INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. today confirmed recent acquisition reports by announcing that it has inked a $35 billion deal to buy Xilinx Inc., a maker of programmable chips used in systems ranging from data center servers to satellites.

The $35 billion price tag represents a roughly 25% premium to Xilinx’s closing price. AMD will finance the transaction entirely with stock.

Investors may not be entirely thrilled with the deal, at least for now. AMD’s stock fell about 5% in trading so far today.

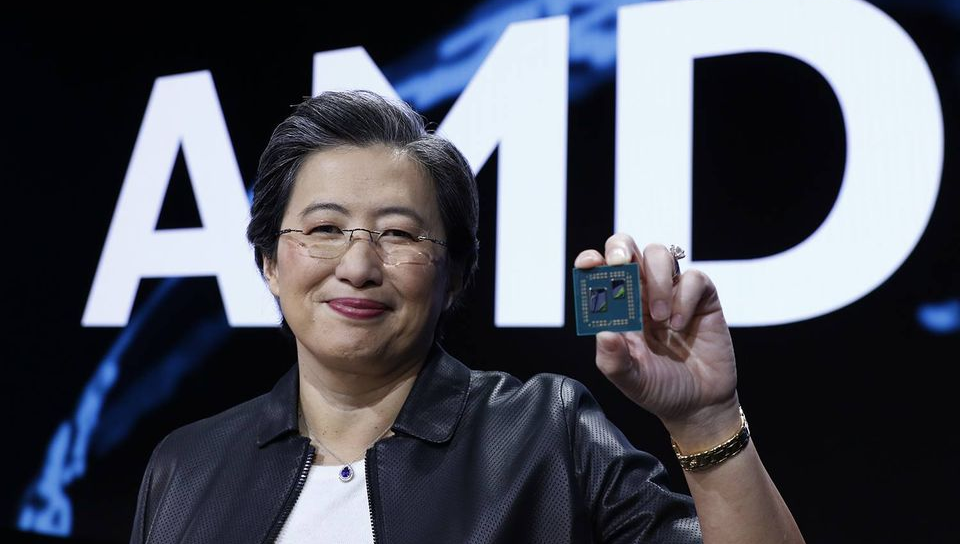

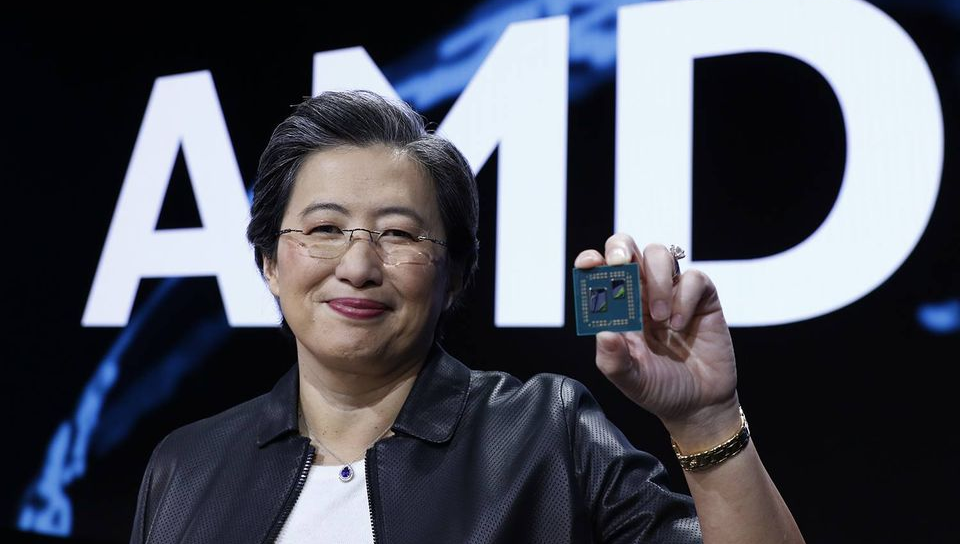

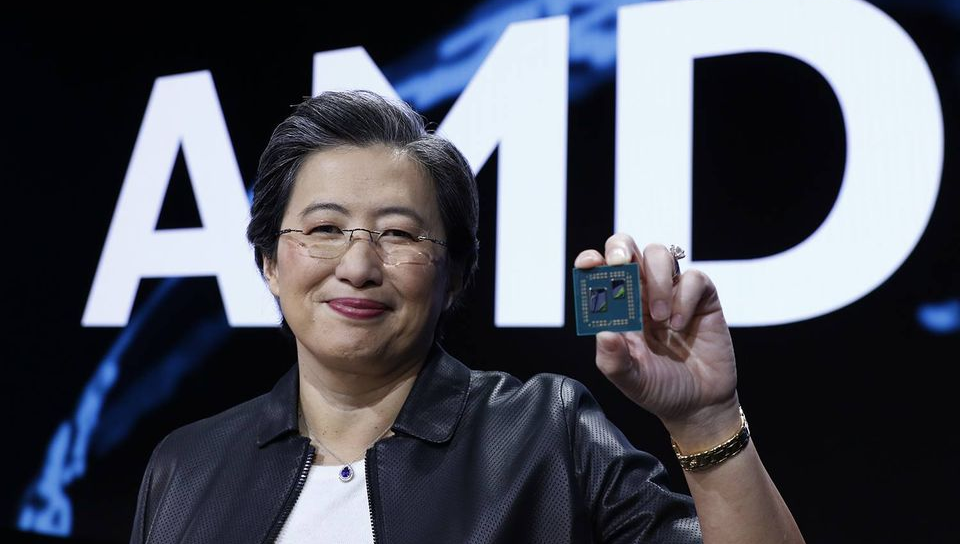

“This is truly a compelling combination that will create significant value for all stakeholders, including AMD and Xilinx shareholders who will benefit from the future growth and upside potential of the combined company,” said AMD Chief Executive Officer Lisa Su (pictured). The upside potential is significant: For each Xilinx share they own, investors in the company will receive about 1.7 AMD shares, which are currently trading about 80% higher than at the start of the year.

San Jose, California-based Xilinx is the inventor and largest provider of field-programmable gate arrays or FPGAs, a class of specialized chips that can be reconfigured after production. FPGAs allow enterprises to customize circuit behavior to maximize performance for one specific type of application. This customization enables an FPGA to run the narrow set of workloads for which it’s optimized significantly faster than a traditional central processing unit.

Xilinx’s FPGAs are used in a wide range of environments. They can be found in data center servers and inside the drive assistance systems of some smart cars and onboard satellites, among other places. Across the different market segments where it operates, Xilinx brought in revenues of $767 million last quarter.

The $35 billion AMD is proposing to pay for the company reflects the size of the future growth opportunities the deal is expected to unlock. AMD estimates that absorbing Xilinx will expand its total addressable market to a hefty $110 billion. In the shorter term, the chipmaker expects the deal to be accretive to its cash flow, earnings and margins immediately after closing.

“AMD has a brighter, long-term future with Xilinx as it creates a larger entity that is more diversified across different markets and products while leveraging similar technologies,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy. “While I was more excited by its long-term possibilities, I am now equally impressed by its day one accretion and look forward to getting more details on its short-term leverage.”

