INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Arm Ltd.’s latest Neoverse announcement further cements our opinion that its architecture, business model and ecosystem execution are defining a new era of computing — and leaving Intel Corp. in its dust.

We believe the company and its partners have at least a two-year lead on Intel and are currently in a far better position to capitalize on the major waves driving technology industry innovation. To compete, Intel needs a new strategy — which new Chief Executive Pat Gelsinger is bringing — as well as financial support from U.S. and EU governments and, very importantly, volume for its chip foundry business. And that’s where Apple Inc. could be the key.

In this Breaking Analysis, we’ll explain why and how Apple could hold a key to saving Intel’s, and America’s, semiconductor industry leadership position. In addition, we’ll use Enterprise Technology Research data on Dell Technologies Inc.’s laptop demand to explain why a booming business for Dell may not be all that great for Intel. Finally, we’ll further explore our scenario on the evolution of computing and what will happen to Intel if it can’t catch up. Here’s a hint: It’s not pretty.

Volume makes kings. Our most fundamental premise is that, all other things being equal, volume is the most important determining factor to semiconductor leadership. It drives cost, experience, quality and innovation.

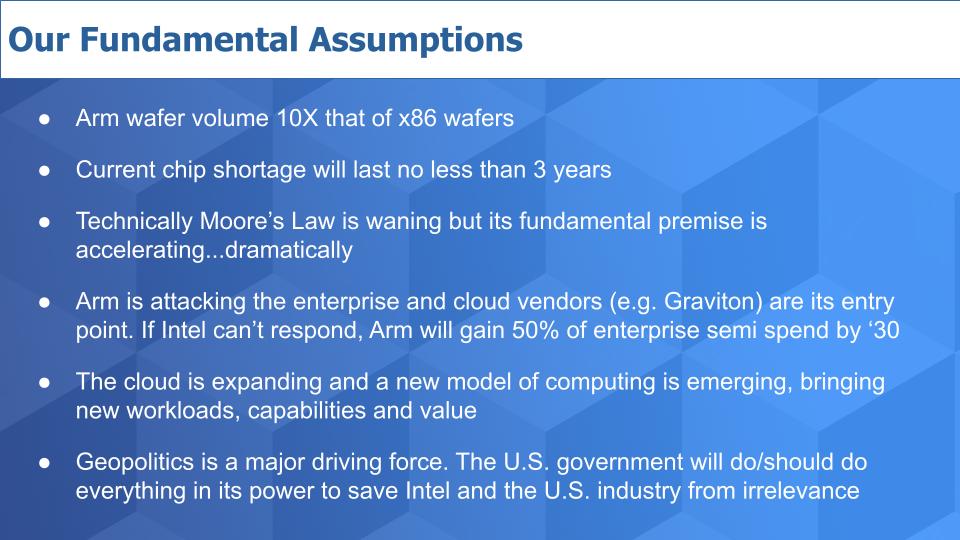

We’ve pointed out many times that we believe Arm wafer volumes are approaching 10 times those of x86 wafers. This means that manufacturers of Arm chips have a significant cost advantage over Intel. We’ve covered that extensively, but we repeat it because when we see news reports and analysis in print, it’s not a factor that is often highlighted. We believe this is the single most important issue that Intel faces and it’s why we feel Apple could be Intel’s savior.

And as another assumption, we project that the chip shortage will last no less than three years and perhaps longer.

As we reported in a recent Breaking Analysis, although Moore’s Law is waning, the outcome of Moore’s Law – the doubling of processor performance every 18 to 24 months — is accelerating. We have observed over the past five years, and continue to project, a quadrupling of processor performance every two years.

Arm is attacking the enterprise and we see hyperscalers as the tip of their entry spear. Amazon Web Services Inc.’s Graviton chip is the best example. Amazon and other cloud providers that have engineering and software capabilities are making Arm-based chips capable of running general-purpose applications. This is a huge threat to x86, and if Intel doesn’t respond quickly, we believe Arm will gain a 50% share of enterprise semiconductor spend by 2030.

We also see the definition of cloud expanding. Cloud is no longer a remote set of services “out there in the cloud.” Rather, it is expanding to the so-called network edge, where the edge could be a datacenter, a data closet or a true edge device or system. And Arm is, by far in our view, the best-positioned to support the new workloads and computing models that are emerging as a result.

Finally, geopolitical forces are at play. We believe the U.S. government will do, or at least should do, everything possible to ensure that Intel and the U.S. chip industry regain its leadership position in the semiconductor industry. If it doesn’t, the U.S. and Intel could fade to irrelevance.

