CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Divvy Inc., a startup with a cloud service for managing corporate spending, this morning divulged that it has closed a $165 million funding round at a $1.6 billion valuation.

The round included the participation of more than a half-dozen investors. The consortium includes PayPal Holdings Inc.’s venture capital arm, NEA and Insight Venture Partners, among others.

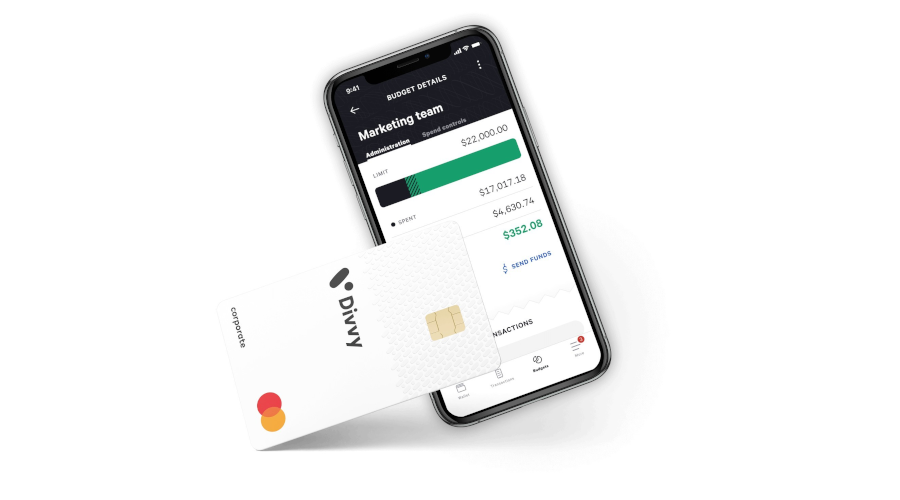

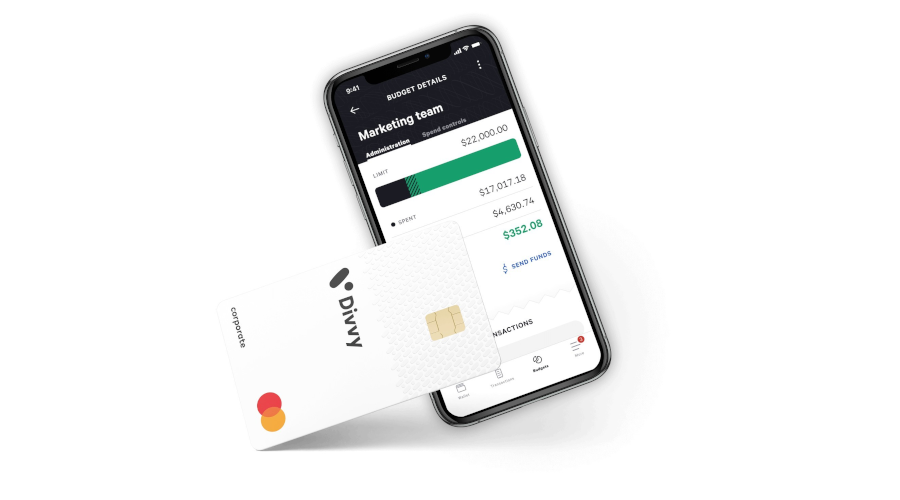

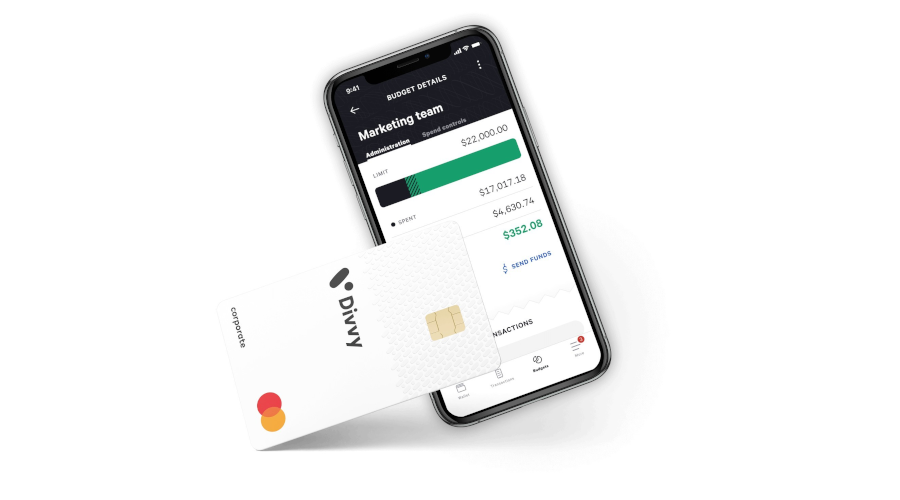

Divvy’s namesake service enables companies to create virtual payment credits that their employees can use for business purchases such as software subscriptions. A centralized dashboard enables accounting teams to track how much workers are spending and set limits. To save time for corporate finance professionals, Divvy also has integrations that automatically sync transaction information to a company’s existing bookkeeping application.

The startup offers its service for free and makes money by charging a small commission on every transaction made with one of its cards. The startup also has a number of secondary revenue streams, notably implementation services and a paid extension that companies can sign up for to ease business expense reimbursements.

Divvy’s decision to offer its core feature set at no charge has been a boon to user adoption. Since March 2020, the startup disclosed today, monthly signups have surged 500%. Divvy’s 9,000-plus customers include cybersecurity heavyweight OneLogin Inc. and SAP SE’s Qualtrics analytics unit.

In 2020, Divvy Chief Executive Officer Blake Murray detailed in a blog post today, “we were able to reduce acquisition costs by 75% and double our contribution margin — allowing us to scale more efficiently and invest more in our product development and customer teams.”

Divvy is one of several venture-backed startups developing software to help organizations manage their spending more efficiently. Tipalti Inc., whose technology automates the process of paying external parties such as suppliers for goods and services, closed a $150 million funding round in October. Earlier in 2020, a consortium led by Bain Capital Ventures invested $23.5 million into Airbase Inc. to help the startup widen the adoption of its namesake spend management platform.

The influx of venture-backed contenders isn’t the only trend reshaping the accounting software market. Some of the manual tasks historically involved in managing a company’s finances are being automated partially or fully using artificial intelligence. Even the major cloud providers have entered the fray with AI services that can automatically extract information from paperwork such as invoices into digital systems of record.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.