CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Software-as-a-service companies have been some of the strongest performers during this COVID-19 era. They finally took a bit of a breather this month but remain generally well-positioned for the next several years with their predictable revenue models and cloud-based offerings.

Meanwhile, the demise of on-premises data center legacy players from COVID shock seems to have been overstated, in part because of the return of the laptop and, in the case of Oracle Corp., what some see as a cloud play. In this Breaking Analysis, we’ll pick out a few of the more recent themes from this month and share our thoughts on some major enterprise software players, the future of on-prem and a review of our take on cloud — what cloud will look like in the 2020s.

As many predicted, the stock market has been pretty volatile this month. February saw some leading SaaS names such as Workday Inc., Salesforce.com Inc., ServiceNow Inc. and Snowflake Inc. take a bit of a breather. Workday, which reported its earnings Feb. 25, had its first $1 billion subscription revenue quarter, 16% revenue growth, a revenue and earnings beat, but the stock closed down Friday more than 2%. Salesforce, reporting the same day, had a nearly $6 billion revenue quarter, 20% growth, a revenue and earnings beat, yet the stock was down more than 6%.

The market is worried about inflation and rising interest rates, which make high-multiple stocks less attractive. So any whiff of caution by company managements is met with dampened enthusiasm and some profit-taking.

Meanwhile, it’s looking like some of the big on-prem legacy firms, notably Dell Technologies Inc., HP Inc. and Hewlett-Packard Enterprise Co., are making it through COVID and might even come out the other side stronger. Dell handily beat expectations on Feb. 25 as well on the strength of 17% growth in its client business. That’s personal computers, the gift that keeps on giving. HP had a strong beat as well and we’re anticipating a solid quarter from HPE on March 2.

And then there’s Oracle. Barron’s had a big article on Feb. 19 entitled “Oracle is Turning Into a Cloud Giant. Why Its Stock is a Buy.” It moved the market and many investors rotated out of the growth tech stocks into Oracle. Others who had owned Oracle for a while scooped some profits. Is Oracle a cloud giant? We’ll discuss that in a moment.

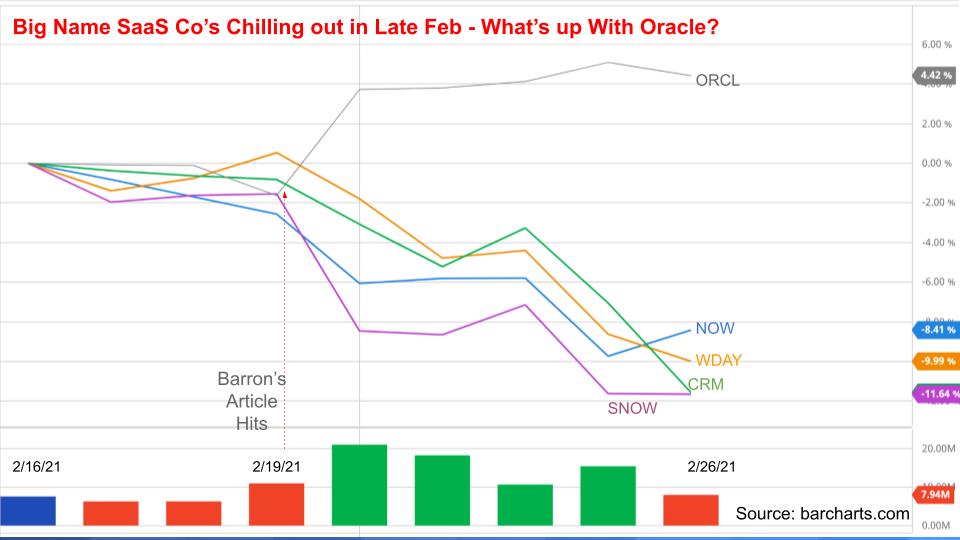

Below is a chart showing the relative performance of some big name SaaS companies in the latter half of February.

Despite the strong earnings for Workday and Salesforce, you can see the market’s negative response on Feb. 26. Snowflake and ServiceNow had epic runs last year and have been softening, although on Friday morning ServiceNow shot down quickly on sympathy with Workday and Salesforce and then investors came back in.

