EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

Lincoln Electric Holdings Inc. is one of the world’s largest makers of welding equipment, with more than 42 manufacturing locations in North America, Europe, the Middle East, Asia and Latin America — and its business depends on making sure enough welders are certified to use its equipment.

For that reason, it felt it needed a school to train workers — but traditional training was slow, expensive and cumbersome. So it turned to technologies more often associated with consumer gaming: virtual reality and the metaverse.

Now, trainees don VR headsets to do virtual welds, and they get immediate feedback in an immersive environment on how straight their pipe or sheet metal welds are. If they mess up, they can simply reset the virtual system instantly and keep getting better, and they don’t have to waste materials in repeated attempts. Once they’ve learned to do it right, they apply those skills in actual welding using Lincoln’s gear.

The result: Lincoln Electric discovered that it could train welders in 23% less time. And more skilled welders means a larger potential market for its welding gear. “Virtual reality can reduce time while increasing the proficiency of training programs,” Randal Kenworthy, senior partner at technology consulting firm West Monroe, told SiliconANGLE.

The hype around the term “metaverse” has been building thanks in part to Meta Platforms Inc. and others promising it’s the next big technology platform, akin to the personal computer and the smartphone. The idea is consumers will be able to connect in immersive digital worlds in which they can entertain themselves, play and socialize far better than they can on PCs and smartphones.

But there’s another potential set of uses that may actually spread faster, in industries that train workers, manufacture products or operate infrastructure. This is what is known as the industrial metaverse, and it uses virtual and augmented reality to blend the physical and digital worlds to transform how businesses design, manufacture and interact with objects.

Many of the building blocks of the industrial metaverse are not new. What is new: the greater availability and affordability of AR and VR headsets, “internet of things” technology, and better connectivity and computing. Taken together, they make it possible to bring industrial applications into the virtual world.

That has spurred a great deal of growth for industrial metaverse use cases, including training, collaboration and digital twins, which simulate the real world. In each of these use cases, the ability to bring people into immersive 3D worlds that can reliably simulate real-world industrial applications such as factory floors, components, robots or even other people are helping industry players do their work faster, more efficiently and better than before.

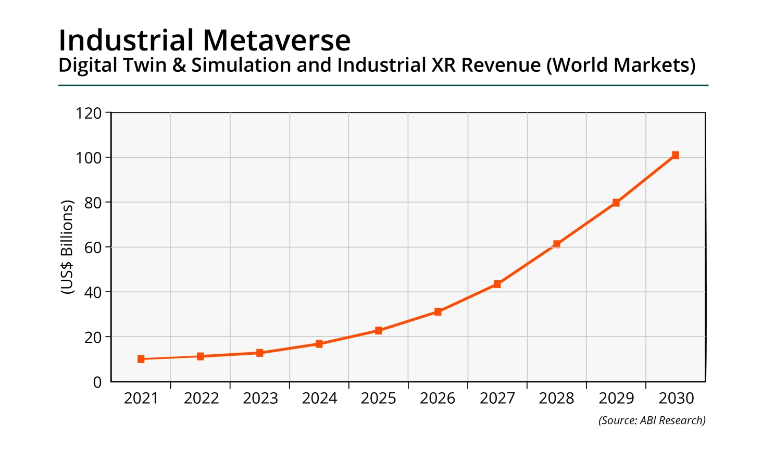

The recent revival of virtual reality for consumers has led to a dramatic rise in affordable AR and VR headsets for industrial applications and the development of enterprise-ready head-mounted displays. According to a report from Market Prospects, the industrial metaverse is expected to reach $540 billion in revenue by 2025. This is coupled with the availability of AR/VR headsets, which ABIresearch reported have shown continuous growth in both consumer and enterprise markets and will reach 50.1 million shipments and generate more than $50.1 billion in revenue by 2026.

These devices include current-generation virtual and mixed reality head-mounted displays such as the Meta Quest Pro, HTC Vive and Varjo XR3, which are all high-end enterprise-capable headsets. And augmented reality headsets such as Microsoft Corp.’s HoloLens 2 and the recently released Magic Leap 2. Heavy industrial use cases also benefit from companies such as Vuzix Corp., which produces industrial-grade, safety-rated smartglasses and headsets for fieldwork.

The industrial metaverse is still nascent, and it faces challenges because of high equipment costs and technical difficulties. Virtual and mixed reality often leads to limited participation because of “simulator sickness” — a type of motion sickness suffered by some from immersive experiences — and the overall costs of building and modeling accurate virtual experiences.

