POLICY

POLICY

POLICY

POLICY

POLICY

POLICY

Early predictions for 2020 showed the digital health market was predicted to decline. Yet, as tech companies across the globe deal with fallout from the COVID-19 pandemic, some areas of digital health seem to be benefiting from the demand for digitally assisted healthcare.

Do the predictions of a decline still hold true?

In a follow up to our original report on the digital health market, theCUBE checks back in with some of the executives we spoke to at the beginning of the year to ask how the coronavirus pandemic has affected the market outlook.

Digital health is a relatively new market, one that covers a large scope of products and treatments. This makes the market harder to predict as the huge variety of solutions it covers do not react to the same market forces. For example, live filming for Peloton’s popular remote fitness classes have been canceled under the social restrictions of COVID-19, whereas the use of clinical care robots is increasing.

Back in early 2019, Keith Figlioli, former healthcare technology executive and current general partner at the venture capital firm LRVHealth, was one of the first to forecast a slowdown in the rapid growth of investments in digital health solutions. LRVHealth invests across the market, in healthcare IT companies, technology-enabled health services companies, and devices and diagnostics. Figlioli stands firm in his view that overall investment will continue to slow.

“The market was just waiting for the right shock to go down a bit. Sadly, COVID-19 is that shock,” Figlioli said.

LRVHealth is tightening the belt in its investments, according to Figlioli. “We are assessing the overall market with more scrutiny now,” he said. “The bar for new investments has gone way up as we assess the next 12 to 18 months, with COVID-19 in the picture.”

Eric Heil, senior vice president of global growth and opportunity at nonprofit Health Quality Partners, was also interviewed by theCUBE earlier in the year. At the time he noted that investors were demanding that “new solutions take financial risk alongside the purchaser.”

Now, he forecasts less investment overall. “New deal flow will slow as investors are focused on managing their existing portfolio,” Heil told theCUBE.

Overall, COVID-19 has had a negative effect on the digital health market, as it has on the economy as a whole. In terms of investment, both current and future investments must be viewed with the impact of the pandemic in mind. This means, as Figlioli stated, higher scrutiny for investments in terms of how they will perform in the current climate.

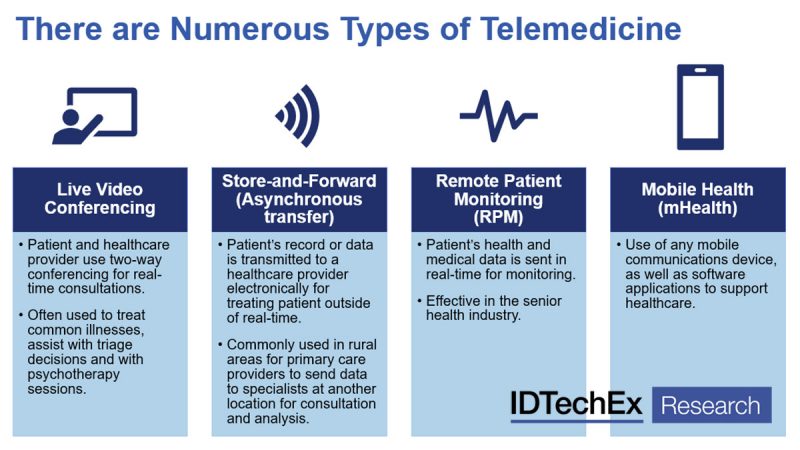

Digital health solutions that require physical client or patient presence, such as high-end hospital equipment or fitness facilities, are the unfortunate losers in this situation. But telehealth, which includes telemedicine, patient monitoring, and medical education, is about removing the need for face-to-face clinician visits. This gives telehealth an edge in the current situation.

Source: IDTechEx report “Digital Health & Artificial Intelligence 2020: Trends, Opportunities, and Outlook”

While the market as a whole is slowing, telehealth solutions are receiving more funding than before the crisis. “New deals will slow this year except in areas with direct solutions, like telehealth,” Heil said. “Those with solutions to support COVID-19 … are getting additional funding during this time.”

Telehealth is not a new concept. The idea of remote care was first proposed in a 1924 Radio News article, and by the 1960s, several academic institutions were developing methods for providing remote care to residents in rural areas, on Native American reservations and for medical emergencies. The rise of the internet increased the scope of telehealth solutions but limited access and lack of awareness constrained adoption. As recently as 2019, only one in 10 Americans had used a telehealth solution.

However, the coronavirus pandemic may be the tipping point that makes telehealth the new normal. “What we are seeing is that people are looking for technology to help them cope with the new situation,” said Eran Orr, founder and chief executive officer of XRHealth.