But look at the reaction investors had to the Barron’s article on the Feb. 19, anointing Oracle as a cloud giant. Kudos to the Oracle PR team for that one.

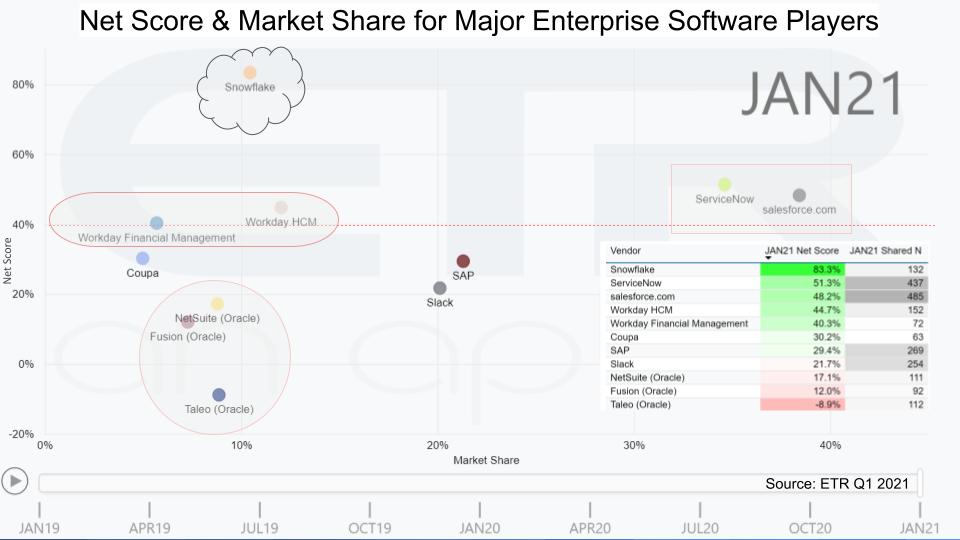

Even though they’re not direct competitors, it’s instructive to model some of the top enterprise software companies and position them against each other.

The chart below shows two dimensions from the Enterprise Technology Research data. On the vertical axis is Net Score or customer spending momentum and on the horizontal axis is Market Share or pervasiveness in the survey. The table insert shows the Net Score measurement and the Shared N is the metric that plots the dots. In both cases bigger is better.

Note the red dotted line at 40%. Forty percent is a bit of a magic number – anything above that line is elevated, and especially impressive for companies with a large market presence.

So we have ServiceNow and Salesforce up to the right — big companies with significant market presence among chief information officers. Both have elevated spending velocity in the 50% range. We’ve have said for years these two companies are on a collision course and stand by that. It’s starting to happen and new ServiceNow Chief Executive Bill McDermott, we believe, will accelerate that as ServiceNow continues to expand into business lines.

We put a cloud around Snowflake because it’s literally in the clouds on this chart. It stands alone with a solid market presence and an off-the-charts Net Score at 83.3%.

For context you can see Oracle Fusion, NetSuite and Taleo, all grouped as Oracle assets. In addition, we put Slack Inc. and Coupa Inc. on the graphic– two names that have been on the radar — as well as SAP SE, which continues to show decent spending momentum despite its challenges.

We’ve reported extensively on Snowflake, saying at its IPO that if you really wanted to own it and couldn’t wait for a better price, which we thought you’d get, then hold your nose and buy on day one… then wait a few years. The data continues to show strong demand for Snowflake, with no signs of slowing down. It announces earnings on March 3, so we’ll have more data then and we expect confirmation of our analysis.

On Workday, our take is that the market is catching up to it. It had a three-year lead in human capital management and had the best product. But now Oracle, ADP Ceridian… they’re all catching up. Workday’s expansion into financial management has been much more challenging and as it gets bigger, things get tougher. It’s still an enduring name, however.

Salesforce we see a bit differently. It’s so big now that it’s really hard for it to move the needle. And it has been on an acquisition binge to grow and that’s likely to continue. It could work well for the company, similar to the way in which Oracle consolidated software names and picked up customers, Salesforce is a great name that will continue to grow in our view.