Here’s a map of the South China Sea:

Way off in the Pacific Ocean, we’ve superimposed a little pie chart. We asked ourselves: If you had 100 points of strategic value to allocate, how much would you put in the semiconductor manufacturing bucket and how much would go to design? Our conclusion is 50/50.

Historically, because of Intel’s dominance with x86 volume, the United States was No. 1 in both strategic areas. But today, that orange slice of the pie is dominated by Taiwan Semiconductor Manufacturing Corp., thanks to Arm volumes. On all accounts, on cost, technology and volume, TSMC is the clear leader.

China’s President Xi Jinping has a stated goal of unifying Taiwan by China’s centennial in 2049. Will this tiny island nation, which dominates a critical part of the strategic semiconductor pie, go the way of Hong Kong and be subsumed into China? And if so, what are the implications for the U.S. semiconductor industry, Intel and Apple?

Admittedly, military experts say it would be very hard for China to take Taiwan by force without heavy losses and serious international and domestic repercussions. The U.S. military’s presence in the Philippines, Okinawa and Guam, combined with support from Japan and South Korea, would make it even more difficult. And certainly the Taiwanese people, you would think, prefer their independence.

But Taiwanese leadership ebbs and flows between those hard-liners pushing for independence and those more sympathetic to China. Could China, for example, use cyberwarfare to control the narrative in Taiwan over time? The most embryonic state of the narrative is the meme. Control the meme you can control the narrative. Control the narrative, you can control the idea. If you can control the idea, you can control the belief system.

If you can control the belief system, you can control the population, without firing a shot. So is it possible that over the next 25 years, China could weaponize propaganda to reach its objectives with Taiwan?

Maybe it’s a long shot, but if you’re a senior strategist in the U.S. government, or at Apple, would you want to leave that to chance? We wouldn’t.

Let’s park this for now and come back later to this dynamic.

