BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Investors love Snowflake Inc.’s stock at $400 and hate it at $165. That’s the nature of the business, isn’t it? Especially in this crazy cycle over the last two years of lockdowns, free money, exploding demand and now rising inflation and rates.

But with the Fed providing some clarity on its actions, the time has come to really look at the fundamentals of companies and there’s no tech company more fun to analyze than Snowflake. In this Breaking Analysis, we take a look at the action of Snowflake’s stock since its initial public offering, why it has behaved the way it has, how some sharp traders are looking at the stock and, most importantly, what customer demand looks like.

The action in Snowflake’s stock has provided great theater since its IPO.

Some lucky individuals were able to acquire the stock at its IPO price of $120 before the open. Many held their noses and bought the stock on day one at over $300… a day when it closed at around $240.

Snowflake hit $164 earlier this week, its all-time low as a public company. As Chip Symington, a longtime trader, told us, “When great companies trade at all-time lows because of panic selling, it’s worth taking a shot.” Now, of course the stock could go lower. There’s geopolitical risk and the stock, with a $64 billion market cap, is expensive for a company forecast to do around $2 billion in product revenue this year. And remember – I don’t recommend stocks and you shouldn’t trade on my comments; but I have lots of data and opinions that I’m willing to share with you.

When great companies trade at all-time lows because of panic selling, it’s worth taking a shot — Chip Symington

Stocks such as Snowflake, CrowdStrike Holdings Inc., Zscaler Inc., Okta Inc. and companies like this are highly volatile, with high betas. When markets are moving up, they’ll move faster than the mean… and when they’re declining, they drop more severely. And that’s clearly what has happened to Snowflake. So with a company such as this, you see panic selling and panic buying like we’ve seen with this name. It went from below $200 to $320 in a very short period of time last year.

Some investors believe Snowflake put in a short-term bottom this past week and many felt the issue was oversold.