ServiceNow is entering a new chapter under McDermott. He wants to double the company’s revenue to $10 billion and we think he has a good shot through a combination of great go-to-market efforts, an expanding platform and acquisitions. SAP’s market value tripled under his watch, he knows the customers and he’s a magnet for attracting talent.

ServiceNow is not without challenges. Its customers complain that it’s becoming the Oracle of service management, but as McDermott aims more at SAP and Oracle customers, he has a nice price umbrella to work with.

From a cloud technology standpoint, ServiceNow’s multi-instance approach is a bit of a “If you can’t fix it, feature it” story. At scale this may present challenges for ServiceNow. Without going into too much detail, suffice it to say that ServiceNow runs on its own cloud and doesn’t have a multitenant implementation, which means it fundamentally has a more expensive platform. There are advantages to this architecture, but it’s not without drawbacks, including cost.

If you asked us in April 2020 if we thought any of the traditional on-prem names, such as Dell, would be able to grow last year, we would have said no. But Dell did grow, and it appears many of the legacy players will come out of COVID in a strong position.

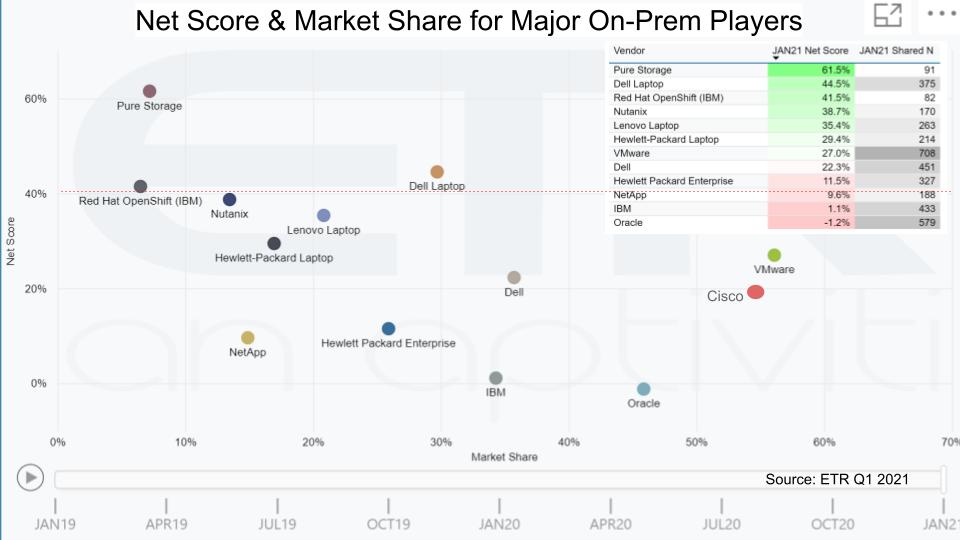

Below is the same XY chart with some of the big names with a presence on-prem.

Reading right to left on the horizontal axis (market presence in the survey) you can see VMware Inc., Cisco Systems Inc., Oracle, Dell, IBM Corp. and HPE have a large Market Share or pervasiveness in the ETR data set.

Unlike the larger SaaS companies, however, none is above the 40% mark in Net Score. Pure Storage Inc., Dell’s laptop business and OpenShift are above the line, with Nutanix just about there. The other major laptop players, Lenovo and HP, show momentum, and for context you can see NetApp Inc.

Pure beat its earnings last week but grew only 2% last quarter. Remember the ETR survey is forward-looking, so this potentially bodes well for the companies above the 40% line.

Of the companies on the chart above, only IBM and Oracle own a public cloud. And we’ll dig further into that in a moment, but virtually every name shown, even Oracle, has a mandate to redefine cloud. That means Oracle must put forth a north star vision – and execute on it – that will unify the experience between on-prem, hybrid cloud, public clouds, across clouds and the edge. We say “even Oracle” because in our view, Oracle is in a stronger position than the others thanks to its coherent software architecture and “same:same” architecture, for example Cloud at Customer.

