SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Identity verification and authentication startup Incode Technologies Inc. today said it has raised $220 million in new funding on a valuation of $1.25 billion, giving the company “unicorn” status for the first time.

General Atlantic and SoftBank led the Series B round. Also participating in the round were J.P. Morgan, Capital One, Coinbase, SVCI, DN Capital, 3L Capital and Framework Ventures. Including the new funding, Incode has raised $257.1 million to date, according to data from Crunchbase.

Founded in 2015, Incode offers secure biometric identity services for banking, payment, hospitality and retail experiences. Pitched as providing an end-to-end identity platform that offers a frictionless customer experience, Incdode says its service provides a consistent level of security across multiple channels.

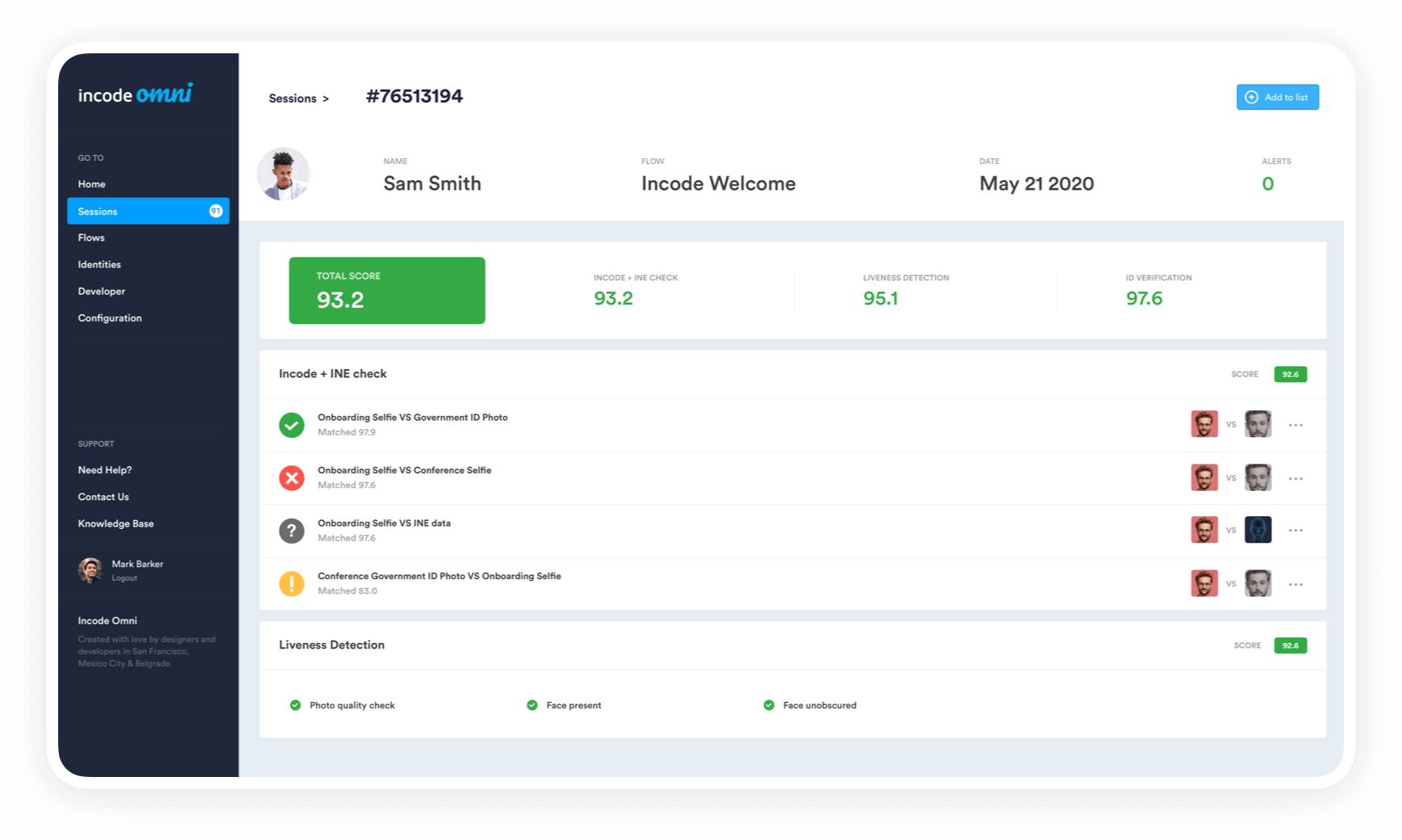