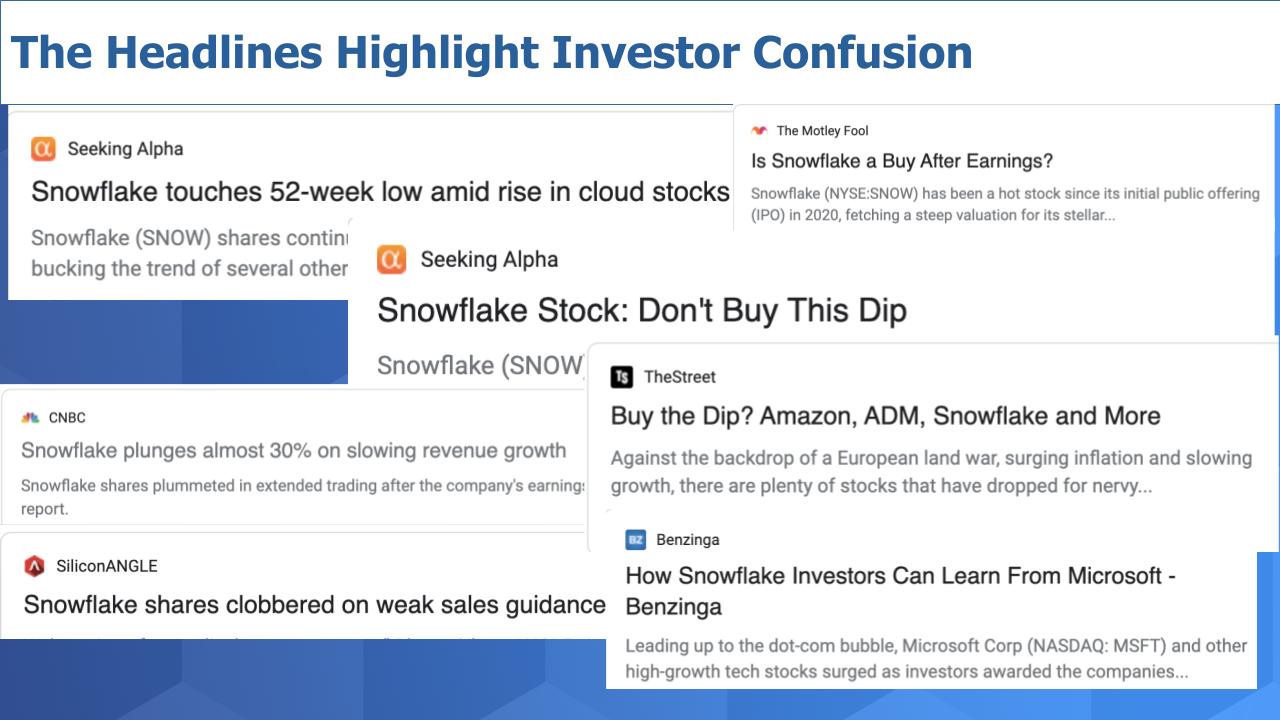

But not everyone felt bullish, and you could see that in the headlines:

Look at the headlines in the graphic above. “Snowflake hits low but cloud stocks rise…” Let’s come back to that. Is it a buy? Don’t buy the dip! Buy the dip? And what Snowflake investors can learn from Microsoft Corp. And Daniel Martins wrote on TheStreet: “SNOW stock is sliding on the back of ill-received guidance.”

To that last comment, we would say conservative guidance these days is anything but ill-conceived.

Let’s unpack all this a bit. To do so, we reached out to Ivana Delevska, who has been on this program before. She’s with SPEAR Invest – a female-led adviser that goes deep into understanding supply chains. She came on Breaking Analysis and laid out her “buy the dip” thesis on Snowflake.

She told us SPEAR still likes Snowflake and it has doubled its position. In her analysis she called out two drivers for the downside on Snowflake’s stock: 1) interest rates; and 2) Snowflake’s conservative guide.

Let’s dig into that further. Snowflake guided for product revenue growth of 67%, which was below buy-side expectations but within sell-side consensus. So Snowflake’s chief financial officer chose in his guidance to moderate expectations and keep them below the so-called “whisper numbers.”

Regardless, the guide was nuanced and in a large part driven by Snowflake’s decision to pass along price efficiencies to customers from optimizing processor price/performance. This will hit a net of about $100 million in revenue this year to Snowflake’s income statement. But the timing is not precise. Snowflake estimates it will lose around $165 million in revenue as a result of the price change but gain back around $65 million through increased demand.

Chief Executive Frank Slootman on the earnings call said, “This is not philanthropy – this stimulates demand.” That’s classic Slootman. The point is SPEAR and other bulls believe this will result in a gain for Snowflake over the medium term and we would agree. When the price goes down, return on investment goes up. Customers will respond by allocating more projects to Snowflake and, in our view, this gives the company an advantage as they continue to build its competitive moat.

It’s a longer-term bet on cloud and data. Good bets in our opinion.

Now, some of this could also be related to competitive threats. There have been published studies from independent firms (possibly sponsored) attacking Snowflake’s price/performance and making comparisons. Oracle has also been publicly aggressive, as have others, but so far it hasn’t seemed to affect Snowflake as its customers continue to consume.

Back to the article on what can we learn from Microsoft that applies to Snowflake… the article from Benzinga.

The article quoted a wealth manager named Josh Brown talking about what happened to Microsoft after the dot-com bubble burst. It explained how Microsoft quadrupled earnings over the next decade and the stock went sideways, suggesting the same thing could happen to Snowflake and investors could end up with no return. Although that is possibly true, the comparison didn’t resonate, in our view.

First, Microsoft was a $23 billion company at the time and had earned a monopoly position. Microsoft was already highly profitable then the bubble burst. Steve Ballmer became CEO of Microsoft right after the boom and he held on to Windows for dear life. He basically lived off Microsoft’s personal computer software monopoly. During Ballmer’s tenure, Microsoft became an extremely profitable and remarkably uninteresting caretaker of a PC and on-premises software estate. It was the story of “maximum vanilla.”

So we just don’t see the comparison as relevant. Snowflake may struggle for other reasons, but that one didn’t make sense.