The other companies must architect a platform that abstracts the underlying complexity of clouds, leverage cloud native tooling in the respective public clouds, connect on-prem infrastructure and build a layer that stretches to accommodate edge workloads. We think Oracle will follow suit and is actually ahead of most in a narrower context – that is, hybrid within its own “Red Cloud” stack, but it doesn’t have to race to this vision. It can sit back, as it often does, watch everyone else fumble, keep investing in R&D and then enter the market and act like it invented it.

Now Cisco will come at this from a strong networking and security perspective, and it has a nice story on programmable infrastructure with DevNet, but unfortunately it doesn’t own VMware, as Dell does. But Dell is in the middle of a fairly remarkable journey and it will be interesting to see what happens with the VMware spinout and the cozy commercial relationship Dell is structuring with VMware. It will be much different than the vertically integrated Oracle approach. A vertically integrated company with an aligned development mission makes it easier in our view.

CEO Arvind Krishna has said IBM must win the architectural battle for hybrid cloud. Red Hat OpenShift is possibly most powerful card in the industry deck right now (not just IBM’s deck). OpenShift is open source. It’s everywhere. It has momentum, as we show above, and we like Red Hat’s position.

Our concern lies with IBM. The company is still unwinding and restructuring its business, as we’ve seen with its outsourcing operation (NewCo) and now the Watson Heath asset – shedding non-strategic businesses that don’t fit. Arvind has a lot to deal with.

We want to stress that this idea of an abstraction layer across clouds is not easy. First, all these companies have to stop being so defensive about the public cloud. To a large extent VMware and Red Hat have found a “happy place” in cloud, but in our view, all these companies should be embracing Amazon Web Services, Microsoft Azure and Google Cloud for building out this great global distributed system that they can leverage and on which they can build a value layer.

Second, this is going to be expensive and Cisco, Dell/VMware and IBM are all really stretched thin from an R&D perspective. They have a lot of mouths to feed across the portfolio. So is HPE stretched thin on its innovation budget, and it doesn’t have the R&D expenditure at more than $2 billion annually to give this enough attention.

So our concern is that we are going to have lots of complexity across these abstraction layers on a vendor-by-vendor basis. Containerizing everything won’t solve the problem: Customers need deep functionality, metadata management, data sharing, low latency solutions, AI inferencing, strong recovery systems, security, governance, data integration and the list goes on.

Maybe this is good news for companies such as HashiCorp or specialists with a vision such as Clumio Inc. or VAST Data Inc. But this is big and they are small. So this is going to take the better part of a decade to play out.

What a win for Oracle with that Barron’s article. It has an illustration of a stout Larry Ellison rising above the clouds and a headline like a flashing neon sign: “Buy, Buy, Buy!”

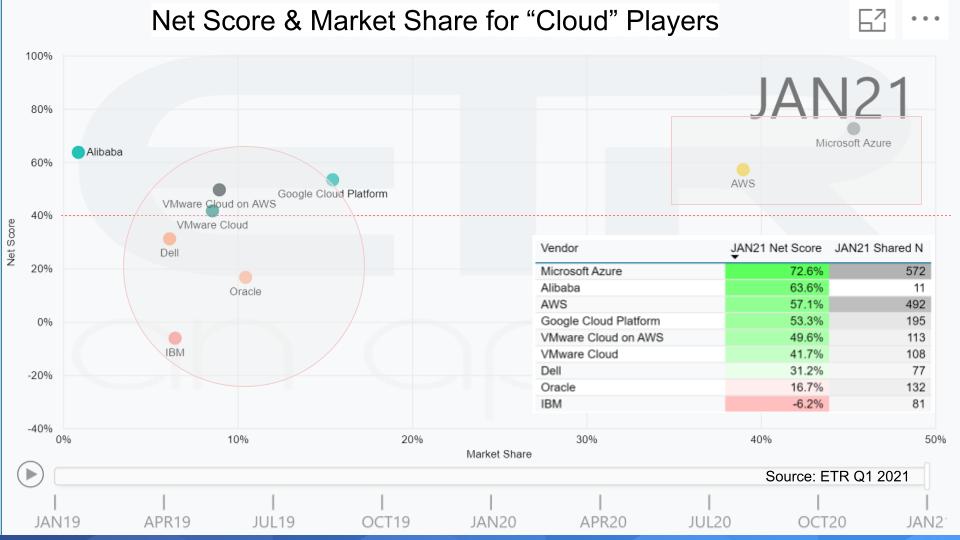

Below is a picture of the ETR data for the cloud players.