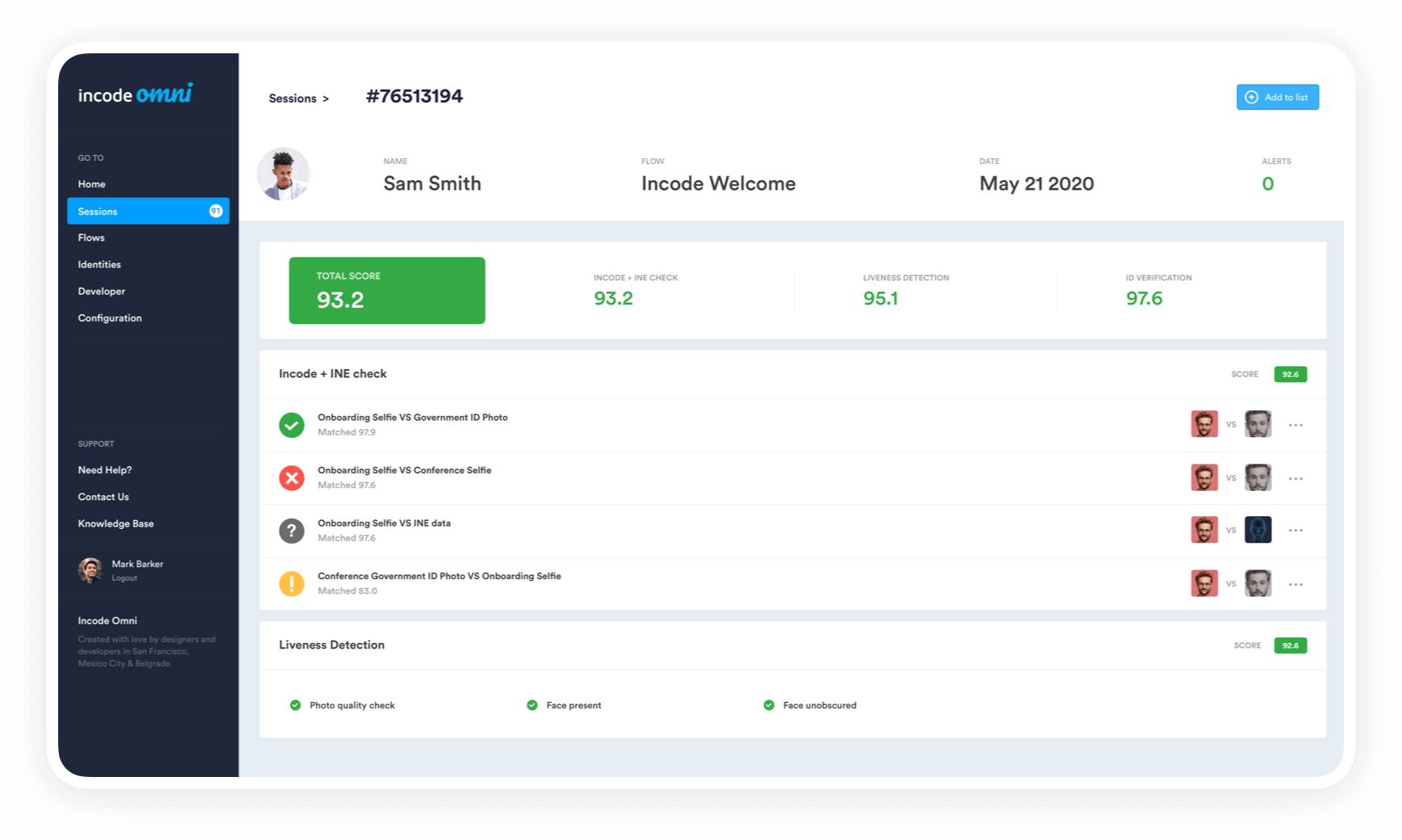

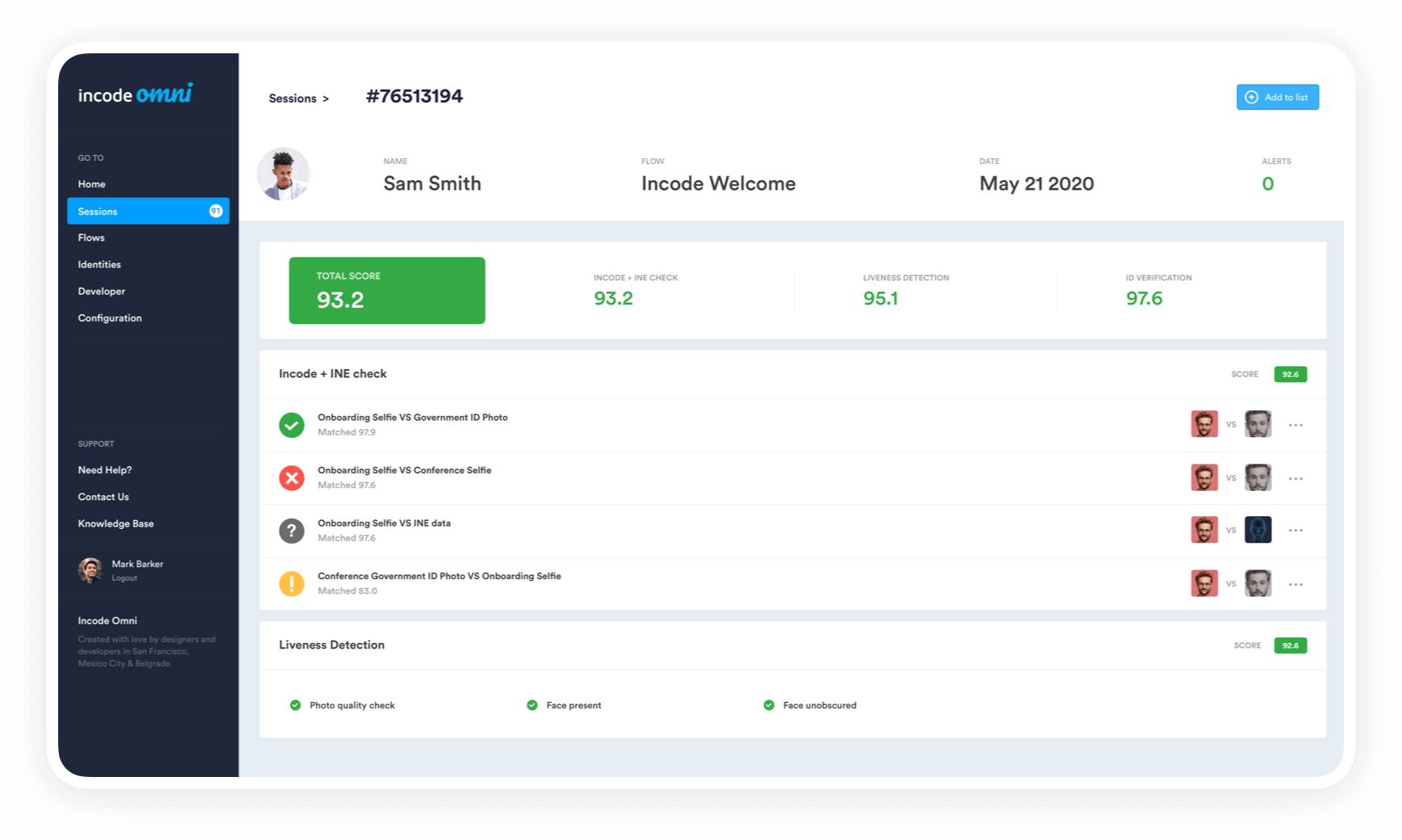

Incodes Omni platform uses what the company calls “passive liveness technology,” a proprietary, fraud-proof, liveness detection technology that is claimed to be 50 times faster than any other liveness solution on the market. Liveness detection is the use of computer vision technology used to detect the presence of a live user rather than a representation such as a picture, fake video, or mask.

The company offers a full omnichannel orchestration platform that allows companies to have a single integration point to solve the identity problem – from onboarding customers to seamlessly authenticating them once they’re onboarded. Fully automated, the service does not require humans in call centers to identify clients.

Incode notes that it also owns its entire technology stack, instead of using subvendors such as competitors. This is claimed to create a direct relationship between the enterprise and the technology owner, allowing Incode to improve its technology based on customer feedback.

The company is finding an increasing customer base with revenue multiplying by six times over the last 12 months. Notable clients include Citigroup Inc., Grupo Financiero Banorte, S.A.B. de C.V., Banco de Sabadell S.A. and Metal Pay.

“Our ‘One Identity Everywhere’ vision is transforming the way humans experience their identity journeys with companies,” Ricardo Amper, founder and chief executive officer of Incode, said in a statement. “We have created an experience that is so seamless and frictionless, it brings that ‘Wow’ moment to the end customer when onboarding to a new bank, checking into a hotel or being admitted to a hospital.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.