AI

AI

AI

AI

AI

AI

Like a marathon runner pumped up on adrenaline, UiPath Inc. sprinted to the lead in what is surely going to be a long journey toward enabling the modern automated enterprise.

In doing so, the company has established itself as a leader in enterprise automation, while at the same time getting out over its skis on critical execution items and disappointing investors along the way. In our view, the company has plenty of upside potential but will have to slog through its current challenges, including restructuring its go-to-market efforts, prioritizing investments, balancing growth with profitability, and dealing with a difficult macro environment.

In this Breaking Analysis and ahead of Forward 5, UiPath’s customer conference in Las Vegas Sept. 27-29, we once again dig into robotic process automation leader UiPath to share our most current data and view of the company’s prospects, its performance relative to the competition, and the market overall.

Since the pandemic, four sectors have consistently outperformed in the overall tech spending landscape – cloud, containers, machine learning/artificial intelligence and robotic process automation.

We entered 2022 with the expectation that information technology spending would increase by more than 8% in 2022. In the last Enterprises Technology Research macro survey we saw those expectations moderate to just over 6%. We would expect the next ETR macro drill-down in October to show continued deceleration in spending expectations – perhaps as low as the 4% to 5% range.

All sectors are showing softness, as no sector in the ETR data set has shown a significant increase in spending expectations. For the first time in a long time, ML/AI and RPA have dropped below the elevated 40% line shown in this ETR graph above. The data plots the Net Score or spending momentum for each sector with videoconferencing added to simply provide height to the vertical axis. The squiggly lines for ML/AI and RPA demonstrate the downward trajectory over time with only the most current period dropping below the 40% Net Score mark.

While this is not surprising, it underscores one component of the macro headwinds facing all companies generally and UiPath specifically. That is the discretionary nature of certain technology investments. It has been a topic of conversation on theCUBE since the spring, affecting strong data players such as MongoDB Inc. and Snowflake Inc., the cloud, security and other sectors.

The point is ML/AI and RPA appear to be more discretionary than certain sectors, including cloud. Containers most likely continue to benefit from the fact that much of the activity is spending on internal resources – i.e. developers — as much of the action in containers is free and open source. Security is not shown, but as we’ve previously reported, it’s somewhat less discretionary than other sectors.

As it relates to the Big Four above that we’ve been highlighting since the pandemic hit, we’re starting to see CIOs prioritize more tactical and low friction areas like cloud over strategic investments such as AI and automation.