Some of this is overcome by the use of AR in industrial simulation for workers, but the technology has been slow to develop. Metaverse applications also require a great deal of data to be exchanged at high bandwidth and low latency, which means next-generation telecommunications infrastructure needs to be in place to support it.

Still, the prospects are tantalizing to many companies, especially since the emergence of more powerful VR and AR hardware and software is starting to turn the industrial metaverse into a reality. As a result, some companies are moving full speed ahead to get a jump on what could be a key foundation of technology development for years to come.

Training in the metaverse is a lot like playing a video game, except that the worker plunges into an immersive real-world scenario that can happen at their job site using a virtual reality headset. The use of VR has proven to increase outcomes for worker training over hands-on and it’s cheaper, faster and safer. “In terms where I’m seeing the most utilization of VR today – some of these other use cases might be more prevalent moving forward – is in training,” said West Monroe’s Kenworthy.

Using emerging industrial metaverse technologies, highly immersive experiences can be created that closely mimic what a worker will see and hear when they’re on the job site in virtual reality models of the equipment they’ll interact with. People can even behave and react similarly to the environment they will be in, helping them prepare for being on the factory floor or field.

Another advantage of VR is that workers can be trained without the need for access to expensive equipment and trained anywhere, even remotely or at home before they’re even brought onto a job site. They can also be trained in potentially hazardous scenarios and environments without being put in any danger.

In order to see the benefits of training in the metaverse, Lincoln Electric and Iowa State University compared two groups, one that did entirely traditional hands-on training and one that did half hands-on and half VR welding.

The results showed that welders who did the VR training had significantly higher levels of learning and team interaction, with a 41.6% increase in overall certification over the traditional group. And besides the 23% less time spent in overall training than the traditional group, using VR also greatly reduced training costs by $243 per student, because they could start over each time without wasting materials or losing time reassembling.

“Using the VR platform, students can more quickly learn and test the techniques before going out with the actual equipment,” said Kenworthy. “VR accelerated time by helping them show adjustments in real time that are required to improve their welding techniques.”

In the past four years, VR training has become even more prevalent across manufacturing — for example in automotive and aviation, where workers repeat rote steps on factory floors or even interact with robots. BMW uses VR to train multiple employees at once. Volkswagen AG formed a global initiative with 10,000 employees. Aviation manufacturing giant The Boeing Co. cut training time by 75% with VR. Aeronautics companies also use metaverse technologies to train pilots in the air, spurred by a pilot shortage that began with the pandemic. Loft Dynamics AG has been using VR simulators to train helicopter operators in the U.S., cutting air-time training by as much as 60%.

Although today’s video teleconferencing technology may work for supporting people doing remote work and for sharing applications for collaboration, it lacks the immersive power of virtual and mixed reality. For industrial metaverse applications, engineers and designers would use headsets to bring multiple people around a design for manufacturing.

Urho Kontorri, co-founder and chief technology officer of Varjo Technologies Oy, the Finnish maker of industrial-grade VR headsets, told SiliconANGLE that a major trend for the automotive industry is designing the vehicle engine and chassis with remote teams.

For example, at automobile manufacturer Kia Corp., designers would develop designs, but in order to complete reviews, members of the team would have to fly out from the car maker’s European headquarters to the design facility in Korea to do a session. However, when the pandemic hit and travel restrictions were imposed, that was no longer possible.

Using Autodesk VRED’s virtual collaboration feature and VR headsets to bring everyone together remotely into a single immersive metaverse space, designers, engineers and even executives could gather around a car without the need for travel. That changed the game entirely.

“You’d have a few designers from Frankfurt, some from Korea, and they’d do the same thing they did previously,” Kontorri said. “Except what would take a week because of travel time to have that session now could be done once a week, so four times as often.”

Not only did they discover that they could do sessions more often, beginning to get collaborations as often as every day, but the teams discovered that they could even have more people around car designs. They were able to scale up to 20 people around a car, which is about as many as you could have without the space becoming so crowded as to become unproductive.

“What was magical is that they stopped feeling that they were a satellite office and started feeling like they were one global team working together,” Kontorri explained. “That was quite a revelation.”

This same sort of adaptation is most likely happening throughout the automotive industry, he said. For example, Volvo Group has a very similar setup. Using VR, the automaker discovered it could have teams do in a day what would normally take weeks or longer, and iterate on user experience concepts quickly by testing them in “real life” scenarios inside virtual reality.