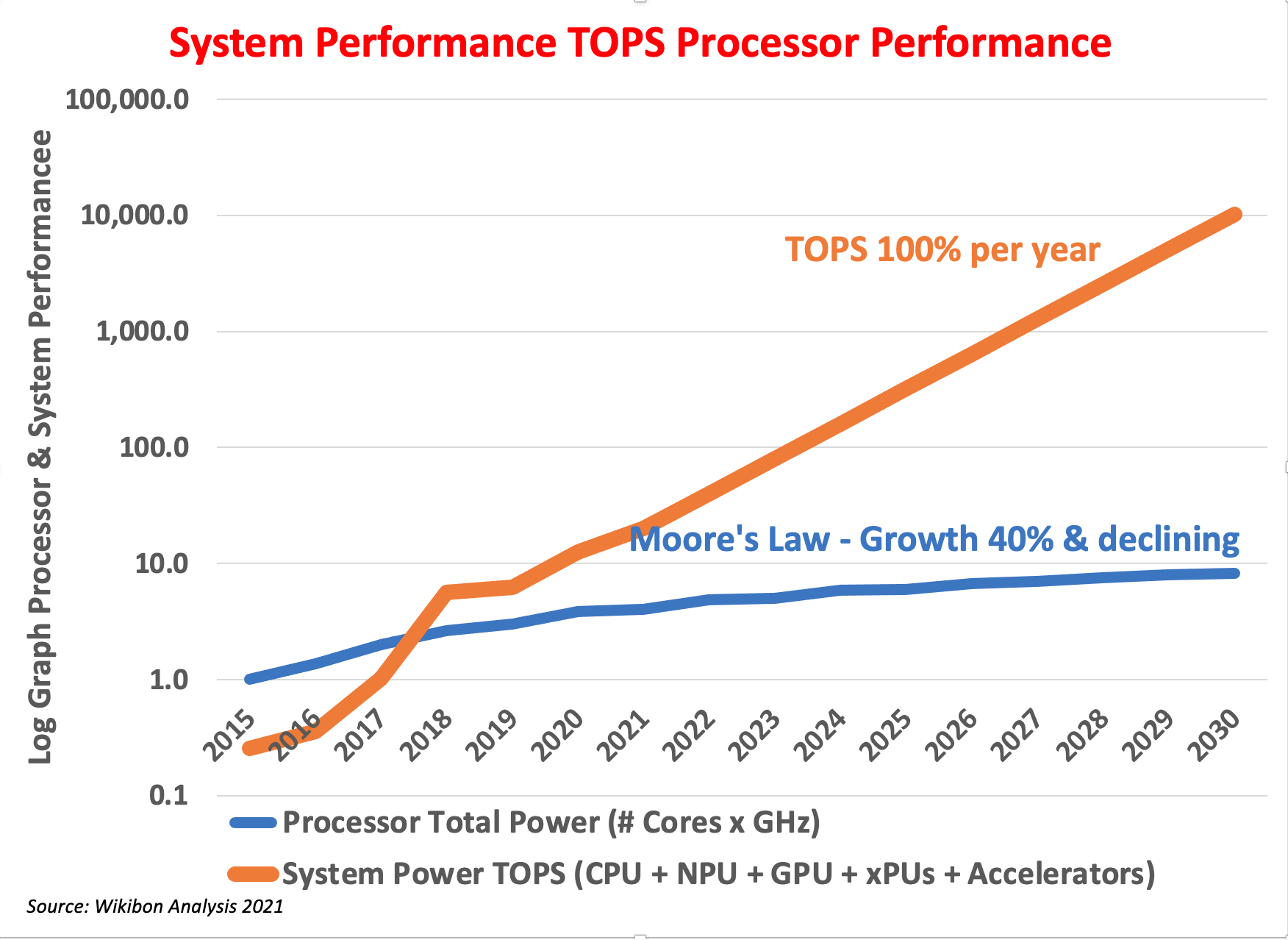

For at least four decades, the technology industry has marched to the cadence of Moore’s Law. Although by the strict definition of the principle, it is slowing, the rate of semiconductor performance gains is accelerating, dramatically.

As we first reported a few weeks ago, although Moore’s Law is moderating, the outlook for cheap, dense and efficient processing power has never been better. Processing power is now quadrupling every 24 months versus the historical doubling.

The chart above shows two simple log lines. The blue line depicts traditional Moore’s Law progression and the orange shows the current pace of system performance improvement– measured in trillions of operations per second. The math on the historical annual rate of processor performance improvement with x86 comes out to around 40% per year. That rate is slowing; it’s now down to around 30% annually. So we’re not quite doubling every 24 months anymore. And that’s why people say Moore’s Law is dead.

But if you look at the combinatorial effects of packaging central processing units, graphics processing units, neural processing units, accelerators, digital signal processors and all the alternative processing power you find in systems-on-chip and eventually systems-on-package, it’s growing at more than 100% per annum. This means processing power is now quadrupling every 24 months.

Arm has redefined the core processor model for a new era of computing. It made an announcement last week that recycled some content from last September but also put forth new proof points on adoption and performance.

The company laid out three components in its announcement:

1) Neoverse V1, which is all about extending vector performance. This is critical for high-performance computing, once thought a niche but it’s the AI platform — and AI workloads are not a niche.

2) Arm announced the Neoverse N2 platform based on the recently introduced Armv9. This got a performance boost of 40%.

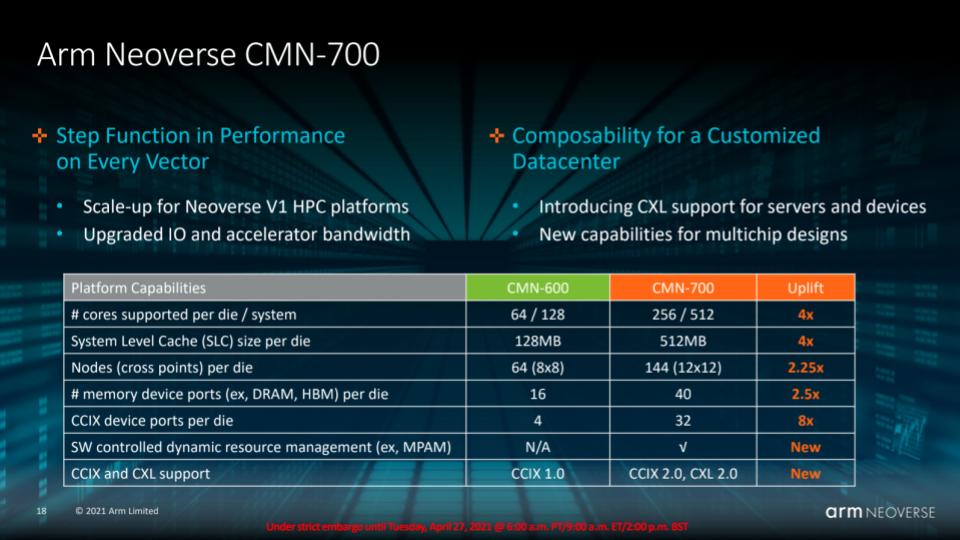

3) The CMN-700, which Arm said was the industry’s most advanced mesh interconnect. This is the glue for the V1 and N2 platforms. The importance is that it allows for more efficient use and sharing of memory resources across components of the system package. We talked about this extensively in previous episodes and will dig deeper into the importance of this technology later in the post.