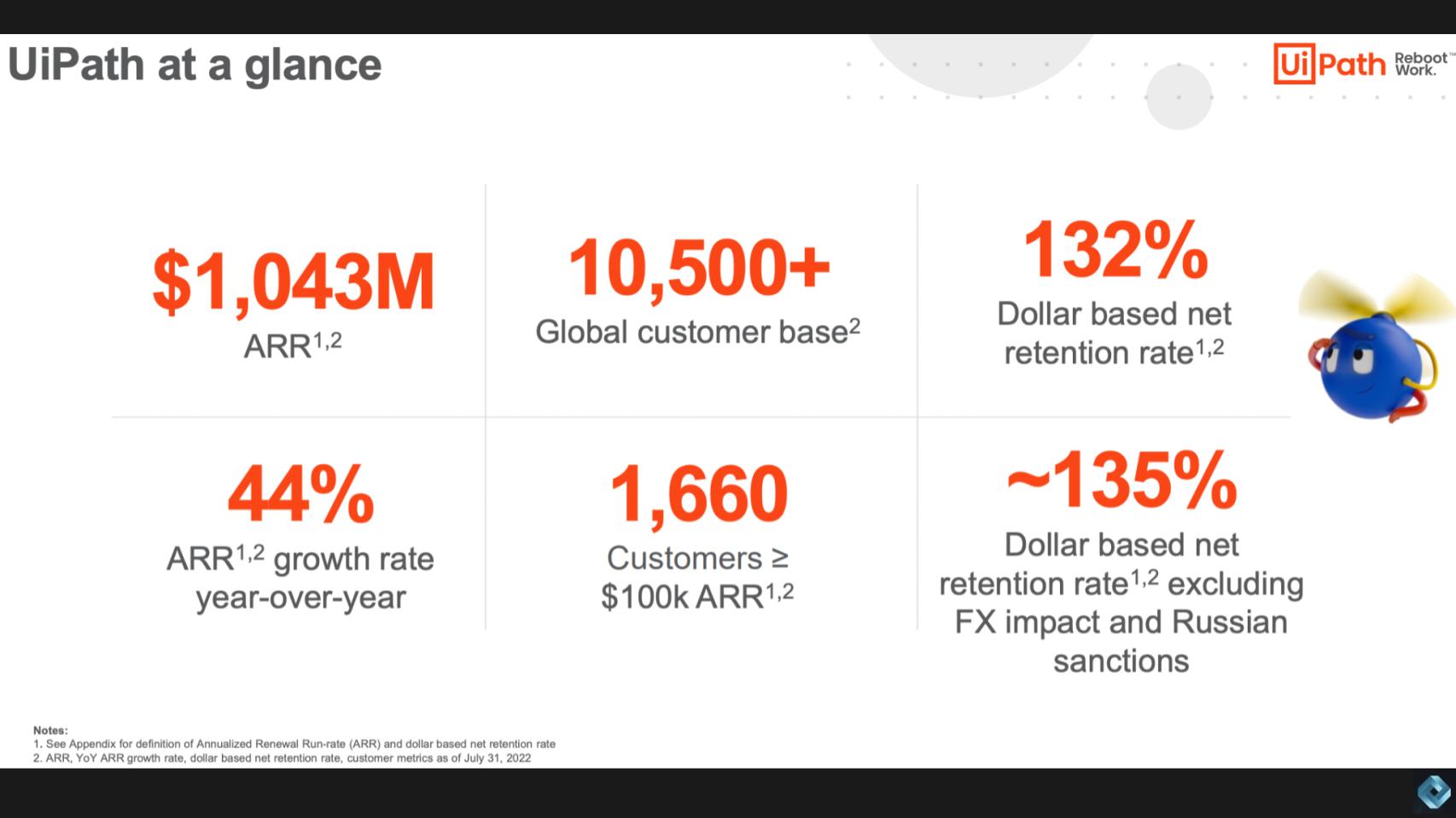

UiPath has not been immune to this downward pressure, but the company is still able to show some impressive metrics.

The above chart provides a snapshot from UiPath’s investor deck. For the first time, UiPath’s ARR has surpassed $1 billion. The company now has more than 10,000 customers, with a large number generating more than $100,000 in annual recurring revenue. Though not shown in this data, UiPath reported this month in its second-quarter close that it had 190 $1 million-plus ARR customers, which is up 13% sequentially from its first quarter. As well, the company’s net revenue retention is over 130%, which is solid and underscores the low churn which we’ve previously reported for the company.

