CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

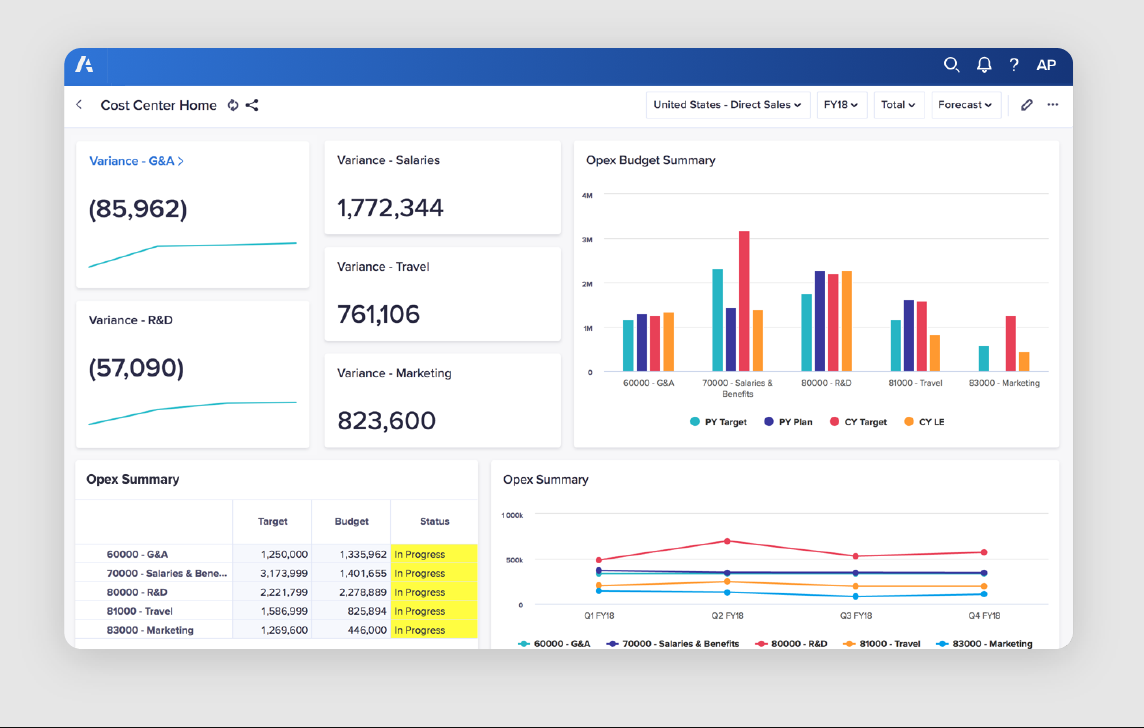

Shares in Anaplan Inc. plunged in after-hours trading today despite the business planning firm beat quarterly expectations.

For the quarter ended Oct. 31, Anaplan reported a loss before costs such as stock compensation of $6.9 million, or five cents a share, on revenue of $155.3 million, up 35% year-over-year. Analysts had been predicting a loss of 11 cents a share on revenue of $146.1 million.

Anaplan’s increasing revenue was driven by subscriptions, which rose 33%, to $139.3 million, in the quarter.

“We delivered another solid quarter and the robust demand for an enterprise-wide planning solution positions us well to capitalize on growth opportunities,” Frank Calderoni, chief executive officer of Anaplan, said in a statement.

Looking forward, Anaplan predicted revenue of between $154 million and $155 million in its 2022 fiscal fourth-quarter and full-year revenue of between $583.5 million and $584.5 million. Adjusted operating margin for the fourth quarter is expected to be in the range of negative 10% to 11%.

The figures across the board seem to be positive, although giving a percentage loss prediction for the next quarter versus an absolute figure of loss per share is unusual. Analysts had been predicting revenue of $152.36 million and a loss of seven cents per share.

On the company’s investor call, Anaplan Chief Financial Officer Vikas Mehta talked about why the company will change the way it provides figures in future earnings reports, using current remaining performance obligations or CRPO.

“Now, almost two years later, we believe this is a good time to replace quarterly billings as a guidance metric,” Mehta said. “We believe CRPO reflects the underlying operating growth and is a better leading indicator than billings. It normalizes timing and duration noise that can impact quarterly billings. Next quarter, we will start providing quarterly CRPO guidance for Q1 FY ’23.”

Buried somewhere in the figures is something investors didn’t like. Despite seemingly strong revenue growth, investors have not loved Anaplan stock this year. As Nasdaq.com pointed out, Anaplan shares have lost about 25% since the beginning of the year versus the S&P 500’s gain of 25%.

Anaplan shares fell 15% in after-hours trading.

THANK YOU