INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. surprised Wall Street today as it beat expectations on sales and profit in its fourth-quarter financial results, thanks to strength in its data center division.

But the company warned analysts that it’s expecting a 10% revenue decline for the current quarter. The chipmaker’s stock rose 2% in after-hours trading nonetheless.

AMD reported earnings before certain costs such as stock compensation of 69 cents per share, beating the analyst consensus estimate of 67 cents. Revenue for the period rose 16%, to $5.6 billion, just ahead of the $5.5 billion expected. All told, that resulted in a slight net income of $21 million for the quarter.

For the full year, AMD delivered $23.6 billion in revenue, up 44% from a year earlier.

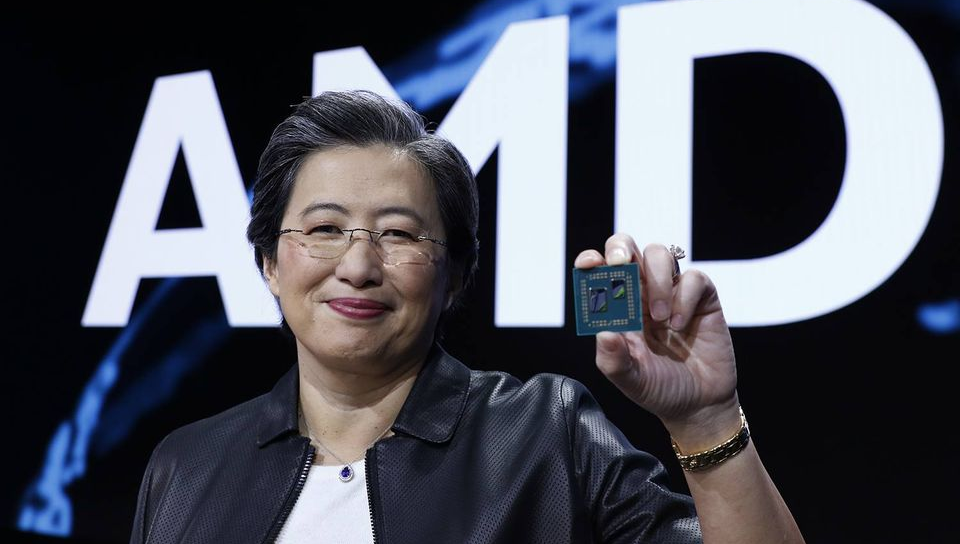

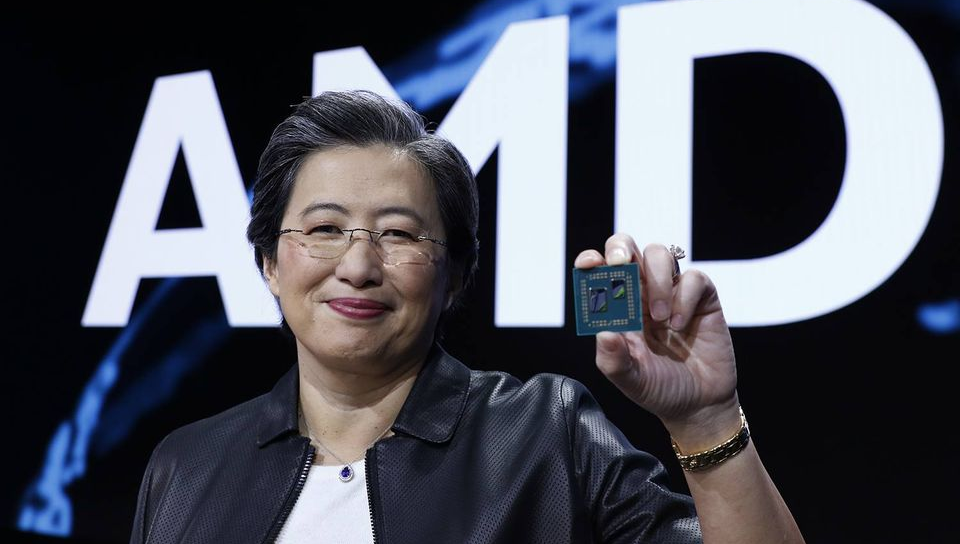

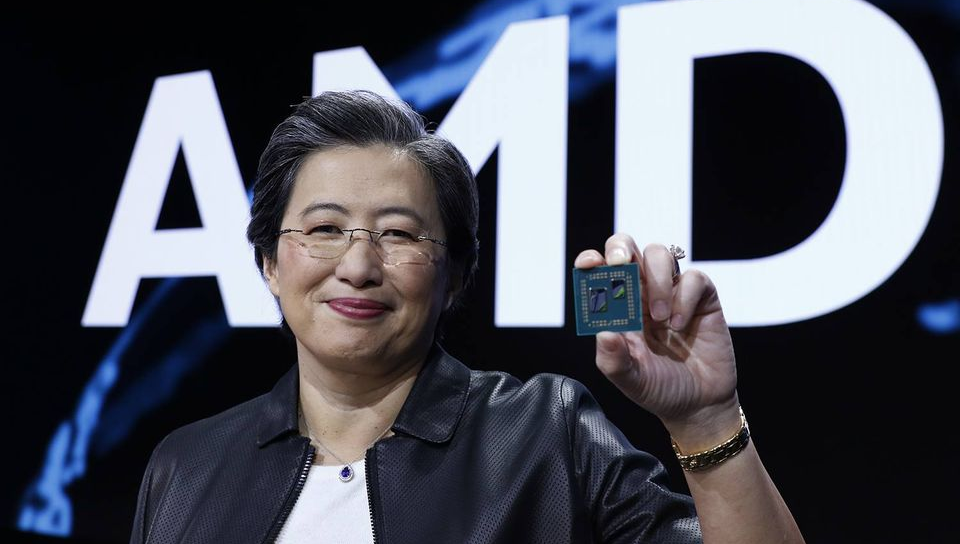

AMD Chair and Chief Executive Lisa Su (pictured) said 2022 was a strong year for the company, delivering record revenue and the best growth in its history, despite a weak personal computer environment in the second half of the year. “We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model,” Su said. “Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio.”

For the current quarter, AMD is guiding to expected sales of $5.3 billion, slightly lower than Wall Street’s estimate of $5.47 billion. That suggests a revenue decline of about 10%. The company also forecast an adjusted gross margin of about 50%.

AMD’s latest results come at a time when many of its rivals in the semiconductor space are struggling amid lower demand for consumer electronics. As a result, device makers have held back on buying new chips as they attempt to sell off their existing inventories.

Last week, AMD’s main competitor Intel Corp. reported disastrous fourth-quarter results that included a forecast for a 40% sales decline in the coming quarter. Just yesterday, Samsung Electronics Co. Ltd. reported that its memory chip business suffered an incredible 90% drop in sales in the fourth quarter.

AMD said it was able to continue growing thanks to the strong performance of its embedded and data center businesses, which helped offset the weak demand that hit its client and gaming units. Sales within AMD’s data center segment jumped 42% from a year earlier, to $1.7 billion, suggesting it may have taken some market share from Intel, while the embedded segment saw revenue jump 19-fold, to $1.4 billion, following its acquisition of Xilinx Inc.