Same XY plotting Net Score and Market Share. If you follow Breaking Analysis, you know we believe there are four and only four hyperscale cloud players with the resources to compete as horizontal infrastructure players – which really is how we view the origin of modern cloud computing. AWS created it with S3 and EC2 back in 2006 in our view, and there shouldn’t be much debate around that.

Those four are AWS and Azure, which have a large lead over the pack, Google Cloud and Alibaba. And you can see we’ve circled the on-prem pack, which comprises Oracle and IBM along with Dell/VMware, and we snuck Google at the edge of that circle because to differentiate they’re cozying up to the companies with strong enterprise sales teams. Google’s smart and patient so we by no means count it out. It’s spending like mad and it has the cash.

Note that all four of the hyperscalers show spending momentum above the 40% line. Also, we should point out that Alibaba is underrepresented in the survey; the company’s IaaS revenue is actually larger than that of Google.

Now in that on-prem pack, IBM and Oracle, as we stated, own their own public clouds. IBM acquired SoftLayer, a bare-metal hosting company, to get in the game and retooled the platform over several years. But try to unpack IBM’s cloud business by looking at its financials, and it’s just a mess. We hope Arvind cuts the nonsense and actually develops and reports a set of metrics that are meaningful to cloud and IBM observers because the way IBM reports its cloud business today is opaque and practically useless, in our opinion.

Oracle for its part announced a public cloud years ago. Its version 1.0 was by all accounts (including Wikibon’s hands-on tests), terrible and hardly usable. The company hired a bunch of really smart cloud engineers and spent a lot of money to fix that.

So let’s agree that both IBM and Oracle got through the painful early days and now have clouds that are credible. However, neither IBM nor Oracle have the capital spending resources of the Big Four. Not even close. Yes,they’ll build out data centers and yes, they have a cloud play, but they are different. And that’s OK.

In the Barron’s article, the author was quite positive on Oracle, noting the following:

“On a recent earnings call, CEO Safra Catz said that Oracle Cloud Infrastructure revenue was up 139% for the quarter,” noting further, “Alas Oracle doesn’t break out OCI sales and comps can be messy.” Yes, messy indeed. Oracle is hiding the ball on OCI in our opinion, and that’s because if Oracle did break out OCI (which by the way it used to report as IaaS revenue), it would only be highlighting what a minor player it is in IaaS.

The article continues: “Catz says that hers is the only tech company that has both a global cloud and full set of enterprise applications.”

Bingo! There it is – that’s why Oracle is in a better position than many if not most of the on-prem players listed in the chart. By the way, we’d argue that Microsoft has a pretty impressive set of enterprise applications and more than a fairly global cloud.

But what Safra is talking about is applications that support the world’s most mission critical work — and when it comes to those workloads, Oracle is No. 1. Don’t fool yourself and get caught up in the Oracle lock-in and high pricing narrative thinking it’s going to get disrupted and crushed. It’s not. Oracle is the best in the mission-critical workload game. There’s no one better, period.

But a “cloud giant?” We think that’s a bit over the top. The Big Four last year grew at 41% and accounted for $86 billion in IaaS (aka real cloud) revenue. They’ll surpass $115 billion this year.

Real cloud companies don’t grow in the single digits today. So talk to us when we reach equilibrium on that front.

Now, we’re not saying that the rest of the pack shouldn’t redefine cloud. They should. But we hope we can all agree that modern-day cloud computing was defined in business terms by AWS. It is No. 1 in cloud computing – make no mistake. However, AWS is bringing the cloud into the wheelhouse of the on-prem players, cleverly saying it’s bringing AWS to the edge and that the data center is just another edge node. That’s good positioning.

But it’s not so easy. Just look at Outposts and how AWS has had to evolve its pricing strategy and terms. The pricing is sound, but unlike true cloud pricing a customer is locked into a three-year term. Now, AWS Outposts pricing is probably more coherent than most as-a-service offerings that we’ve seen – but it’s just one product. Moreover, it’s going to be interesting to see how customers respond and how AWS services these edge nodes called data centers.