One key area where the transaction should give AMD a boost is the data center segment. AMD has gained significant ground on Intel Corp. in the server CPU market over recent years, growing its share to double digits with its Epyc processor line. That growth could be boosted by the addition of Xilinx’s data center business, which had revenues 30% year-over-year last quarter.

The deal will also buy AMD a foothold in many parts of the chip market where it currently doesn’t have as big a presence. Xilinx’s silicon is widely used in the auto, aerospace and defense sectors. Not least, the company supplies chips for carrier telecommunications equipment.

Xilinx targets carrier customers not only with its hallmark FPGAs but also a line of processors dubbed Versal that it introduced a few years ago. The processors combine the reconfigurable circuits found in FPGAs with CPU cores and machine learning accelerators. Carriers are expected to run a mix of different applications on their 5G infrastructure and Xilinx says Versal, with its mix of different processing components, can support this use case better than traditional CPUs.

Versal, too, will bolster AMD’s product portfolio.

“AMD’s intent to acquire Xilinx is a bold move that I think makes sense and caps off an incredible run by AMD,” commented Moorhead. “I believe AMD will continue to organically grow with or without this acquisition, as hopefully evidenced by its monster Q3, its upward guide and roadmap,” he added, referring to the strong quarterly results AMD posted today.

The company said it earned 41 cents a share, adjusted for costs such as stock compensation, up 128% over a year ago. Revenue rose 56%, to $2.8 billion. Analysts had expected a 35-cent profit on revenue of $2.56 billion. AMD said strong demand for personal computer, gaming and data center gear drove the outperformance.

For the fourth quarter ending in December, AMD said it expects revenue of about $3 billion. Analysts were forecasting $2.62 billion.

The acquisition of Xilinx is set to close by the end of 2021. The combined company will have 13,000 engineers and, through operational synergies stemming from the merger, is expected to reduce $300 million in operating expenses within 18 months of the transaction closing.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.