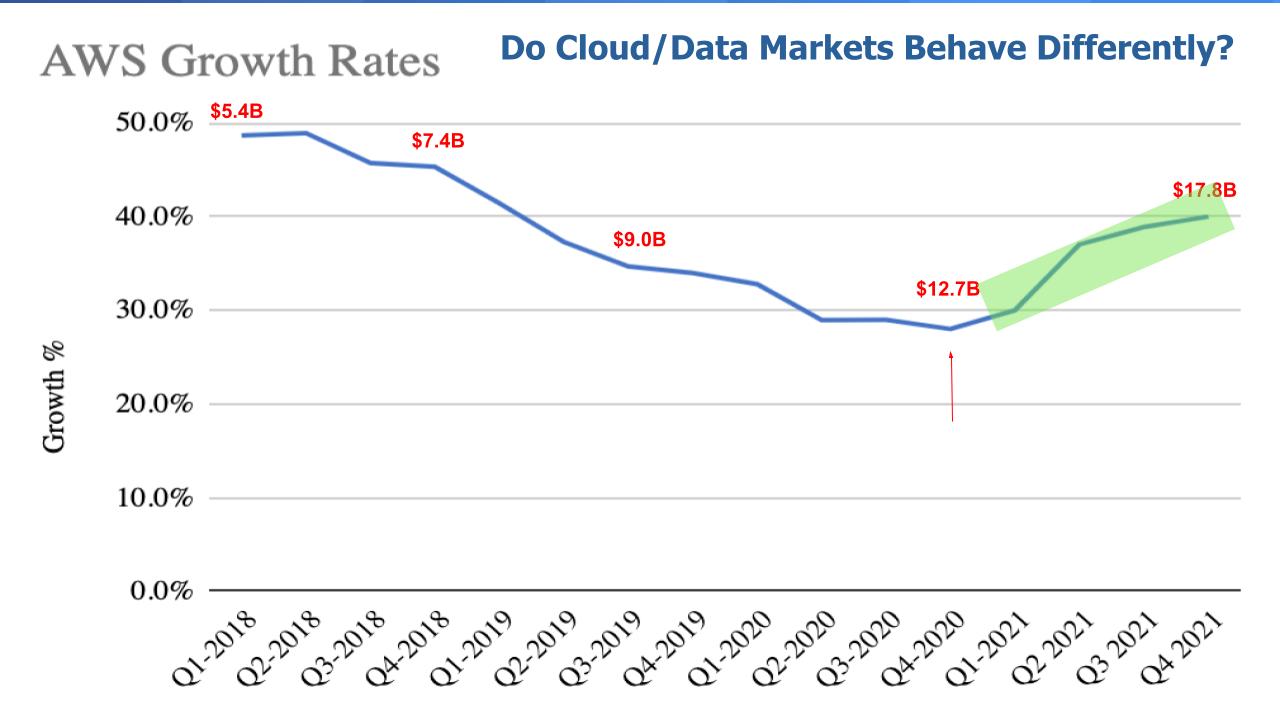

Take a look at the chart below:

It poses the question: Do cloud data markets behave differently than traditional on-prem models? The chart shows Amazon Web Services Inc.’s growth rates over time, and superimposes revenue in red. In the first quarter of 2018, AWS generated $5.4 billion in revenue and was growing at nearly a 50% rate. That rate decelerated quite significantly as AWS grew to a $50 billion run rate company. Makes sense, right? Law of large numbers: Can’t keep growing as fast when you get that big.

Well… look what happens in 2021. AWS’ growth rate bottoms in the high 20s and then rockets back up to 40% this past quarter as AWS surpasses a $70 billion revenue run rate.

So you have to ask: Is cloud different? Is data different? Is cloud data different? Will the Snowflake Data Cloud be different? Can cloud, because of its consumption model, speed of innovation, ecosystem depth and breadth and network effects, enable Snowflake to exhibit lots of variability in its growth rates versus a progressive and somewhat linear decline in growth as the company grows?

It’s entirely possible and even probable.

Having a large market is critical to companies such as Snowflake. If they run out of market, it limits a company’s strategic options. It happened to Slootman at Data Domain. It has happened to many great and good companies — EMC Corp., Sun Microsystems Inc., Digital Equipment Corp., Tableau Software Inc., Slack Inc., Netscape Communications Inc., Lotus Development Corp., Marketo Inc. and dozens of other companies that ran into headwinds in part because of a lack of market.

