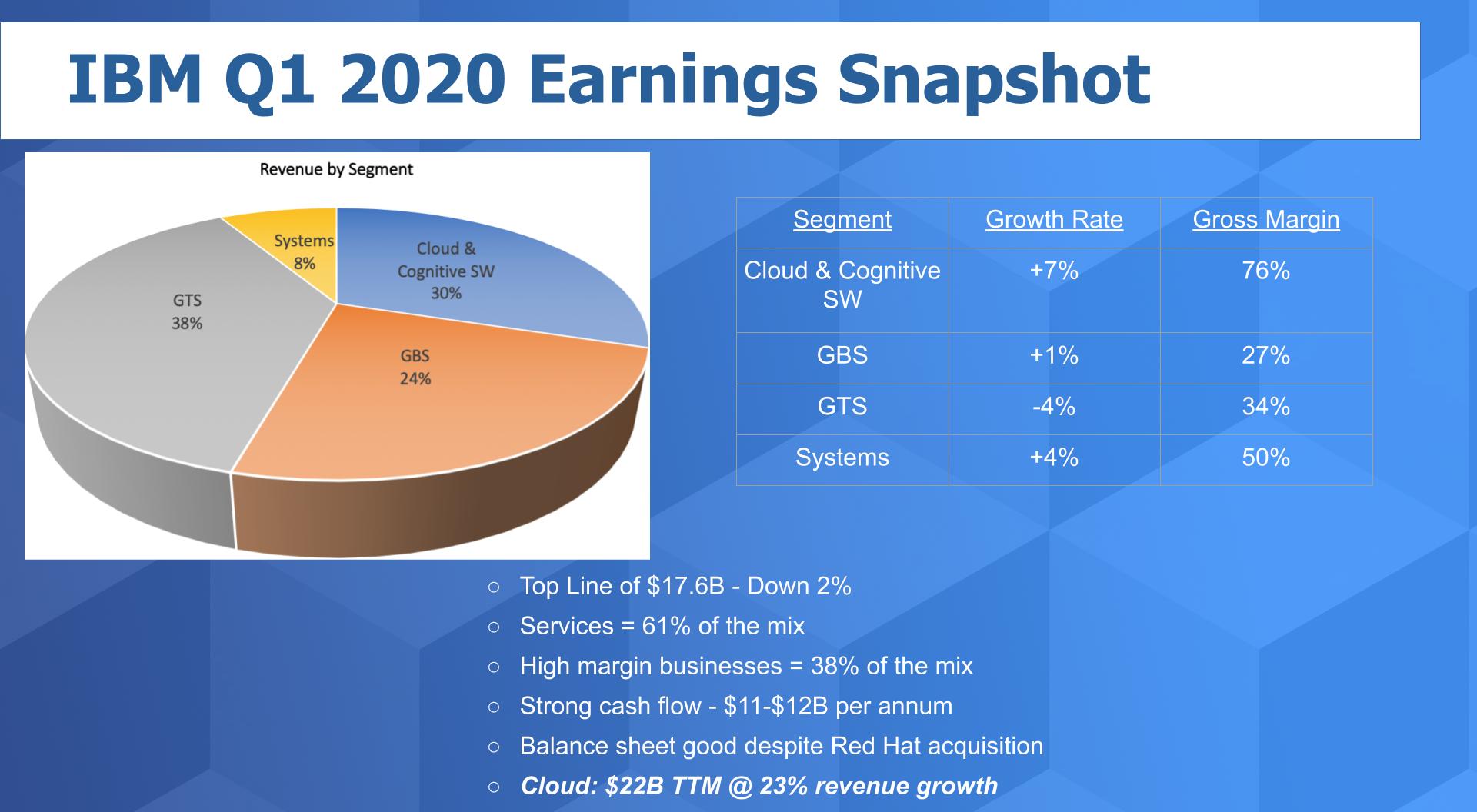

Let’s look at how IBM’s business segments performed:

As you can see in this graphic above, IBM’s $17+ billion in revenue comprises four reported segments.

IBMs balance sheet looks fine; it has good liquidity and IBM took advantage of low rates and issued $4 billion in commercial paper.

A note on services: Krishna mentioned services as an enduring platform for IBM and he’s right. Services gives IBM world-class coverage and deep industry knowledge. But services margins are low, and it has diseconomies of scale and compresses IBM’s revenue multiple and subsequent valuation. To secure IBM’s future, the company must dramatically grow other parts of its business in our view.

