APPS

APPS

APPS

APPS

APPS

APPS

Just two months after closing a $280 million round of funding, commission-free stock trading app Robinhood Markets Inc. today said that it has raised an additional $320 million at a $8.6 billion valuation.

The Menlo Park, California-based startup didn’t name the investors that provided its latest capital injection. Robinhood’s previous raise included the participation of Sequoia Capital, NEA and others.

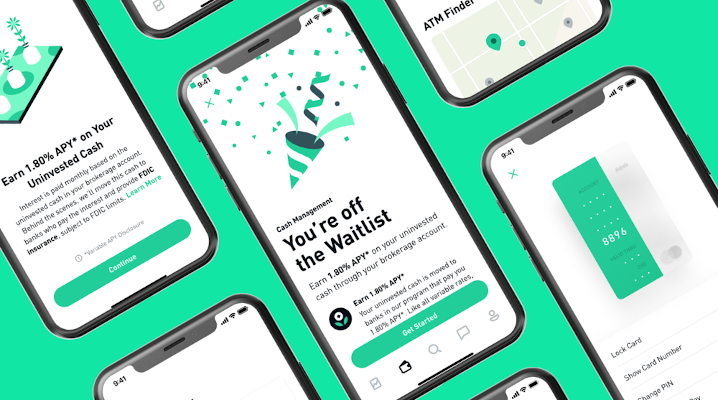

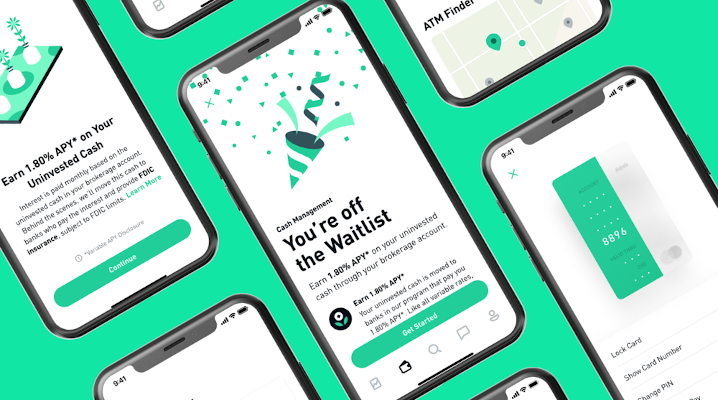

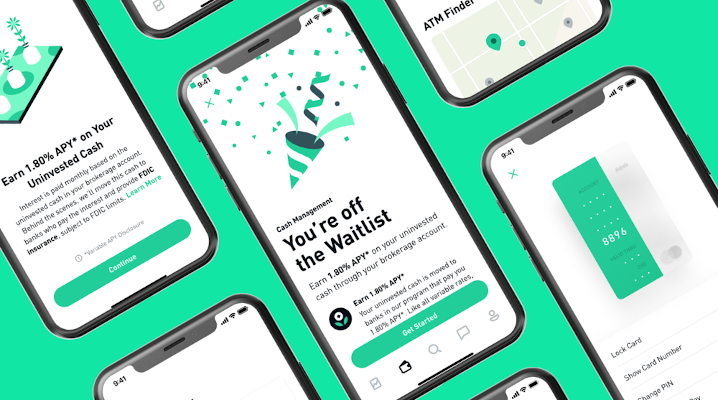

Robinhood operates a popular mobile app that allows users to trade in stocks and other securities without paying traditional brokerage commissions. The startup generates revenue from other sources, including partnerships with Wall Street firms. The recent volatility in the stock market has led to a surge of activity from first-time retail investors, many of whom are carrying out their trades via Robinhood.

The startup passed the 10 million user mark in late 2019. Robinhood has since suffered high-profile service disruptions and faced criticism for allowing inexperienced investors to make risky stock market bets, but its average customer trading volume nonetheless tripled in March. Regulatory filings reported by TechCrunch last month revealed that Robinhood’s “stock and options order flow” revenues amounted to nearly $100 million during the first quarter, more than what it made in the entirety of 2019 from this segment.

Robinhood’s latest $320 million funding suggests its investors expect the growth to continue. The startup didn’t say how the capital will be used in the brief statement in which it revealed the investment today. However, after its earlier May funding round, Robinhood divulged plans to hire more employees and build unspecified new products.

Financial technology startups raised nearly $34 billion in 2019, according to market intelligence provider CB Insights. The segment continues to draw interest from venture capitalists despite an overall slump in startup fundraising this year. Besides Robinhood, a number of other high-profile fintech players have raised funding at steep valuations since the start of 2020 including solarisBank and personal loans startup Upgrade LLC, which in June entered the unicorn club following a $40 million round.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.