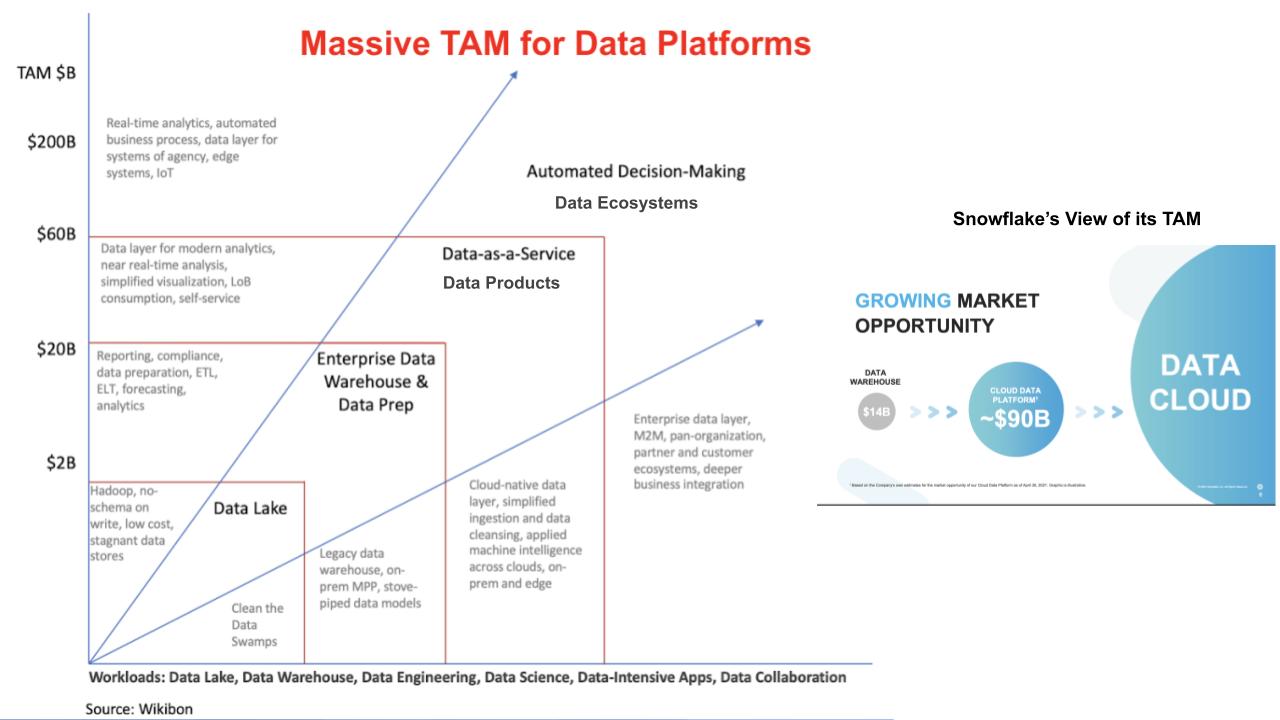

Below is a chart we’ve shared before with some additions. It’s our version of Snowflake’s total available market. With Snowflake’s version superimposed on the right.

It shows the various layers of market opportunity that Snowflake and others have in front of them. Emerging from the disruption of legacy data lakes and data warehouses to what Snowflake refers to as its data cloud (maps to our third and fourth layers). We think about the data mesh concept and decentralized data architectures with domain ownership and data product/service builders as consistent with Snowflake’s data cloud vision, where Snowflake data stores are nodes on the mesh that can be discovered, shared and of course are governed in a federated model — along with data lakes, data marts, Amazon S3 buckets and other data repositories.

And then it gets fuzzy in the outer layers where data from edge locations becomes massive and decision-making occurs in real time, where machines and machine data take over the world. Sounds out there, but it’s real and how exactly Snowflake plays there is unclear. It’s not a real-time engine – it’s an analytical system moving into the realm of data science and we’ve talked about the need for a semantic layer between those two worlds. But expanding the scope further out, we think Snowflake has a big role to play in this future. And the size of this future is massive.