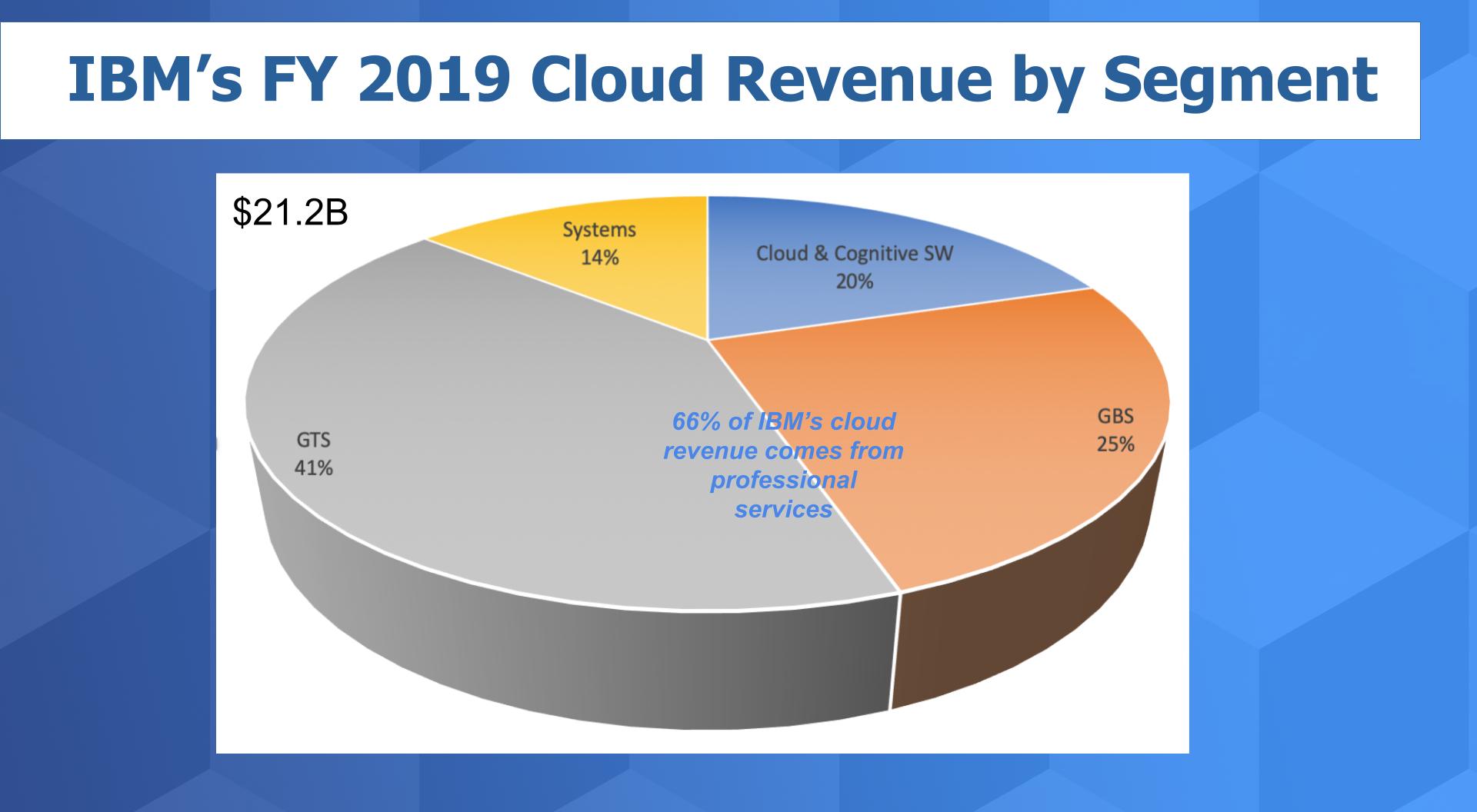

IBM reported that its cloud business generated $22 billion in the past twelve months. It claimed that business is growing at 23%. Your reaction, perhaps like ours, is “no way.”

The following graphic explains:

This chart above shows the breakdown of IBM’s cloud revenue by segment for fiscal year 2019. As you can see, the Cloud and Cognitive segment (which includes Red Hat) comprises only 20% of IBM’s cloud business. The business IBM calls “cloud” only accounts for 20% of its cloud business. We agree, that’s strange.

Professional services accounts for 66% of IBM’s cloud revenue, with Systems at 14%. In our view, IBM’s future depends on decreasing its reliance on services and building up more profitable, scalable and higher-margin parts of its business.

IBM is defining cloud differently than most people. As a benchmark, what percent of the cloud business of Amazon Web Services Inc., Microsoft Corp. with Azure and Google Cloud – the generally accepted cloud leaders – comes from professional services and on-premises hardware?

In our view, this breakdown just doesn’t have real meaning and we think hurts IBMs credibility as it hides the ball on cloud. Nobody believes this number reflects what customers consider cloud. Cloud in this definition is whatever IBM says it is and could include anything.

Let’s bring in some ETR data and look at the customer spending angle.