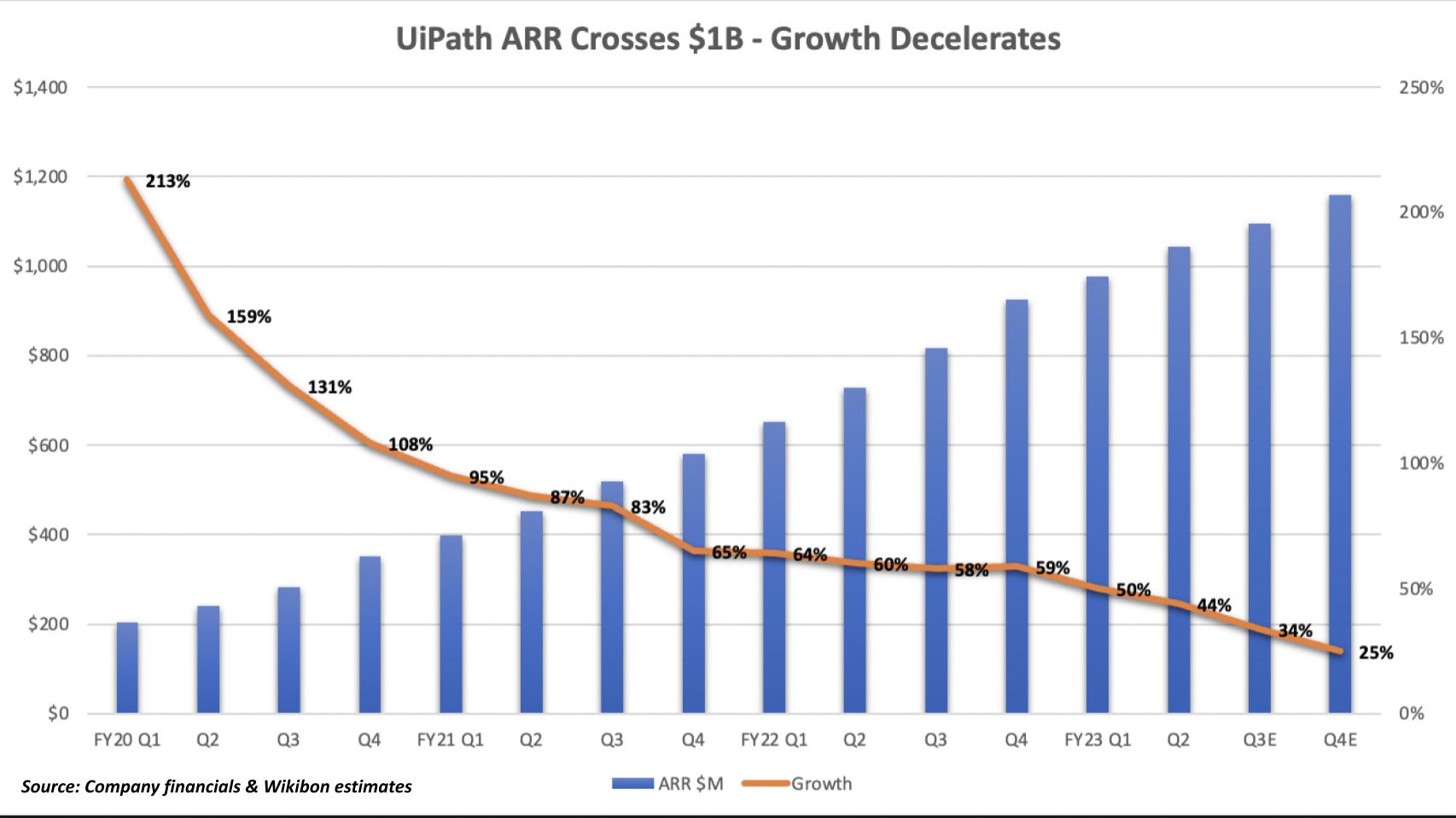

It’s very rare to see a company’s growth rate dramatically accelerate when it reaches a significant size. It’s often why more mature companies turn to mergers and acquisitions to accelerate the top line. Amazon Web Services Inc. and Microsoft Corp.’s Azure business are two exceptions to this rule, but generally as a company reaches critical mass, growth slows, and that’s what the data shows for UiPath.

We created this chart above from UiPath financials and Wikibon estimates. It shows the dramatic growth in ARR (the blue bars) compared with the rapid deceleration in ARR growth (the orange line). For the first time, UiPath’s ARR growth dipped below 50% last quarter. We’ve projected 34% and 25%, respectively, for the company’s third and fourth quarters which is slightly higher than the upper range of UiPath Chief Financial Officer Ashim Gupta’s guidance from the last earnings call. That still puts UiPath exiting its fiscal year at a 25% ARR growth rate.

While it’s not unexpected that a company reaching the $1 billion ARR milestone will begin to show slower growth, net new ARR for UiPath is off its fiscal year 2022 levels. The other perhaps more concerning factor is the company, despite strong 80%-plus gross margins, remains unprofitable and free cash flow negative. New co-Chief Executive Rob Enslin has emphasized the focus on profitability and we’d like to see a consistent and disciplined rule of 40 performance going forward.

UiPath’s growth has slowed and management has lowered guidance. The company has discussed significant macro challenges including currency fluctuations and weaker demand (especially in Europe and Asia-Pacific). The stock has reacted poorly, as shown above, and has been on a steady decline.

All growth stocks are facing challenges related to inflation, rising interest rates and a looming recession, but as seen above, UiPath has significantly underperformed relative to the tech heavy Nasdaq. UiPath has admitted to execution challenges and it has brought in an expanded management team to facilitate its sales transition and desire to be a more strategic platform play versus a tactical point product.

Adding to this challenge are foreign exchange issues. As we’re previously reported, unlike most high-flying tech companies from Silicon Valley, UiPath has a much larger proportion of business coming from locations outside of the U.S. – around 50% of its revenue. Because it prices in local currencies, when you convert to appreciated dollars there are less of them and that weighs on revenue.

We asked Breaking Analysis contributor Chip Symington, former managing director of institutional trading for Piper Jaffray, for his take on the stock and he told us the following:

From a technical standpoint there’s really not much you can say – it just looks like a falling knife. It’s trading at an all-time low, but that doesn’t mean it can’t go lower. New management with a good product is always a positive with a stock like this but this is just a bad environment for UiPath and all growth stocks, really. And 95% of money managers have never operated in this type of environment before, so that creates more uncertainty. There will be a bottom, but picking it in this high-inflation, high-interest rate world hasn’t worked lately. There’s really no floor to these growth stocks that have no earnings until you start to trade toward cash levels.

