APPS

APPS

APPS

APPS

APPS

APPS

Robinhood Market Inc. today said it has raised an additional $2.4 billion on top of the $1 billion it raised last week to give it enough capital to survive the frenzy in retail trading that started with the mass buying of GameStop Corp. shares.

The new funding was led by Ribbit Capital and included existing investors ICONIQ Capital, Andreessen Horowitz, Sequoia, Index Ventures and NEA. The $3.4 billion total funding is considerably higher than the $2.2 billion Robinhood had previously raised in total as of its last round in September.

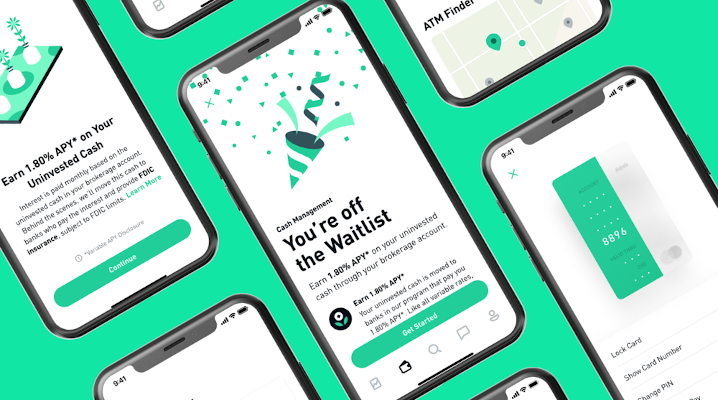

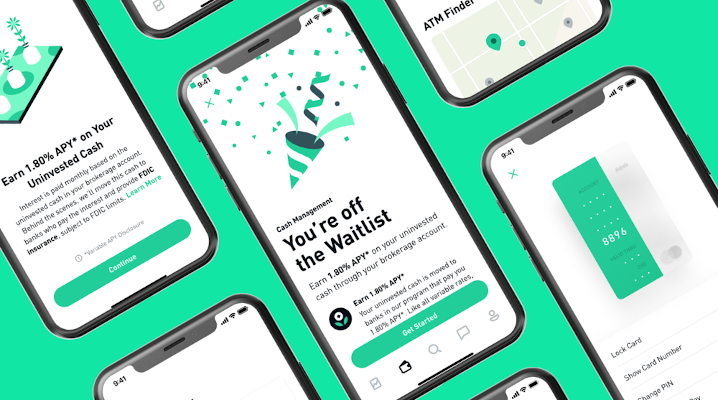

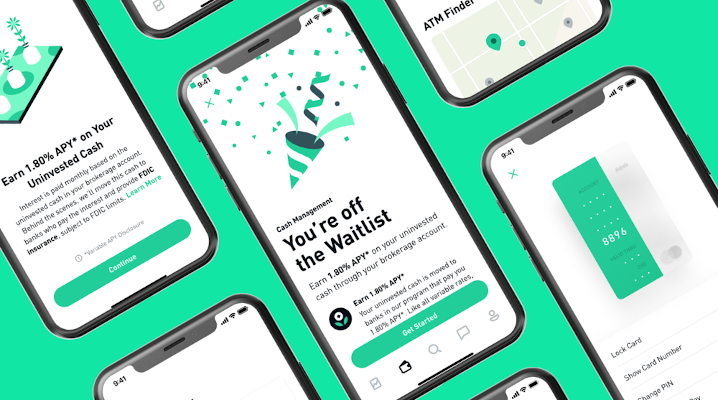

Robinhood is spinning the new funding as a “strong sign of confidence from investors” that will be used to build for the future and continue to serve its customer base. “We’re witnessing a movement of everyday people taking control of their own financial futures, many investing for the first time through Robinhood,” the company said in a blog post. “With this funding, we’ll build and enhance our products that give more people access to the financial system.”

The funding comes as the company remains under fire after deciding to suspend trading in a range of stocks that were being purchased by users of the subreddit r/wallstreetbets last week. That the likes of large firms such as E-Trade Financial Corp., Interactive Brokers Group Inc., Charles Schwab Corp. and TD Ameritrade also blocked trading on the same shares did not come as a surprise. But Robinhood has always pitched itself as being pro-small retail investors, with a mission “to democratize finance for all.”

Robinhood Chief Executive Officer Vladimir Tenev continues to justify the firm’s decision to suspend trading on some stocks, telling Tesla Inc. and SpaceX founder and CEO Elon Musk on Clubhouse Sunday that “we had no choice in the case” and that Robinhood “had to conform to our regulatory capital requirements.” Tenev claims that Robinhood was asked by the National Securities Clearing Corp. to provide a deposit of $3 billion to back up trades.

Whether or not it’s to blame for the decision, Robinhood is now facing scrutiny from legislators. MarketWatch reported that Tenev is expected to testify before the House Financial Services Committee Feb. 18.

The fundraising comes as Google LLC., which was dragged into the drama after it deleted negative reviews for the Robinhood app last week,, has now apparently changed its tune. Despite initially deleting more than 100,000 negative reviews, further negative reviews have flooded Robinhood’s Google Play Store listing. A spokesperson for Google told The Verge that the new reviews comply with Google polices and will not be removed.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.