INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. showed no signs of slowing down today, delivering stellar first-quarter financial results that easily beat expectations as it almost doubled its revenue from a year ago.

The company’s growth was driven by strong sales across all of its major product lines, including its Ryzen chips for personal computers, its EPYC server chips and its Radeon graphics processing units.

For the first quarter, AMD reported a profit before certain costs such as stock compensation of 52 cents per share as it amassed $3.5 billion in revenue — up 93% from the same period a year ago.

Wall Street had been expecting a strong quarter, but analysts’ average prediction of earnings of 44 cents per share on revenue of $3.2 billion were still well off the mark. Shareholders cheered, with AMD’s stock up almost 4% in after-hours.

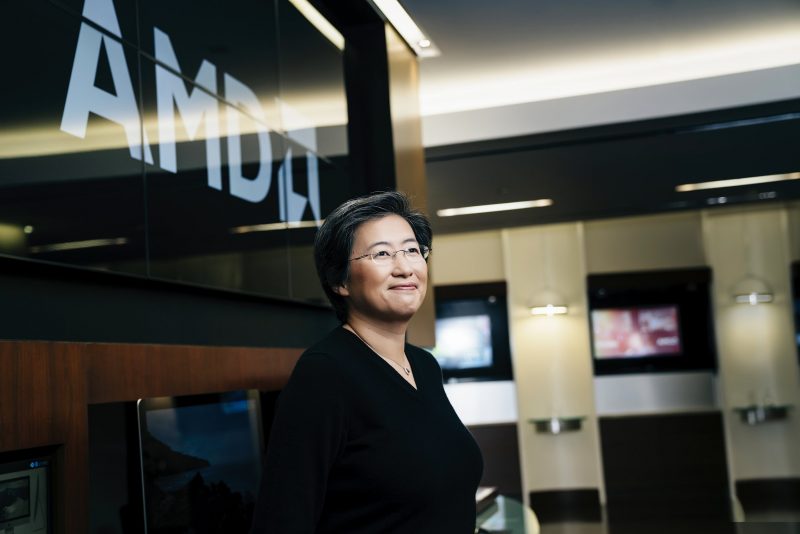

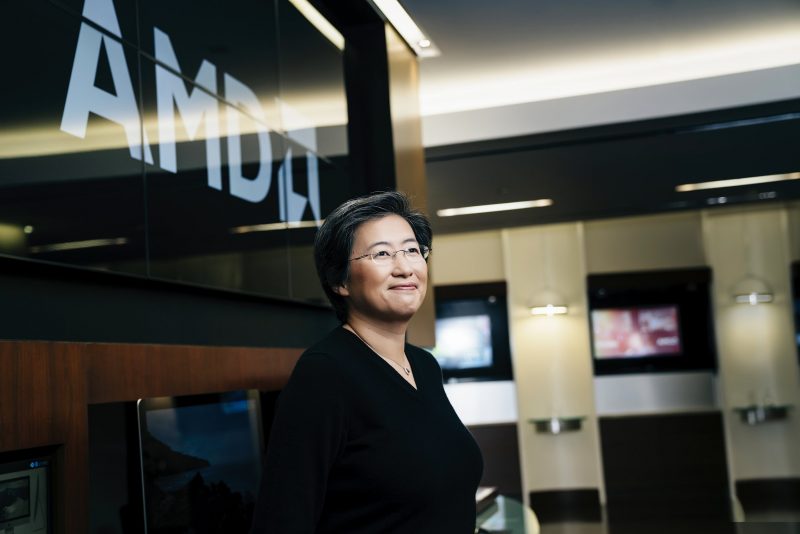

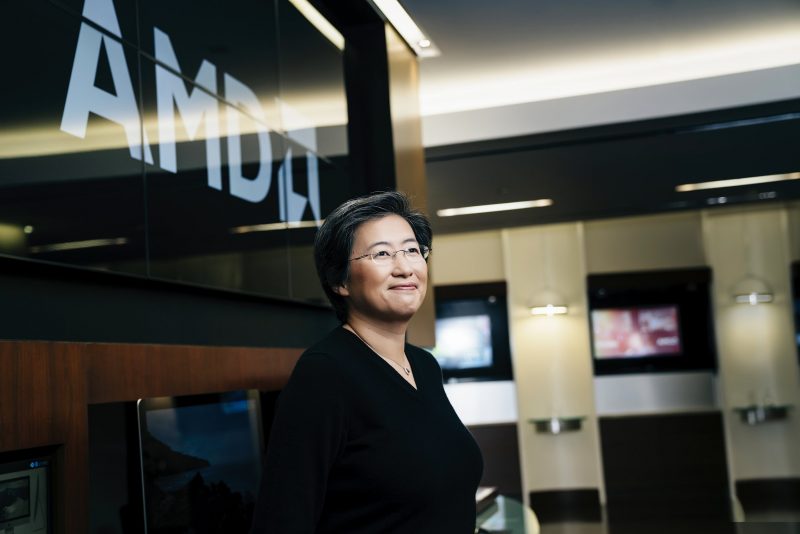

AMD Chief Executive Lisa Su (pictured) said the enormous growth was driven by “the best product portfolio in our history,” together with strong execution and robust demand.

