INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

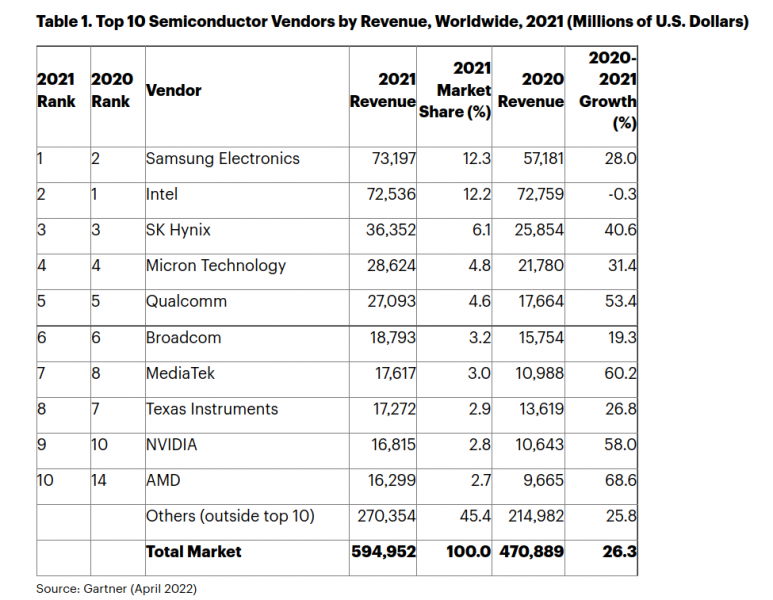

Ongoing shortages in the semiconductor industry helped chipmakers’ revenue jump by more than 26% last year, hitting $595 billion.

Today’s report from Gartner Inc. also reveals the impact of U.S. sanctions on China, which saw its market share fall dramatically. It no longer has a single chip manufacturer that ranks in the top 10 list.

The main beneficiary of China’s declining market share appears to be Samsung Electronics Ltd., which surpassed Intel Corp. to become the world’s biggest semiconductor maker in terms of revenue. Revenue for its chip business jumped 28% in 2021 from the year earlier, to $73.2 billion.

That puts the company just ahead of Intel, which saw revenue slip by 0.3%, to $72.5 billion. In terms of market share, Samsung commands 12.3% of all chip revenues, compared to Intel’s 12.2%.

Computer chipmakers are raking in the profits despite a semiconductor shortage that has been plaguing the world for the best part of three years now. The shortage is unlikely to be abated anytime soon either. On a conference call with investors this week, Taiwan Semiconductor Manufacturing Co. Chief Executive CC Wei said he believes component shortages will continue for the foreseeable future, with “tight production capacity” across its entire operation.

Although the shortages are likely one of the main factors driving price increases and therefore increased profits for chipmakers, China has struggled to benefit. China’s overall share of the computer chip market shrunk from 6.7% to 6.5%. Its biggest chipmaker, HiSilicon Technologies Co. Ltd., saw revenue decline by 81% from 2020 to 2021.

Gartner Research Vice President Andrew Norwood said the blame for this lies squarely at the feet of U.S. sanctions on HiSilicon’s parent company, Huawei Technologies Co. Ltd.

With China’s market share in decline, South Korea enjoyed the largest increase in market share, and now commands 19.3% of all semiconductor revenues.

In terms of market segments, revenue from wireless communications chips rose 24.6% in 2021, while the number of 5G chipsets for handsets manufactured in the last year more than doubled, from 251 million units in 2020 to 556 million units last year. The automotive chip market saw even bigger growth of almost 35%, outperforming all other segments.

The biggest profit driver overall, however, remains dynamic random-access memory chips. Revenue grew by 33.2% to account for 28% of all semiconductor sales in 2021.

Memory continued to benefit from the shift to home and hybrid working and learning, Gartner explained. That prompted more server deployments by “hyperscale” cloud service providers such as Amazon Web Services Inc., Microsoft Corp. and Google Cloud, as well as a surge in demand for PCs and mobile devices.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.