Quarantine and stay-at-home restrictions have boosted telehealth adoption in the U.S. Big names, such as Humana Inc. and UnitedHealthcare Group, have upped their telemedicine game. And the only publicly traded pure telehealth company, Teladoc Health Inc., has seen its stock price jump from $80 to $180 per share since the start of the year.

Usage has also expanded thanks to the country’s $8.3-billion emergency coronavirus response bill, which loosened regulations to allow Medicare providers to treat at-risk patients using telehealth solutions. In one case study, a rural hospital in Minnesota adapted Zoom for Business to treat patients via video call during the COVID-19 crisis; albeit a dubious decision in light of recent security challenges faced by the platform.

“Some healthcare systems have seen their telehealth visit volume over the last 30 days match what they saw over the last full year,” Figlioli said.

Confirming his statement, an April 2020 Frost and Sullivan report showed a revised forecast of 64% growth for the telehealth market in 2020, up from the 32% forecast prior to the start of the pandemic.

Patient tracking tools, such as PatientPing and others, are going to increase, according to Heil, who pointed out how network tools are another area of growth. These tools allow clinics and healthcare facilities to share when patients have procedures and attend appointments — virtual or onsite — as well as encourage patient follow-up through appointment reminders and satisfaction surveys.

The benefits of being able to easily access a patient’s medical history are clear. However, tracking sensitive information introduces security risks and privacy concerns, especially when it extends into applications that track contact paths of patients who have tested positive for a specific disease.

China, Israel, Iran, Singapore, and South Korea have already begun using smartphones to track citizens in the name of preventing the spread of the virus. Even more privacy-minded Europe, home of the General Data Protection Regulation, recently launched a coronavirus tracking app initiative with the goal of protecting personal information while still enabling warnings to be sent to those who have had potential exposure to the virus.

In the U.S., Apple and Google hit the headlines for proposing tracing of COVID-19 positive citizens using APIs built into their Android and iOS operating systems. While the phone user would need to download an app and consent to the tracking, it still opens the door for widespread citizen monitoring on a global scale.

Research shows an increase in demand for remote-access mental health solutions since the start of the year. It’s not surprising. Alongside the fear of catching the disease, people are dealing with disrupted routines, isolation, and economic hardships. The combination has created a tsunami of stress.

Licensed mental health professionals are using telepsychiatry to remotely treat patients, and some states have relaxed rules about practicing across state lines, allowing counseling to continue for patients, such as college students, who may have had to relocate away from their therapists.

Increased demand has lead to an increase in funding for mental health startups. According to mental health venture capital firm What If Ventures, the first quarter of 2020 alone also saw an increase in funding for mental health startups, with $462 million invested compared with $750 million across the entire year of 2019. Startups that have received funds just this month include SilverCloud Health Inc., which recently received $16 million in series B funding for its mental health platform.

Supporting this trend, Orr reports that XRHealth is experiencing rapid growth under the impact of COVID-19. “We are hiring as fast as possible,” Orr told theCUBE. “We basically doubled the team in less than one month, and we will continue to hire as many people as possible to support the growth and the demand.”

XRHealth’s unique approach to telehealth uses VR for both physical therapy and mental health. While the platform was developed to cover a wide range of treatments, COVID-19 inspired XRHealth to offer VR support groups for patients in isolation.

“VR is very powerful because it allows the patient to escape to a different place,” Orr said, emphasizing the benefits of VR treatments over two-dimensional interfaces when it comes to stress management. In addition, working in VR using three-dimensional avatars, both patients and clinicians can feel as if they are truly meeting in person without the need for wearing personal protective equipment.

It seems that within the digital health market, and especially telehealth, the current pandemic will have a silver lining. It has already brought remote care solutions into the spotlight, and Heil, Figlioli and Orr all agree that adoption will continue as the world moves out of crisis mode and adapts to day-to-day life with COVID-19.

“More practices will have a permanent telehealth consult to screen sick patients before coming into the office,” Heil stated.

Figlioli predicts investments will move from brick and mortar “into digital solutions and approaches that complement the physical plant.”

Telehealth is about to step into the mainstream of healthcare and stay there, according to Orr. “Any technology that can allow a clinician to remotely treat the patient … will be the golden standard of the industry for the next 50 years,” he said.

It’s a beautiful vision. But, before that golden standard is reached, there are still some imperfections to remove. As sensitive data is transported to the edge, keeping it secure and private is a challenge faced not only in telehealth but across the entire technology industry. Once that barrier is crossed, then we can look to a future where healthcare is as accessible as your phone or device.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.