“We had outstanding year-over-year revenue growth across all of our businesses and data center revenue more than doubled,” Su said. “Our increased full-year guidance highlights the strong growth we expect across our business based on increasing adoption of our high-performance computing products and expanding customer relationships,”

AMD has benefited over the last year from the COVID-19 pandemic and associated lockdowns that have led to a sharp rise in demand for notebooks and desktop personal computers that can enable remote work and online education, as well as for other products such as games consoles. The demand for such products has led to a widespread shortage of processors, further boosting AMD’s business.

The veteran chipmaker did well across the board. Its Computing and Graphics segment, which includes Ryzen PC processors and Radeon GPUs, reported revenue of $2.10 billion, up 46% from a year ago and 7% from the prior quarter. Officials said that average selling prices for both the Ryzen central processing units and Radeon GPUs rose year-over-year.

The most impressive performance however came from AMD’s Enterprise, Embedded and Semi-Custom business, which includes sales of its EPYC server chips. This unit saw revenue leap by a massive 286% year-over-year, to $1.35 billion.

Charles King, an analyst with Pund-IT Inc., told SiliconANGLE that Su was dead right about this being the best product portfolio in the company’s history.

“For decades, AMD has mostly been Intel’s punching bag and seen by many as a distant second-place player in PC and data center products,” King said. “Even when the company did pull off a stunning upset, like when its Opteron CPUs effectively drove a stake into the heart of Intel’s Itanium line and forced it to pivot to x86-64, manufacturing errors and sales flubs left AMD looking like the gang that couldn’t shoot straight.”

That’s no longer the case, King said, as Su has transformed the company since taking over the top job in 2014. He said Su had hired a number of talented executives to help her, including Forest Nerrod, formerly of Dell Technologies Inc., and Frank Azor, the co-founder of Dell subsidiary Alienware, which makes gaming PCs.

“Su and company deserve kudos for knocking it out of the park this quarter,” King said. “It’s really hard to see how they could have executed any better.”

Even so, King noted that AMD’s achievements need to be kept in perspective. “The fact is that while $3.45 billion is a nice chunk of change, it’s considerably less than a fifth of the $19.7 billion in quarterly revenues Intel announced less than a week ago,” he said. “With Pat Gelsinger at the helm, Intel is likely to be a far more formidable opponent in the quarters ahead than it has been for several years. It will be interesting to see how Lisa Su and her leadership team respond and adjust.”

Holger Mueller of Constellation Research Inc. also had words of warning, saying AMD needs to watch its cost discipline as it grows, noting that its sales, marketing and general and administrative expenses were all up more than 50%, while its research and development costs grew by less than that. “In good times R&D should outgrow sales and marketing,” he said.

Still, Mueller said AMD had an otherwise stellar quarter: “Rarely can vendors in the $1 billion-plus segment in the hardware industry show close to a doubling of revenue and profit,” he said. “AMD is clearly on the way up, showing how a successful new product line — the EPYC platform — can really make a difference.”

Analyst Patrick Moorhead of Moor Insights & Strategy said that he too was very impressed with AMD’s quarter, noting that alongside its revenue increase, its gross profit jumped 94% year-over-year, and its net income rocketed 243%.

“This phenomenal achievement was driven by strength in every aspect of the business: processors and graphics in the PC, data center and game console markets,” Moorhead said. “It’s a seller’s market as supplies are tight, so as you would expect, AMD focused its manufacturing on higher average selling price and profitable products. The only nit I have is that AMD did not release specific EPYC revenue numbers, which, while I know are substantial, the degree of the business is still a bit of a mystery.”

For the second quarter, AMD said it’s expecting even more rapid growth. It forecast revenue of $3.5 billion to $3.7 billion, well above Wall Street’s consensus of $3.2 billion in sales. Company officials said they expect data center and gaming to drive its growth in the next quarter.

If AMD does grow its data center business again. that would not be a surprise. The company last month announced its newest CPU family for computer servers, the EPYC 7003 series. It’s built on a seven-nanometer chipmaking process and incorporates some interesting new security technologies. AMD claims the EPYC 7003 chips provide more than double the performance of Intel Corp.’s latest data center chips in some cloud workloads.

Also last month, AMD debuted its new Ryzen Pro 5000 chips for business-grade laptops. They combine high performance with newer security and management features that should appeal to enterprises that want to kit out their remote workers.

AMD is clearly confident that the new chips will be a hit with customers. The company raised its full-year guidance too, saying it believes total revenue for 2021 will grow by 50% from the previous year, up from its earlier forecast of 37% growth. Wall Street is forecasting full-year revenue growth of 38%.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.