The technology made this possible by allowing engineers and designers to take designs for test drives in VR. So teams could perform studies on future cars before they were turned into prototypes and avoid flaws before they became a problem further down the production line.

Another type of collaborative industrial metaverse application in manufacturing uses augmented reality, such as enabled by HoloLens 2. This enables a worker in the field to have digital imagery overlaid over the real world in what the company calls holograms. It recently revealed that it signed Kawasaki Heavy Industries Ltd. as a new customer for the technology, joining Kraft Heinz Co. and Boeing as manufacturing partners.

Workers wearing AR headsets can use holograms when out on the factory floor as guides when operating machinery. Then, when attempting a complex task or a repair, they can collaborate with an expert in order to walk them through the repair process using visual cues in their field of vision. The headset’s sensors and cameras also enable remote engineers to collaborate remotely with workers regarding what’s happening on the factory floor even if they’re in a different part of the building or across a continent.

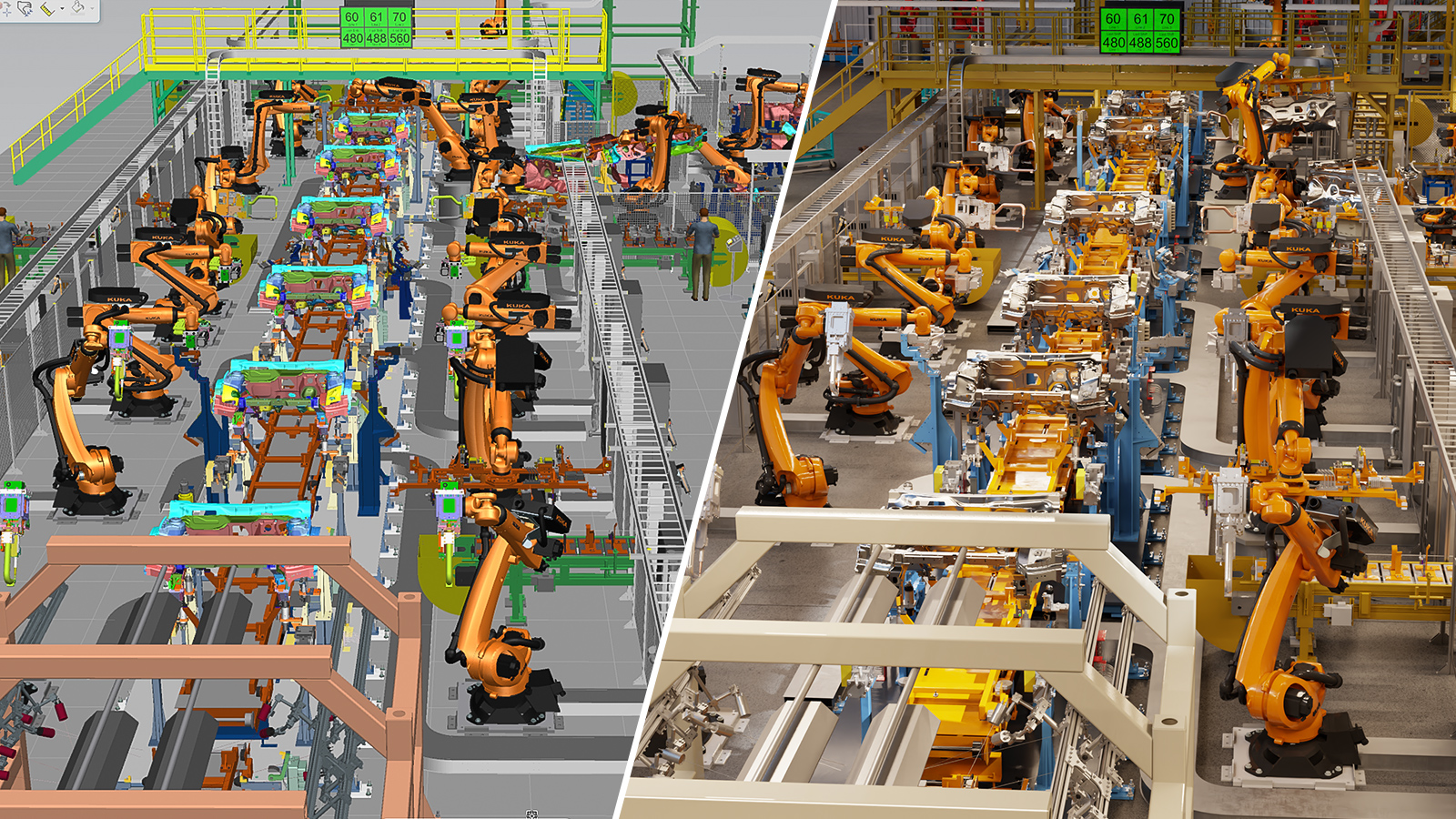