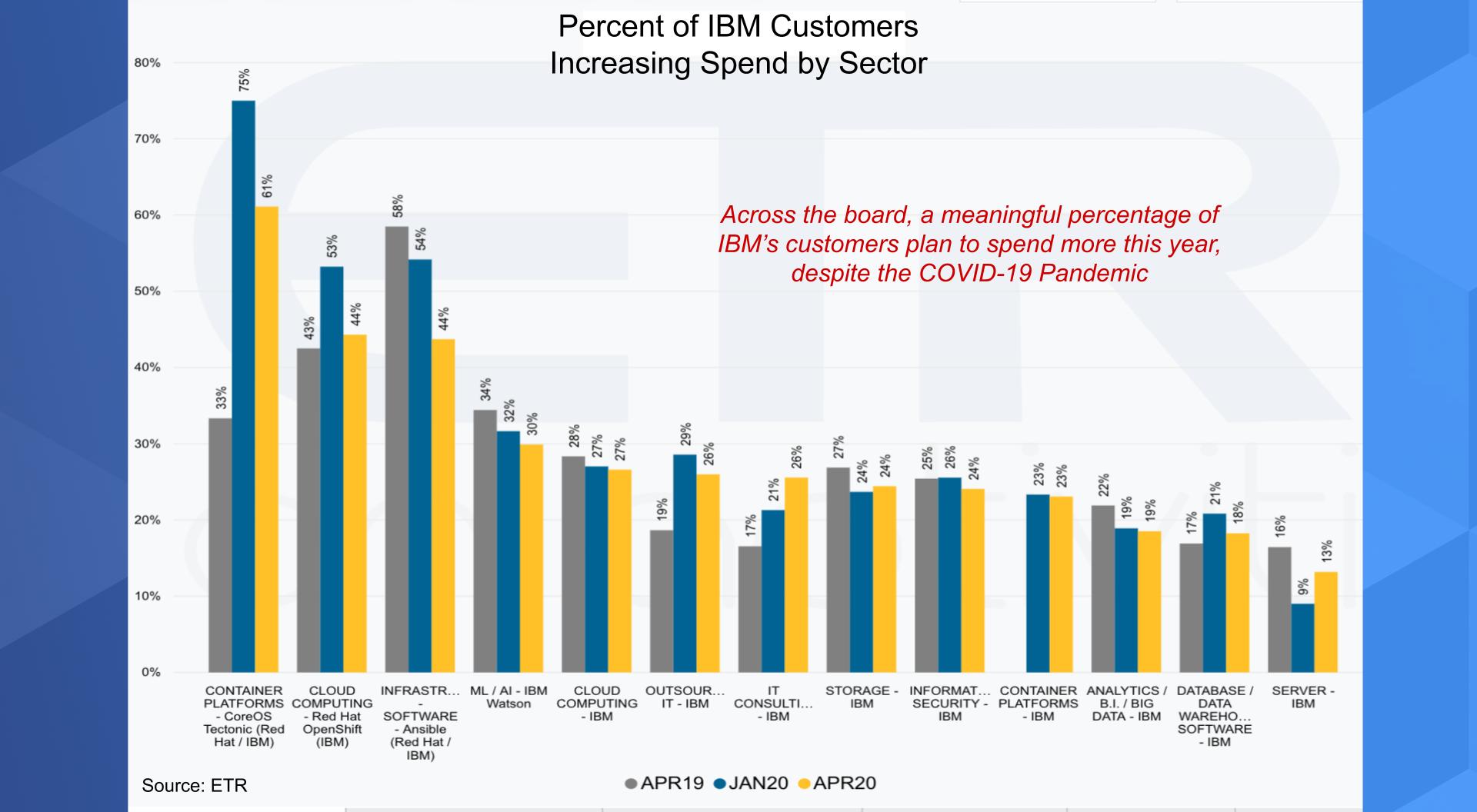

The chart above shows the results of an ETR survey that ran from mid-March to Mid-April. It comprises more than 1,200 respondents and almost 800 IBM and Red Hat customers within the sample. The graph shows the percentage of customers spending more on IBM products by segment across three survey samples – April last year, January 2020 and the most recent April 2020 survey. The key point to remember is this global survey was taken at the height of the COVID-19 pandemic in the U.S.

On the plus side, container platforms, OpenShift and Ansible, the staples of Red Hat, are showing nice strength within IBM’s portfolio – even though they are notably down from previous surveys. But that’s the part of IBM’s business that is promising and one reason it acquired Red Hat.

Artificial intelligence, machine learning and Watson are in the positive mix, as is cloud. Even outsourcing and consulting has some positives and across the board you can see a respectable percentage of IBM customers plan to spend more with IBM in 2020. That bodes well for IBM’s future.

