INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Semiconductor firm Micron Technology Inc. delighted Wall Street once again today with strong second-quarter revenue and profit that was in line with a revised forecast it provided earlier this month.

The company also posted a strong outlook for the next quarter that came in above the analyst consensus. It reported a profit before certain costs such as stock compensation of 98 cents per share on revenue of $6.2 billion, up 30% from one year ago

That was more or less in line with an updated forecast it provided March 4, when it said it expected earnings of 95 to 98 cents per share on revenue of $6.2 billion to $6.5 billion. Wall Street had modeled a 95-cent-per-share profit on revenue of $6.2 billion.

In a statement, Micron Chief Executive Sanjay Mehrotra (pictured) said the company’s results reflected “rapidly improving market conditions” and its solid execution.

Micron supplies two key products, namely dynamic random-access memory and NAND flash memory chips, which are key components of personal computers, servers and mobile devices.

“Our technology leadership in both DRAM and NAND places Micron in an excellent position to capitalize on the secular demand driven by AI and 5G, and to deliver new levels of user experience and innovation across the data center and intelligent edge,” Mehrotra said.

The company’s report showed that DRAM products accounted for 71% of its revenue, with the balance coming from sales of NAND flash.

Micron has in recent months been buoyed by strong demand for its chips, thanks to rising sales of personal computers and mobile devices that can help enable remote work and online learning. The company, along with rivals such as Samsung Electronics Co. Ltd. and SK Hynix Inc., has struggled to meet that demand and is rushing to increase supply.

In an interview with Bloomberg, Mehrotra said that as countries roll out COVID-19 vaccines at different rates, he expects the economy will recover in stages beginning this year and stretching into 2022. As a result, he said, memory chip demand will likely stay strong, while supplies will remain tight.

The executive explained that new cars, servers and other devices now come with much more memory than they used to. Meanwhile, enterprises and consumers alike are spending more money on networking and devices than before, he said. That has resulted in “firm, secular demand across the industry,” Mehrotra said.

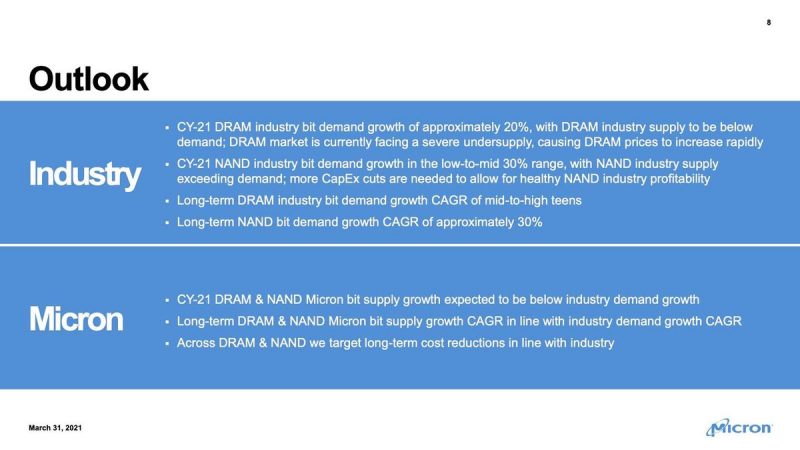

In a presentation, Micron showed that it expects supply of DRAM to fall short of demand this year.

The company also warned of a drought in Taiwan that has reduced water supply to one of its DRAM factories there and could further limit supply. “We are accelerating our water conservation efforts and have secured alternative sources of water,” Mehrotra told analysts in a conference call. “At this time, we do not see an impact to DRAM production output; however, this is a developing situation that we are monitoring closely for the next several months.”

Analyst Holger Mueller of Constellation Research Inc. said Micron’s successful quarter was driven by strong demand and great cost control too. “You rarely see an enterprise grow 25% and reduce its expenses in R&D and selling and G&A, as Micron has done. If it wasn’t for $131 million in other income expenses, this quarter would have been even better,” Mueller said.

The situation is in any case good news for Micron’s bottom line, and its prospects for the next three months look very encouraging. Officials said they expect between $6.9 billion and $7.3 billion in third-quarter revenue, above Wall Street’s consensus of $6.86 billion. The company also forecast third-quarter earnings of $1.55 to $1.69 per share, versus the consensus of $1.33 per share.

Meanwhile, reports elsewhere say Micron is looking to expand its NAND flash business by acquiring the Japanese firm Kioxia Holdings Inc. The Wall Street Journal reported that Micron is trying to negotiate a deal to buy Kioxia for about $30 billion, though it said it faces competition from Western Digital Corp., which is also interested in buying that company. The Journal said any deal could be concluded before the end of spring, though it’s also possible that no agreement will be reached.

“Kioxia’s future is the elephant in the room right now in the memory chips business,” Mueller said. “Whoever can acquire Kioxia will be able to reach better economies of scale and achieve better unit prices. The memory chip market is up for some exciting times until the future of Kioxia is determined.”

Micron’s stock rose more than 4% in after-hours trading.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.