POLICY

POLICY

POLICY

POLICY

POLICY

POLICY

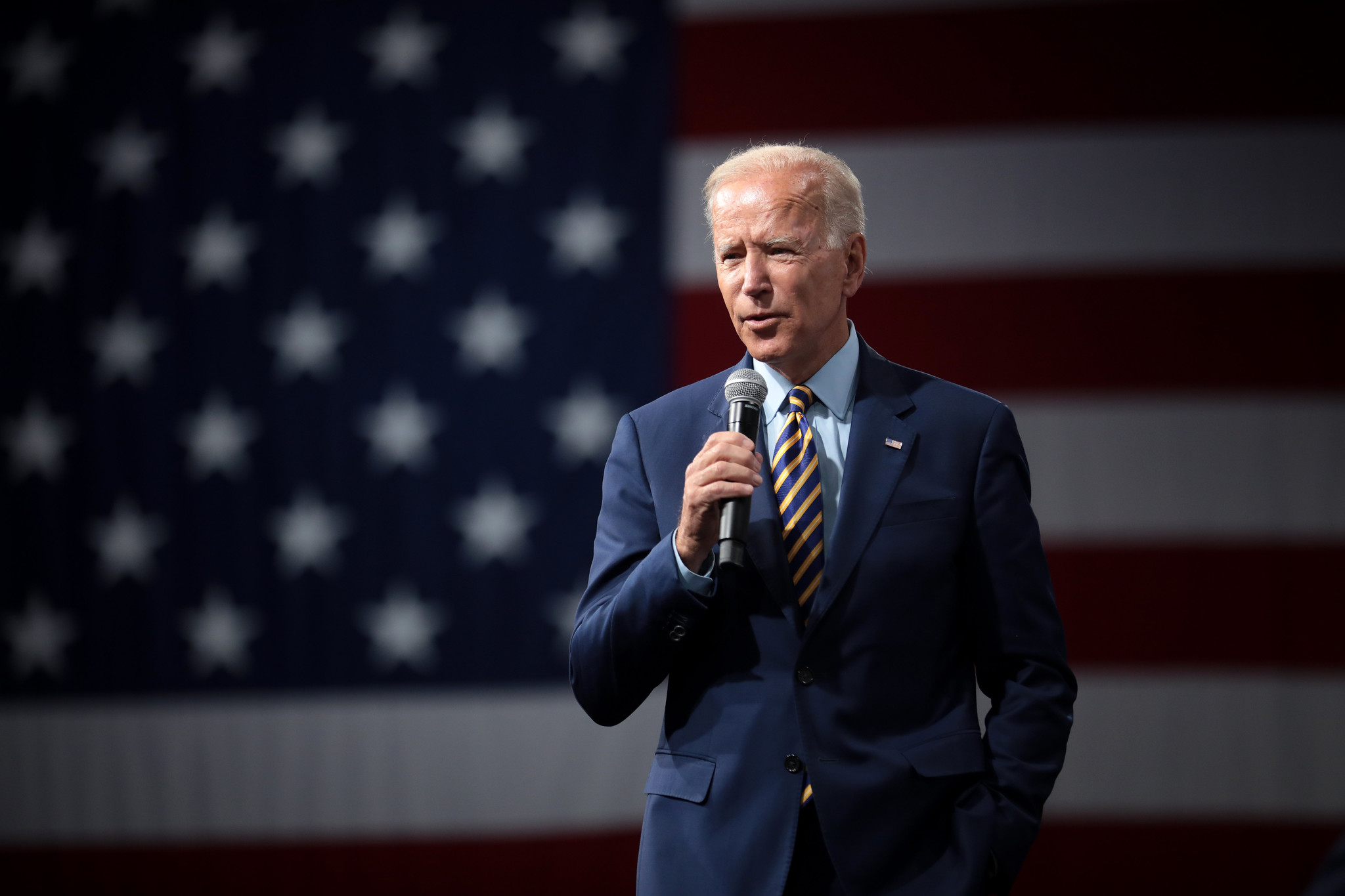

U.S. President Joe Biden issued an executive order today that will block American citizens and organizations from investing in Chinese companies focused on certain kinds of technologies, including artificial intelligence, quantum computing and semiconductors.