UiPath has $1.6 billion in cash on the balance sheet and no debt, so we’re a long way from cash levels with its current $7 billion valuation. But you have to go back to April 2019 to UiPath’s Series D funding round to find its previous $7 billion valuation, so as Symington says, the stock could still go lower. The valuation range for this stock has been quite remarkable – from around $44 billion last May to $7 billion today – quite a swing.

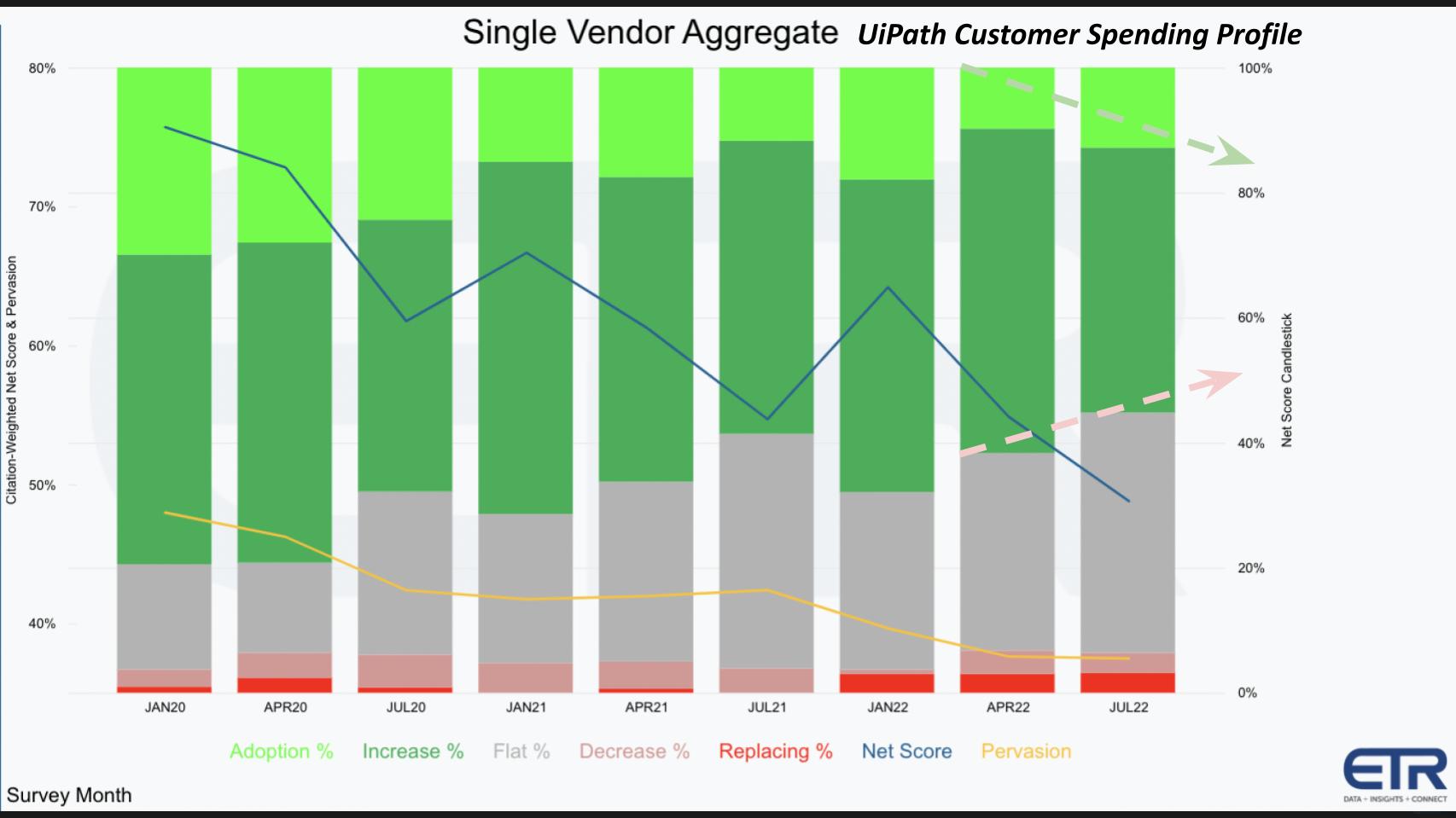

The graphic above shows the Net Score or spending momentum granularity for UiPath. The lime green is new adds, the forest green is spending 6% or more, the gray is flat spend, the pink is spending is down by 6% or worse and the bright red is churn. Subtract the red from the green and you get Net Score, which is the blue line.

The yellow line is Pervasiveness within the data set and is skewed because of Microsoft’s large number of citations. There’s a belief from some that competition from Microsoft is the reason for UiPath’s troubles, but Microsoft is really delivering RPA for individuals and isn’t an enterprise automation platform – at least not today. But it’s Microsoft, so you can’t discount the company’s presence in the market and possible impact on competitors.