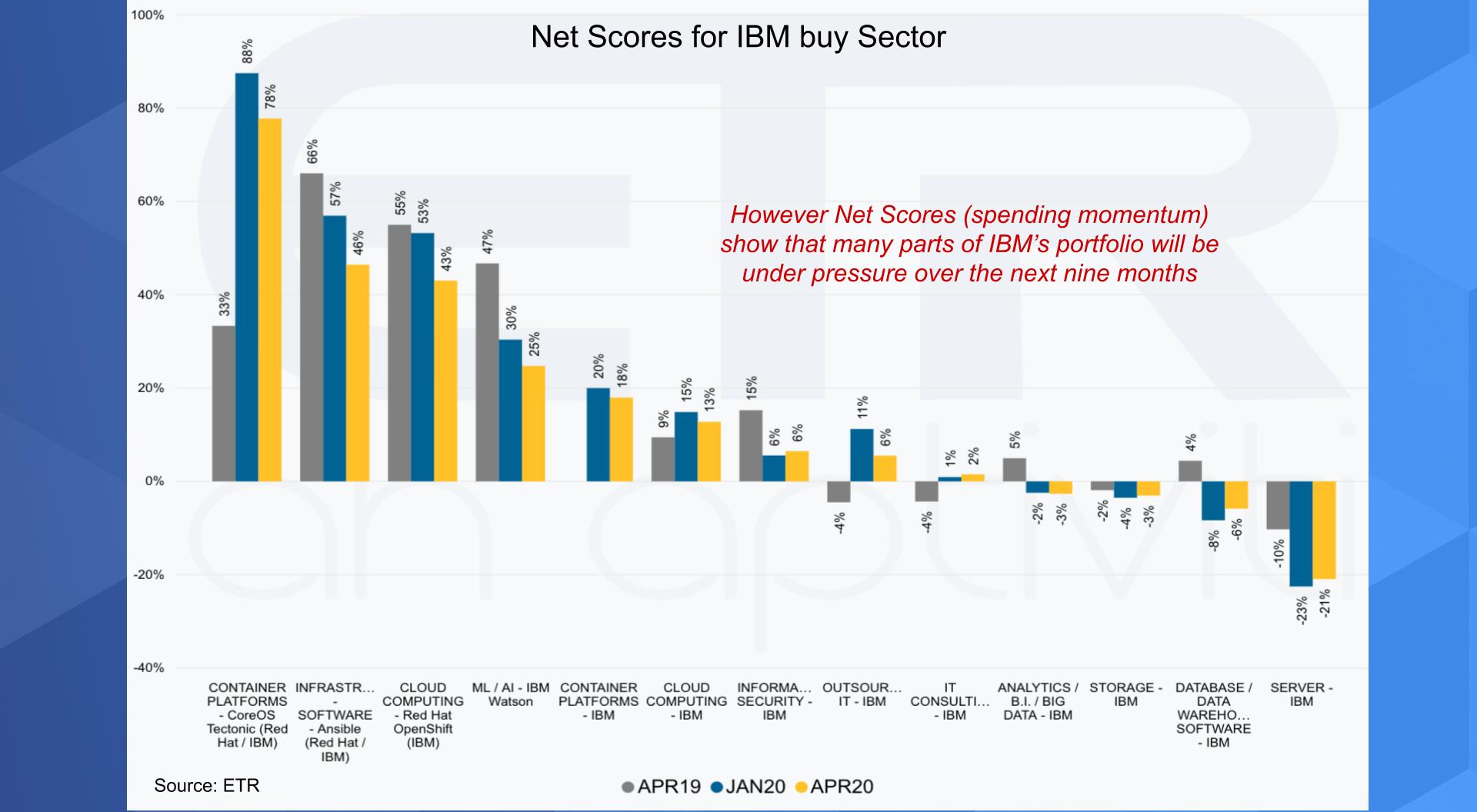

But if you look at the Net Scores across IBMs portfolio, it’s not all rosy. Remember Net Score is a measure of spending momentum derived by essentially subtracting the percentage of customers spending less from those spending more. It’s a nice simple metric – sort of like Net Promoter Score. ETR surveys use the exact same methodology each quarter for consistency.

The chart above shows a more complete picture.

You can see here that Red Hat remains the strongest part of IBM’s portfolio. But generally in our experience as Net Scores start to dip below 25%, you get into the danger zone. So you can see many parts of IBM’s portfolio are showing softness and even though the outsourcing and consulting business are up relative to last year, if you slice the data by large companies – as we showed you last week – IBM’s services businesses are showing deceleration along with Accenture, Ernst & Young, Deloitte and others.

So the takeaway here is Red Hat is where all the action is and that’s where IBM is going to invest heavily in our opinion. We’ll talk more about that later when we dig into what it means for IBM’s future.

Let’s circle back to Krishna because he has a chance to pull off a Satya Nadella-like turnaround. Different, of course. Nadella, when he took over Microsoft as CEO, had access to a balance sheet with $87 billion in cash. But there are similarities in that you have two great companies in IBM and Microsoft that lost their untouchable status. Microsoft has gained it back under new leadership and IBM has a chance to repeat the comeback. And of course there’s the India-born CEO angle – pretty impressive what’s happening in the U.S. right now.

Krishna has cited four enduring platforms for IBM. Mainframe, Services, Middleware and the newest: Hybrid cloud. He has said that IBM must win the architectural battle for cloud. We are going to share later what we think that means. There’s a lot in that statement including the role of AI and the edge – both which we’ll address in this segment.

IBM must win the architectural battle for cloud. – Arvind Krishna

But before we go there, we want to understand from a historical perspective how we got here and the opportunities Krishna has ahead. Importantly, we believe he must take much bolder steps than his predecessors to secure IBM’s future.

