SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Cybersecurity firm ZeroFox Inc. is set to go public through a special-purpose acquisition company merger with L&F Acquisition Corp.

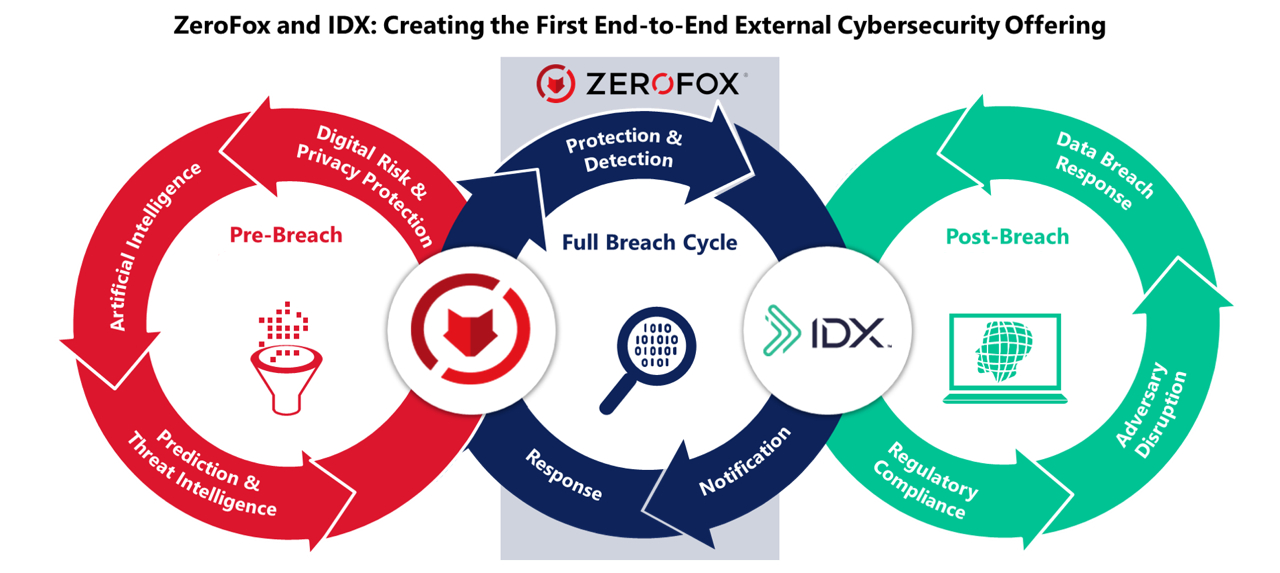

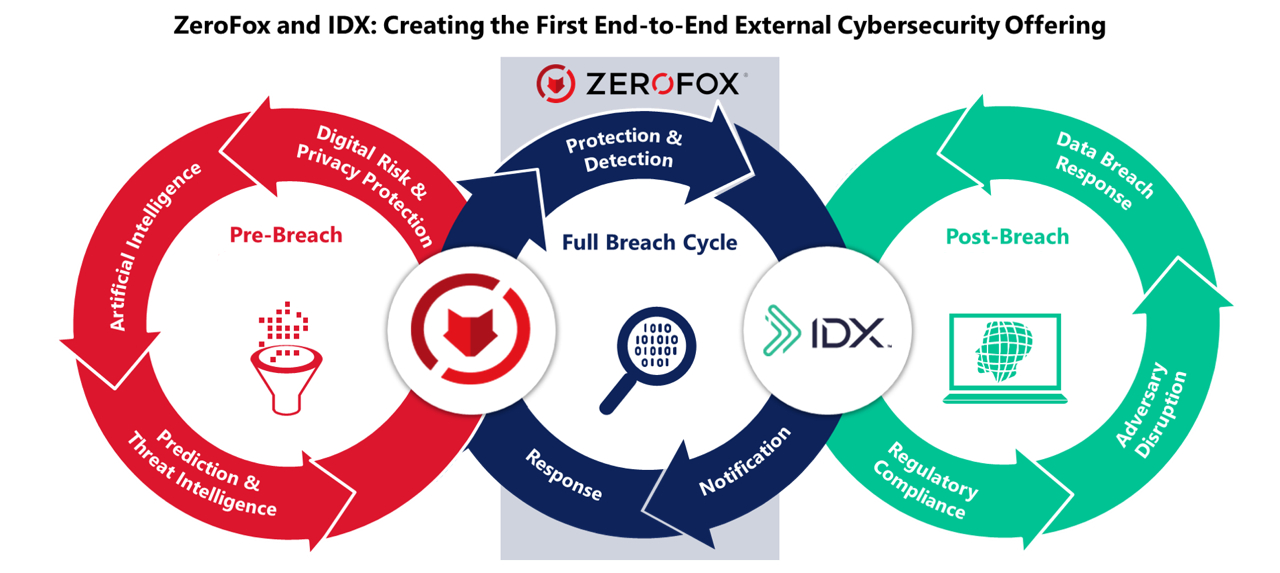

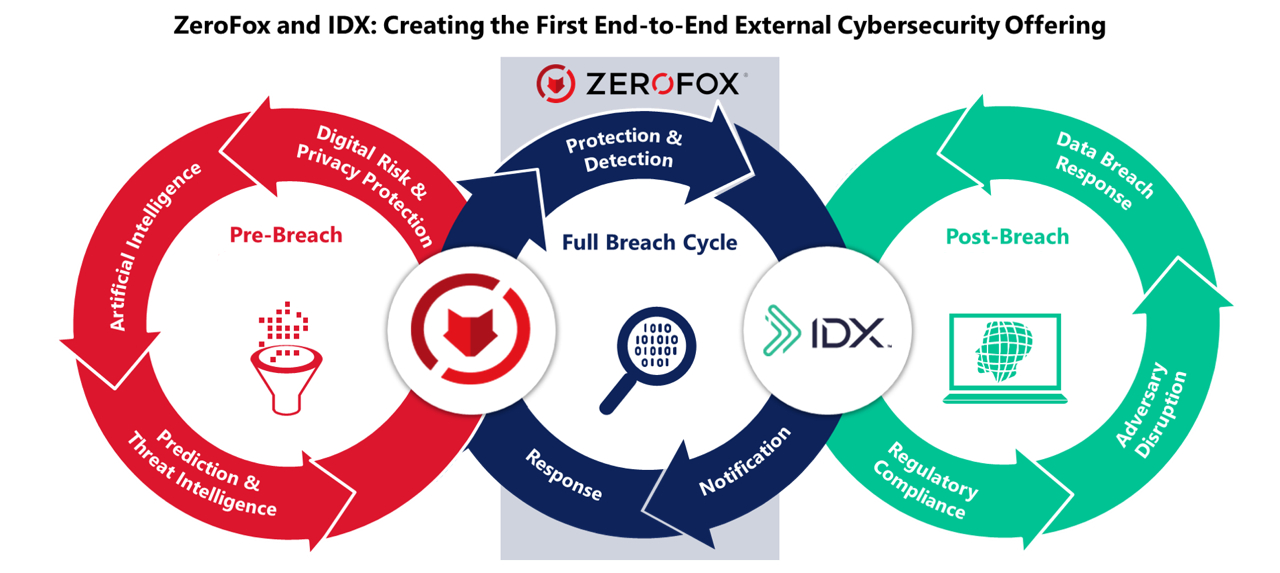

Along with the SPAC merger, ZeroFox also announced today that it’s acquiring Identity Theft Guard Solutions Inc., known as IDX.

The SPAC merger values ZeroFox at $1.4 billion. The combined company will be named ZeroFox Holdings Inc. under the stock ticker symbol “ZFOX” once the deal is complete. The deal includes Monarch Alternative Capital and other firms investing $170 million into ZeroFox.

“Since ZeroFox was founded in 2013, we have helped companies address emerging security challenges caused by the transformational shift to a ‘digital everything’ world,” ZeroFox Chief Executive James Foster said in a statement. “This rapid digital transformation has made companies vulnerable to attackers, resulting in the highest breach rate the industry has ever seen. We believe that external cybersecurity must be a top-three priority and part of the critical security tech stack for chief information security officers because perimeter firewalls and internal endpoint agents alone are not enough to protect company assets and customers.”

ZeroFox last raised venture capital in February 2020 in a $74 million round led by Intel Capital. The company’s platform finds threats by analyzing content across channels, including social media platforms, GitHub, Slack and mobile app stores. Under the hood, ZeroFox’s platform uses artificial intelligence to comb through data to isolate items that might be of interest to a company’s security team.