The data above is through the July survey but taking a glimpse at the early October returns they’re trending with the arrows – meaning less green – more gray and red, which will lower UiPath’s overall Net Score – consistent with the macro headwinds it is seeing.

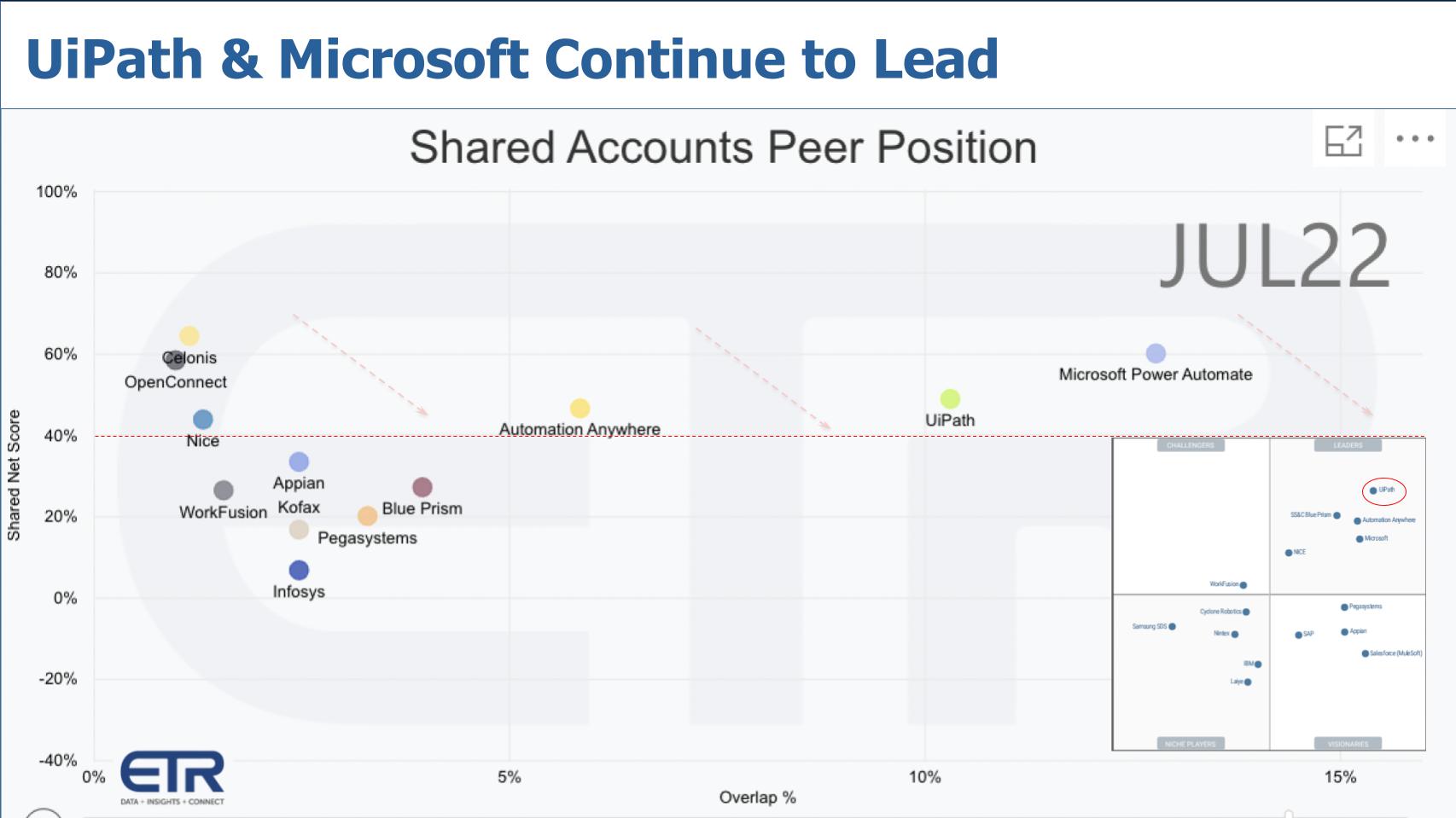

Despite its challenges, UiPath continues to get high marks from customers and analysts, and relative to peers, it maintains a leadership position in the ETR data set.