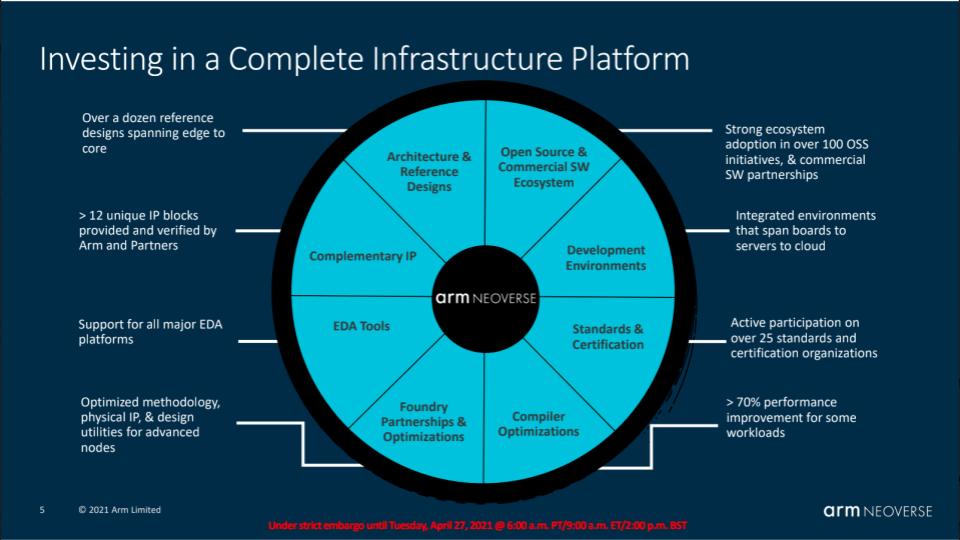

This wheel diagram above underscores the completeness of the Arm platform. Arm’s approach is to enable flexibility across an open ecosystem, allowing for value-add at many levels. Arm has built the architecture and design and facilitates standards across an open ecosystem that provides value-added software to the package.

Importantly, Arm has created and is the steward of the standards and specifications by which software run on its platforms. It can, with certainty, certify that the foundry can make chips to a high standard — and that all applications will run properly. In other words, if you design an application, it will work across the ecosystem and maintain backward compatibility. Intel has done that for years, but Arm, as we’ll see next, is positioning not only for existing workloads but all the emerging and high-growth applications.

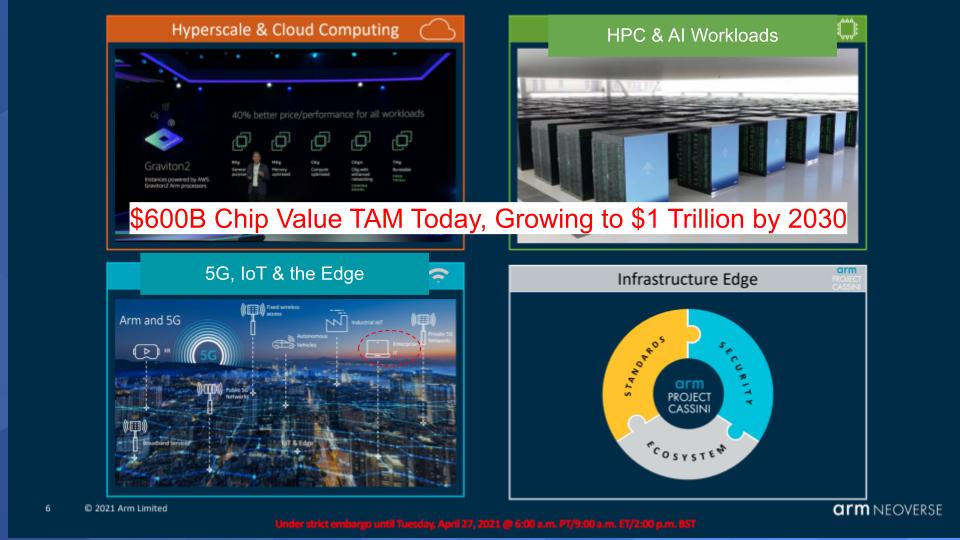

Below is the Arm total available market. Intel is following a similar path based on Gelsinger’s announcement earlier this year, but Arm and its ecosystem are well ahead in our opinion.