The company was last in the news in July when it acquired dark web intelligence research company Vigilante ATI Inc. for an undisclosed sum. ZeroFox said at the time that it would add Vigilante’s global team of expert operatives and analysts to enable access to unique data sets and exotic threat research that it claims is “unattainable by any other provider.”

IDX was founded in 2003 and offers a consumer privacy platform designed to enable consumers to take control of their privacy and identity.

In a bold claim, IDX claims to be the nation’s leading provider of external breach response services, protecting enterprises from associated risks with its proprietary digital protection and privacy platform, though it didn’t provide specific evidence of that status.

According to Crunchbase, the company had raised $47 million prior to the acquisition. Investors included BlueCross BlueShield Venture Partners, Peloton Equity, Escalate Capital Partners and Comerica.

ZeroFox said the acquisition of IDX will provide external threat protection capabilities and breach response services, a “holistic offering” for companies protecting against, or responding to, an external cyberattack. The combined company will have more than 650 employees and serve nearly 2,000 customers, including half the Fortune Top 10 and some of the largest companies in media, technology, retail and energy.

“With this transaction, we are creating the industry’s first publicly traded company that is focused on providing an enterprise external cybersecurity SaaS platform,” Foster added. “We intend to leverage this growth capital to continue investing in our artificial intelligence capabilities, scaling our go-to-market efforts and expanding our world-class team.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.