CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Salesforce Inc. delivered a strong earnings beat and raised its full-year guidance above analysts’ expectations, but concerns about its rising capital expenditures and delayed deals sent its stock down more than 5% in the after-hours trading session.

The company reported net income for the first quarter of $199 million, up from a profit of just $28 million one year earlier. Earnings before certain costs such as stock compensation came to $1.69 per share, ahead of the analyst consensus estimate of $1.61. Revenue rose 11%, to $8.25 billion, above the $8.18 billion forecast.

However, investors were apparently none too happy about Salesforce’s increased capital costs, which rose 36%, to $243 million in the quarter, well ahead of the $205 million analyst consensus.

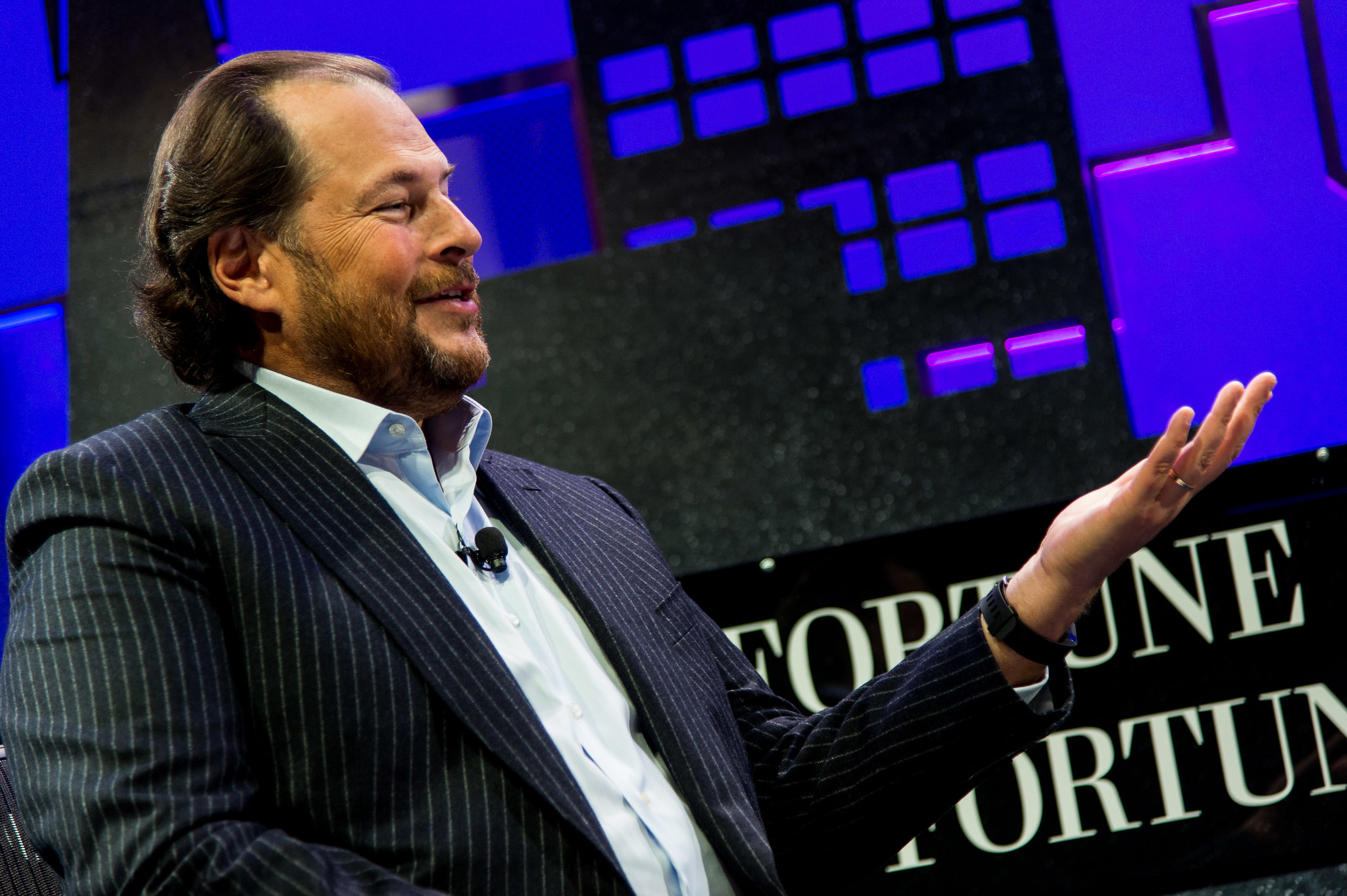

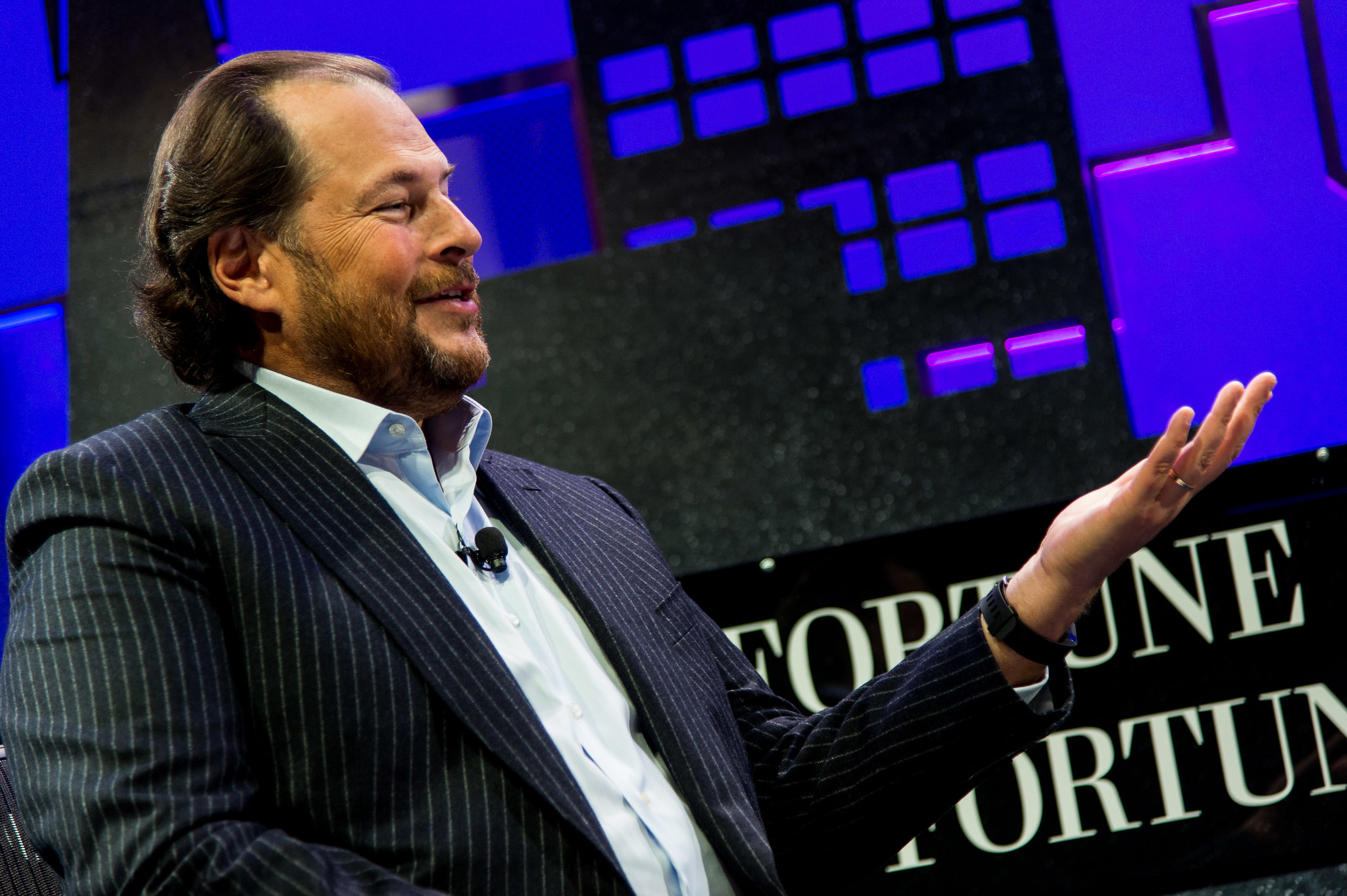

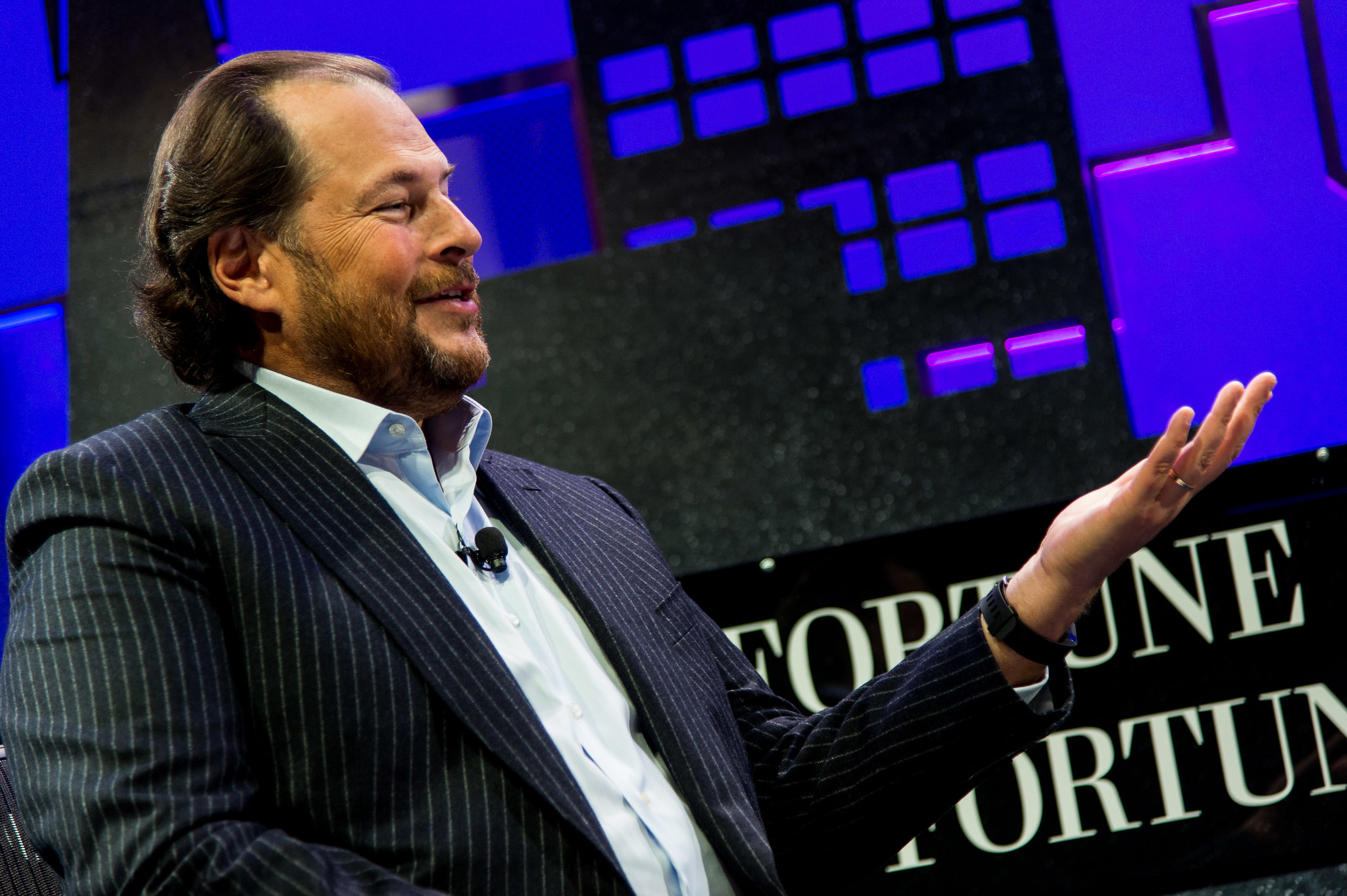

In a statement, Salesforce Chief Executive Marc Benioff (pictured) said the company had “significantly exceeded” its quarterly operating margin target by more than 1,000 basis points year-over-year. As a result, “we are raising our FY24 non-GAAP operating margin guidance to a 550 basis point increase year-over-year,” he added.