We think the end-market spending value of just the chips going into these areas is $600 billion today and will grow to $1 trillion by 2030. In other words, we’re allocating the value of the end-market spend in these sectors to the marked-up value of the silicon as a percentage of the total spend. It’s enormous.

So the big areas are hyperscale clouds, which we think is around 20% of this total available market. The HPC and AI workloads account for about 35% and the edge will ultimately be the largest at 45%. Although these are rough estimates and there’s obviously some overlap, the bottom line is this market is enormous — and growing rapidly.

And you see that red highlighted area — that’s enterprise IT or traditional IT, and that’s the x86 market in context. The prevailing approach of traditional information technology providers has been to repackage an x86 box and position it for the edge as a remote aggregation point. This is all well and good but: 1) It’s really not edge computing as many view it; it’s more like remote office installations; and 2) We believe the real opportunity is for AI inferencing at the edge where most of the processing is done locally.

General-purpose x86 systems will play a role in this market, in much the same way that data center technologies factor in to mobile. But the real innovation, growth and action will occur much more widely at the outer edge of the ecosystem.

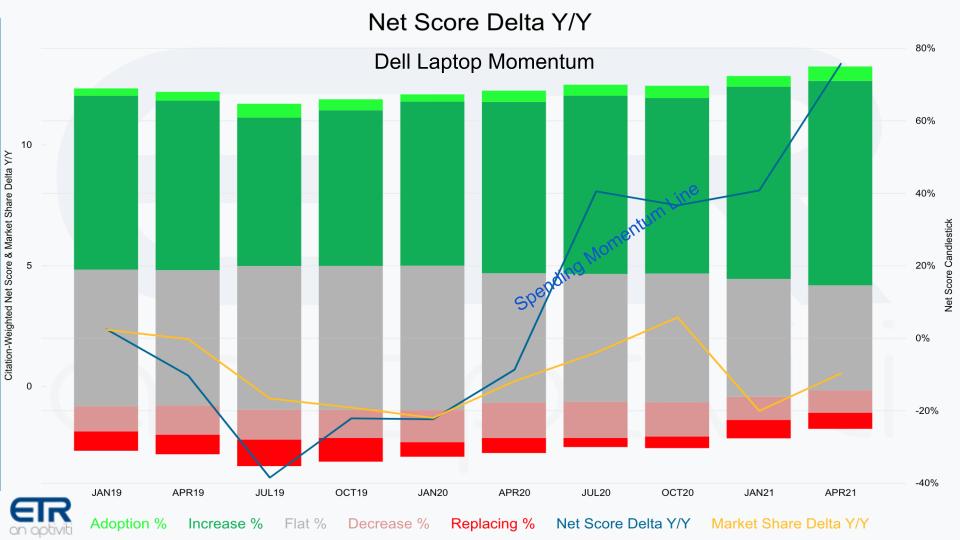

We’ve made the point many times that personal computer volumes peaked in 2011 and we saw that as problematic for Intel for the cost reasons we’ve been highlighting. But amazingly, PC volumes actually grew last year thanks to COVID — and will continue to grow for a while. This is great news for Dell. But perhaps not as good for Intel.

Below is data from ETR that underscores that fact. The chart shows the Net Score or spending momentum breakdown for Dell’s laptop business. Green is accelerating spend and red is decelerating and the blue line is Net Score. The trend is up and to the right.

Now as we’ve said, this demand dynamic is awesome news for Dell, HP Inc. and all the laptop sellers. But it’s not necessarily great news for Intel. It’s OK, but it shifts Intel’s product mix toward lower-margin PC chips and squeezes Intel’s historically elevated gross margins. So Intel’s chief financial officer has to explain that margin contraction to Wall Street. Imagine that irony: The business that got Intel to monopoly status is growing faster than the high-margin server business and it’s pulling margins down, which the Street sees as a negative.

So as we’ve said, Intel is fighting a war on multiple fronts: battling Advanced Micro Devices Inc. in its core x86 business in both PCs and servers, watching Arm mop up mobile, and trying to figure out how to reinvent itself to allow more flexibility into its designs and spin up a foundry business to compete with TSMC.

It has to fund all this while at the same time propping up its stock with buybacks. Intel last summer announced it was accelerating its $10 billion stock buyback program. Hmmm. Buy stock back or build a foundry? Which do you think is more important for the future of Intel and the U.S. semiconductor industry?

And placate Wall Street at the same time.

Here’s where it gets even more dicey. Intel must protect its high-end x86 business at all costs. It is the cash cow and funds the company’s operations. Who is Intel’s biggest customer? Dell? HP? Facebook Inc.? Google LLC? AWS? Well, let’s just say Amazon is a big customer – can we agree on that? And we know AWS’ biggest revenue generator is EC2, powered by microprocessors made from Intel … and others.