As analysts who view companies through a fundamentals prism, you look at markets and TAM, but you also want to understand the customers, customer adoption and buying patterns and why they buy.

It’s easy to find Snowflake customers. Capital One, Disney, Micron, Allianz, Sainsbury, Sonos and hundreds of other companies will speak publicly about Snowflake. We’ve interviewed Snowflake customers who have also been customers of Oracle Corp., Teradata Corp., IBM Corp. with Netezza, Hewlett Packard Enterprise Co.’s Vertica Systems– serious database practitioners who tell us that Snowflake is different. It’s simpler, more agile, less complicated to secure and disruptive to their traditional ways of doing data management.

There are naysayers. We’ve spoken to a number of analysts who feel Snowflake is deficient in areas such as workload management and complex joins and is too specialized in a world where we’re seeing the convergence of analytics and transactional workloads. Wikibon’s own David Floyer believes that what Oracle is doing with MySQL Heatwave is radically disruptive to many of the database architectures and blows away anything out there. And he has stated that Snowflake is not architected for real-time inference, where a lot of that multihundred billion-dollar market is going.

And look, Snowflake has a ton of competition. All the major cloud players have very capable competitive database platforms – even though they all partner with Snowflake… except Oracle, of course. But companies such as Databricks Inc. and lots of other venture-funded companies that have raised billions of dollars to do elastic, consumption-based workloads separate compute from storage stuff.

So you have to always keep an open mind and be aware of blind spots to these companies. But to the criticisms, we would say Snowflake really got there first, and we would watch their ecosystem. It is a key to its continued success. Snowflake will not go it alone and it will use ecosystem partners to expand its reach and accelerate network effects and fill gaps.

And it will acquire. Its stock is valuable, so it should be doing that as it just did with Streamlit, a zero-revenue company Snowflake acquired for $800 million in stock and cash. Streamlit is an open-source Python library that gets Snowflake further into the data science business. And watch what Snowflake is doing with Snowpark – an application programming interface library for processing data and building data-intensive applications.

Rather than trying to do it all themselves, it seems Snowflake is staring at the API economy and building its ecosystem to plug holes.

Back to the customers.