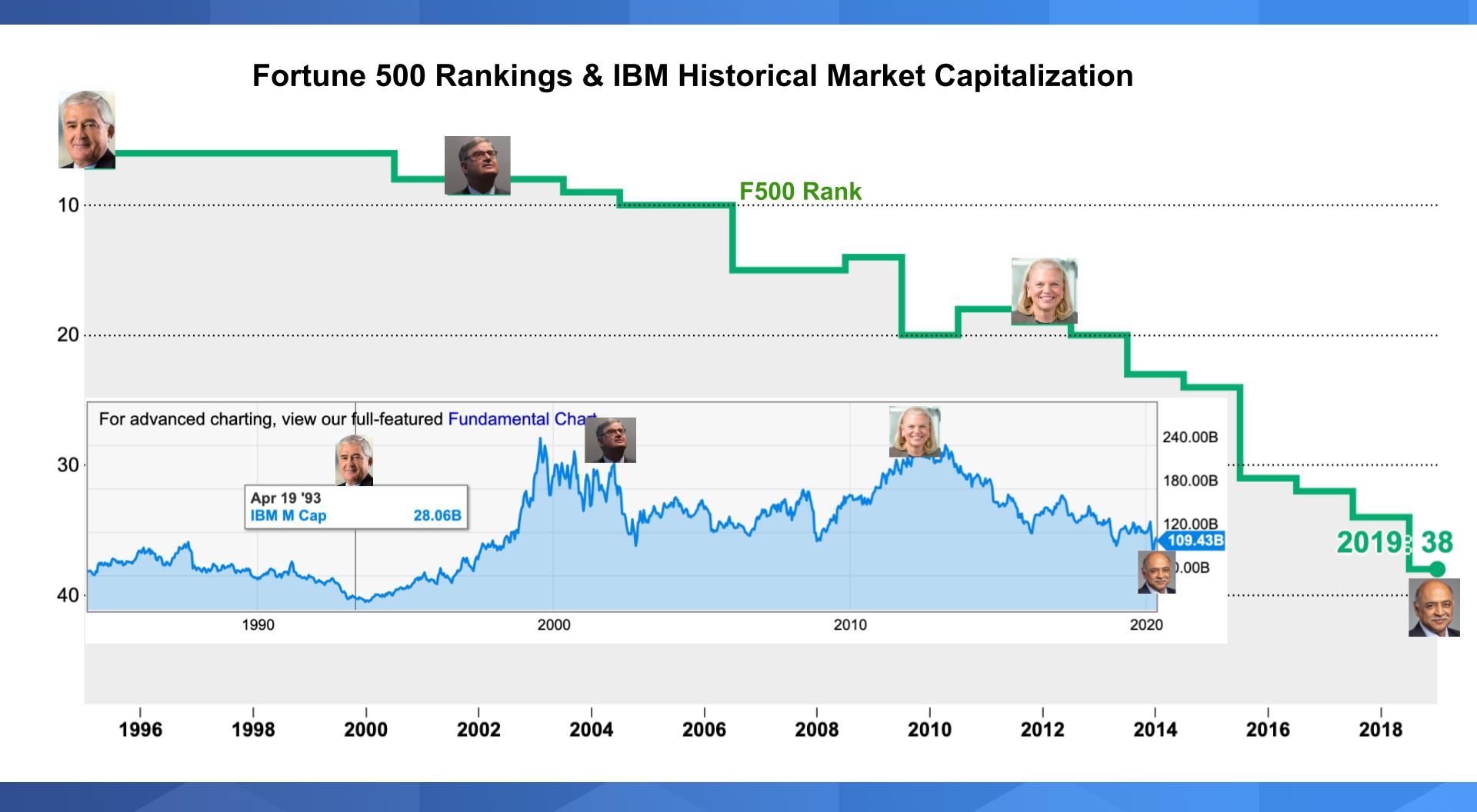

Let’s look back over the modern history of IBM, meaning the post-mainframe dominance era, which started in 1993 when Lou Gerstner took over.

The story in the above graphic has been pretty well-documented, but it’s worth exploring from a current market context. The data shows IBM’ rank in the Fortune 500 in the green line over time. It was sixth under Gerstner, and today IBM is No. 38.

The blue area chart on the insert shows IBM’s market value over time. Gerstner was a hero to Wall Street and IBM’s performance under his tenure was stellar. But history is now beginning to understand fully the decision Lou Gerstner made to pivot into services. By turning the company into a services-led firm (further accelerated by the acquisition of PwC under Sam Palmisano), IBM lost its product edge. Rometty, who architected the PwC deal, inherited from Palmisano a portfolio that she had to unwind and hence the steep revenue declines as she jettisoned so-called nonstrategic businesses.

But that’s only part of the story. What does the past say about IBM’s future?