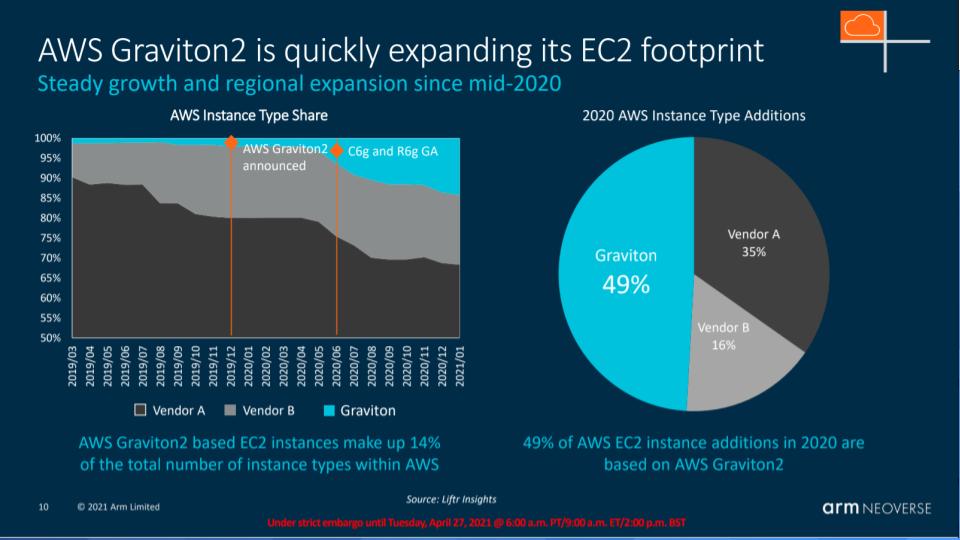

We found the following slide in the Arm Neoverse deck and it caught our attention.

The data comes from a data platform called Liftr Insights. The charts show the rapid growth of AWS’ Graviton chips, based on Arm, of course. The blue is Graviton and the black, Vendor A, presumably is Intel. The gray is assumed to be AMD. The eye-popper is the 2020 AWS EC2 instance deployments in the pie chart: nearly 50% Graviton.

Now if you’re Gelsinger – you are all over AWS. You do not want to lose this customer and you’re going to do everything in your power to keep them. But the trend is not your friend in this account.

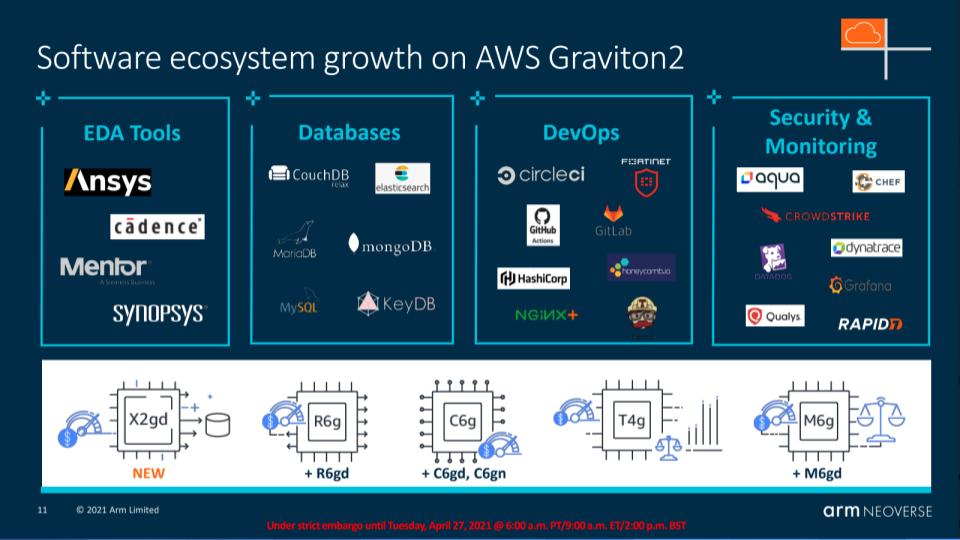

Below is the kill shot in the Arm Neoverse deck:

It shows the ISV ecosystem platforms that run on Graviton2. Because AWS has such good engineering and controls its stack, it can build Arm-based chips that run software designed to work on general purpose x86 systems. It’s true the ISV has to do some work, but large ISVs have an incentive because they want to ride the AWS Graviton wave. Certainly the user doesn’t know or care. But AWS cares because it’s driving cost and energy consumption down and performance up. Lower cost and higher performance. Sounds like something Amazon wants to deliver consistently to compete, doesn’t it?

