BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Paystand Inc., a blockchain-enabled payment network for business, today announced it has raised $50 million in a new funding led by NewView Capital.

SoftBank’s Opportunity Fund, King River Capital, Industrious Ventures and Transform Capital also participated in the Series C funding round. In addition to previous rounds, this brings the company’s total funding to $85 million.

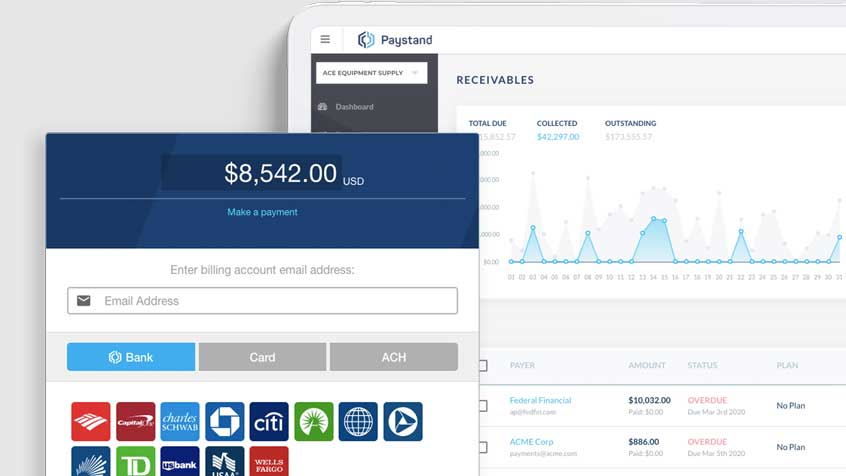

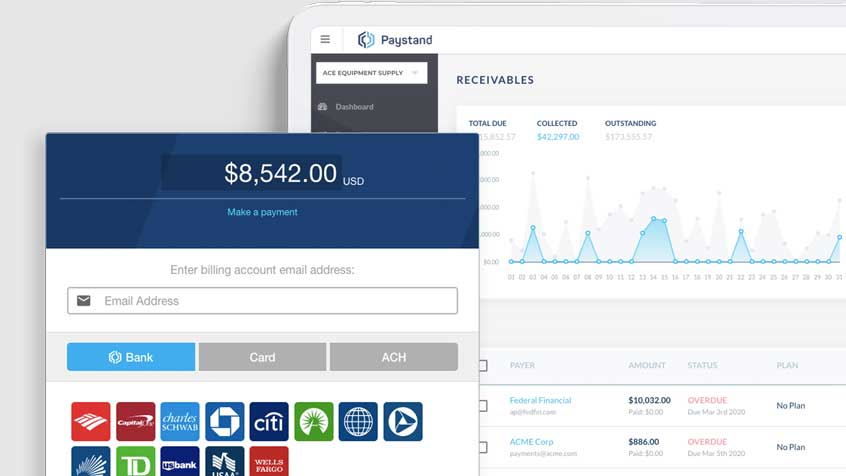

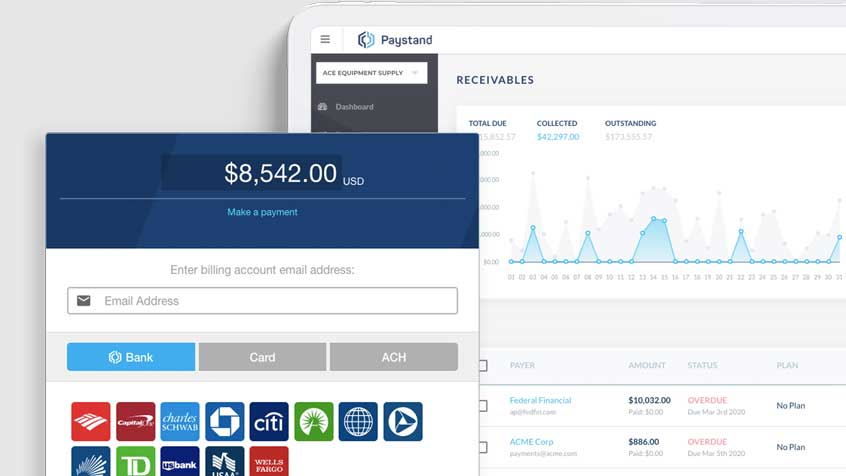

Paystand uses cloud technology and the Ethereum blockchain to power what it says is a highly secure, no-fee business-to-business payments network called the Paystand Bank Network.

Traditional payment networks take a cut of all transactions – often 2% to 3.5% — Paystand instead offers a payments-as-a-service subscription model so that businesses are not penalized by growth or size.

“Decentralized finance and blockchain represent the largest shift in our economy in over a generation. B2B payments can now happen instantly and securely as money has become software; yet, most finance teams are still mired in paper, manual processes and fees,” said Jeremy Almond, co-founder and chief executive of Paystand.

Decentralized finance is a form of software-powered finance that automates most of the processes involved in payment remediation without the need for middlemen. It uses blockchain technology to allow parties to resolve payments automatically using software-driven contracts between parties that helps reduce errors and other inefficiencies.

Paystand estimates that paper checks account for over half of all business payment volume and cost the economy anywhere between $550 billion and $1 trillion in errors and delays annually. Centralized digital alternatives, such as Visa Inc. and Mastercard Inc., take high fees on transactions. These costs could be reduced by replacing them with systems such as DeFi and blockchain.

“With this new funding, Paystand is uniquely positioned to bring the benefits of blockchain to commercial payments so businesses can be more agile and competitive in the post-pandemic landscape,” said Almond.

In the past three years, more than 250,000 companies have made payments through the Paystand blockchain-based network. This has led to over $2 billion in payment volume over the network.

Along with this investment, Jazmin Medina, a principal with NewView Capital, will join Paystand’s board.

“Paystand has been quietly rebooting commercial payments since 2013,” said Medina. “In the same way that the EV industry re-thought the automobile to permanently move society away from fossil fuels, Paystand is creating an entirely new system for B2B payments – not simply laying a digital facade over broken plumbing.”

Here’s a 2018 interview with Almond when he appeared on theCUBE, SiliconANGLE Media’s video studio:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.