BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Cobo Global Ltd., a Singapore-based cryptocurrency custody and asset management firm, today announced that it has raised $40 million in new funding led by DST Global, A&T Capital and IMO Ventures.

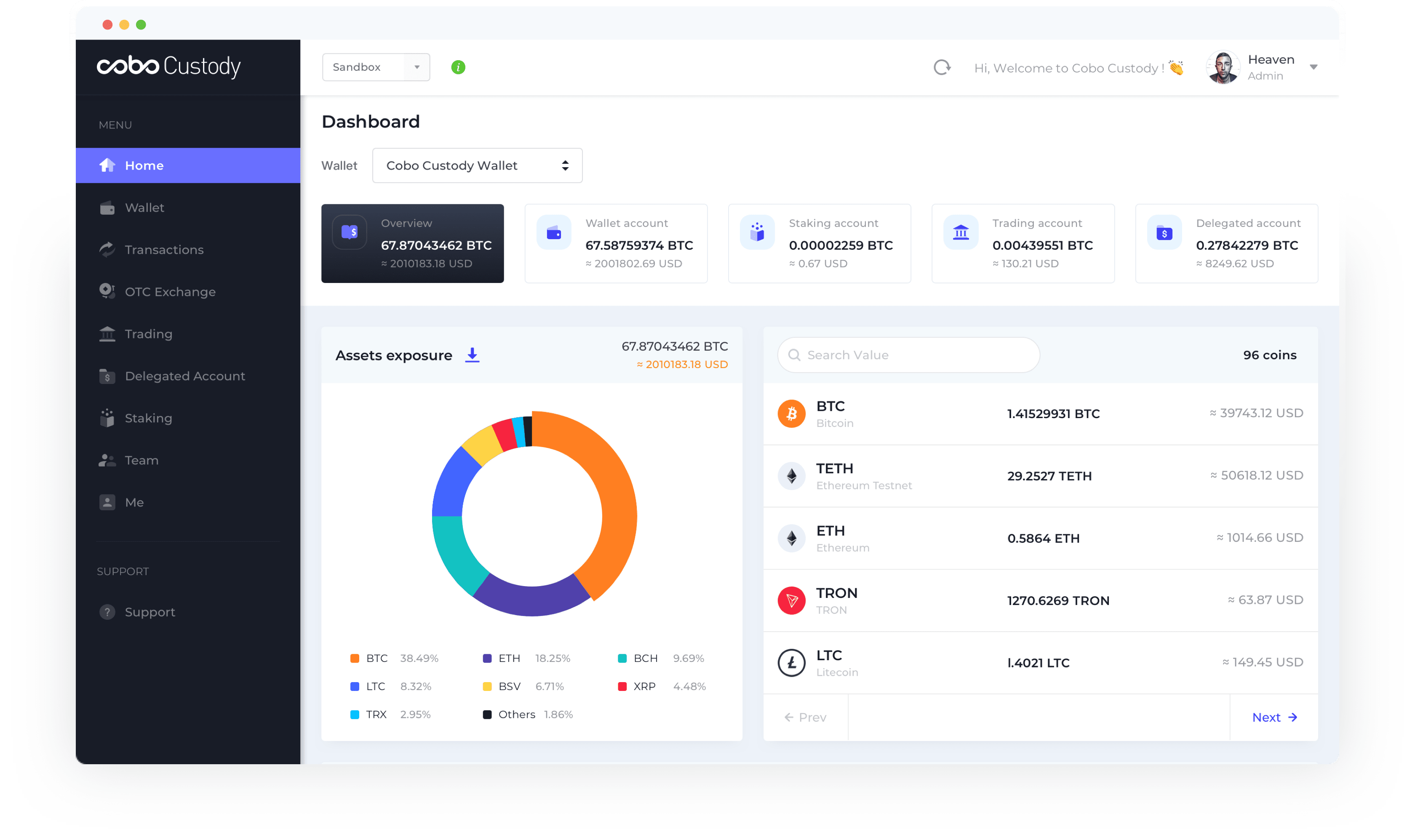

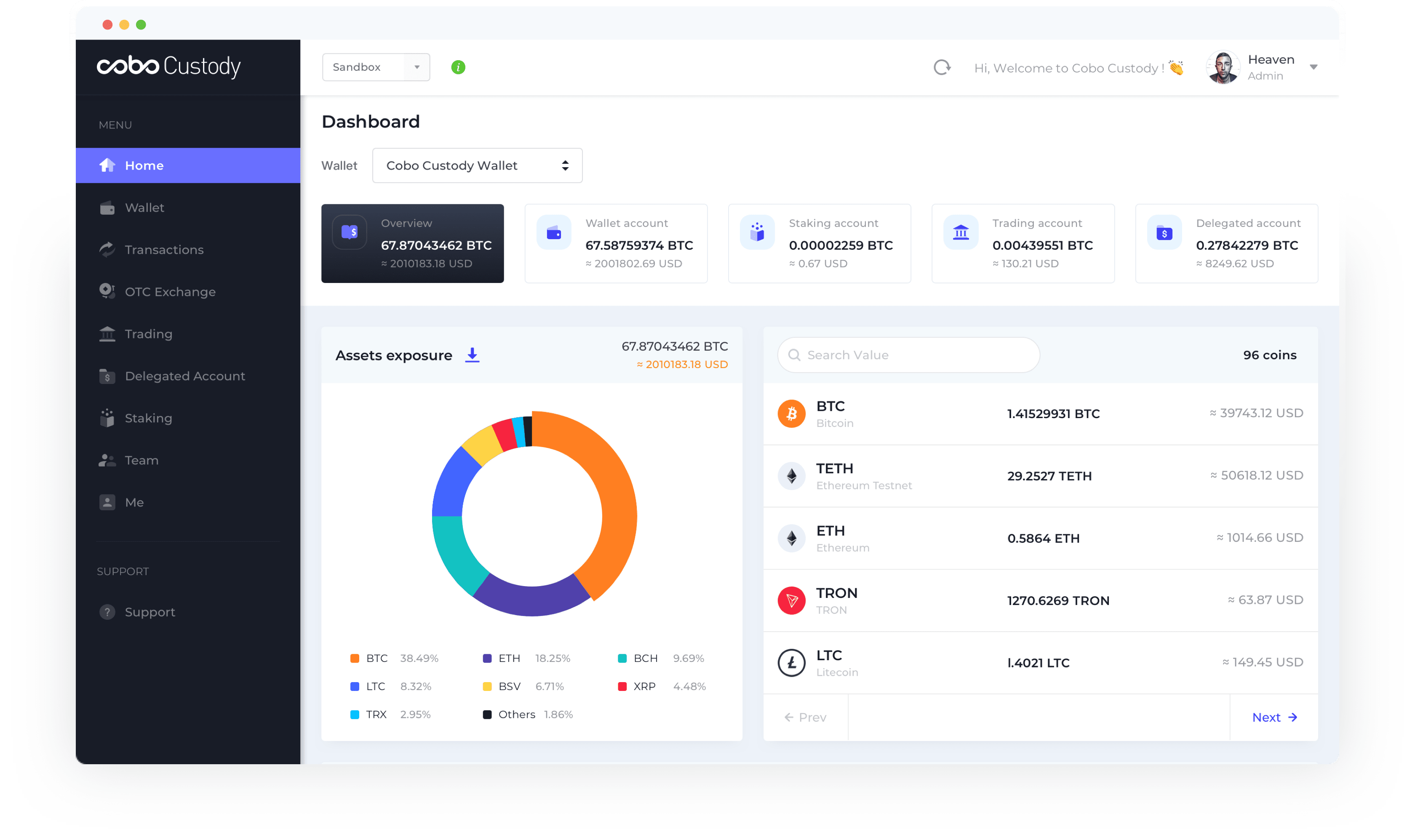

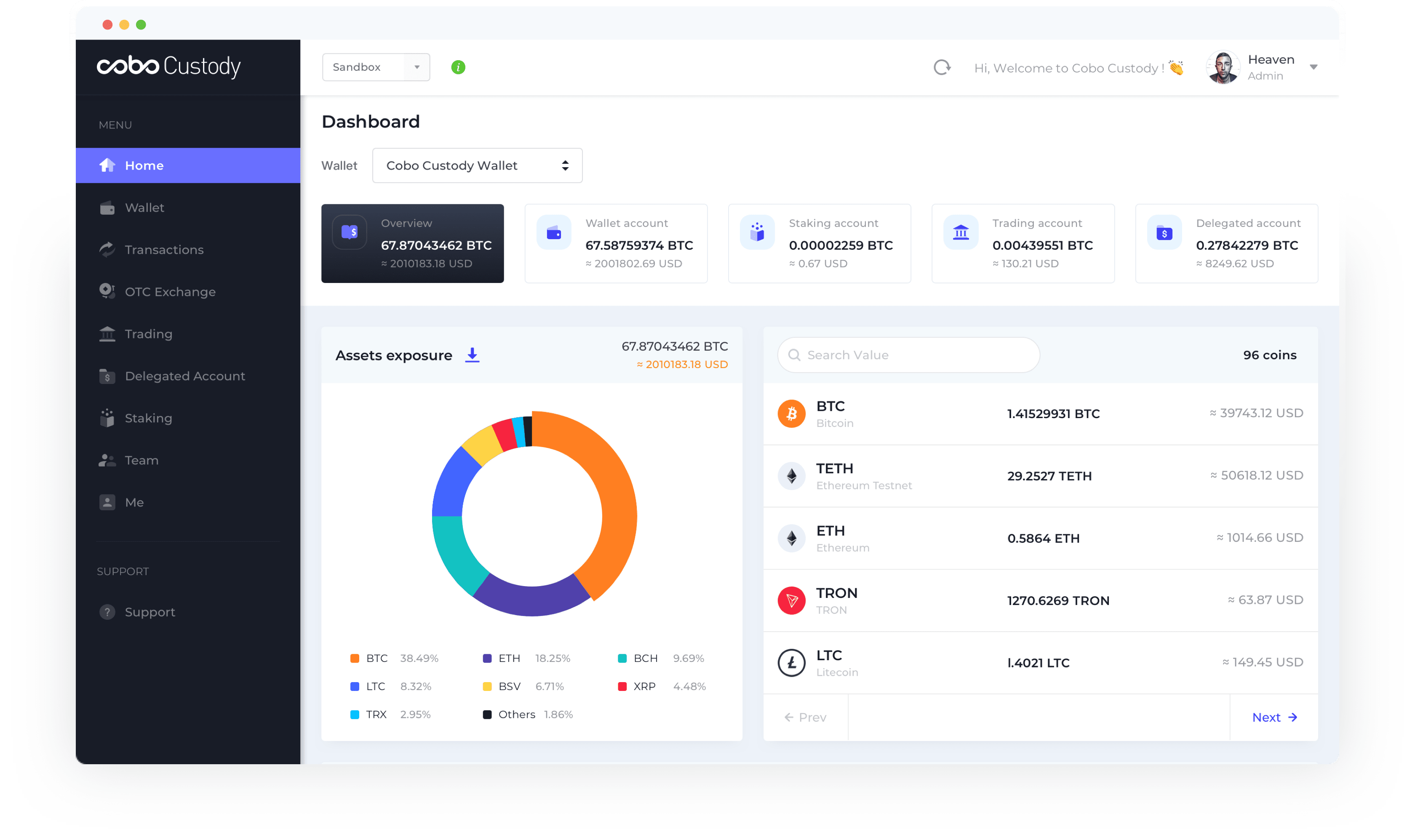

The company said the Series B funds will be used for expanding its decentralized finance infrastructure, adding to its existing cryptocurrency custody services and a wallet-as-a-service solution, and trading and crypto staking services.

The new services will allow customers to access DeFi protocols safely and compliantly via user-friendly interfaces. The company will help them navigate the complex regulations related to DeFi by proactively applying for regulatory licenses and ensure strict compliance with anti-money-laundering and other laws.