In a conference call, Salesforce executives admitted the company still faces some challenges to its business. Chief Operating Officer Brian Millham said clients are still looking very carefully at deals, and as a consequence, they’re taking longer to close than in previous years. To respond, Salesforce is looking at ways it can automate the sales process to clients at the low end of the market, in order to boost the productivity of its salespeople, he explained.

“Our professional services business started to see less demand for multiyear transformations and in some cases, delayed projects as customers focus on quick wins and fast time-to-value,” Millham noted.

Salesforce Chief Financial Officer Amy Weaver said these challenges are likely to persist throughout the year. “One of the things that we are seeing right now is not only professional services as a whole seeing pressure, but more customers are choosing to contract on the time and materials basis,” she said.

Despite these issues, Salesforce offered strong guidance for the coming quarter, saying it expects to see earnings in a very narrow range of $1.89 to $1.90 per share, with revenue coming to between $8.51 billion and $8.53 billion. The earnings target is some way higher than Wall Street’s call for $1.70 per share, and also above its revenue target of $8.49 billion.

For fiscal 2024, Salesforce increased its earnings forecast to a range of $7.41 to $7.43 per share, up from its earlier guidance of $7.12 to $7.14 per share. Its revenue guidance remains intact at $34.5 billion to $34.7 billion. Wall Street is still looking for full-year earnings of $7.14 per share on sales of $34.65 billion.

CEO Benioff won a reprieve of sorts in the quarter, when the activist investor Elliott Investment Management LP announced it had canceled its plan to nominate new directors to the company’s board of directors. Had it gone ahead and seen its nominees voted onto Salesforce’s board, Elliott would have been in a strong position to push for significant changes to the business, including potentially replacing certain executives.

“I have great respect for Marc and his team, and I have become deeply impressed by their strong ongoing commitment to profitable growth, responsible capital return and an ambitious shareholder value creation plan,” Elliott Managing Partner Jesse Cohn said at the time.

Analyst Holger Mueller of Constellation Research Inc. said Salesforce is on a path to higher profitability, and did well to grow its revenue in the quarter. “The growth came despite Salesforce paying almost three quarters of a billion in restructuring costs, showing that it has tapped into efficiency gains that were previously unrealized,” Mueller said. “These efficiency gains would likely not have been found without the presence of Elliott. So for now, investors see a better Salesforce, though they still harbor even bigger expectations.”

Benioff also stressed how the company is leading the “next major revolution in CRM” in the shape of generative artificial intelligence.

During the quarter, the company announced Einstein GPT, a supercharged version of Einstein AI. Einstein GPT for Salesforce Sales Cloud can perform a number of useful tasks, with one of the main benefits being its ability to automatically generate extremely personal and relevant prospect emails to contacts based on their CRM data.

Benioff pointed out the strong emphasis Salesforce is placing on trust and safety with its generative AI offerings. “Our Salesforce GPT Trust Layer will shield customer data, enabling productive automation and intelligent enterprise enhancements securely,” he said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.