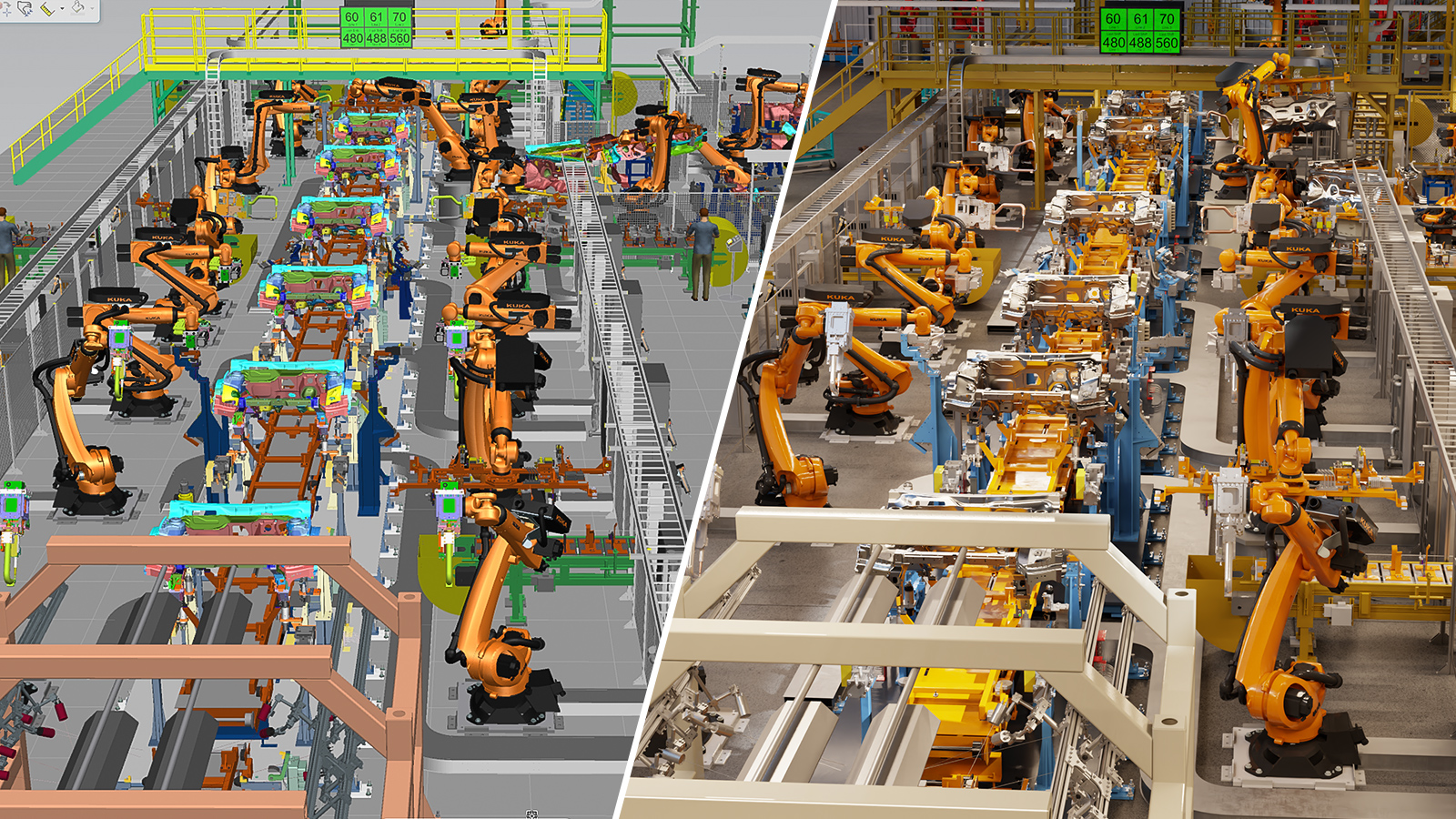

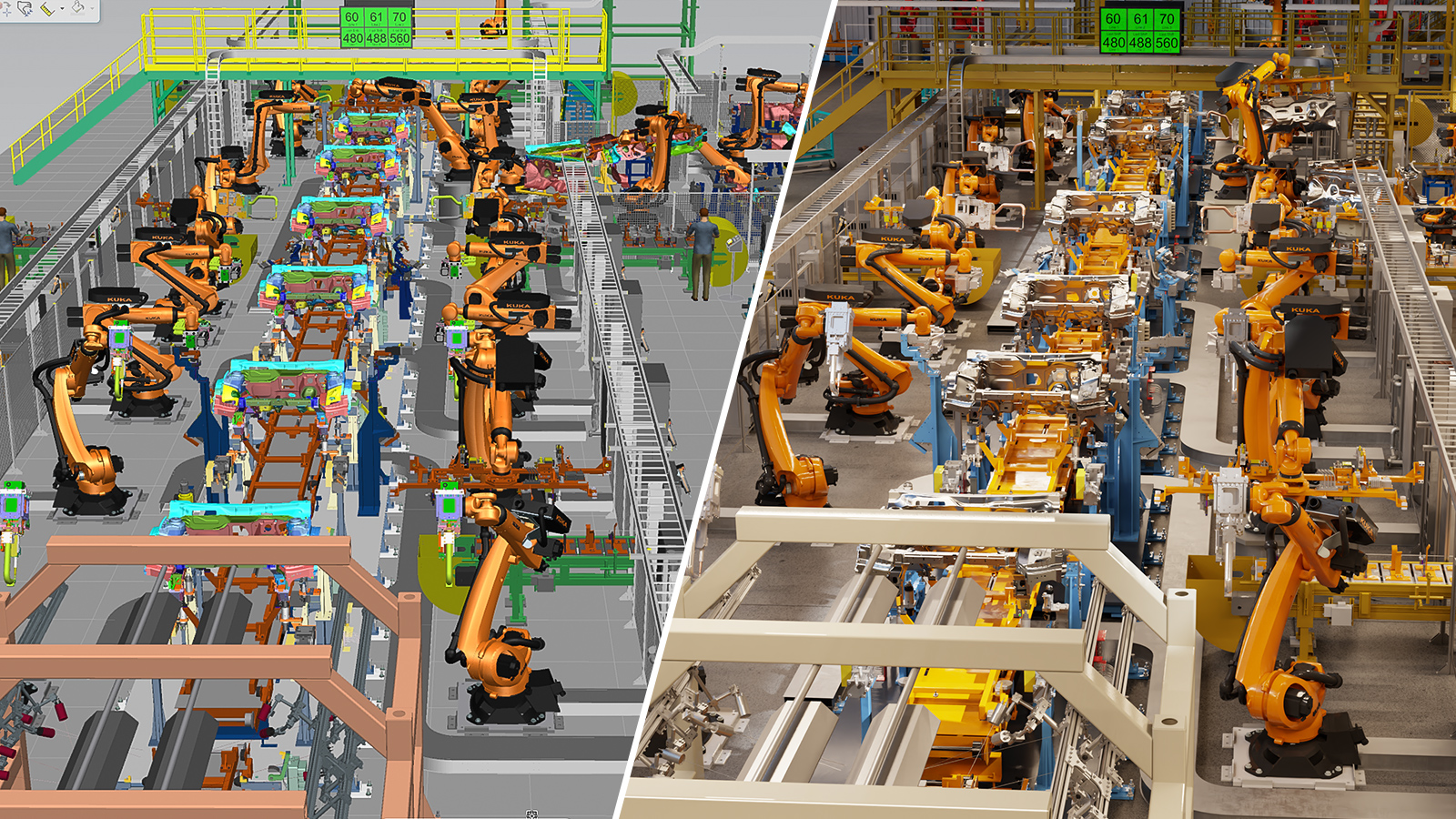

One of the more prominent use cases for the industrial metaverse is “digital twins,” or accurate simulations of real-world objects such as walkways, buildings, factory floors, conveyor belts and robots.

Rev Lebaredian, vice president of Omniverse and simulation technology at Nvidia Corp., said digital twins create a number of “superpowers” for manufacturing that didn’t exist before because suddenly enterprise customers have access to fully realized simulated virtual versions of their factories they can work with.