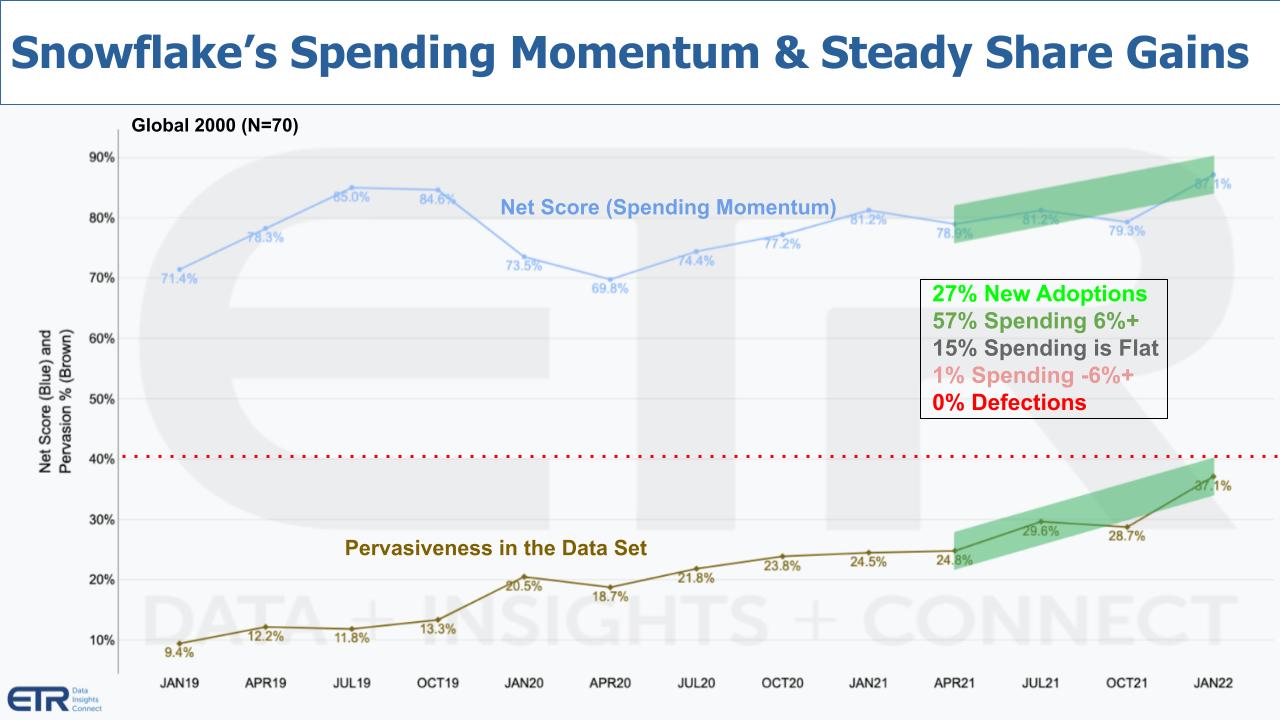

The chart above shows Snowflake’s customer spending momentum or Net Score on the top blue line and pervasiveness in the data or marketshare on the bottom brown line. Snowflake has unprecedented Net Scores and has held them up for many quarters, all leading to its market share penetration.

This chart shows Net Score in the Global 2000, which indicates Snowflake has even greater momentum with these customers.

Now, we will point out the following. We don’t see how this performance is sustainable in the Enterprise Technology Research survey. We wouldn’t be at all surprised to see Snowflake come back to earth in one of the ETR surveys this year.

Even then, however, we would expect it to maintain a high spending velocity score. In our view, it’s likely that we’re going to see Snowflake porpoise a bit here – meaning moderate and come back up and undulate a bit. It’s just really hard to sustain this pace of momentum and hire, train, retain and scale without absorbing some friction that will slow you down.

But to the AWS growth example earlier, it’s entirely possible we could see a similar dynamic with Snowflake. You could see an AWS and, say, a Salesforce.com Inc. or a ServiceNow Inc. — very successful, large, entrenched high-growth companies that show sustained momentum.

Snowflake, we think, will achieve that status sometime this decade.

Even though people are concerned about the moderated guidance of 80% growth – yeah, that’s the new definition of tepid – we like to look at remaining performance obligations. Snowflake’s RPO is up to something like $2.6 billion now and it’s an indicator of future success. Its other metrics are also off the charts and though we do expect some moderation in growth rates, we believe management is being prudently cautiously in its guidance. For a stock valued as highly as Snowflake, we think that’s smart.

So you’re going to see some ups and downs, we have no doubt, but things are still looking pretty solid for Snowflake. Growth companies such as Snowflake and the ones we mentioned earlier have probably been repriced and refactored by investors. And though there’s always market and geopolitical risk – especially in these times — fundamentals matter.

Snowflake: Huge market, well capitalized, leadership product position, strong customer adoption and great team.

Team is something we haven’t touched on but it’s a critical fundamental. We’ll leave you with this thought. Everyone knows about Slootman and CFO Mike Scarpelli and what they’ve accomplished in the years they’ve worked together. It’s not just those two, of course, but their ability to attract and retain talent. They complement brilliant technical founders. We saw this at Data Domain, ServiceNow and again at Snowflake.

Slootman just documented much of this in his book “Amp it Up,” which gives great insider insight into how he thinks about companies, markets and his management style. But you have to wonder how long he’s going to keep going.

What keeps Frank Slootman motivated? We asked him one time and here’s what he said on theCUBE, explaining why he’s still at it:

So there you have it. He’s in it for the sport! How great is that? He loves building companies. That’s how he thinks about success. It’s not for the money – that’s the byproduct of success. As Earl Nightingale would say: “Success is the progressive realization of a worthy ideal.” It’s about building great companies, building products that change the world, changing people’s lives with data and insights, creating jobs, creating life altering wealth opportunities – not for himself – but for thousands of employees and partners.

We’d say that’s a pretty worthy ideal and we hope Frank Slootman sticks with it for a while.

Thanks to Stephanie Chan who researched several topics for this episode, and to Alex Myerson on production. Alex also handles the podcasts and media workflows. And special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor-in-chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.