INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Intel Corp.’s stock lost almost 10% of its value in after-hours trading today on weakness in its data center business, despite reporting third-quarter results more or less in line with Wall Street’s expectations.

The chipmaker reported a profit before certain costs such as stock compensation of $1.11 per share on revenue of $18.3 billion. Wall Street’s forecast was almost spot on, with analysts having forecast a profit of $1.11 per share on slightly lower revenue of $18.25 billion.

In a statement, Intel Chief Executive Bob Swan (pictured) said the company had managed to deliver “solid” third-quarter results that exceeded its own expectations, despite COVID-19 affecting “significant portions” of its business.

Update: Intel’s shares fell 10.6% on Friday.

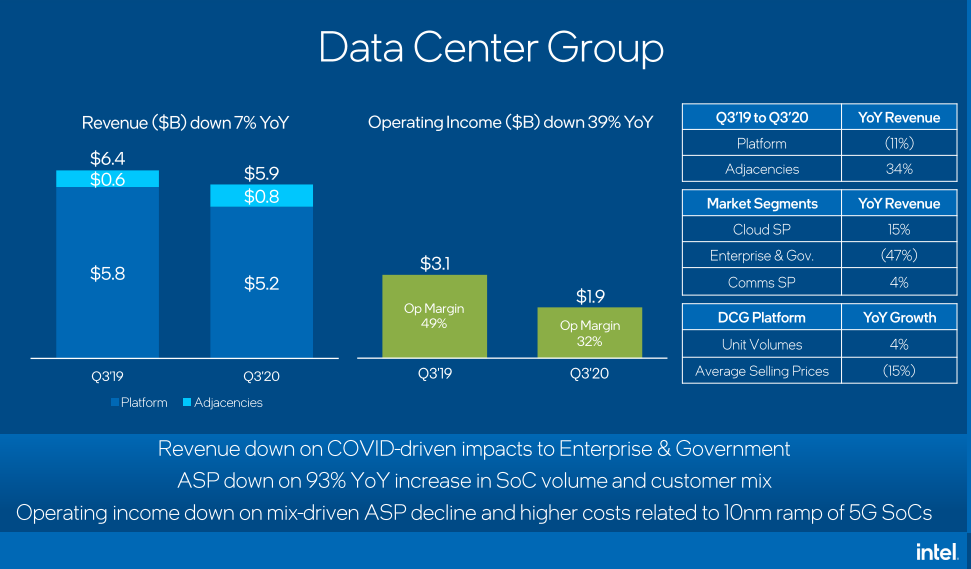

No doubt Swan was referring to Intel’s data center business. The Data Center Group, which sells chips to cloud computing providers and server makers, reported revenue fell 7% from a year ago, to $5.91 billion. Intel said that was primarily the result of lower demand from enterprises and governments in the quarter, though its data center cloud revenues did manage to grow by 15%. The unit wasn’t helped by an average selling price that was 15% lower than it was in the same period a year ago.

“This is the first quarter I have seen COVID-19 negatively impact the company,” Moor Insights & Strategy analyst Patrick Moorhead noted.

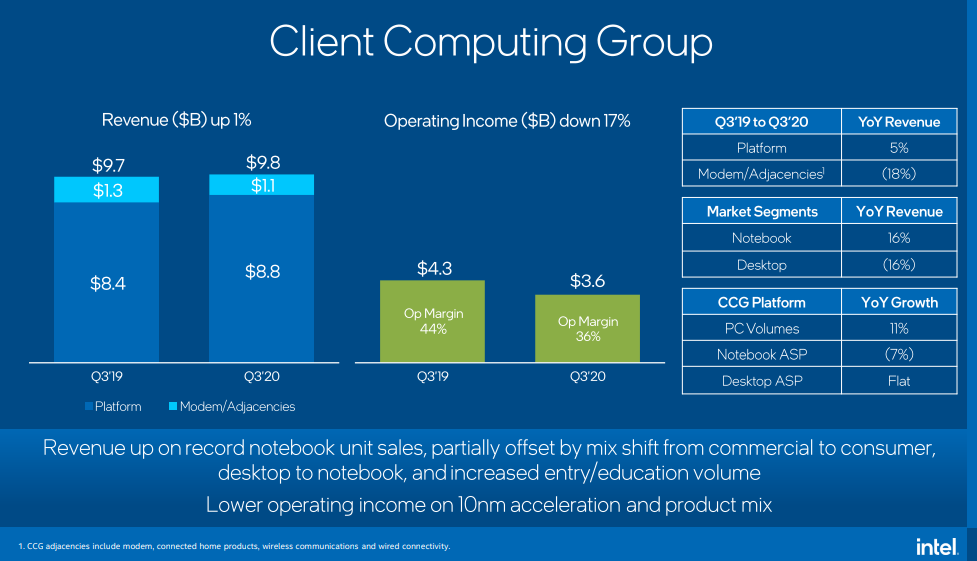

Intel’s Client Computing Group, which sells personal computer chips, did better. It reported $9.85 billion in revenue, up 1% from a year ago, helped by a bump in PC sales during the third quarter as people kept buying new machines to work from home more efficiently.

Intel recently announced that it plans to sell its NAND flash memory chip business to South Korean firm SK Hynix Inc., and the performance of its Non-Volatile Memory Solutions Group probably showed why. NAND flash sales make up the vast majority of that business, and it reported revenue of just $1.15 billion in the quarter, down 11% from a year ago.

Charles King of Pund-IT Inc. told SiliconANGLEthat Intel’s earnings report shows that the company is in a tough situation. He said that although it had initially benefited from trends such as working from home at the start of the COVID-19 pandemic, it was under pressure from larger economic issues that were forcing customers to cut costs wherever possible, including in the data center.

“Add in substantial threats from ambitious competitors including AMD and Nvidia, which have many products priced substantially lower than Intel’s, and something has to give,” King said.

Analyst Holger Mueller of Constellation Research Inc. said he found it difficult to understand why Intel hasn’t been able to profit more from the growth in PC sales and cloud computing. “What’s more inexplicable is, why does a technology vendor that knows it’s facing headwinds have its cost of sales up $4 billion in the previous nine months?”

The growing costs of sales meant that Intel’s operating margins were down, to just 27.6% this quarter, from 33.6% one year ago. Operating margin in the data center group took the worst hit, down to 32% from 49% the year before.

Moorhead said this may have been from Intel selling more 10-nanometer chips in the quarter. He noted that these are more expensive to manufacture than its previous-generation 14-nanometer chips.

Looking ahead, Intel said it’s expecting fourth-quarter earnings of $1.10 per share on revenue of $17.4 billion, just ahead of Wall Street’s forecast of $1.07 in profit on $17.36 billion revenue.

“I don’t think the company’s situation is as dire as some shareholders do,” King said. “However, current conditions for Intel, along with quite a few other traditional data center vendors, are pretty challenging.”

In a conference call with analysts, Swan said that despite the challenges it faces, Intel was actively executing a diversified growth strategy and that it operates several multibillion-dollar businesses fueled by the explosion in data and the emergence of new technologies such as artificial intelligence and 5G networks.

“Swan is focusing (AI, GPUs and networking) and disinvesting (NAND, modems) in the right things in growing markets,” Moorhead said. “I don’t think Intel needs to apologize for anything at this point.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.