These superpowers include teleportation, such as workers being able to jump to any point on a factory floor no matter where they are in the world and see what’s going on in a digital twin, as long as it’s simulating what’s happening right now in the real one. Or they can time travel into the past, where the factory’s activity could be recorded and played back so that anomalies could be viewed to see how they happened – or even better, time travel into the future, by speeding up the simulation and watching what will happen.

Digital twins also allow designers to build entire apparatus or factory floors in virtual prototypes and simulate them before they put them into actual production. The aim is to see how they will operate and see if there will be any potential problems. It permits them to experiment, optimize and streamline them before potential anomalies happen in the real world, thus reducing the risk of failures or safety issues for human workers.

Tony Hemmelgarn, president and chief executive of Siemens Digital Industries Software, told SiliconANGLE that Siemens has been using digital twins in its own manufacturing processes and with customers for many years. What the industrial metaverse brought to digital twins is comprehensive simulation.

“I remember the first time I did a 3D model, a 3D wireframe – before you had solid modeling,” Hemmelgarn said. “You went from 2D drawings, which is where the business all started, to a 3D wireframe. And I remember the first time I rotated one around on a screen and someone behind me said, ‘Wow, why would you ever need more than that?’”

With the advances in industrial metaverse technologies, engineers can see entire factory floors with fully comprehensive, immersive views and simulate with confidence. Now, Hemmelgarn said, “teams can come together and see it. I think that’s that real promise of the industrial metaverse.”

That way, Lebaredian explained, “we gain all these superpowers by having a digital twin. All of that is dependent on having this accurate model of the real-world thing and keeping them in sync with the digital one. If you can do that, I think you can imagine many things in the industry you can do. I mean, what can’t you do with a teleportation and time machine and one that lets you explore multiple possible futures?”

One thing about the industry that came as a surprise for Nvidia, Lebaredian said, is that the company expected that metaverse technologies would first unfold through industries through entertainment – where VR is already broadly used — then architecture and design, and finally manufacturing.

Instead, the inverse happened. Manufacturing came first. Lebaredian said he believes the reason is because the systems and factories themselves are extremely complex and require the capability to simulate the future to optimize and reduce costs – one of the superpowers, if you will, of digital twins.

A 2022 Capgemini survey of organizations using digital twins noted that organizations noted that participants have seen, on average, a 15% improvement in sales, turnaround times and operational efficiency. Of those surveyed, they also saw improvements of up to 25% in system performance and up to 16% improvement in sustainability through their use. According to MarketsandMarkets, the digital twins market alone was estimated at $6.9 billion in 2021 and is projected to grow to $73.5 billion by 2027.

Much of this interest has been fueled by the complexity of factories and the need to understand better the way different systems interact, as well as how the pandemic affected planning and construction at large scale. Suddenly many manufacturing operations needed to find a different digital transformation pathway to consider even minute details from the first minute onward. Digital twins – as accurately simulated as possible – do that.

This also captured the interest of Boeing, which announced in December 2021 that it intends to use digital twins and the industrial metaverse to link its entire supply chain for building aircraft. The expectation is that the immersive power of simulating designs, parts and manufacturing processes in the immersive metaverse will catch flaws before they are set and help bring aircraft from the drawing table to market much more quickly.

The aerospace manufacturer intends to play the long game by building up the digital tools needed to make that happen with the help of veteran engineer Linda Hapgood, who is best known for taking the 767 tanker’s wiring bundles and turning them into 3D models. After that, workers were outfitted with tablets and HoloLens AR headsets for operating on the engines, which improved quality by 90%. The effort to bring the supply chain into the metaverse will involve more than 100 engineers and build on those early successes.

The industrial metaverse holds a great deal of promise for manufacturing with opportunities for training that have already displayed significant results. Both virtual and augmented reality can pull together teams from across the world to collaborate on projects as if they are in the same room. It also gives technicians in the field the ability to pull in help from outside who can overlay information on their vision. The addition of digital twins has also opened up whole new “superpowers” for industrial and business use cases.

Advances in augmented and virtual reality devices will drive even more opportunities for industrial metaverse applications going forward. But what may bring the most for business use cases will is data integration and machine learning for the 3D models that the immersive simulation will depend on. That will be especially important as more industries begin to augment more of their supply chains with metaverse applications, including onboarding their workers with training, collaboration and digital twins, with more photorealistic and real-to-life physics simulations.

All that means the impacts of the metaverse are likely to be more apparent in coming years in industry than among the consumers the technologies’ creators originally imagined.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.