This chart above shows Net Score or spending velocity on the vertical axis and Overlap or presence in the data set on the horizontal axis. Microsoft continues to have a big presence and, as we mentioned, somewhat skews the data. UiPath has maintained its lead relative to Automation Anywhere Inc. on the horizontal axis and remains ahead of the legacy pack of business process and other RPA vendors. Celonis GmbH has popped up in the ETR data set as a process mining player. This is a critical market UiPath entered via its acquisition of Process Gold in October of 2019 and we expect UiPath to continue to gain ground in the process mining discipline as part of its integrated platform play.

We’ve also inserted a thumbnail of the most recent Gartner Magic Quadrant for RPA. We don’t show the detail, but we’ve circled the position of UiPath in red. The company leads on both axes ahead of all players, including Microsoft.

We’re still not seeing the likes of SAP SE, ServiceNow Inc. and Salesforce Inc. show up in the ETR data, but these enterprise software vendors are in a reasonable position to capitalize on automation opportunities within their installed bases. This is why it’s so important that UiPath transitions to an enterprise-wide horizontal play that can cut across multiple enterprise resource planning, customer relationship management, human capital management and service management platforms. Although the big software companies can add automation to their respective stovepipes, UiPath’s opportunity is to bring automation and enable enterprises to build on top of and across the SaaS platforms that are running their companies.

Notably, on the chart you see the red arrows slanting down – that signifies the expected trend from the October ETR survey, which is currently in the field and will run through early next month. Suffice it to say there is downward spending pressure across the board and we would expect most of these names, including UiPath, to dip below the 40% dotted line.

Let’s discuss UiPath’s platform play.