And the ISV portfolio that runs on Arm-based Graviton is going to continue to grow.

By the way, it’s not just Amazon. Alibaba Group Holding Ltd., Oracle Corp., Marvell Technology Inc. and Tencent Holdings were all part of the Arm announcement, doing similar things but customized for their specific purpose. The list grows.

The last piece of the Arm architecture story we want to share is the progress they’re making and compare that to that of x86. This chart below shows how and where Arm is innovating.

Let’s start with the first line above under platform capabilities — the number of cores supported per die or system.

A die is what ends up as a chip on a small piece of silicon. Think of the die as the circuit diagram of the chip. These circuits are fabricated on wafers using photolithography. The wafer is then cut up into many pieces, each one having a chip. Each of these pieces is a chip and two chips make one system.

The key here is that Arm is quadrupling the number of cores. Instead of increasing thread counts, it’s providing cores. Cores are better than threads because threads are a shared resource. Cores are independent and much easier and less complex to virtualize. This is particularly important in situations where you want to be as efficient as possible, sharing massive resources – like the cloud!

And you can see on the right hand side of the chart under the orange, Arm is dramatically increasing the amount of capabilities compared with previous generations.

And one of the other highlights to us is that last line – the CCIX and CXL support. These refer to Arm’s memory-sharing capabilities within and between processors. This allows CPUs, GPUs, NPUs and other chips to share resources very efficiently, especially compared to the way x86 works, where everything is currently controlled by the x86 processor.

CCIX and CXL support, on the other hand, will allow designers to program the system and share memory wherever they want within the system, directly, and not have to go through the overhead of a central processor, which owns the memory. So for example if there’s a CPU, GPU and NPU, the CPU can say to the GPU, “Give me your results at a specified location and signal me when you’re done.” When the GPU is finished calculating and sending the results, the GPU signals the operation is complete — versus having to ping the GPU constantly, which is overhead-intensive.

Finally, “composability” means the system isn’t fixed. Rather, you can programmatically change the characteristics of the system on the fly. For example, if the NPU is idle you can allocate more resource to other parts of the system.

In fairness, Intel is headed in this direction too, but we think Arm is at least two years ahead.

This memory innovation is huge for Nvidia Corp., which today relies on x86. A major problem for Nvidia has been coherent memory management because the utilization of its GPU is appallingly low and can’t be easily optimized. Last week Nvidia announced its intent to provide an AI capability for the data center center without x86 — that is, using Arm-based processors.

So Nvidia, another big Intel customer, is also moving to Arm. And if it is successful acquiring Arm – which is still a long shot – this trend will only accelerate.

The bottom line: If Intel can’t move fast enough to stem the momentum of Arm, we believe Arm will capture 50% of the enterprise semiconductor spending by 2030.