“AMD’s diversification strategy is paying off better than that of its rivals,” said Holger Mueller of Constellation Research Inc. “Its strategy is aided by an attractive chip portfolio in all segments, but its resilience is likely to be tested in the next full year.”

Already under pressure is AMD’s client computing group, which accounts for processors for personal computers, saw revenue slump 51% from a year earlier, to just $903 million. Su told analysts on a conference call that many of the company’s customers have too much inventory on hand, and that they’re struggling to shift it amid a slowdown in PC sales. The analyst firm Gartner Inc. recently reported that fourth-quarter worldwide PC shipments declined by 28.5%, the biggest fall since the firm started following shipments in the mid-1990s.

Su added that the company believes the PC market will decline again in 2023, by around 10%.

Patrick Moorhead of Moor Insights & Strategy told SiliconANGLE that AMD’s ongoing success is partly because it has a much smaller share of both the PC and data center markets than Intel. “It’s still gaining revenue share so a decline in the market doesn’t have as large an impact as it has on the segment leaders,” Moorhead explained. “AMD is also more diversified with its embedded business that weathers the PC and data center gyrations. This is one of the reasons why it acquired Xilinx.”

AMD’s gaming business, which sells graphics processing units and chips for video games consoles and gaming PCs, saw revenue fall 7%, to $1.6 billion. The drop in revenue was attributed to lower sales of GPUs, but was offset to an extent by “semi-custom” sales, which refers to chips that power consoles such as the Sony PlayStation 5.

Pund-IT Inc. analyst Charles King also highlighted AMD’s diversification strategy, saying this means that it is no longer dependent on having all of the cylinders in its business firing perfectly. “If PCs and gaming systems falter, as they are now due to current economic factors, its continuing success in data center, edge and other areas can pick up the slack,” he said.

King said it was entirely sensible for AMD to issue the cautious guidance that it did. He noted that the economic picture for this year is still coming into focus and that the outlook varies significantly from region to region. It also has to contend with the launch of Intel’s new 4th Gen Xeon data center chips. “The launch of those chips could cast clouds over AMD’s sunny data center story,” King explained. “It’s better to anticipate heavy weather and be wrong than to project clear skies that end up raining on your most important supporter’s parade.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.