The order was issued on “national security concerns,” according to senior White House officials. The government said the restrictions are “narrow and targeted” and are necessary to protect U.S. national security. They’re designed to prevent China from using sensitive, advanced technologies to enhance its military prowess, build new weapons and boost its intelligence and surveillance capabilities.

The order is likely to be seen by Beijing as a significant escalation by the U.S. in its efforts to restrict the flow of advanced technologies into China. The Biden administration, like former President Donald Trump’s administration before it, has regularly voiced concerns that China might use American technology to modernize its military and defense capabilities.

However, the Biden administration is being forced to walk a rather tight line, for it’s also seeking to improve relations with China, with recent high-profile visits made by U.S. Treasury Secretary Janet Yellen and Secretary of State Antony Blinken.

It’s for this reason that officials insisted Biden’s latest order is a “national security action, not an economic one.” In a statement, a White House spokesperson said the administration recognizes “the important role that cross-border investment flows play in U.S. economic vitality, and this executive order is aimed at narrowly protecting our national security interests while maintaining that longstanding commitment to open investment.”

The order, which will not go into effect until next year, will completely prohibit U.S. private equity firms, venture capital funds and other entities from making certain investments in China. In addition, U.S. investors will also be required to give authorities advance notice of other transactions, officials said.

Treasury Department officials will soon draft a rule-making process that better defines the scope of the restrictions. The administration said it consulted with over 175 stakeholders before Biden issued the order, and there will be a period where the public, including lawmakers and affected industries, will be allowed to comment.

“What we’re talking about is a narrow and thoughtful approach, as we seek to prevent the PRC from obtaining and using the most advanced technologies to promote military modernization and undermining U.S. national security,” an official said, using the acronym for China’s official name.

Despite the White House’s claim that it’s taking a thoughtful approach, the reality is anything but, said analyst Rob Enderle of the technology consulting firm Enderle Group. He believes that cutting off U.S. investments in China’s tech industry would have little impact, because investment is not the cause of the problem. Rather, he believes the U.S. should be focused on stemming the flow of information to China.

“When you have investment between countries that provides a strong disincentive for war, so when you eliminate the disincentive, war becomes much more likely,” Enderle said. “In any case, China seems to have little trouble penetrating U.S. security, and it is already well-funded enough to create advanced weaponry without U.S. money, so it seems the downsides of this policy may significantly exceed any upsides.”

Enderle also cautioned that the policy would hamper the U.S.’s own intelligence efforts and make it harder to know what technologies China is developing. “U.S. investment in China provides a back channel on what it is building, all you have to do is follow the money,” he explained. “By cutting off the money, you lose that critical intelligence. In the end, this policy weakens our ability to protect ourselves against China’s developments.”

In related news, the Financial Times reported today that Chinese technology giants are racing to buy up as many high-performance graphics processing units from Nvidia Corp. as they can, ahead of another expected crackdown by the U.S.

Chinese companies that include Baidu Inc., Tencent Holdings Ltd., Alibaba Group Holding Ltd., and TikTok parent ByteDance Ltd. have reportedly placed orders for more than $5 billion worth of Nvidia chips, and are expecting about 100,000 A800 GPUs to be delivered this year. In addition, the Chinese firms have placed orders for a further $4 billion worth of chips to be delivered in 2024.

Last October, the Biden administration implemented various restrictions aimed at freezing China’s semiconductor industry. Meanwhile, the U.S. is investing billions of dollars in subsidies to accelerate its own chip industry.

Nvidia’s A800 GPU is a scaled down version of the Nvidia A100 GPU with slower data transfer rates. The chipmaker designed the chip to get around U.S. export control rules, which prevent it from selling its most advanced products to Chinese companies.

According to the Financial Times, the Chinese companies are stockpiling the A800 chips due to fears that the U.S. will introduce even harsher restrictions that may even prevent them from buying Nvidia’s modified chips.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.