At any rate, AWS competitors should absolutely try to redefine cloud. By AWS moving to the edge and evolving its strategy toward hybrid, it has opened the door for the discussion.

Notwithstanding the earlier comments on Oracle, Microsoft is in the best position to redefine cloud. It has earned the right and we’ll never accuse Microsoft of cloudwashing.

Google has some work to do in terms of solidifying its position in hybrid and multicloud along with public cloud. But remember, Google probably has the largest cloud infrastructure in the world to support its advertising empire. As we’ve written, Google just needs to pull its head out of its ads and quadruple down on cloud.

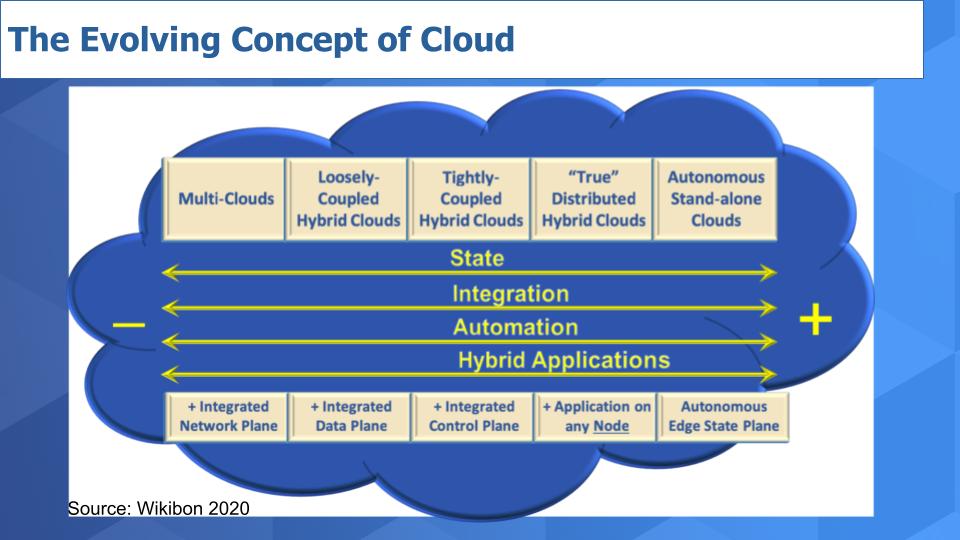

But coming back to this idea of abstracting away the underlying complexity of the cloud, leveraging cloud-native capabilities, building on top of the shoulders of the cloud giants and, as Wikibon analyst David Floyer expressed in this chart below, moving from stateless to stateful, integrating across clouds and advancing automation. And not only through the stack but across domains and ultimately using metadata to govern where workloads should live, be moved, disintegrated and recombined with low latency… and be highly secured.

We think about this and say: 1) Is this technically feasible? Smart techies say yes and so we keep trying to dig here for signs – and definitely see some movement in this direction; and 2) We don’t think any one vendor will own this. What’s going to happen is you’ll get successes within layers of the stack.

Think about Snowflake’s data cloud. We’ll see that for storage and backup, data management, security (within different domains), applications and the like. But without clear standards, it’s going to be a challenge and – with respect to my friends at Snowflake — we might even see it in database (yes, Snowflake has a long way to go to fulfill its Data Cloud vision).

The industry has a lot of work to do, and to my our CIO friends – you know the drill much better than we do – technology will keep relentlessly coming at you and you know how to deal with that. It’s the people and the change management and culture that are the real challenges.

But don’t screw up the tech!

Remember these episodes are all available as podcasts – please subscribe. We publish weekly on Wikibon.com and SiliconANGLE.com, so check that out and please do comment on the LinkedIn posts we publish. Don’t forget to check out ETR for all the survey data. Get in touch on twitter @dvellante or email david.vellante@siliconangle.com. And remember, Breaking Analysis posts, videos and podcasts are all available at the top link on the Wikibon.com home page.

Here’s the full video analysis:

THANK YOU