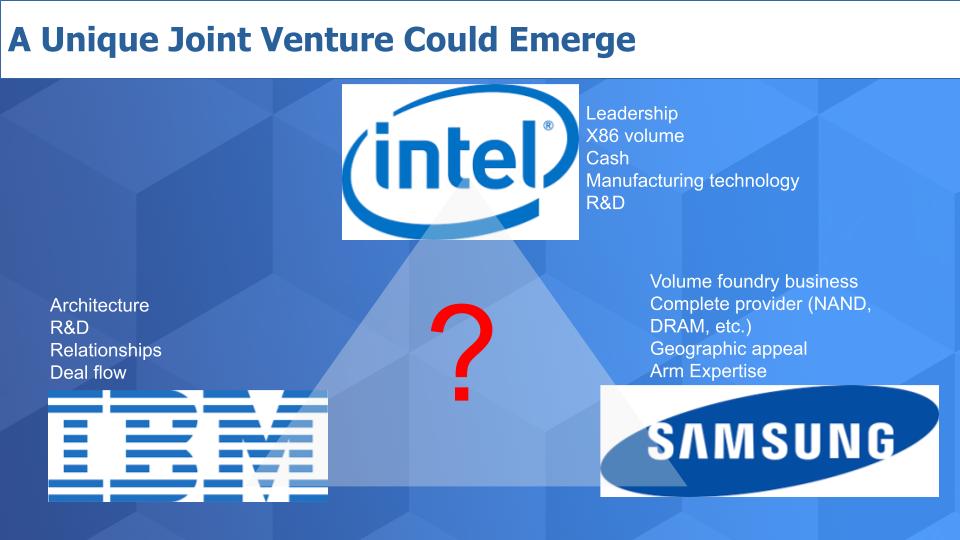

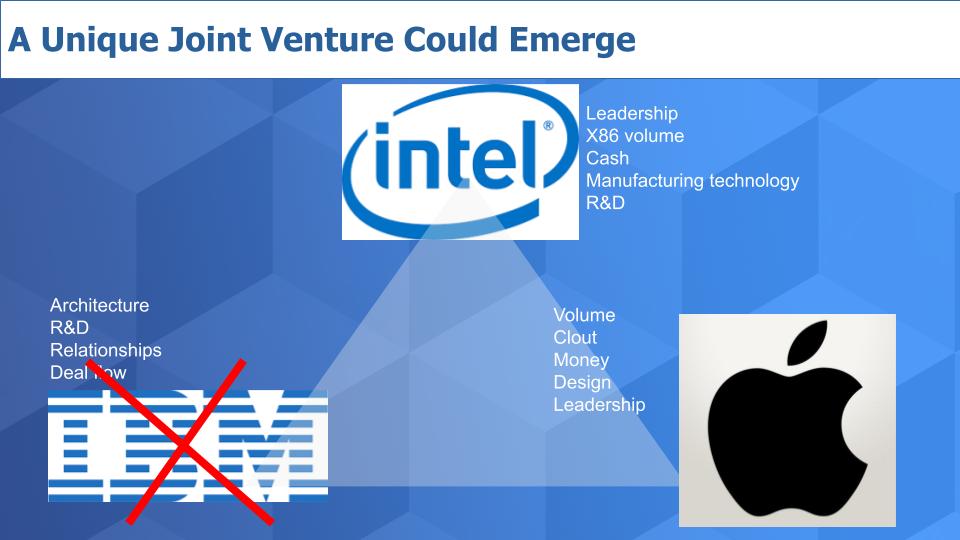

This won’t be easy, but we think there is a path. Remember in one of our earlier posts, we said Intel can’t go it alone? And we posited that the company would have to initiate a joint venture?

We had a triumvirate as shown below of Intel, IBM with its Power 10 memory architecture, and Samsung Electronics Co. Ltd. with its volume manufacturing expertise.

Upon further review, we’re not sure that Samsung would be willing to contribute intellectual property to this venture, given its huge investment in IP and infrastructure in South Korea. And furthermore we’re not convinced that IBM CEO Arvind Krishna, whom we believe ultimately made the call to jettison IBM’s microelectronics business, wants to put his efforts back into manufacturing semis.

So we have this conundrum. Intel is fighting AMD, which is already at a seven-nanometer chipmaking process. Intel has fallen behind in process manufacturing, which is strategically important to the United States, its military and the nation’s competitiveness. Intel is behind the curve on cost and architecture and is losing key customers in the most important market segments. And it’s way behind on volume.

Intel must become more price- and performance-competitive with x86 to protect its core customer base and bring in new composable designs that maintain x86 compatibility — and provide customers the ability to add and customize GPUs, NPUs, accelerators and the like. And that’s all while launching a successful foundry business.

Whew.

So we think there’s another possibility to this thought exercise.

Apple is currently reliant on TSMC and is pushing them hard on five-nanometer. But Apple needs a trusted onshore supplier. Sure, TSMC is adding manufacturing capacity in the U.S. in Arizona, but back to our precarious scenario in the South China Sea: Will the U.S. government and Apple sit back and hope for the best? Or will they hope for the best and plan for the worst? Let’s face it: If China gains control of TSMC, it could block access to the latest and greatest process technology.

Apple just announced it’s investing billions of dollars in semiconductor technology across the U.S. The U.S. government is pressuring big tech. What about an Apple-Intel joint venture? Apple brings the volume, its clout, money, design leadership to the table and partners with Intel. It gives the Intel foundry business a guaranteed volume stream and maybe the U.S. government gives Apple a little breathing room on the whole “break up big tech” narrative.

Wouldn’t that be ironic? Apple dumps Intel in favor of Arm for the M1 and then incubates and essentially saves Intel with a pipeline of foundry business.

IBM in this scenario maybe just gets in the way, so why not a nice, clean partnership between Intel and Apple. Who knows, maybe Gelsinger can negotiate this without giving up any equity?

But Apple could be a key ingredient to a cocktail of a new strategy under Pat’s leadership: gobs of cash from the U.S. and EU governments and volume from Apple.

It’s still a long shot but one worth pursuing — because as we’ve written. Intel is too strategic to fail.

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.