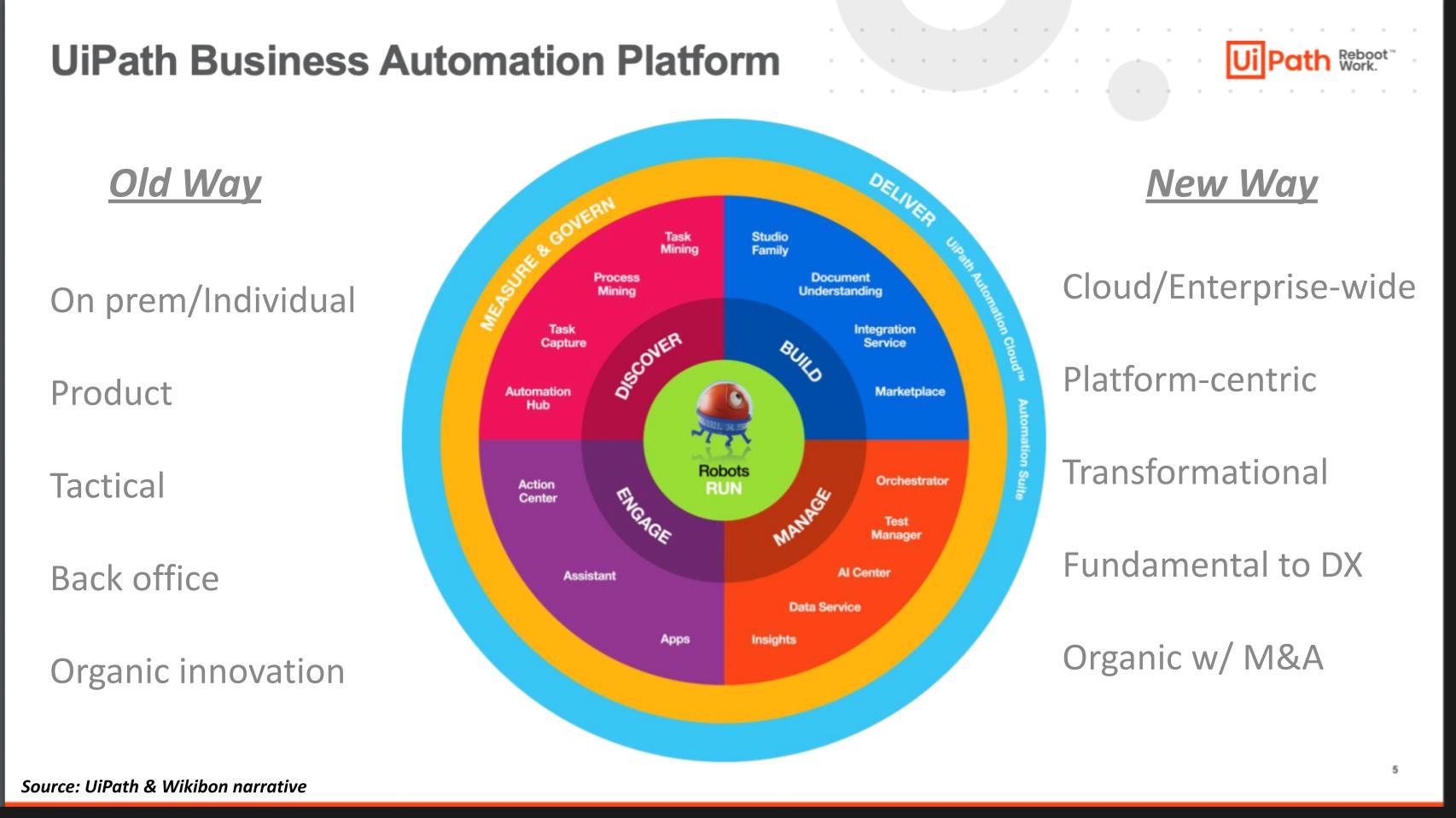

The graphic above is from an older UiPath investor deck that underscores the move from product to platform. UiPath has expanded its platform significantly. It’s moved from an initial on-premises point product, automating tasks for individuals and back offices, to a cloud-first platform with many more features and capabilities. The company has made a number of critical technology acquisitions to build out its platform. These include the previously mentioned Process Gold for process discovery, process documentation from the acquisition of StepShot, application programming interface automation via the acquisition of Cloud Elements, and its more recent acquisition of Re:Infer, a natural language processing specialist.

The company is positioning its automation platform as a fundamental ingredient of customers’ digital transformations. This is a distinctly different value proposition relative to UiPath’s early days where customers could install a software robot and start attacking mundane processes virtually overnight. The sales cycles will be longer, and the change management for customers will be more complicated, but the returns should be much larger and transformational for organizations.

