APPS

APPS

APPS

APPS

APPS

APPS

The first-quarter smartphone shipment data from Canalys shows that the top two smartphone companies in the world are slowly shrinking in market share despite some reports focusing on Apple Inc. iPhone sales surging in the first quarter.

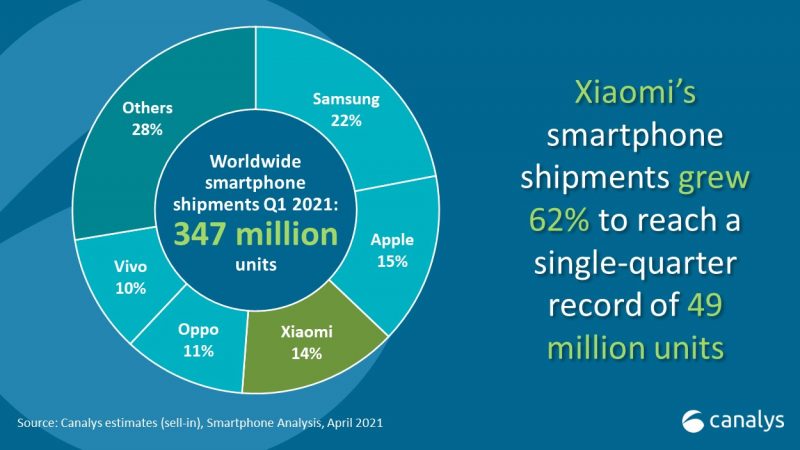

Samsung Electronics Co. Ltd. maintained its lead with a 22% share of all smartphone sales in the first quarter, shipping 76.5 million units, followed by Apple with a 15% share, shipping 52.4 million units. Combined, the two leading companies now hold only 37% of the overall smartphone market as leading Chinese firms, save one, surging in popularity.

Xiaomi Corp. took third place for the first time in global smartphone shipments with a 14% market share, shipping 49 million units. Fellow Chinese smartphone makers made up the rest of the top five with Guangdong Oppo Mobile Telecommunications Corp. Ltd. and Vivo Communication Technology Co. Ltd. with an 11% and 10% market share, respectively shipping 37.6 million and 36 million units.

The company that’s missing from the top five list is the standout. Huawei Technologies Co. Ltd. this time last year was the second-largest smartphone manufacturer in the world but is now lumped into “other” on the smartphone share chart. According to Canalys, Hauwei, which sold 49 million units in the first quarter of last year, only sold 18.6 million units in the first quarter of this year to come in at seventh place.

Huawei was subject to U.S. trade restrictions in 2019 that resulted in its not being able to ship smartphones with an officially licensed version on Android with Google LLC apps on them. Android itself is open source and any company can use it, but to include Google apps such as search, Gmail and Maps requires a license. Huawei’s smartphones generally get strong reviews, but as The Verge noted when reviewing the Huawei P40 Pro, “the lack of Google software hampers incredible hardware.”

Overall, smartphone shipments grew 27% in the first quarter to reach 347 million units, the highest first-quarter shipment number since 2012. The quarter was also notable because of the recovery in some markets such as the U.S. following COVID-19, but going forward the global chip shortage may dampen overall growth.

“COVID-19 is still a major consideration, but it is no longer the main bottleneck,” Canalys Research Manager Ben Stanton said. “Supply of critical components, such as chipsets, has quickly become a major concern and will hinder smartphone shipments in the coming quarters.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.