Decentralized finance is a blockchain-based form of finance that operates through the use of peer-to-peer smart contracts. It allows consumers to transfer, trade, borrow and lend without the need for intermediaries such as banks or clearinghouses.

“With interest in the crypto revolution soaring across Asia, it’s high time to expand blockchain infrastructures to meet the rising demand, especially as we’re seeing growing enthusiasm among institutions,” said Discus Fish, co-founder and chief executive of Cobo. “In the past, we’d witnessed crypto applications evolve from bitcoin to DeFi and now nonfungible tokens.”

To date, Cobo has served more than 300 institutions through its one-stop custody services, which represents more than 85% of the Asia-Pacific region’s second-tier crypto exchanges. The company’s include bitcoin futures exchange Deribit, mining pool F2Pool, crypto exchange BitMart and crypto exchange Pionex. The firm says it has also seen a cumulative transaction volume of more than $20 billion since its launch.

“Ultimately, this fundraising takes us another step closer to Cobo’s foundational vision of empowering 1 billion users to access crypto,” said Fish.

Since its founding in 2017, Cobo’s vision has been to play a role in the crypto ecosystem as an infrastructure developer and bridge the gap between crypto and users. To do this for enterprise customers, Cobo provides a wallet-as-a-service solution with support for more than 50 blockchains and over 1,000 tokens.

“As blockchain technology and innovation advances, we are observing a wave of increasing institutional demand,” said Jasmine Zhang, partner of A&T Capital. “We are confident in what Cobo is seeking to deliver to the market. Cobo’s Custody and asset management solution provide a great product-market fit.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.