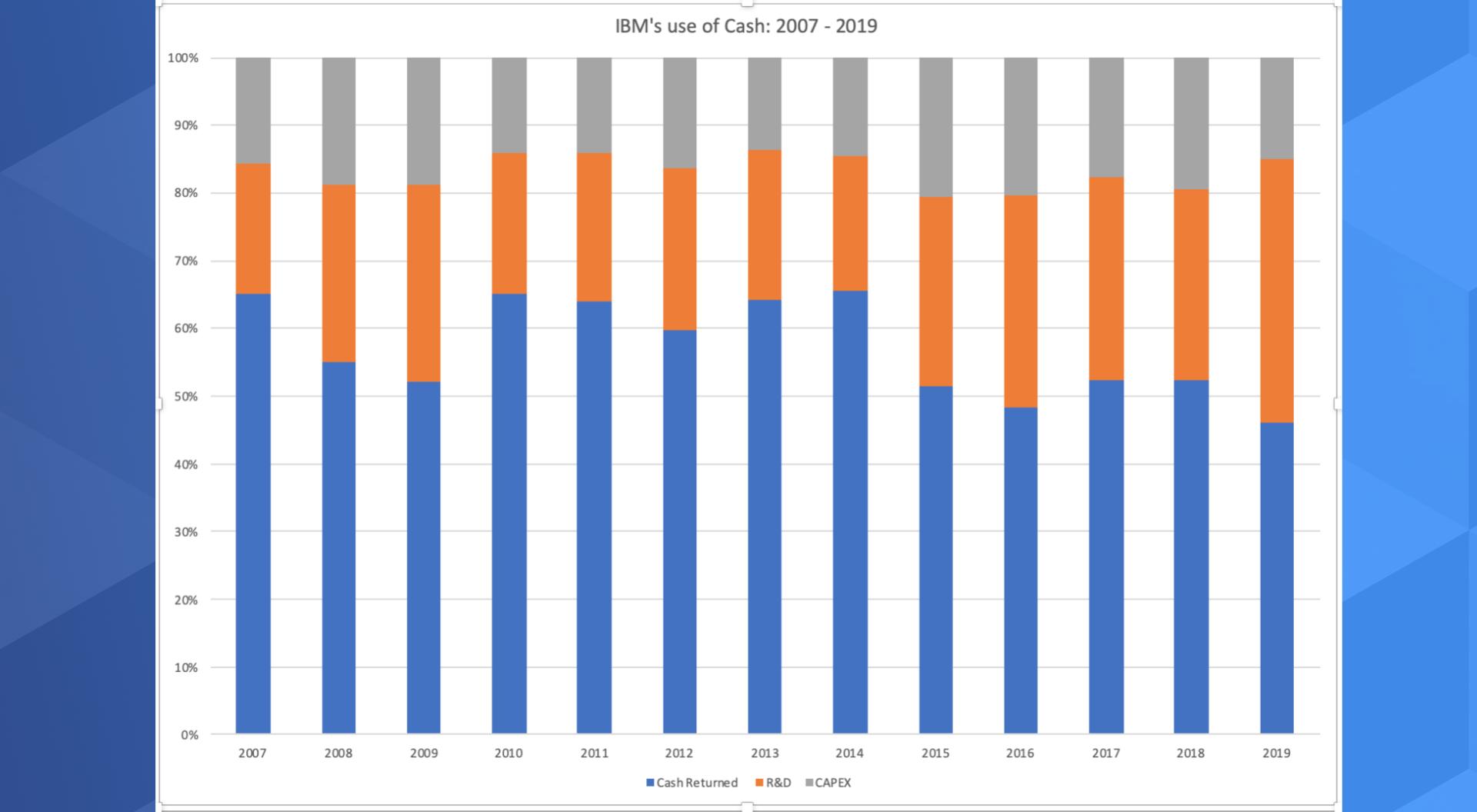

The chart below shows IBM’s breakdown of cash use between 2007 and 2019. The blue is cash returned to shareholders, the orange is research and development spend and the gray is capital spending. We chose these years because we can all agree that this was the period of tech defined by the cloud. And you can see that during those critical early formative cloud years, IBM consistently returned well over 50% and often 60%+ of its free cash flow back to shareholders in the form of dividends and stock buybacks.

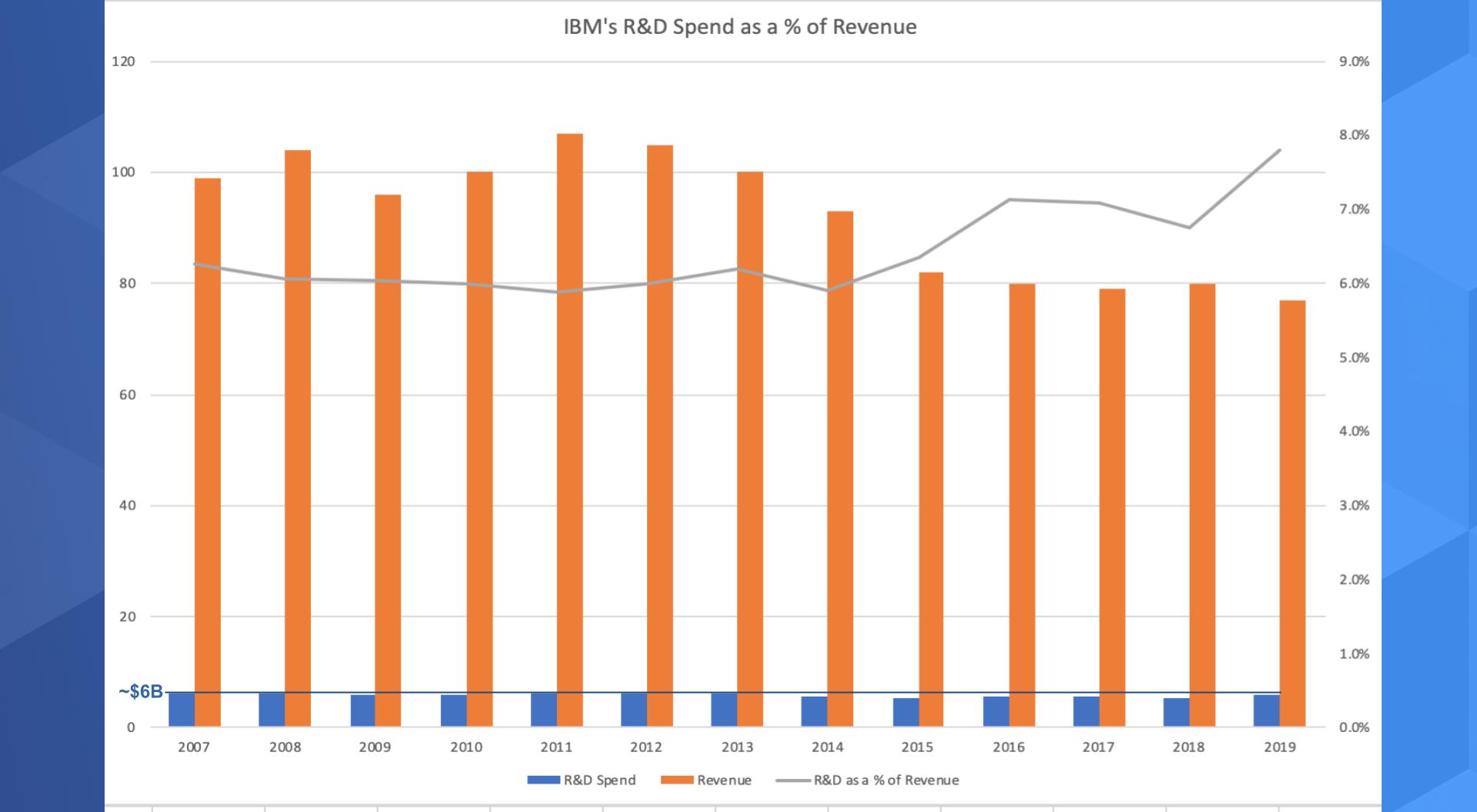

And while the orange bar appears to grow, it’s because of what you see in the chart below. It’s a double y-axis chart showing IBM’s revenue in the orange and R&D spend in the blue ($B on the left axis). The line shows the % of revenue spent on R&D.

