BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

MoonPay, a cryptocurrency payment infrastructure startup, today announced that it has raised $555 million in its first-ever funding round led by Tiger Global Management and Coatue.

Existing investor Blossom Capital and new investors NEA, Paradigm and Thrive also participated in the Series A round, which values the company at $3.4 billion.

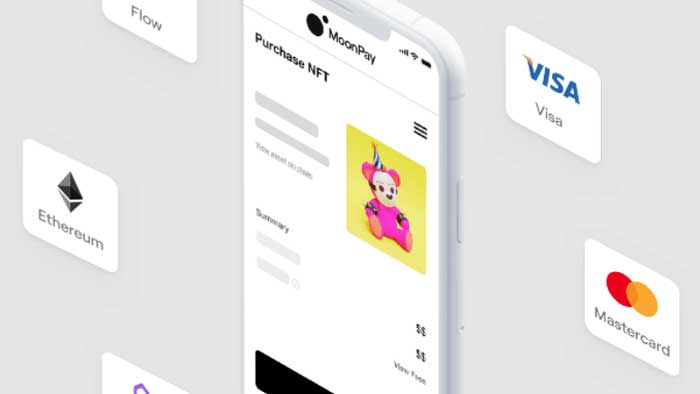

MoonPay launched in 2019 with the mission to allow people to buy and sell crypto assets using all major payment assets, such as credit and debit cards, Google Pay, Apple Pay and Samsung Pay. The platform currently supports more than 90 different cryptocurrencies and more than 30 fiat currencies.

The company offers services directly to crypto consumers – allowing them to buy and sell crypto – and to businesses for crypto infrastructure. MoonPay’s services are in use by companies such as the bitcoin-related web portal Bitcoin.com and the nonfungible token marketplace OpenSea.

“MoonPay is the world’s largest provider of crypto payments infrastructure that enables any organization to bridge traditional finance and crypto,” said MoonPay co-founder and Chief Executive Ivan Soto-Wright. “We set out to democratize access to the crypto economy by providing the tools for businesses to onboard new users with magical product experiences.”

Since the company’s launch, MoonPay has come a long way in its mission. According to Soto-Wright, the company has processed more than $2 billion in transactions and the customer base has expanded to more than 7 million users. MoonPay has also been joined by more than 250 partners across 160 countries.

Soto-Wright especially focused on MoonPay’s partnership with NFT-related companies, saying that the typical experience buying and selling NFTs “remains fragmented and full of friction.” However, MoonPay is helping to solve this by reducing lengthy checkout processes and partnering with marketplaces such as OpenSea to accelerate adoption.

He added that although “crypto” is used to refer to cryptocurrency, the spectacular rise of NFTs has delivered “a booming revolution in digital ownership” that is leading a fundamental shift for the technology and will give rise to new use cases.

The NFT market has seen explosive growth over the past year with sales reaching a market cap of $7 billion, JPMorgan Chase & Co. reported last week. According to the same report, the sale of digital art items continues to hover at a monthly rate of about $2 billion, up from just $400 million monthly at the start of the year. Other types of NFTs include virtual items from play-to-earn games — where players collect and trade in-game items – digital collectibles, music, concert and sports tickets, domain names and more.

“In the arts, this has sparked nothing short of a renaissance — an explosion of activity that’s bound to reach other industries as new use cases for digital tokens are discovered,” said Soto-Wright. “We believe the ticketing industry, for example, will likely be radically disrupted by NFTs.”

With the new funding, MoonPay intends to hire more people to expand its staff from around 130 people to 260 over the next year. The company will also use some of the funds to expand its physical presence across 20 different cities and add more payment methods to its services.

THANK YOU