INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

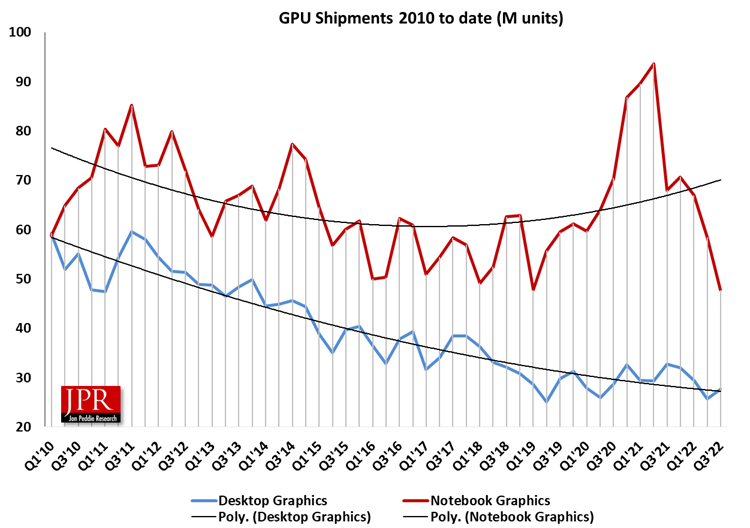

Demand for graphics processing units sank to a 20-year low in the third quarter of 2022, according to new data from the industry analyst Jon Peddie Research.

The report shows that desktop graphics card sales during the quarter fell to their lowest level since 2005, bringing further misery to chipmakers like Nvidia Corp. and Advanced Micro Devices Inc. Like many other products, GPU sales went through the roof during the COVID-19 pandemic as people sought more powerful computing hardware while staying at home. But the story has changed amid a global economic slowdown and demand is waning fast.

Peddie’s 2022 GPU market summary Q3 report released Tuesday covers GPUs for desktops and laptops, as well as central processing units with integrated graphics chips. According to the report, AMD, Nvidia and Intel Corp. together shipped just under 6.9 million discrete desktop GPUs in the quarter, down 47% from the same period a year earlier. By way of contrast, Peddie said the 2008 recession caused a similar 46% decline in GPU shipments between the fourth quarter of 2007, when they reached an all-time high thanks to the launch of Nvidia’s 8800 GT, and the fourth quarter of 2008.

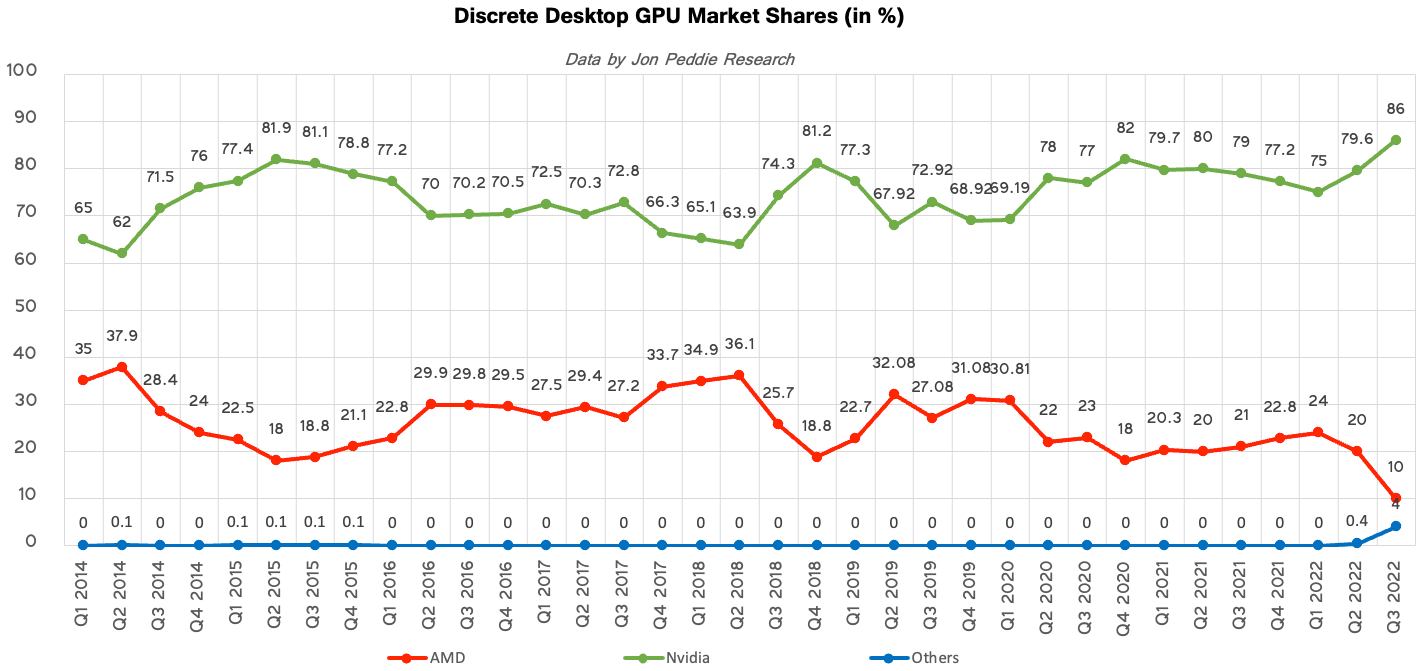

The two biggest players in the GPU market, by some distance, are AMD and Nvidia. According to the report, the former was hit much harder than the latter. Although Nvidia’s discrete desktop GPU shipments fell 40%, AMD’s sales plunged by an alarming 74% year-over-year.

It’s well-known that the GPU industry’s fortunes are linked to those of the personal computer market, and with the decline in sales of PCs, tablets and smartphones, it was obvious that GPU manufacturers were going to suffer. However, the GPU market has been further hit by a unique factor.

Peddie’s data shows that GPU sales for cryptocurrency mining collapsed during the quarter — something that’s likely linked to the Ethereum merge, which saw the world’s second-biggest decentralized network adopt a new consensus algorithm that doesn’t require mining. In the report, Peddie notes that Ethereum miners helped inflate GPU sales and prices in recent years, so their exit from the market has caused significant disruption.

Looking ahead, Peddie pointed out that both AMD and Nvidia launched new flagship GPUs this year, namely the Radeon RX 7000 and RTX 4000 series GPUs. Those models are high-end GPUs, and the companies are both expected to launch lower-end GPUs in 2023, which could lead to a boost in sales.

Intel entered the GPU market only this year and its entry-level Arc Alchemist series GPUs helped the company to grab a 4% share of the overall market. Nvidia grew its market share by 10.2%, to 86% overall, while AMD’s has fallen to about 10%.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.