CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud data warehouse firm Snowflake Inc. beat expectations today for its fiscal fourth-quarter revenue, but a larger-than-expected loss caused its stock to dive in after-hours trading before it recovered later.

The company reported a loss before certain costs such as stock compensation of 70 cents per share on revenue of $190.5 million, up 117% from the same period one year ago. Wall Street had forecast a loss of just 17 cents per share on lower revenue of $179 million.

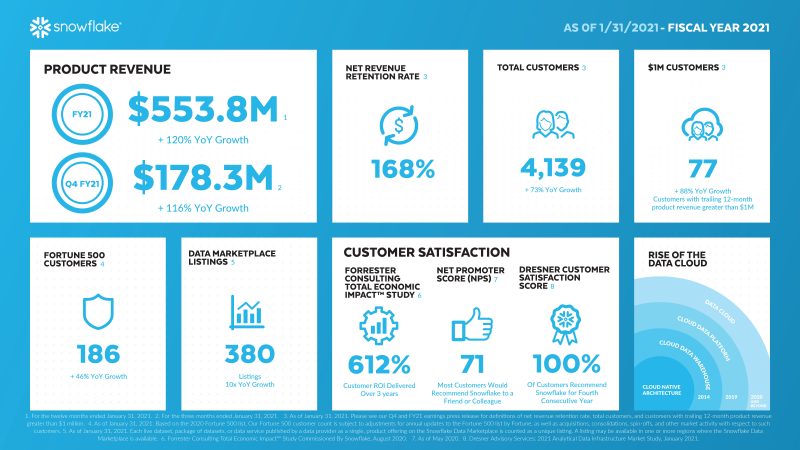

Snowflake added that its product revenue in the quarter came to $178.3 million, above the $167 million estimate. However, it posted a net loss of $199 million, up from a loss of $83 million one year ago. For the full year, Snowflake’s product revenue jumped 120%, to $553.8 million.

The company’s stock was down more than 7% at one point in the after-hours trading as investors reacted to the news, however it has since rebounded and is down less than a percentage point at the time of writing. It had fallen nearly 9%, to $247.03, in regular trading on an ugly day for tech stocks.

It was the second time Snowflake has reported earnings since going public in one of the biggest initial public offerings of 2020.

Snowflake sells software that enables companies to run a data warehouse on any public cloud platform. It pays public cloud infrastructure firms such as Amazon Web Services Inc., Microsoft Corp. and Google LLC to run workloads in their data centers, and also competes with their similar offerings.

The company is primarily seen as an alternative to data warehouses that unify data and execute queries using on-premises hardware and software. Customers pay for Snowflake’s software according to how much they use it, instead of a flat subscription fee.

Snowflake Chief Executive Frank Slootman (pictured) hailed the company’s “strong performance” during the quarter, highlighting its “triple-digit product revenue growth.” He added that the results “indicate that customers across multiple industries rely on the Snowflake Data Cloud to mobilize their data and enable breakthrough data strategies.”

During the quarter, Snowflake announced new developer-focused tools and added support for unstructured data types such as audio and video files.

Constellation Research Inc. analyst Holger Mueller told SiliconANGLE that Snowflake’s data warehouse services help enterprises unlock the vast computing capabilities of the public cloud, which are highly beneficial for analytical, machine learning and artificial intelligence process. That’s why Snowflake is showing such strong growth, he said.

“Snowflake deserves congratulations for doubling its revenue and passing the half-a-billion mark,” Mueller said. “However, Snowflake’s management will need to manage costs better as the company still needs to become profitable. An operating loss at roughly 90% of its revenue is not sustainable in the long term.”

The stock recovery may be thanks to Snowflake’s guidance for the next quarter. It said it expects product revenue of between $195 million and $200 million in the first quarter, above the Wall Street forecast of $196 million. For the full year, Snowflake expects product revenue in the range of $1 billion to $1.02 billion, which is in line with Wall Street’s forecast of $1.01 billion.

Support our open free content by sharing and engaging with our content and community.

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.