The absolute R&D spend didn’t really grow; it pretty much hovered around $5.5 billion to $6 billion annually. The percentage grew as IBM’s revenue declined. Meanwhile, IBM’s competitors were allocating precious capital to R&D and capex, building out the cloud. These choices set the stage for IBM’s future.

For reference, in 2007, IBM spent $6.2 billion on R&D. Microsoft spend $7 billion that year. Intel spent $6 billion. Amazon spent $800 million and Google spent $2 billion in 2007.

That same year IBM returned nearly $21 billion to shareholders.

In 2012, IBM spent $6.3 billion on R&D. Microsoft that year: $9.8 billion. Intel Corp. $10 billion, Amazon.com Inc. $4.6 billion, Google LLC $6.1 billion.

IBM returned almost $16 billion to shareholders in 2012. The following year IBM acquired SoftLayer for $2 billion and formed a cloud division.

By 2019, the picture changed dramatically. IBM spent about the same $6 billion on R&D last year, around the same figure as Cisco Systems Inc. and Oracle Corp. Meanwhile Microsoft and Google are spending nearly $17 billion each, Amazon $23 billion. IBM could only return $7 billion to shareholders last year.

So while IBM was returning its cash to shareholders, its competitors were investing in the future of cloud and are now reaping the rewards.

Since 2007, IBM has returned more than $175 billion to shareholders.

Now in fairness, these numbers don’t include acquisitions, which are a form of R&D for sure. And IBM could argue that it piled $34 billion more on top of its $6 billion last year to acquire Red Hat. But that’s not organic research. Organic invention is the lifeblood of innovation. If the company had reprioritized its cash use, it might have meant a different outcome for IBM’s future.

IBM suspended its stock buybacks after the Red Hat deal. Good. Buybacks have been a suboptimal use of cash for IBM in our view. Recently IBM raised its dividend by a penny. It did this so it could say that it has increased its dividend 25 years in a row. OK. We’ll give IBM a “golf clap” for that one. And at the end of the day, it’s not an expensive move for IBM. Investors were disappointed that the number wasn’t bigger.

We say “hooray” to that.

Somehow Krishna has to figure out how to tell Wall Street to expect less while he invests in the future. As we’ve reported before, here is the opportunity:

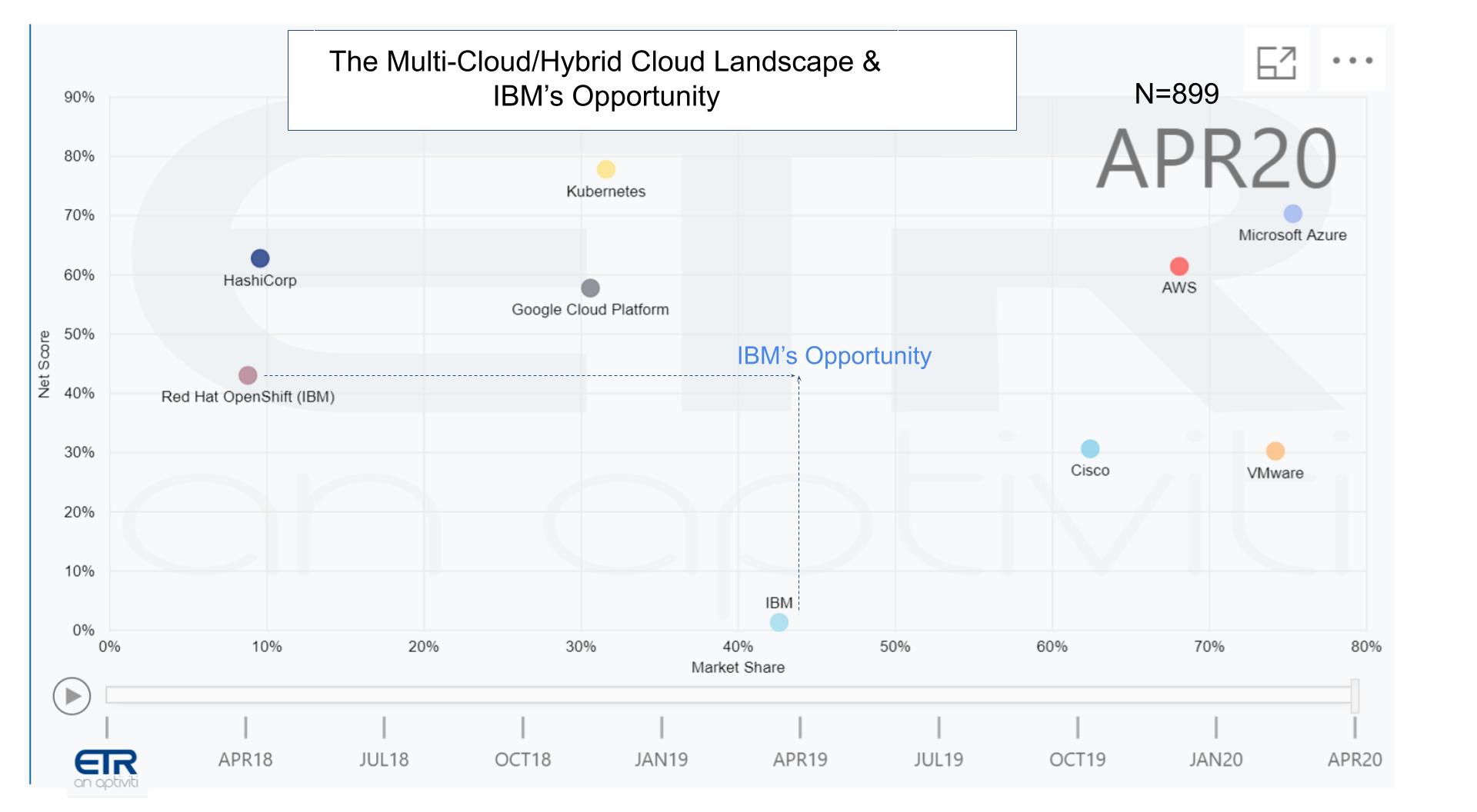

The chart above shows data from ETR. It plots the cloud landscape and is a proxy for multicloud and hybrid cloud. It shows Net Score or spending momentum on the y axis and Market Share – which isn’t real marketshare, rather it’s a measure of pervasiveness in the survey – on the x axis. And we’re showing various competitors in the mix (including Kubernetes spending, which we know isn’t a company).

The point is, IBM has presence, Red Hat and OpenShift have relevance and spending momentum. Krishna’s opportunity is to plug OpenShift into IBM’s large installed base to increase Red Hat’s pervasiveness, while lifting IBM’s momentum and relevance to buyers.

This in our view, as we reported last week at the Red Hat Summit, puts IBM in a leading position to go after multicloud, hybrid cloud and the edge.

Let’s further break down a couple of areas of potential for IBM Red Hat and what it means for IBM’s future.

When Krishna talks about winning the architectural battle for hybrid cloud, here’s our interpretation. Enterprises want the ability to run any cloud-native application anywhere against any data. They need to be able to manage this interconnectivity using the same set of tools at every point in the network.

The ideal interconnectivity architecture layer would be open standards on open source. No one would completely trust Alibaba, AWS or Microsoft to develop this standard. IBM and Red Hat are in a unique position to create the de facto standard for integrating cloud and hybrid cloud. This includes on-prem, public cloud, cross clouds (multicloud) and the edge.

The opportunity is to have the OpenShift container platform provide the interconnectivity and sets of services natively everywhere. On-premises, in the AWS cloud, the Azure cloud, on GCP, on Alibaba, of course on the IBM cloud, the Oracle cloud… everywhere. And natively so it can take advantage of the respective clouds’ services at a primitive level. With efficiency and low latency. Same thing for on-premises, same thing for the edge opportunities.

Think of the entire interconnectivity set of information technology services (the IT stack) provided natively based on OpenShift. The control plane the security plane the transport, the data management plane, the network plane the recovery plane… every plane. A Red Hat led set of services to allow the distributed management of resources that is 100% identical everywhere. And it’s open source.

IBM can be the independent broker of this open-source standard, covering as many uses cases and workloads as possible.

This will require an enormous amount of R&D. Think about all the startups building cloud-native services and imagine IBM building or buying to fill out that IT stack of services.

In this post we don’t have enough time to go too deep into other areas, but we want to address the edge and weave in AI, beyond what we laid out above, which includes the edge and its impact on IBM’s future.

The edge is a huge opportunity but IBM and most other traditional players, we think, are missing the boat. Successful enterprises will have more than 70% of data created at the edge, and will be running applications against this data in running at the AI inference is going to run at the edge in real time. This is going to be incredibly challenging.

Think about this: A car running inference AI generates 1 billion pixels per second today. In five years it will be 15 times this figure. The pressure for real-time analysis at the edge will be enormous and require new architectures with different processing models than used in data centers today – likely Arm-based systems.

A car running inference AI generates one billion pixels per second today. In five years it will be 15 times this figure.

IBM has the opportunity to build end-to-end solutions, powered by Red Hat, to automate the data pipeline from factory to data center to cloud and everywhere that instrumented infrastructure lives. Rather than toss traditional Intel-based IT hardware over the fence to the edge, IBM can develop specialized systems and make new silicon investments that can power the edge with very low-cost and efficient systems that process data faster in real time.

Briefly we want to touch on three other factors to watch as indicators of IBM’s future, including:

But he has to transform the portfolio by investing heavily in R&D. Somehow he has to persuade the board to stop pouring money back to investors for a number of years and do whatever they have to do to protect the company from corporate raiders.

One has to wonder if IBM has the stomach for this. It’s so straightforward for IBM to continue to milk the cow for decades more. Plodding along, making nominal investments in key areas, hyping things like quantum computing that won’t be here for a long time but are really cool, buying companies to fill gaps and creating more complexity for its customers that its services arms can integrate.

It’s actually not a bad plan. It’s safer and definitely lucrative. Just don’t try to kid us (or yourself) that it’s a growth plan for IBM’s future.

In future episodes of Breaking Analysis, we’ll continue digging into the latest ETR survey data and plan to focus on several other sectors including database, networking, content delivery networks and work-from-home infrastructure trends, along with many others.

Remember these episodes are all available as podcasts wherever you listen.

Ways to get in touch: Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail.

Here’s this week’s full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.