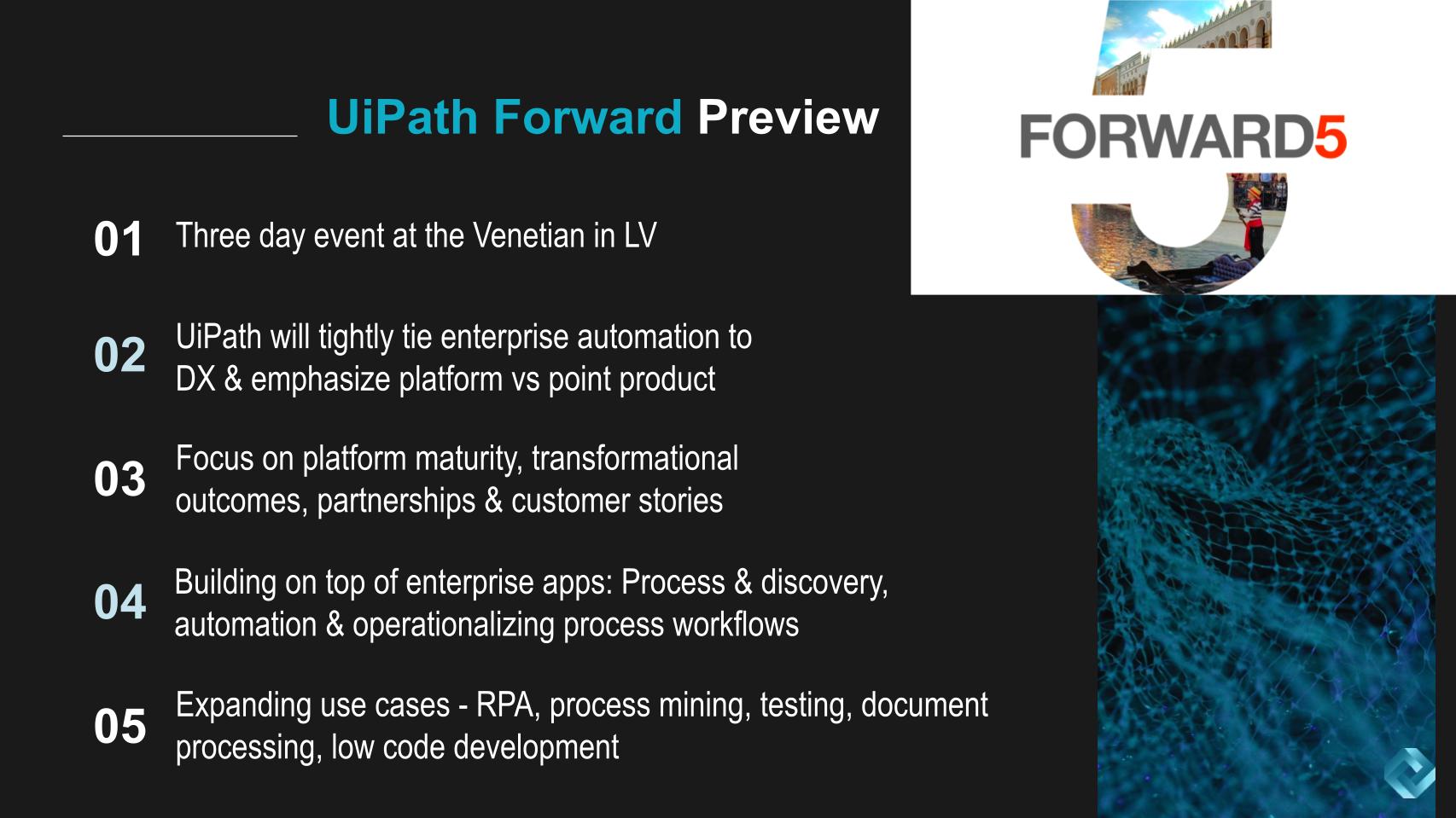

We expect platform to be a big focus of Forward 5, a three-day event this coming week at the Venetian in Las Vegas. It will likely be the most heavily attended in-person event in the company’s history.

It would make sense for UiPath to introduce a new description of its platform at the conference that articulates how it plans to fuse personal automation with enterprise-wide transformations. In some ways, we can draw analogies with ServiceNow’s platform, or Salesforce is perhaps an even better example, where an initial installation solves a tactical problem and then can be expanded across the enterprise to more departments with an increased number of use cases.

As such, we expect UiPath to heavily emphasize the role of automation in the context of digital transformation, and how it has evolved from point product to platform to support DX. Specifically, observers should expect a focus on platform maturity. When UiPath announced its platform intentions in 2019, the last physical customer event prior to COVID, it essentially was laying out a statement of direction that evolved during the pandemic. Last year at Forward IV, we saw the beginnings of this vision in product form. This year we expect that vision to be more real from a product perspective.

In conjunction with this evolution, the company has evolved its partnerships. We’ve seen recent pairings with the likes of Snowflake in the Data Cloud, CrowdStrike Holdings Inc. to provide better security, and of course the big global system integrators to help implement enterprise automation. And we expect to hear a lot from customers about strategic outcomes and how they’re digitally transforming (there are more than 100 customers speaking at the event).

Earlier we touched on the fact that we haven’t seen the big ERP and enterprise software companies show up yet in the ETR data. We know they’re out selling automation and RPA as part of their offerings. And they’re competing. So expect UiPath to position itself (and de-position the enterprise software vendors). UiPath aspires to be a layer above these bespoke platforms (see 04 above), with process discovery and task discovery as foundations to build in automation across enterprise apps, and operationalizing process workflows as a horizontal play.

We look forward to hearing more about this new vision and how UiPath is turning it into product.

And, as we showed earlier in the platform discussion, we expect to hear a lot about the new platform features and use case examples they enable. Not just RPA, but process mining, testing automation, which is a new vector of growth for UiPath, document processing and so forth. We also expect UiPath to address its low-code development capabilities to expand the number of people in the organization that can create automation capabilities… that is, those domain experts who deeply understand the business but aren’t software engineers.

Finally, we expect this conference to set the tone for a new chapter in UiPath’s history. It’s the company’s second in-person gathering since the pandemic. UiPath has a new operations and go-to-market-oriented co-CEO in Rob Enslin, new sales management and the so-called adult supervision that has been lacking at UiPath historically. Daniel Dines will no doubt continue to have a big presence at the event and the company. He’s not a figurehead. Dines has a deep understanding of the product and market. Both co-CEOs will be on theCUBE together and it will be a great opportunity to find out how they envision complementing each other, their respective strengths and how they see the future of enterprise automation and UiPath.

UiPath has rocketed to a leading position in the market. The slingshot effect of growing rapidly, going public and living under the scrutiny of the quarterly shot clock has forced the company to take a pause and reset expectations. At the same time it has been executing on a broader vision to be the clear leader in enterprise automation. To do this the company realized it needed new leadership, or at least an experienced co-pilot with strengths that complement Daniel Dines’ product depth.

UiPath has set a new course for its rocket ship. It has plenty of fuel in the form of a large customer base, relatively low churn, product leadership and a strong balance sheet. Its new co-CEO is a strong communicator who has set a definitive tone underscoring the mandate for profitability while maintaining a growth trajectory. Although the macro environment is a concern, UiPath has enough runway to see itself through the choppiness.

It now has to deliver on its promises to Wall Street the way it has for customers.

Thanks to Chip Symington for his contributions to this episode of Breaking Analysis. Alex Myerson and Ken Shiffman are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.