BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Shares of Progress Software Corp. were trending down today after the company warned that its fiscal second-quarter profit may fall short of Wall Street’s expectations, following a solid earnings beat in the quarter just gone.

The company reported a net profit for the first quarter of $23.7 million, up 16% from a year earlier. Earnings before certain costs such as stock compensation came to $1.19 per share, with revenue topping $164.2 million. The results were better than expected, since analysts had targeted a profit of just $1.04 per share on sales of $158.7 million.

Founded in 1981, Progress is one of the oldest independent software firms on the block. Although it has been publicly held since 1991 and has a global base of more than 100,000 enterprise customers, the company has traditionally kept a low profile.

Progress’ diverse business includes selling tools for building adaptive user experiences across devices, web content management, secure file transfer, network monitoring and machine learning for anomaly detection and business rules automation. Progress says more than 2 million developers use its software.

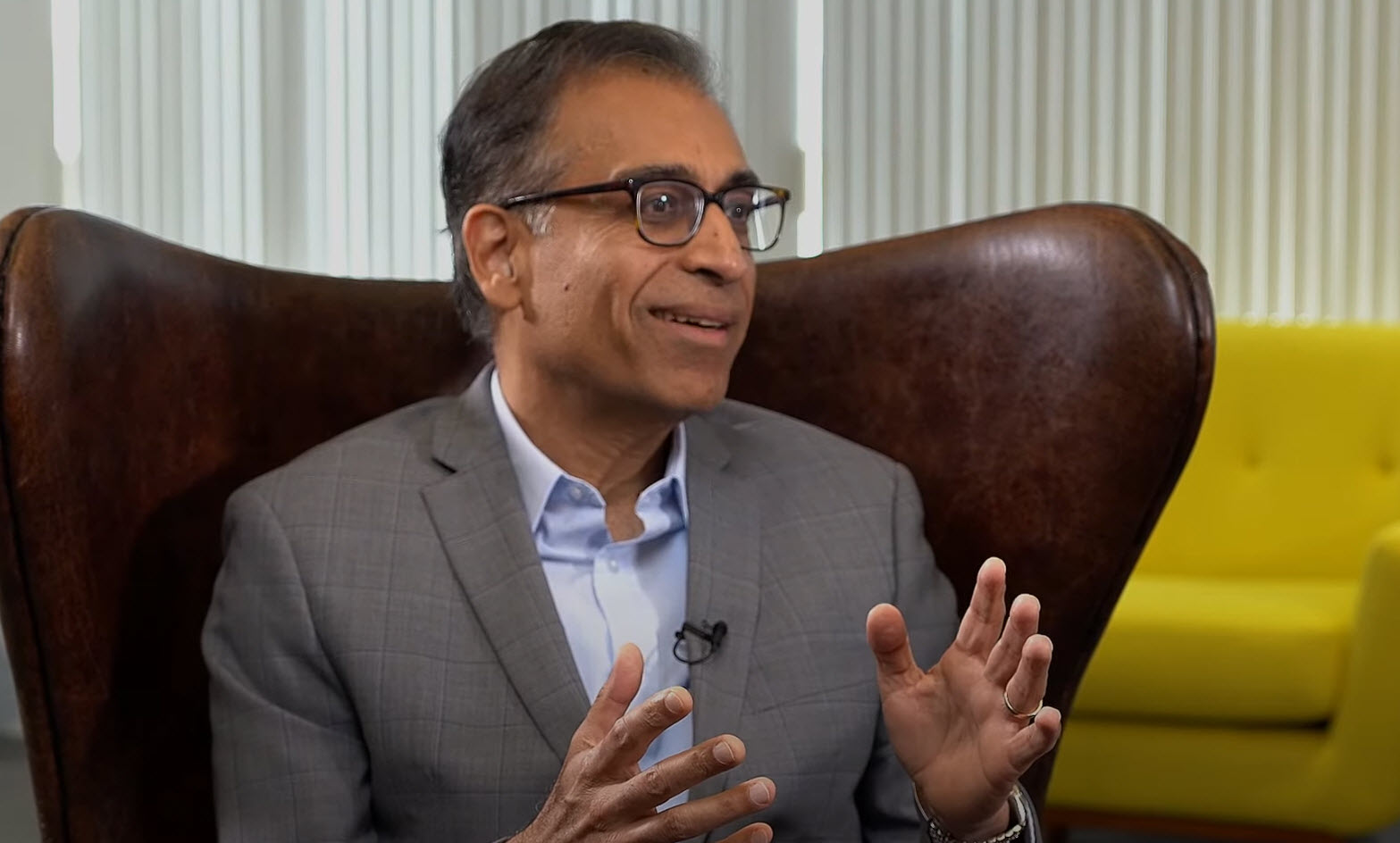

Progress Chief Executive Yogesh Gupta (pictured) said the company got off to a very strong start to fiscal 2023, delivering excellent results across virtually all products and geographies. “Our customers continue to depend heavily on Progress products for reliable, cost-effective, highly functional solutions that help them develop, deploy and manage their high-impact business applications in difficult macroeconomic conditions,” the CEO said. “Importantly, our integration of MarkLogic, which closed just a couple of weeks before quarter-end, is gaining steam.”

The company announced the acquisition of NoSQL data integration engine provider MarkLogic Inc. in January, saying that the deal will allow it to offer customers a unified enterprise-grade semantic data platform for deriving value from complex data.

Progress said the bulk of its revenue in the quarter came from maintenance and services, which delivered $106.6 million in sales, up 4% from a year earlier. However, most of its growth came from software license sales, which rose 35%, to $57.6 million.

The company offered further encouraging numbers, saying its annualized recurring revenue rose 20% from a year earlier to $569 million. Meanwhile, days sales outstanding, a metric that estimates the size of the company’s outstanding accounts receivable, fell to 42 days, down from 52 days in the prior quarter.

Holger Mueller of Constellation Research Inc. said Progress has been doing well, infusing its growth in license revenue with the acquisition of MarkLogic recently. “This has bought the veteran application development firm some time, but it will soon be under pressure to generate more organic license revenue,” the analyst said. “It will be key for Progress’s valuation that it’s able to keep license revenue above its current mark, at 50% of maintenance revenue. So there’s lots of work ahead for Yogesh Gupta and his team.”

Unfortunately for Progress, the encouraging results were tempered somewhat by its cautious guidance, and its stock fell more than 3% in extended trading. Looking to the second quarter, the company projected earnings of between 88 and 92 cents per share on revenue of $168 million to $172 million. Wall Street is forecasting earnings of 99 cents per share on sales of $168.9 million.

THANK YOU